Convenient to the beginning of the contemplative season of the western culture, today I’m taking the liberty of a divergent but thoroughly enlightening (as I hope…) view beyond my own short nose. Once not focusing to the pretty short-term waves, magnets, resistances and supports of the usual US stock markets, I’d like to impart you some security in terms of the uptrend of the stock markets of the coming 4.5-5.5 months. I’d furthermore like to put a present – neatly wrapped-up – under my Xmas tree, and of course under yours, as well, gentle readers.

Whereas for months/years the common US analysts/media/wavers have been living from drumming into their followers’ heads that the US and the EU markets are going to sag striving soon for the 2008 lows by virtue of exposing any droll topic (cues like US downgrade, fiscal cliff, Obama regency with all the ugly impingements to the country and the system, inflation or deflation or stagflation, unemployment rates, ludicrously changing Euro and US$ crises discussions, PIIGS, Grexit, heavy downgrades of the different EU countries and much more besides) – for me just one fact counts, the only valid fact in the whole game…

And this very fact is based on the simplest and most successful trading system on earth. It’s plain and very profitable – because it shows a hit rate of 100 %. The signals of this system are rare appearing once in a blue moon. The institutional participants worldwide follow it blindly. And the small investor should join them investing again and again into the current trend, refueling again and again in case of corrections.

The 100% winner system is: Invest and go long in stocks and stock indexes when the interest rates fall. When the interest rates begin to rise, say good-bye to the stock investments shorting the markets.

Since last week we know for sure that the US interests are not going to be raised for the coming years either. Ergo invest in stocks because the uptrend hasn’t come to an end by a long chalk. Use also the long-standing consolidations and profound corrections in the uptrend for stacking.

The W.D. Gann decade cycle, according to Gann’s own assessment his "most important ever discovery", shows us that the end of important bull campaigns very often coincides with years ending on 9. Why should it be different with the current MEGA stock-bull? Buy all the important lows of the years 2013 and 2014 that are expected to be bear years after Gann’s decade cycle! According to W.D. Gann’s decade cycle 2013 is supposed to top out in March or April. The GUNNER24 Forecasting method is likewise pointing to some important tops in spring 2013.

