The stock markets have been developing an enervating sideways range for weeks. On the one hand every new horror report on the European debt crisis front is keenly being used to sell the little rallies, and on the other hand the market participants are buying the daily swing lows hoping not to miss the second leg of the coming year-end rally. The Elliott Wavers prognosticate the beginning of a new sell-off-tempered downwards wave to happen soon or in only a couple of days, but the seasonality is clearly contrary to that position actually not permitting a considerable sell-off within the next 4-6 weeks (keyword year-end rally…).

Since neither the weekly and monthly GUNNER24 Setups nor the indicators and oscillators on daily basis give any unambiguous timing signal saying when and in which direction the current sideways move is going to be left – during the preparation for this issue I felt pretty desperate, simply because I didn’t know how to back by further setups the ensuing long-recommendation on daily basis. Technically we mustn’t rely on one single setup, but a signal should always be confirmed by an independent setup…

In the end, a chart with one GUNNER24 Setup that displays best the imminent buy signal would have been sufficient because "exceptionally" it is standing on its own. It is obvious, pretty free of risk and strong. But I thought to myself today I’m simply going to show you the way I use to proceed to find something tangible and solid, what kind of reflections and considerations cross my mind and which "tools" I utilize to find a practicable signal:

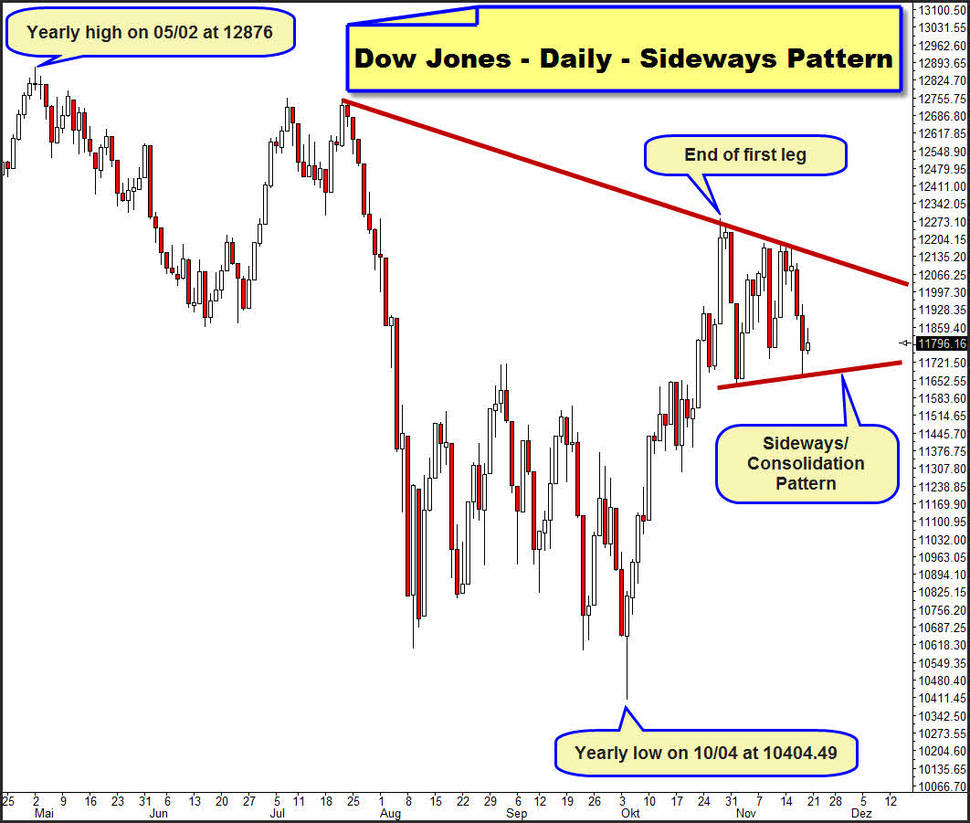

Starting point is, of course, always the respective market. Here it’s the Dow Jones on daily basis since the May highs. At first I regard the actual chart pattern – am I able to identify one? And if so, what does this pattern mean for the future. In the actual case I can see some lower highs since May but also a clear consolidation since the yearly October lows (symmetrical triangle) after the first upwards leg. The pattern speaks plainly for rising prices in the near future. Taking into consideration the seasonality, technically the triangle would have to be dissolved upwards.

