Please cover on daily basis only! If the NASDAQ-100 falls below the mark of 2179 you’ll see the stumbling block that should ring in a correction. And…watch out before you get committed into further long engagements on daily basis in the precious metals.

Something is lurking in the bush. It’s wriggling and rattling, but you can’t see it yet well enough, just a shadow now and then hiding behind the dense leaves. I can’t make out exactly whether it’s a bunny trying to pounce on the bulls or it may be a fierce grizzly.

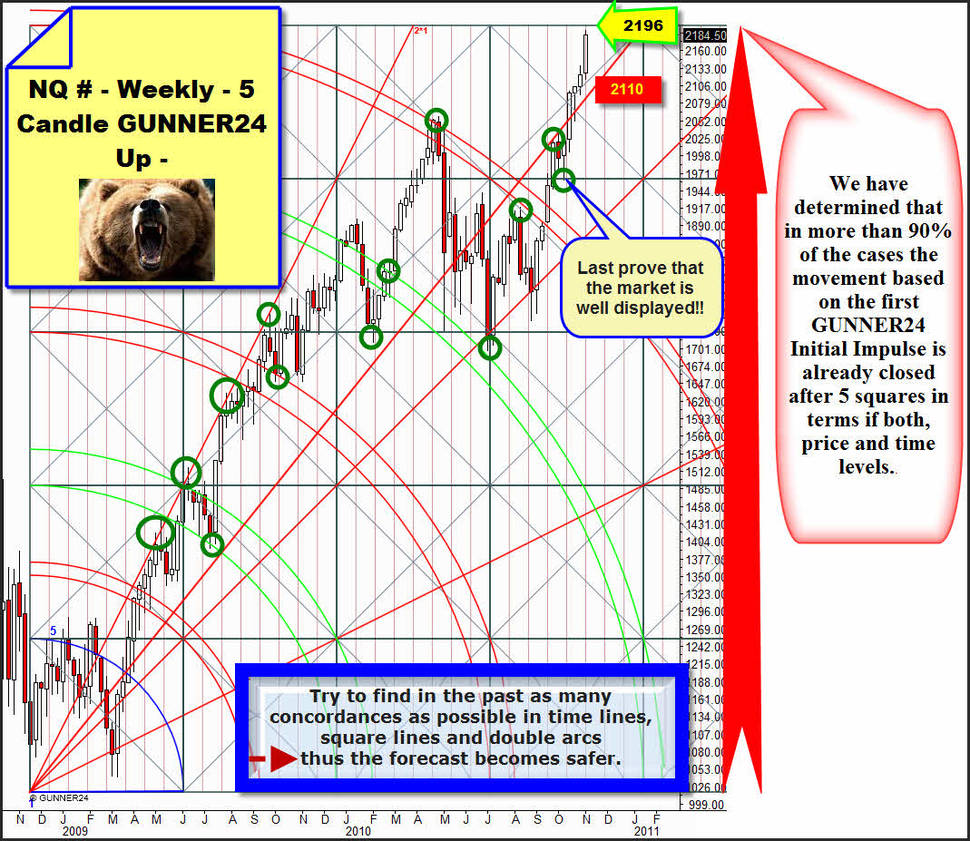

The NASDAQ-100 is the forerunner of the current rally in the stock markets. And the E-Mini is guiding NASDAQ-100’s way. In the NQ # we make out when the very first strong and greedy market participants grabbed it stoutly. As early as by the end of November 2008 the low was formed here with a following five week initial impulse.

The way the GUNNER24 Forecasting Method depicts the market is really so much typical: In the first square we make out a fake high. At the 1*2 Gann Angle the market is steadying itself, and rapidly it’s breaking blue arc, first square, first double arc. Minor corrections are to be seen at the 2nd and 4th double arcs. An extended correction is starting at the main target of the 5th double arc. We make out that the market is starting counter reactions at all the green marked circles. Both last right green circles show that the setup keeps on being valid because it marks exactly the limits of the different moves. The setup will be discontinued by next week. In case of a maximum price extension we always have to reckon on a counter reaction that is more or less violent. At a 90%! That setup is a very important one in my opinion even though in the meantime naturally the actual weekly GUNNER24 Up Setup has taken the lead.

In the actual weekly 5 Candle GUNNER24 Up Setup of the NASDAQ-100 we went long at 2186 even with a third position by the week closing since the 2136 were broken significantly. Target in the weekly setup is 2257! Here is where you find the setup.