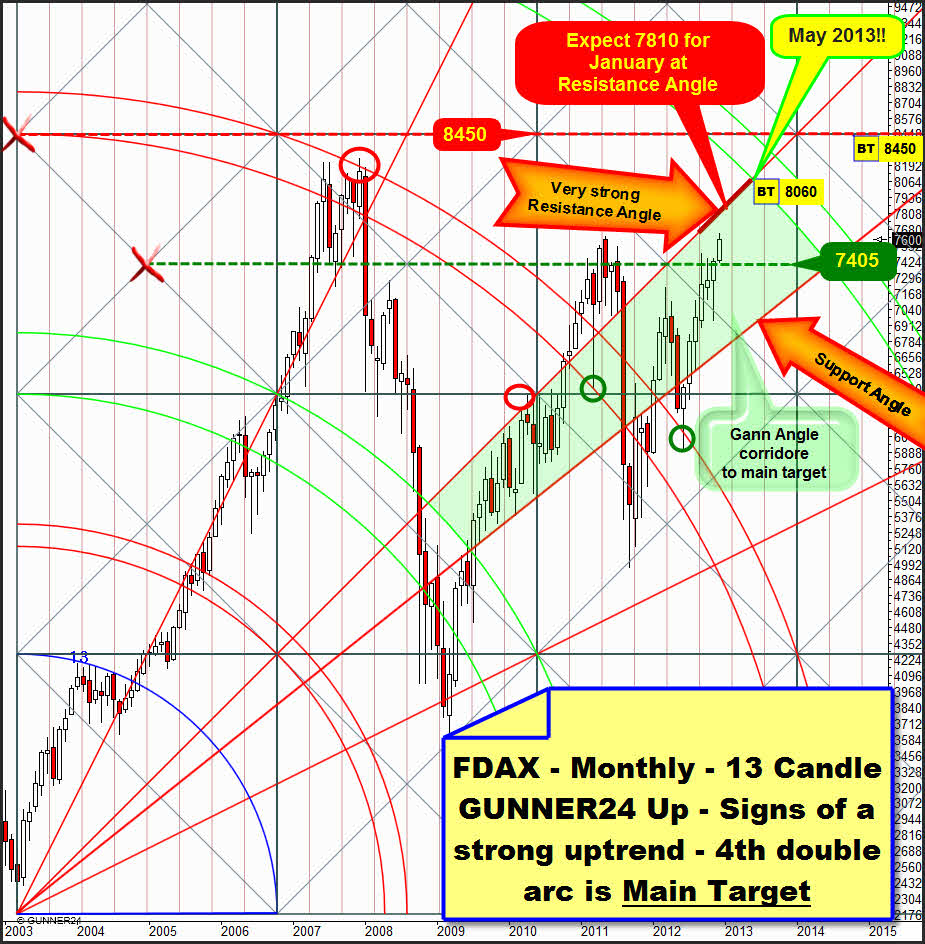

Let’s take advantage of the last upleg of this rally in the US markets! The trigger point when also the US stock markets will turn into a new downleg will be provided to us by the DAX, among others. Not before the DAX is allowed to fall, the other important markets will follow persistently:

We don’t have to understand the markets, but try to interpret them the right way. Here in Germany almost none of the persons I know invests actively and persistently in DAX stocks. The stock market culture is completely on the ground. Like always, the small investors missed the trend, and perhaps they’ll enter near the tops. Except just a few of the 30 DAX stocks, even fundamentally they are not worth an investment from my point of view. But the foreign countries consider it in a different way, so they do invest in this "safe haven". Well, be that as it may, at any rate things are going to continue this way until April/May 2013.

Like clockwork the DAX is approaching its long-term main target, the 4th double arc in the monthly time frame. Fact! The DAX trades again in its long-standing dominating Gann Angle corridor. Above it is limited by the Resistance Gann Angle, and below it is backed by the Support Angle. The obvious main target is situated at the important 8060 magnet. That’s where the Resistance Gann Angle is intersecting the lower line of the 4th. As far as the feeling goes the DAX is even able to top out at the 8450 horizontal resistance since the final wave uses to exhaust frequently. Like in the case of the all-time high at the 3rd double arc from December 2007 the upper line of the 4th is very likely to be reached.

Analyzed from the shorter-term point of view the DAX is supposed to start its Xmas rally in 3-5 days, like all the US indexes do – harshly and strongly. It will close at the year-highs ending up in a 4-6 week correction in the second January week at the latest. Technically the January top would have to be marked in the surroundings of the resistance angle – by 7800! The possible correction target for February are the 7400 at the now very strong horizontal support of the just passed square.

Conclusion: This leader doesn’t permit any more severe correction until spring! Starting from the 4th double arc the DAX is supposed to swing into a profound six month correction in the MEGA stock-bull that will last until 2019.

A couple of apples under the tree:

"The bigger they are, the harder they fall", we are said. Overpriced, exhausted, the last ascent is showing parabolic traits, blah, blah…:

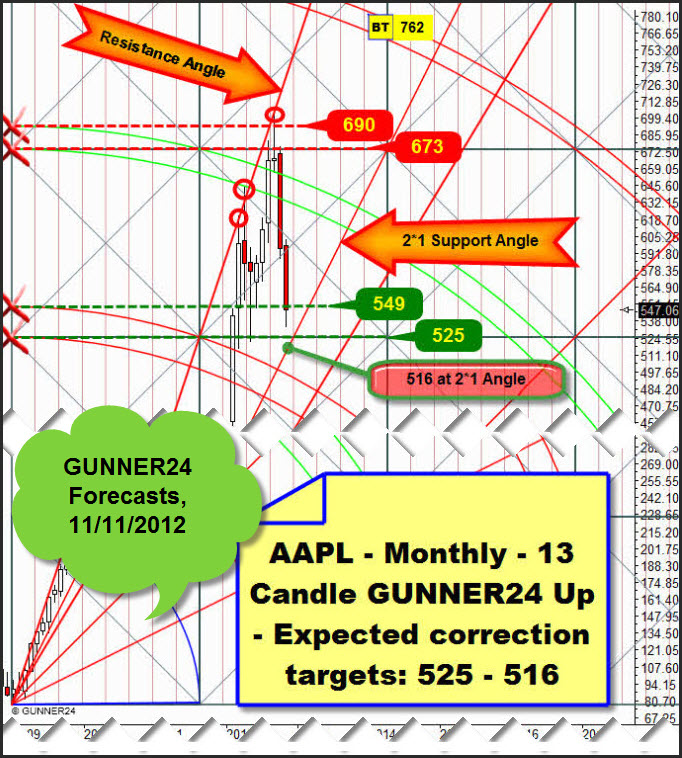

AAPL is an ideal trading vehicle now. And certainly it is a beautiful Xmas gift for every long-term investor! It was on 11/11 when I last went into the highflyer. The stock was supposed to turn up again at 525-516:

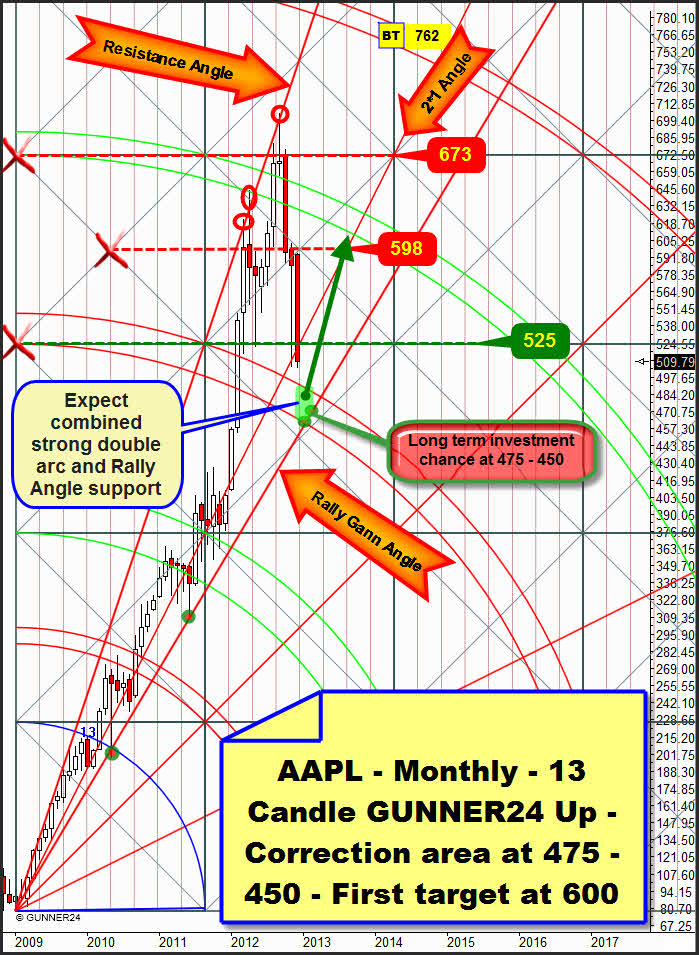

As expected, in November 2012 AAPL got a grip on itself at the important 2*1 Support Gann Angle at about 506. From there a severe countertrend started ending curtly in front of the monthly horizontal GUNNER24 Resistance at 598$. Since the stock did not manage to re-conquer this resistance – now a very, very strong monthly resistance!! – at the beginning of December the second correction leg started. We see that by Friday at 510 the 2*1 Angle was clearly fallen short. The actual weakness should now to continue until the next important monthly support, the 3rd double arc is reached. A truly historical chance is waiting for us investors then. The very strongest support area begins at 475 ending at about 450. At 450 the Rally Gann Angle is residing for December 2012. I think that this one will have to be reached at any rate either in December at 450 and/or in January 2013 at 470 or so.

