Need a Killer Trade? - Try Gold

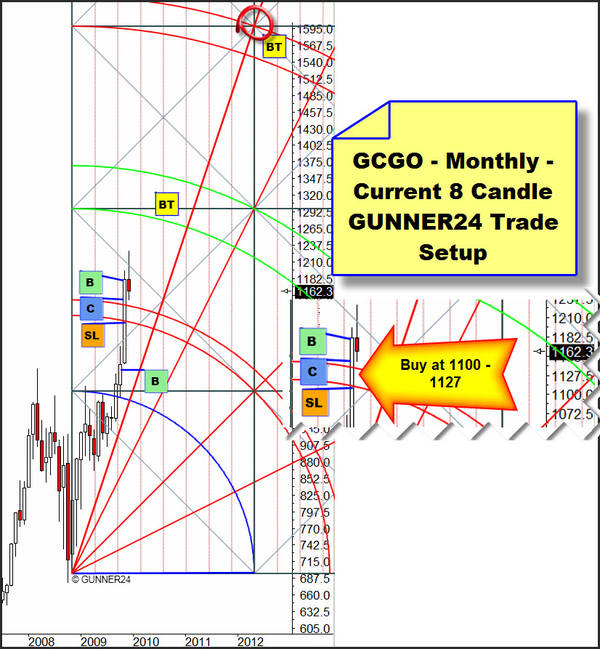

On monthly basis, rarely such a simple clear GUNNER24 Setup is to be found as it is in gold. It's running like clockwork. Two different monthly setups with synchronous course offer us trading security.

|

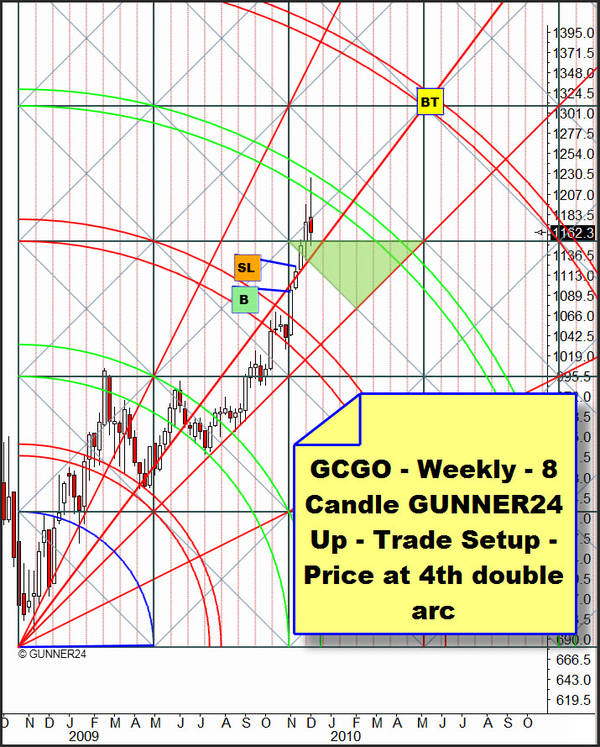

The last time we analyzed this GUNNER24 Up Setup here. The price is making a beeline for the main target being in the gray acceleration zone which determines rapid price moves, the trading zone we traders like because that is where quick and lucrative trades are possible. In those zones, we may work with sell and buy stops which go into plus within a couple of minutes if they are filled. The green support line starts at 1133 where the price positively is going to dip in next/the week after next, at any rate. In any case, the price is going to be stopped by the horizontal square line. 1075 is mega support!

We have been able to improve the following setup in the course of the last months. Well it simply suits us better than in the last forecast because of correspondences in time and price.

|

Here, we are in the gray acceleration zone as well and Thursday we rebounded from the diagonal square line. And now we are approaching the promised killer trade... Obviously, because of the rebound from that diagonal 2nd passed square a test of the first double arc was to come up. But that double arc offers strong resistance. All the fairground barkers who are setting their hopes on a prolonged gold crash will be disappointed. The range for our monster buy with target 1320 is lying between 1100 and 1127.

On monthly basis, in November we had covered 2/3 of our position at 1135, but according to the rules, we had to re-buy at the November closing price.