My first question is now: When is that going to happen? Will I be allowed to buy some gifts next week or will I have to sit around in front of the computer for hours as of Monday because every second the breakout upwards may start off? Next question: Which price will indicate the best entry into the longs? Is it going to go downwards before, is it a fake downwards? And so on. In the final analysis I’m looking look for the least venturesome long-entry in terms of price and time!

For that naturally I’m using GUNNER24 with its abilities to evaluate as well the upwards as the downwards moves at the significant lows and highs in terms of pricing and timing.

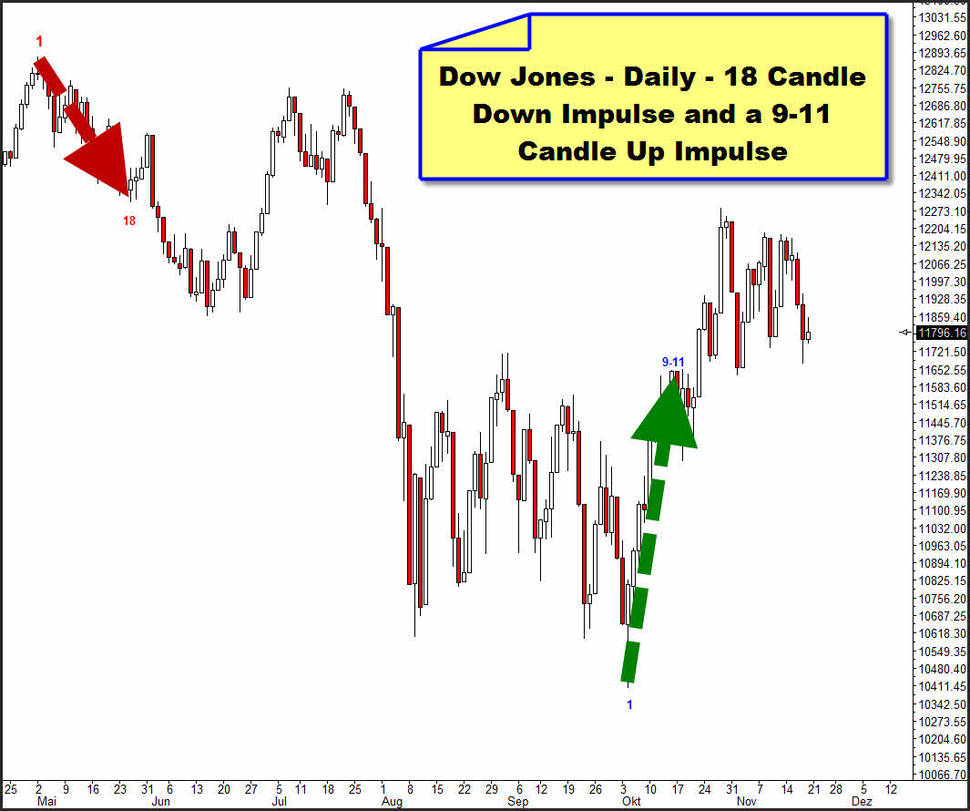

In the chart above I’m counting the candles from the high and from the low to the respectably first significant turning point or halt. Since the first developments released by the market participants are always the most important ones I’m considering first the last upwards impulse starting from the October lows. Here I count from the year low 9-11 upwards candles – until the first breakpoint of the initial up impulse applying a GUNNER24 Up Setup that is depicting as follows:

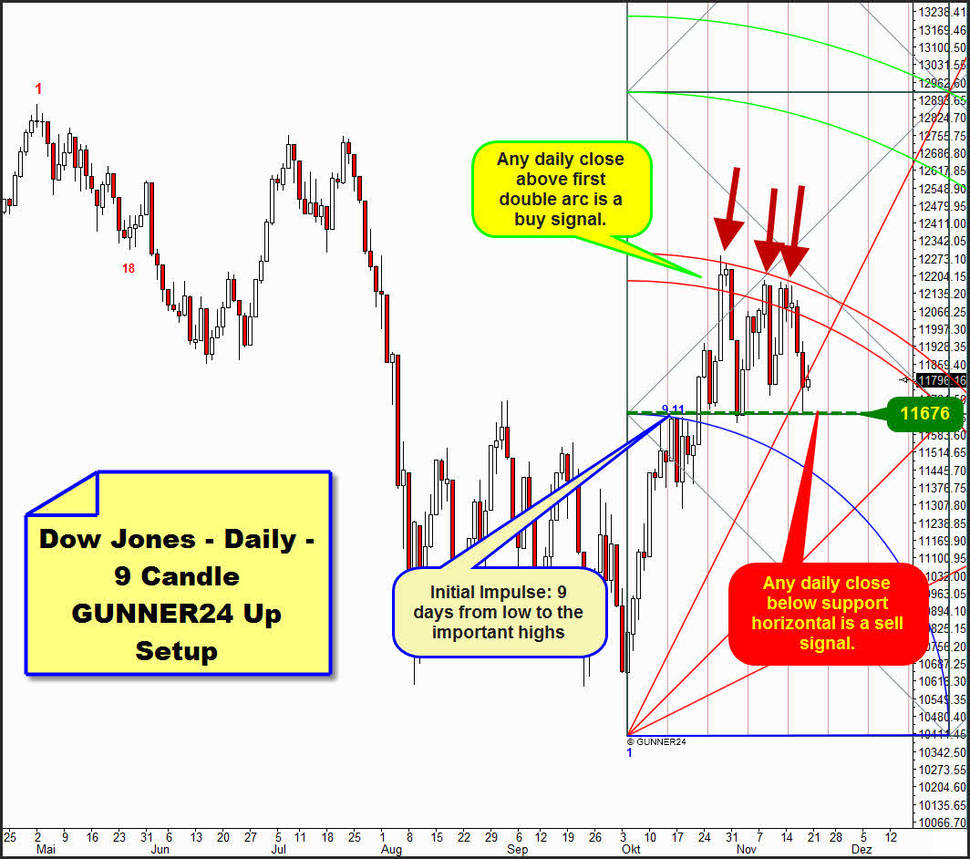

Well, the first double arc is manifestly offering resistance – the upper horizontal of the first square at 11676 is a natural support. A closing price above the first double arc would be an UNEQUIVOCAL buy signal – the target then will be the lower line of the 2nd double arc. If the 11676 breaks on daily basis a short term sell signal will arise… but how low would the market fall in that case? Hmm, next cushion point would be the blue arc then. That one always offers support, as well. So, in case of a break of the 11676 it should go down at least to the blue arc. That means about 11400-11200. Since I consider the year-end rally as to be much more probable than everything else a good long-entry is possible there. But it is also possible and probable that the market wants to fluctuate between the first double arc and the 11676 support during the next days (or maybe weeks). That might last until the middle of December.

But maybe the market launches a fake downwards without being willing to reach the blue arc. After all, the existing symmetrical triangle is a trend continuation pattern.

Conclusion: This setup leaves more questions unanswered than answered. I don’t trust the possible sell signals. I’d only trust the possible long signal: The clear break of the first double arc upwards or the clear breakout of the symmetrical triangle upwards. Still I haven’t got the timing sense: When is it going into which direction? So the next way of consideration is due:

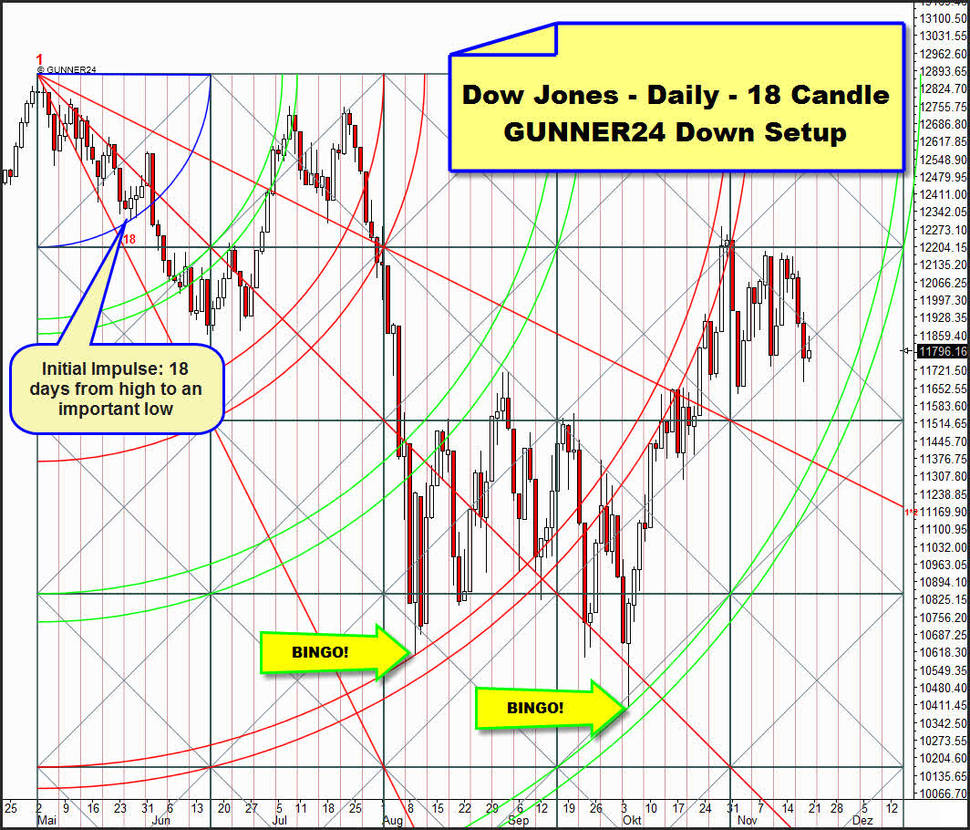

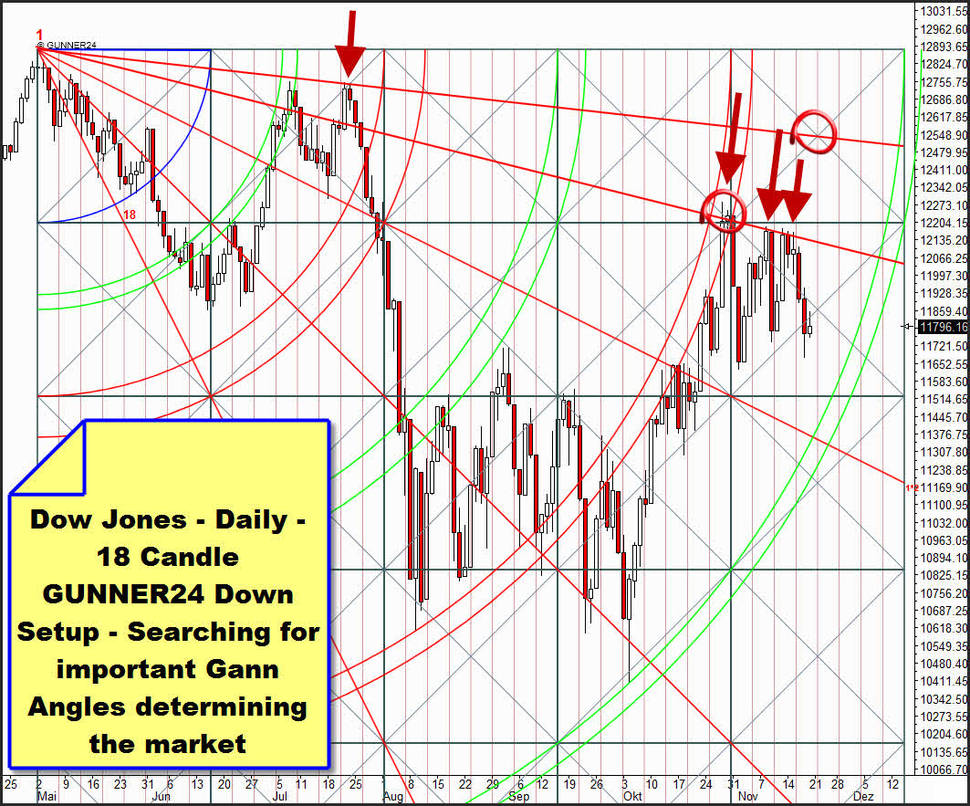

I’m applying the down setup at the year high. The first check is suitable to me. At the upper lines of the 4th AND the 5th double arc I can see the reactions or the change in trend respectively, according to the rules. With this setup I can work. Now I only need to find more evidence for the validity of the setup. I’m looking for some valid Gann Angle reactions:

I’m having some tries until I find resistances at some striking highs at two important Gann Angles. The lower setup-anchored resistance Gann Angle is very important. As many as three times the market bashed its head, and three times retracted it was. But no real sell-off followed on, just some normal retracements. So it is possible that the Gann Angle wants to be headed for once again being ready to be possibly broken upwards in the fourth try. It’s W. D. Gann’s rule of three and four!

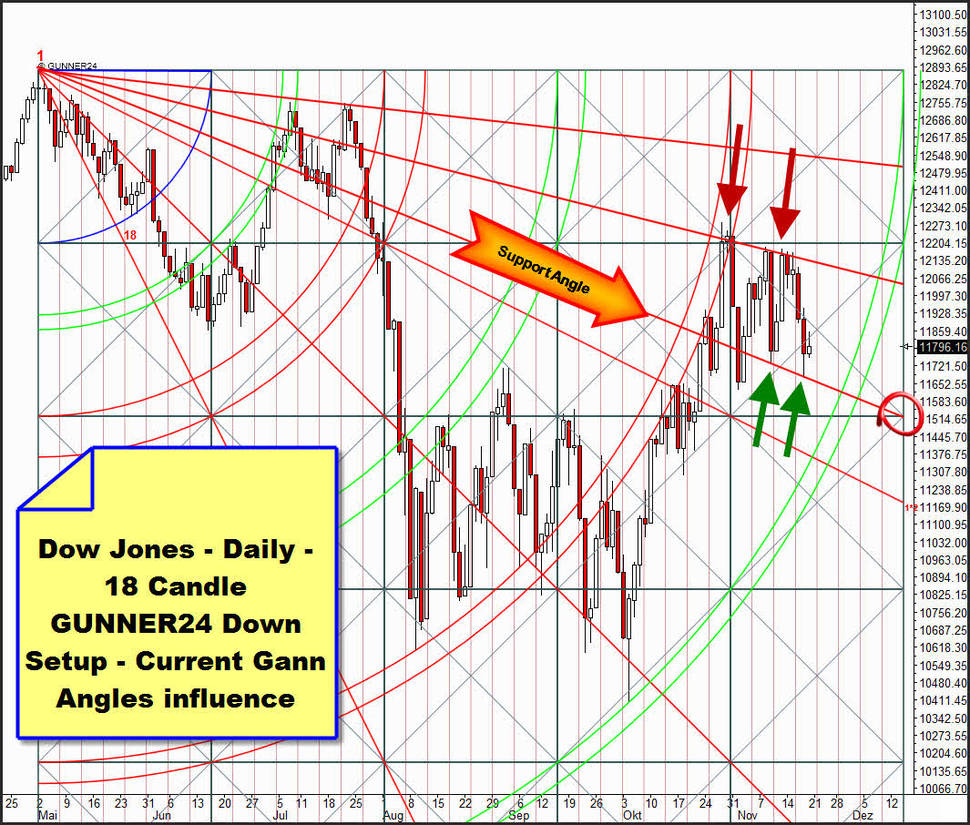

Well, let’s go on. I find another important Gann Angle. It’s the actual support Gann Angle, anchored at the extreme right. It is supporting the market at the green arrows. Also in the near future it will be able to cope with this support function. The third test, perhaps on Monday or Tuesday, may be successful as well. Thus, the market is likely to go down in its existing Gann Angle corridor also for the next time. Above it is limited by the resistance Gann Angle and below it is supported by the support Gann Angle. Just like in the daily 9 candle up setup above, there are trigger marks for entries. The closing price below the support Gann Angle will trigger the short entry. But now comes the most important consideration. And that one speaks clearly against a really profitable short entry. It’s the conduct of the market at the double arcs:

