On the basis of the analysis of 11/17/2013 we are expecting significant tops in the US stock markets to happen in January 2014. In August already – issue of 08/04/2013 – we were able to work out the likely price tops of this bull. Some powerful GUNNER24 Buy Signals indicated then that the S&P 500 was to top out at 1875 coming the NASDAQ-100 to its main target at 3550. We identified then the month of May 2014 as these tops’ period..

On 11/24/2013 we ascertained that the US stock markets were most likely to close at the year-highs putting a flawless trend-year on the floor.

I think our 2013 forecasts have turned out more than satisfactory. Above all they have because especially in the second half-year these predictions have or are going to be paid in hard cash:

http://www.gunner24.com/trading-performance-us-stock-markets/

In the last 2-3 months, once in a while I got down to refining and reviewing this bull regarding the time and price targets. This is elementarily important because by the expected end of an exhaustion move A) often the very highest profits are to be expected (fast and stable trend) and B) we absolutely don’t want the traded profits in the existing long-positions to reduce just because we miss the change and C) we don’t want – what would be the worst – be caught by surprise occupying short-positions too early.

Well, the exhaustion may and is allowed to extend in terms of price as well as time. Exaggeration is the word. But at the end of the exaggeration phase only the stupidest idiots go long…

Today, I’ll check the S&P 500, the NASDAQ-100 and the Dow Jones in the monthly time frame respecting the assumed turning points by virtue of the December informations. As a rule, mostly this time frame indicates the possibly important magnets in case of any exhaustion.

In advance and as a reminder: We expect the tops to happen between January 4 and 13, 2014. The coming trading week – 12/30-01/03 – will still be influenced by low-volume holiday trading being likely to keep on prevailing the main trend. The seasonal features of the first trading week in the 2nd year of the Presidential Cycle speak a clear language as well: For more than 40 years these first weeks in the respecting new trading years have closed in green. Technically next week will be pretty safe for being on the long-side, but the smart trader/investor covers his longs into the expected top!!!!

From 01/06 on, most traders will be back again at the trading desk. The volatility will increase then, and from 01/06 to 01/13 the markets may reach/head for their final tops, following the 2nd years of the respective Presidential Cycles that in the average of the last 85 years have been forming their early year-tops in the 2nd trading weeks of those years…

