Today, some pretty important things are to be reported again: The first GUNNER24 Forecast on the current stock market correction regarding the duration of this bull market correction leg, as well as the resulting turning points resp. downtargets.

The Wednesday FOMC announcement saw the Fed raise rates for the fourth time this year, and the ninth of the cycle, +25bps to a new target range of 2.25-2.50%. Afterwards, it all fell to pieces... and after a severely bearish week for US stock markets, with net weekly losses ranging from -8.4% (NASDAQ, Russell 2000) to -7% (Dow Jones Average) resp. -6.9% for the most important S&P 500 most analysts are calling this recent strong correction a bear market.

Technically speaking a bear market is when an index has fallen 20% from its peak. So yes, there are industry groups and sectors and regions that are in bear markets right now. In fact, the Russell 2000 Index has declined -26% and is technically in a bear market.

Additionally, most important EU stock

markets incl. DAX are in bear market mode now. S&P 500 Index,

NASDAQ, and Dow Jones Industrial Average are not in a technical bear

market yet despite the declines we have seen recently. But they are

close...

One thing traders should remember, bear markets will still have rallies

and bounces. The same way bull markets have pullbacks and

sell-offs.

In 2011, the major stock indexes plunged

from May to October before rallying to new highs. There were two strong

pullbacks in 2012 before another rally higher. Traders may recall the

weak 2015 that we had and the important bullish double bottom in

January and February 2016. Even during the 2008 bear market there were

some monster rallies throughout the year.

The point here is that this is now a traders market. Stocks are no

longer climbing the wall of worry. Almost every news headline that is

negative is being viewed as negative. Even positive news is now being

viewed as negative and this is a change in character from what many are

conditioned to over the past 9 years.

This is an environment where you must cut down the share size and take shots at the long side when the technical levels are talking to you.

This means that you must have the major stock indexes trading into a major support level and at the same time make sure the stock or equity you want to own must also be trading into a major support level too.

Simply put, the bull market will no longer bail out if we are wrong like it did in entire 2017 and most part of 2018. Those days are over for now. Everything is technical, traders and investors must now adapt to the new environment.

Just remember, regardless of a bull or bear market nothing goes up or down in a straight line. There are always bounces and pullbacks, that is what makes a market, so just trade the technicals until another trend is established.

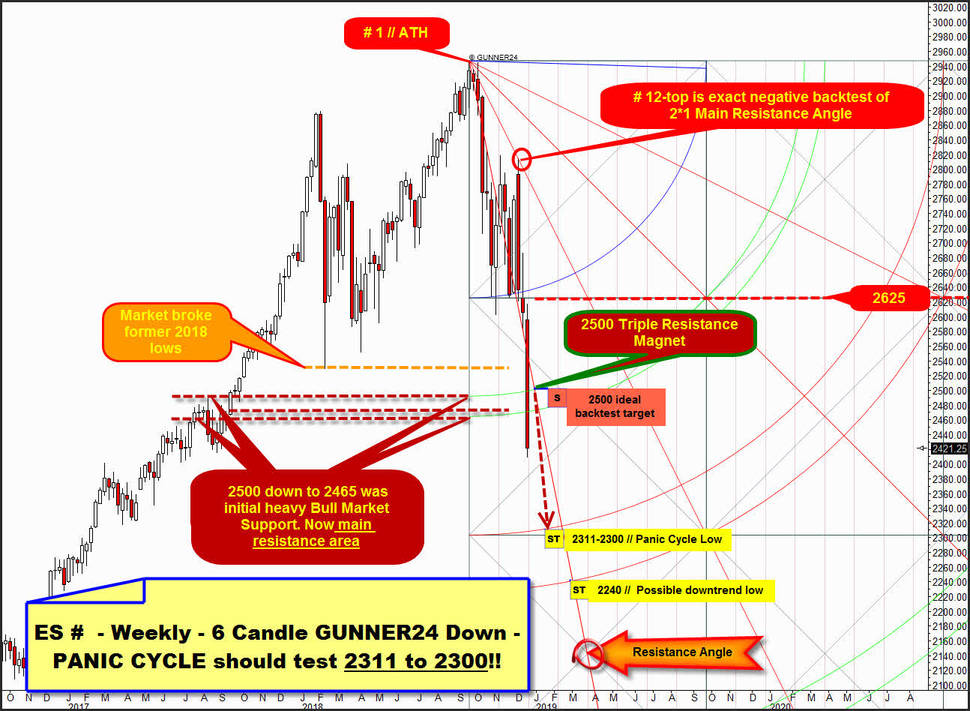

Today’s fundamental GUNNER24 Analysis of the current correction is based on the weekly chart of the e-mini S&P 500 continuous future contract (ES #).

