A broad sell-off swept cryptocurrencies and publicly traded companies tied to digital assets. For the week Bitcoin and Ethereum prices tumbled around -21%. Marathon Digital lost around-10% and MicroStrategy shed -36.78% as Sam Bankman-Fried’s FTX empire filed for Chapter 11 bankruptcy. That came less than 48 hours after a rescue bid from rival Binance Holdings Ltd. collapsed.

MicroStrategy Inc. (MSTR), a Software-Application company, which has been purchasing Bitcoin in bulk since 2020, delivered the steepest decline in more than two decades, wiping out -36.78% in the past five trading days.

MicroStrategy disclosed earlier this month that it held 130000 bitcoins, with a carrying value of 1.99 billion $US. The carrying value is calculated using the lowest fair value of the bitcoins at any time since their acquisition. And in the conference call following 3Q results the company said the "low watermark" for bitcoin was approximately 17600$, suggesting the company will have to record digital-asset impairment charges in 4Q.

Wednesday, the valid monthly GUNNER24 Bitcoin Setup triggered bitcoin should test back BIIIIIG ROUND, at same time major important 10000$ support, which backtest should be expected sometime during 1Q 2023.

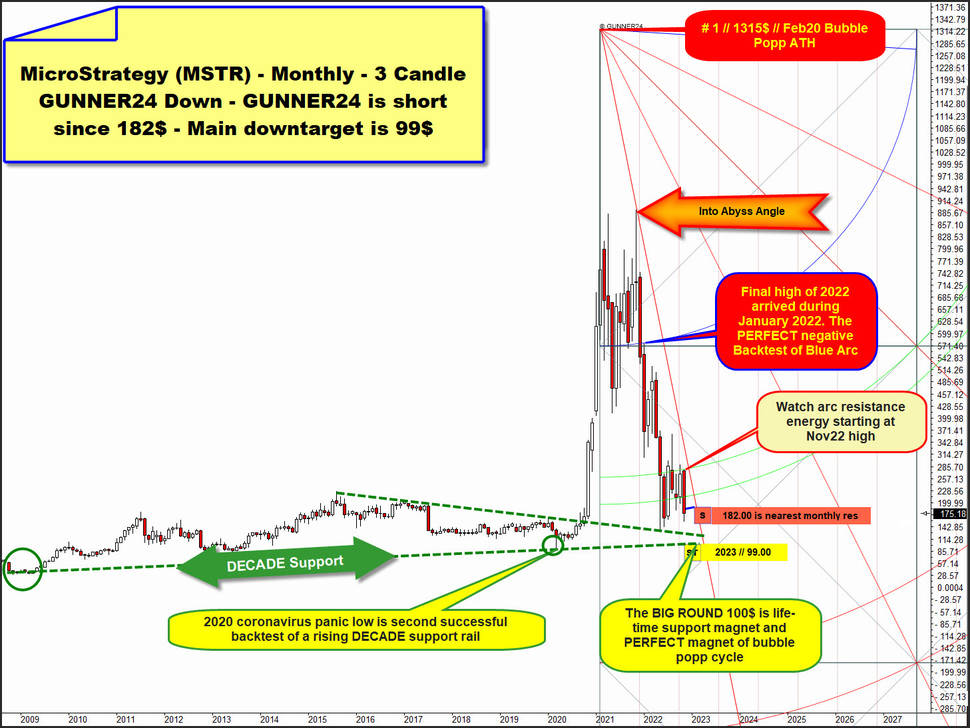

The bubble in MSTR shares popped # 1 // Februray 2020 at 1315$ alltime-high (ATH). The long bear market that started thereafter of course hasn`t ended and is one of the most evil.

What this technical weekly chart of MSTR shares proves ...

On Wednesday, the third longer consolidation cycle of the MSTR bear resolved likely finally and likely decisively to the downside.

In addition, the previously developed support rail of the weekly bearish Head-and-Shoulders Top (SHS) was pulverized after Wednesday sell-off. And all this before the weekly MACD has even fixed its next official sell signal.

In my opinion, this story will end badly not only for bitcoin which should testback BIIIG 10000 $US support. MSTR shares now have activated their very classic retracement down to their life-long support magnet, which is obviously the BIIIG ROUND 100$ W.D. Gann support number!!

If we let this monthly 3 Candle GUNNER24 Down Setup begin at the most important bullish price reached ever (alltime-high/ATH), we recognize the following and can therefore also deduce as follows:

The monthly 3 Candle downside measurement of this stock bear market shows that the final high of 2022 was the absolutely perfect backtest of the Blue Arc from below. Totally perfect, negative of course.

Since the final high of this year was achieved in January and the next heavy sell signal is triggered, the rule applies that with extremely high probability the final low of this year should occur by the end of December, or at least in course of December 2022.

Look again closely at how perfectly this month`s high auction retested the upper line of 1st double arc from below. Thus, the negative energy of the monthly upper line of 1st double arc triggered the just fired next heavy bear market sell signal. As well as the likely upcoming further lower bear market lows.

Some monthly closings below natural support of lower line of 2nd earlier this year were already the Harbinger that this bear market needs some more lower important bear market lows, and well, after the brutal bear week it looks obvious that the MAJOR life-time support magnet formed by BIIG ROUND natural 100$ support number & perfect confirmed rising dark-green dotted DECADE support line is THE major future objective for the MicroStrategy bear.

Normally the BIIG ROUND MAJOR 100$ support magnet = most attractive natural bear market downtarget magnet should be worked off until end of 1Q 2023.

Please start selling MSTR shares at 182.00$ what represents nearest monthly resistance magnet at above! GUNNER24 Trade of the Day service is short since 189$

==> Main downtarget for MSTR shares is a future dip below Big Round 100$ support number. ==> Main bear market downtarget at 99.00$/1Q 2023.

Be prepared!

Eduard Altmann