At the latest from the Rally Gann Angle AAPL should turn up, according to the rules. Target until April/May 2013 is the renewed reaching of the 4th double arc at 600$. Since the 4th double arc was clearly broken upwards in the course of the nearly 3 years lasting upmove, we’ll have to suppose the reaching of the 5th double arc in trend direction with a 70% of probability. In the very worst case, in 2016 at the latest this 5th double arc will have to be headed for again in the 700$ surroundings.

So in the very worst case, for AAPL we can see something like a double-top or marginally lower highs on monthly basis. But if now the rebound from the 3rd double arc or from the ruling Rally Gann Angle turns out to be lasting and strong enough for facilitating the 4th double arc to be taken again until spring 2013 and to be maintained, the 800 at the 5th double arc until the end of 2013/beginning of 2014 will be thoroughly still possible.

AAPL isn’t dead yet!!! It’s rather a huge chance between 475 and 450$!

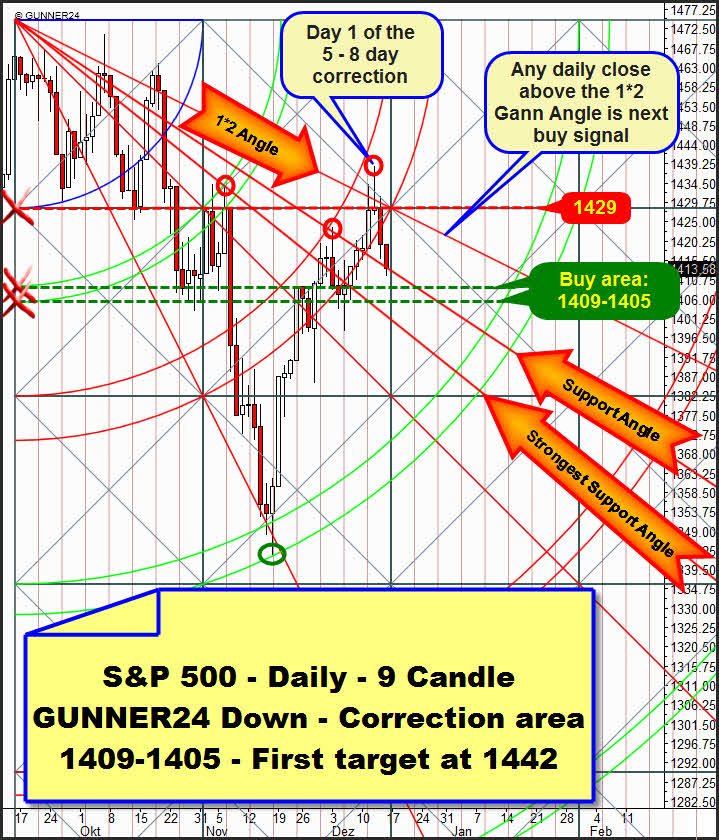

Let’s finally have a brief look at the further rally till the 1442 target in the S&P 500:

Last Sunday I expected a pullback at 1429 points and the last upswing to finish within the next 5-7 days. Intraday it went a shred higher, but the swing high was already reached on Wednesday at 1438.59. Later the 1429 at the 1*2 Resistance Gann Angle and the horizontal resistance turned out to be an important resistance. Daily closing base!

You may expect a resumption of the upmove from the middle of the week on. At the latest next Thursday (at the earliest on Tuesday) the S&P 500 is supposed to start its Xmas rally from the 1409-1405 horizontal support – harshly and severely! Traditionally the two trading weeks before New-Year belong to the very strongest weeks of the entire year. That is not going to be different this time… Just expect the top of the Xmas and New-Year rally to happen in the first trading week of 2013 at about 1442 index points.

|

„As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

By virtue of the Xmas season the next Sunday issue of GUNNER24 Forecasts is dropped. Correspondingly the next free issue won’t be published before 12/30/2012.

I wish all of you a blessed and contemplative Xmas!!

Be prepared!

Eduard Altmann