There is a reason for that: As a rule, important changes, targets and signals in terms of time and price can always (Yessir, yet nowadays) best be identified in the corresponding future markets, since these ones are being traded for nearly 24 hours a day, thereby containing all the swings emerging in the past according to the factors time and price and sentiment = emotions.

Moreover, it’s the really big money, the Big Boys that trade the future markets that again regulate the pricing of the corresponding indexes. So, where the money investment resp. the bet is the highest, also the emotional extrema should have to be the most revealing as far as future developments and expectations are concerned:

The weekly downtrend count that begins at # 1-alltime high (ATH) candle for next week is at No. 15.

For now, I think the downtrend is measured best with above overlayed weekly 6 Candle down, cause first important # 6-downtrend low together with # 10-close and # 11-low confirm existance or former importance of the Blue Arc.

Their positioning, in turn, automatically leads to the 2625 pts first square line which precisely was bearish broken finally at past week opening auction, thus activating a test of upper line of 1st double arc in further course of this downtrend.

Scaling should fit perfectly cause # 12-countertrend high precisely was at 2*1 Angle (... resistance ...) which now consequently is most important downtrend resistance and at same time possible most important future bounce or backtest uptarget or upmagnet resistance.

==> Downtrend week No. 13 broke prior Blue Arc as prior 2625 pts first square line support, thus activating quite normal downtrend target of upper line of 1st double arc at 2500 pts!! # 13-close was a double sell candle in the weekly chart in GUNNER24 Terms.

Now we know for sure that this is an unusual strong behaving sell signal in the weekly time frame cause this week # 14 course brought heavy bearish continuation, with this week:

A) closing near correction lows.

B) firing downside break of initial important former 2018 lows support.

C) breaking the usual concrete bull market support ranging between 2500 and 2465 pts. For this prior heavy support, watch the 3 dark-red dashed horizontal out of lines of 1st or within 1st double arc zone. Of course the 2500 to 2465 has morphed to usual strong heavy future resistance upmagnet.

D) And last but not least the decisive downwards break of 1st double arc, first downtrend target.

This extensive bearish nature means that the market must be in a PANIC CYCLE!

and

This downtrend week No. 14 broke 1st double arc finally and decisively, thus NEXT quite normal downtrend target of upper line of 2nd double arc is now next activated downtrend target and has very high odd to be worked off within this PANIC CYCLE, wherby PANIC CYCLES usually tend to last just 2 to 3 week candles!!

In which this week candle # 14 can only be the very first week of panic.

Thus upper line of 2nd double arc PANIC CYCLE target at 2311 to 2300 pts is expected to be worked off earliest in course of next week # 15, at the latest, however, in the course of the week after next trading week # 16.

2311 to 2300 is potential - then - bear market - MAIN TARGET area and could or should at minimum lead to a knee-jerk cycle which usually should test back 2500 Triple Resistance Upmagnet within a 2 to 3 weeks lasting sharp bounce!

Of course, a very qick test of the 2500 within the next 2 to 5 trading days before the 2311-2300 PANIC CYCLE target is completed would be a gift for all the growling bears!

IF market bottoms out at 2300 surroundings supported by PANIC VOLUME until the end of the very first trading week of 2019, followed by visible bounce which then is able to overcome 2500 pts on weekly closing base there is a 65% chance that entire downtrend has ended and the next strong multi-month bull market upwave has begun, which then should be able to print some higher alltime-highs in course of 2019 and 2020...

IF 2500 Triple Resistance Magnet offers strong resistance on weekly closing base in course of January 2019 the bears could await another - then final - washout which should target and work off the lower line of 2nd double arc at around 2240 pts in course of February to March 2019.

Then, usually the 2240 pts environment, resp. lower line of 2nd double arc support work off ends this - then - official bear market - and triggers next multi-month bull market upleg which usually should be able to deliver some higher altime-highs towards 2020.

I wish you a blessed peaceful Christmas!

Be prepared!

Eduard Altmann