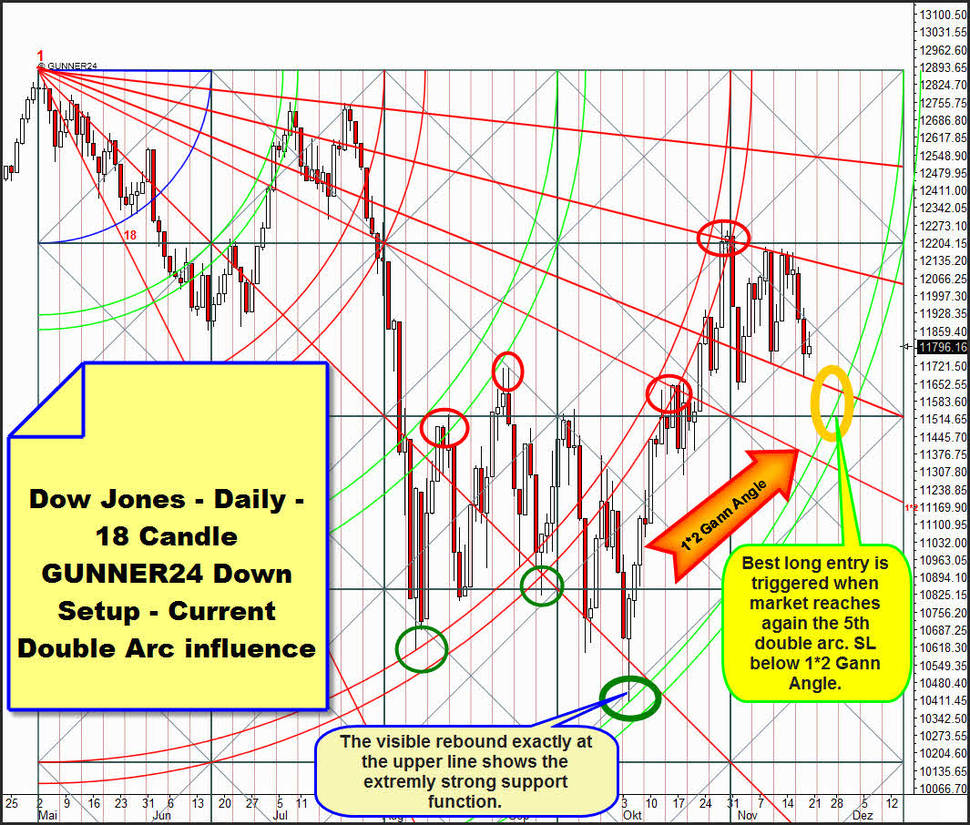

UNAMBIGUOUSLY the market is paying attention to the double arcs, too. Depending on their trend state the 3rd, 4th and 5th double arcs carry out important and visible resistance and support functions. All the red and green ovals and circles make that perceptible to us. The market is bouncing to and fro between them. They are having magnet functions, and they are causing visible reactions.

The most important recognition I’m gaining is that the 5th double arc on 10/04 was responsible for the year-low (bold, fat green oval). The touching of the upper line of the 5th double arc, the reaching of this price and time magnet were responsible for the mighty rebound, for the first leg of the year-end rally.

Furthermore, that means for the future conduct of the market that we may really expect the same reaction if the market wants to head for this double arc once more: a good rebound from the 5th double arc. Why should it lose its support state? The next touch with the 5th will be very likely to be the starting signal for the second leg of the rally!? At any rate that is where the best possible long-entry for all the bulls is lying. – There, at the bold, fat orange oval. It is giving us the right timing! No matter if the market will tank down with -300 points as early as Monday, no matter if it wants to go downwards for another week with a slight sideways tendency, no matter if it wants to head for the upper limit of the Gann Angle corridor again by the beginning of next week retracing downwards once again by the weekend. The new touch of the market with the 5th double arc offers the best long-entry, because it will be free of risk.

When the next touch with the 5th double arc on daily basis happens we will go long. SL will be the 1*2 Gann Angle. As well we’ll trade the breakout of the triangle that may happen even earlier! – About the daily actual long entry and the actual SL-positioning, please pay attention to the survey on http://www.gunner24.com/trading-performance-us-stock-markets/

Be prepared!

Eduard Altmann