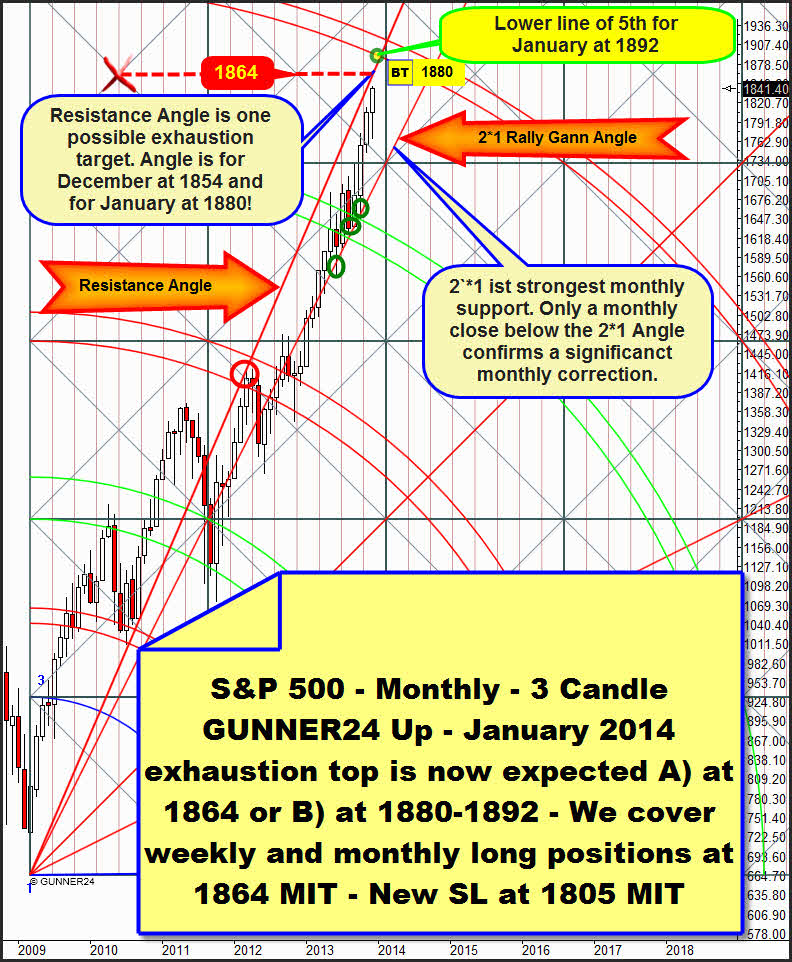

The possible 1854 top might have been reached in December. For December, the 1854 are situated at the Resistance Angle that represents a possible turning point and a main target for the bull-run.

Since the Resistance Angle is little likely to be reached in December yet - see the NASDAQ-100 analysis below – the angle remains being a magnet for January that is likely to want to be worked off. It takes a course at 1880 in January thus lying very close to the natural main target of this bull. For the main target of this move is the lower line of the 5th that is activated as target since the final break of the 4th double arc in July 2013. The lower line of the 5th will be reached with more than a 75% of probability.

It would appear that it wants to be headed for in January. The lower line of the 5th is at exactly 1892 for January, thus corresponding with the 1880 (combined weekly and monthly magnet) and the daily exhaustion target at 1888.

All in all we recognize that for January some extremely important magnets are between 1880 and 1892, above the current 1841. This area can and may be reached, but it doesn’t have to. For the 1864 is offering itself as a possible January top, as well. That’s where the center of the currently passed square is being a natural and strong horizontal monthly resistance. Any time after reaching/working off it may bring the market to its knees.

2 consecutive daily closings above 1864 in January would finally activate the run-up to the 1880-1892 exhaustion area.

But it isn’t yet finally made. I’m rather careful than venturesome, ordering newly as follows:

Now we cover our weekly and monthly long-positions newly at 1864 MIT (market if touched) rising the SL for the longs to 1805 MIT.

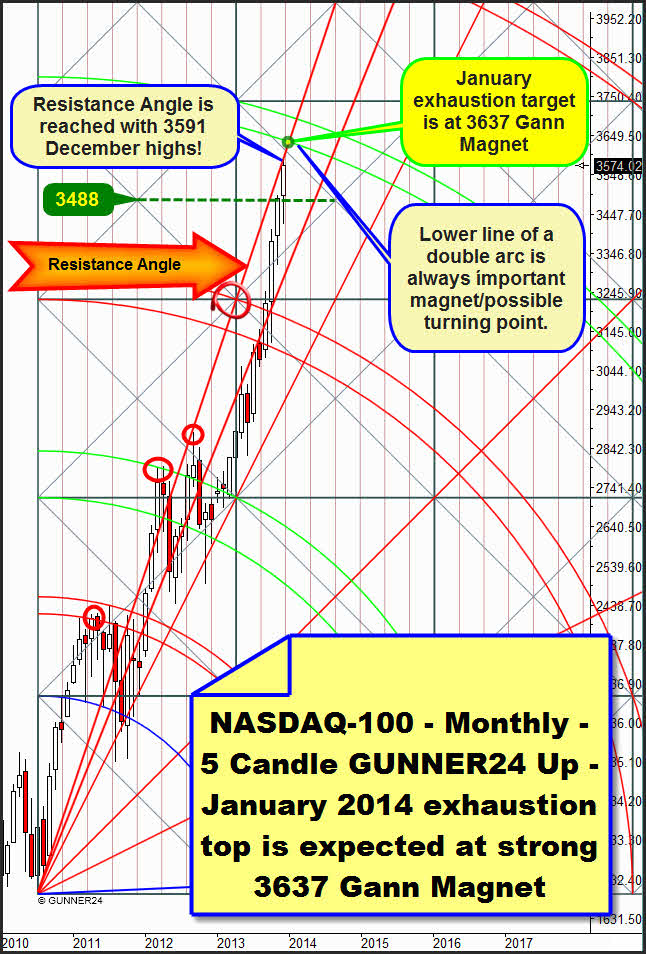

I’m rather careful now because… The NASDAQ-100 has worked off its main target of 3550. The price target is reached! The main target is reached! Now it may turn any time, flowing into an extended several month correction phase! As announced last Sunday, on 12/22 we covered our monthly longs at 3563 with a profit of a +5.51% altogether:

Besides, the current December highs are situated exactly at an important resistance, the Resistance Gann Angle identifiable above. By the current 3591.31 highs, last Friday it was worked off to a T. It also triggered a clear reaction since Friday closed in red at 3574, significantly below this new year-high.

But since the first half of January permits a repeated higher high – almost necessarily – another up-leg is to be expected again. A very likely target is the super-strong Gann Magnet at 3637! There the Resistance Angle intersects the lower line of the 4th in January 2014.

In the daily chart the NASDAQ-100 is showing an opening gap at 3531. Technically the index would be supposed to be willing to close this gap during the coming 2-3 trading days before picking up speed again up to the 3637.

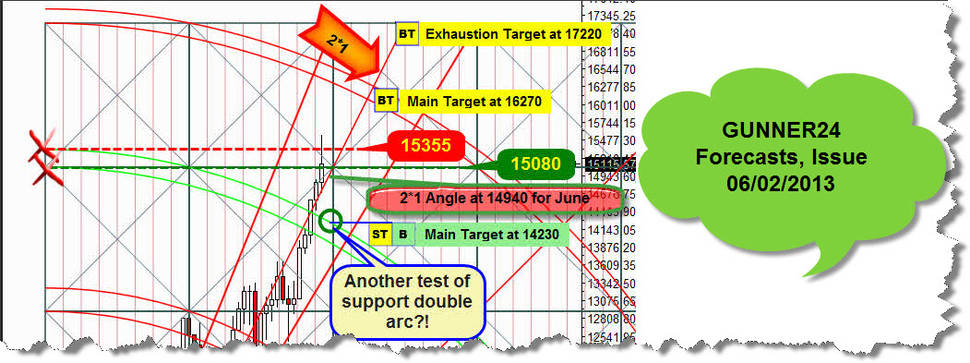

Let’s go now to the Dow Jones in the monthly time frame. It was a pretty long time ago that I last analyzed this index in the monthly time frame. It was on 06/02/2013 when I last took care of the Dow through the monthly 3 Candle GUNNER24 Up. Here’s the extract of the past analysis in the form of a chart. Examined exhaustion target is 17220 and the main target is at 16270:

Well, today the 16270 is unequivocally reached and even finally taken. December closes finally above the main target of the 5th double arc. It’s new monthly buy signal!! In terms of price, the end of the monthly 3 Candle GUNNER24 Up Setup is hereby activated as the next monthly target being headed for in future with a 75% of probability.

The 17220 remains as a possible exhaustion target… but will that really be possible? Again a +4.60% above the current Friday close at 16478, again additional +700 points, in January 2014? Maybe, maybe it will.