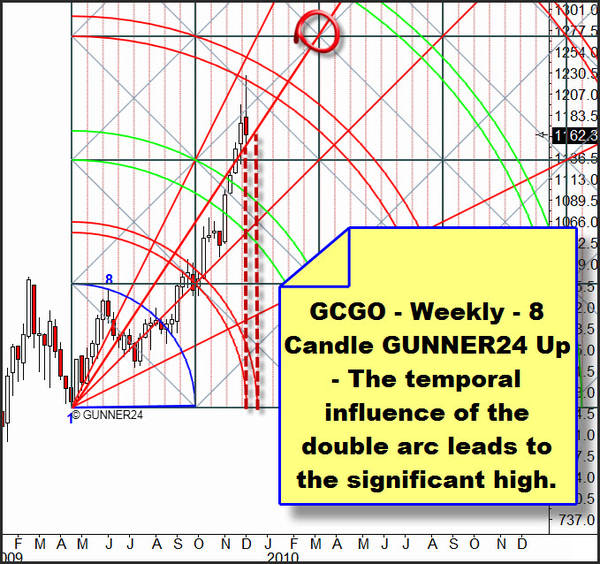

The reason why on Thursday the price produced its high and then had to fall is shown by the different GUNNER24 Up Setups in the weekly and daily time frames, respectively.

|

1. In the Weekly 8 Candle Trade Setup, gold has reached the 4th double arc which offers few resistance. On Friday, the price tested the support zone and at first rebounded from it impressively. Our tactics: Buy every dip within the green support zone. The last time we analyzed this GUNNER24 Up Setup here.

2. In the following less important Weekly GUNNER24 Up, on Thursday we reached the 3rd double arc, as well.

|

Here, too, the Gann Angle resisted Friday night. The support zone is approximately corresponding with the one of the GUNNER24 Trade Setup beginning at 1135.

|

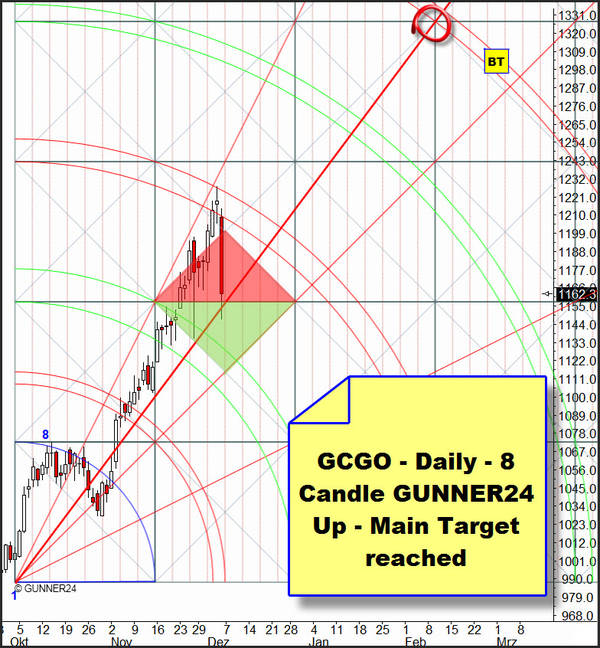

3. The price slide which began last Thursday on the one hand was determined by the 8 candle initial impulse from last October. Here, we have got a clear signal we will go on running up. The price closed within the double arc. We should adjust to go long again at the 1*1 Gann Angle. Dipping in on Monday/Tuesday would be perfect. We'll collect the nuggets at 1119 – 1122. You should use this setup if you trade with futures. For hedging and as a double check, like always you should trade in the 1 hour and in the 4 hour setups in order to have the optimal moment to get in.

|

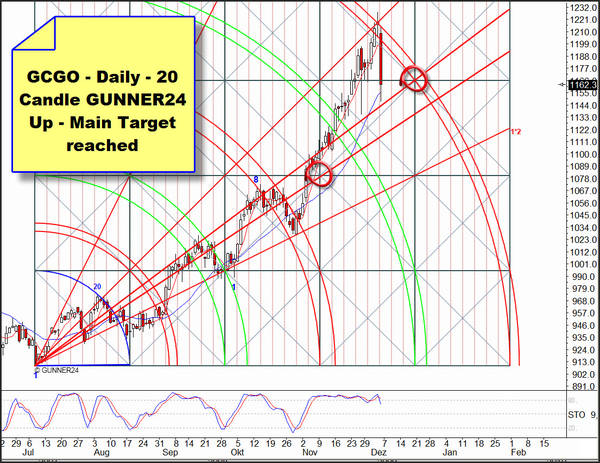

4. In this 20 Candle GUNNER24 Up from July, on Wednesday and Thursday we closed within the main target. Gold has touched the 1*1 Gann Angle from below and reached its price and time target. Since the price closed within the double arc the main trend will try to break it after a consolidation.

Support is formed by the setup-anchored Gann Angles which again offer the main support between 1090 and 1122.

Tactics for next week: We will try to buy each dip under 1130 with GLD in order to be positioned longer term in any case.

Trading futures, we have to consider the 4 hour and 1 hour time frame to determine the precise moment for getting in. Since Thursday we have been short at 1220. SL at 1215. There, the buying range at lower dips is at 1100-1120 where we are going to turn our position.

Be prepared!

Eduard Altmann