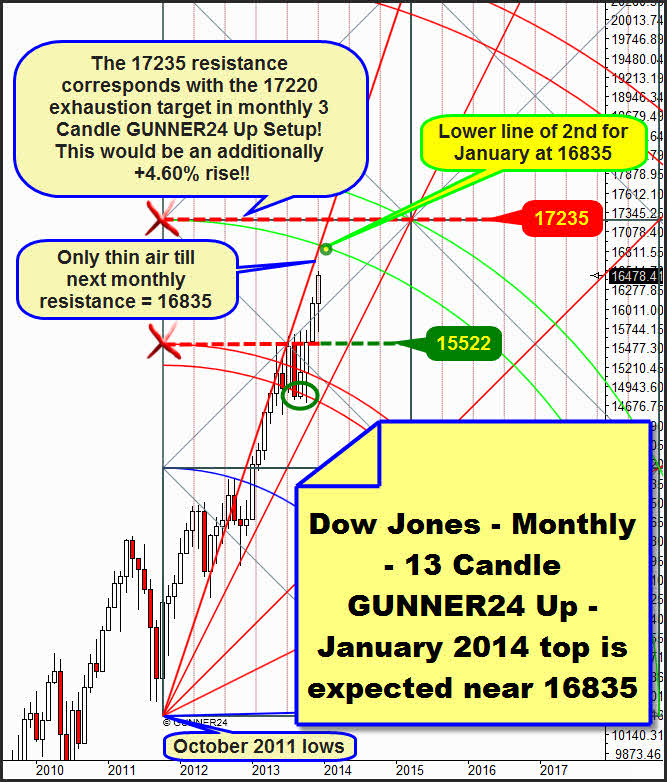

For counter-checking the possible 17220 for the January 2014 top I use a very sound and valid – not yet published in this area – monthly 13 Candle Up that starts at the October 2011 lows comprising the first initial impulse of an entire year.

As far as the next target of the Dow in this setup is concerned, we are almost sure since we can clearly back up the existence of the first double arc. For months the lower line of the first has provided stable support marking the lower end of the sideways move. Above, the several month sideways move was limited at 15522 by the horizontal resistance starting from the intersection point of the upper line of the first with the beginning of the setup.

The November candle broke through the range making now the lower line of the 2nd double arc become the next target of this setup. For January 2014 it is situated at 16835. Above the current 16478 there is really no important resistance to be identified until the lower line of the 2nd. There’s only thin air above till the 16835 will be reached! Thin air doesn’t provide resistance. I think, 16835 is a logical target for January. But the natural horizontal resistance at 17235 is likewise astonishing.

It’s really interesting that two different monthly setups of the Dow Jones – one of them starting at the bear-market low of the year 2009 and the other at the year-low 2011 – put out important monthly targets exactly there, at 17220 and 17235, respectively… isn’t it?!

New: The hottest trades worldwide – Everyday 1 fresh trading idea – Your short-term e-mail trader for quick and safe profits

If you like, every day from now you may acquire with me safe trading-profits after Gann’s forecasting methods. Simply try out now the worldwide first Gann short-term trader. It’s extensively tested and optimized by me, of course. By the way and gradually, you’re going to gain experience and perception of many forecasting methods. The cost of this education could be priceless if you are not an accomplished trader.

Test my new e-mail trader GUNNER24 Trade of the Day yourself now. You best register immediately. If you’re fast you’ll even benefit from the introduction price that’s reserved for the first 100 traders only! But you have to hurry up, for in the moment I’m writing these lines, only just 37 traders have the chance of getting the favorable introduction price:

So it’s foreseeable that as early as tomorrow the door for the unique introduction price with a discount of a 20% will close! Please act now!

With the GUNNER24 Trade of the Day every day you’ll get a fresh trading idea from me directly into your e-mailbox. You’ll simply implement the ideas 1 to 1. Additional sending follows in case of urgent call for action. They contain a chart with the GUNNER24 Setups, comments, buy-and-sell-triggers, targets, detailled order instructions and stop-loss.

These are the markets we’re in: S&P 500, NASDAQ-100, Dow Jones, DAX, the FTSE 100 and Nikkei 225 as well as gold, silver, platinum, copper, crude oil, EUR/USD, $, €, ¥, £ and the worldwide hottest stocks.

Just go ahead. You will gain experience and perception of many forecasting methods. Within the GUNNER24 Trade of the Day you’ll trade steadily and disciplined, focusing on profitable short-term trading.

Be a part of our exclusive sworn GUNNER24 Trader Community – now…

• with daily trades – quick, safe and profitable…

• in well-chosen precious metals, commodities, indexes, currencies and in the hottest stocks worldwide…

• in both rising and falling markets…

• with little use of capital…

• with constantly more than a 70% of winner trades – year by year…

Go and see for yourself. Test the brand-new GUNNER24 Trade of the Day now. Be fast ensuring the whole 20% of discount, month by month!

Click here, to join GUNNER24 Trade of the Day!

Be prepared!

Eduard Altmann