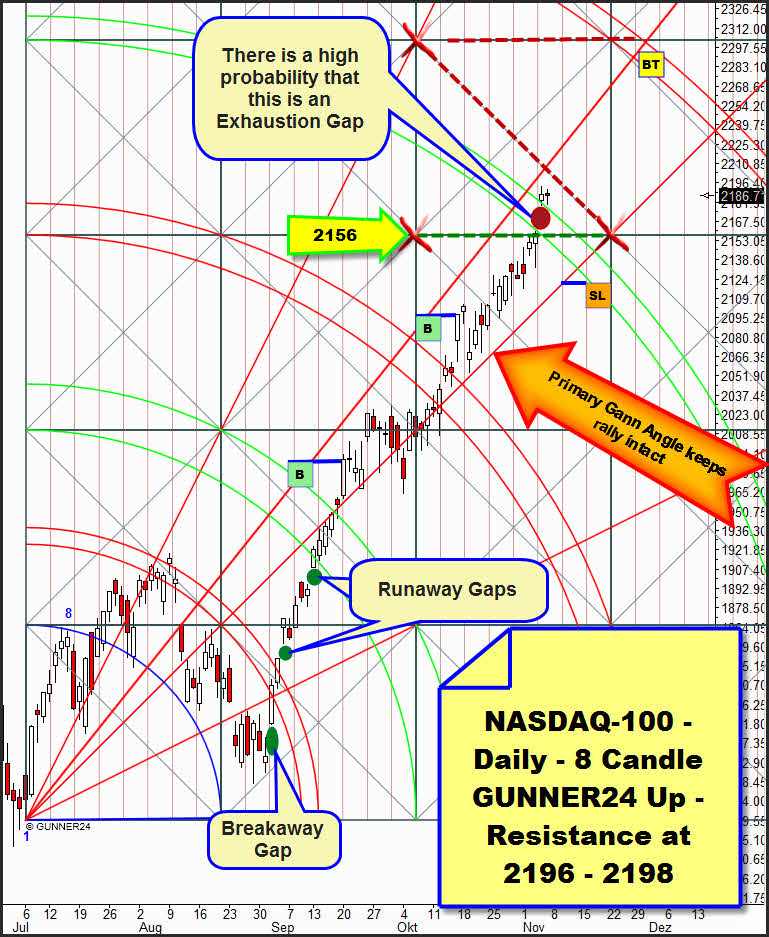

I feel I can even make out the first serious warning signs in the current daily setup of the NASDAQ-100.

The last gap of the daily 8 Candle GUNNER24 of the NASDAQ-100 might be an exhausting one.

An Exhausting Gap uses to arise after a pronounced move in the last third of the move. A last extreme price rise of the mass is being reached, but the time of exaggerations is over then and subsequently there is a stagnation or the actual trend slows down. Frequently a change in trend or a reversal follows. Please, don’t misunderstand me. In the NASDAQ-100 everything is green. The monthly and the weekly time frames are completely signalling buy. Well, also in the chart above with the new gap the 4th double arc has not been overcome finally, the market is sitting on it, which is an absolutely positive sign. But: IF IT’S REALLY AN EXHAUSTION GAP, with the chart anchored resistance diagonal that will be met by the market on Monday or Tuesday a correction onto the primary Gann Angle might/should happen. Duration of the correction will be 5-8 days.

That must/should resist then in order to attack the last leg of the upswing until the main target. We’ll have to assume of course that the last Gap may be another Runaway Gap. We’ll go long if the NASDAQ-100 reaches 2210. We’ll level our current longs if the NASDAQ-100 reaches 2179 next week.

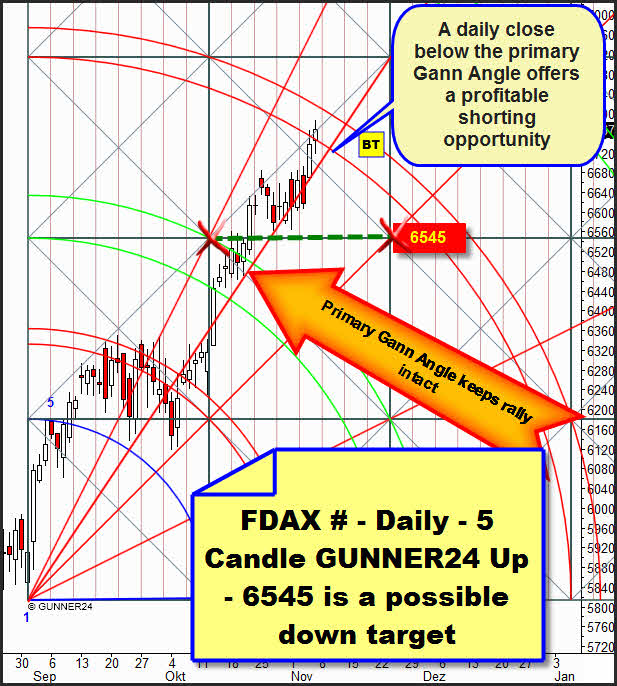

Another sign for a coming correction is to be seen in the FDAX # as well:

On Friday the FDAX continuous contract closed within its main target. Positive! A closing price within a double arc points to a continuation of the trend. But since it’s a main target we will always have to work on the assumption that a reverse GUNNER24 Setup may develop there! If the primary Gann Angle breaks on daily basis the 6545 will be the down target to be expected.

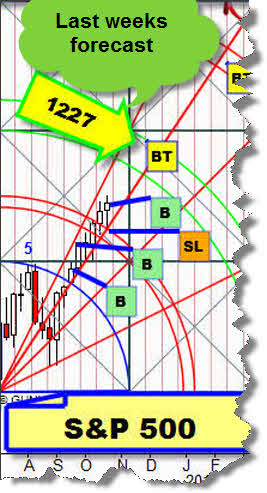

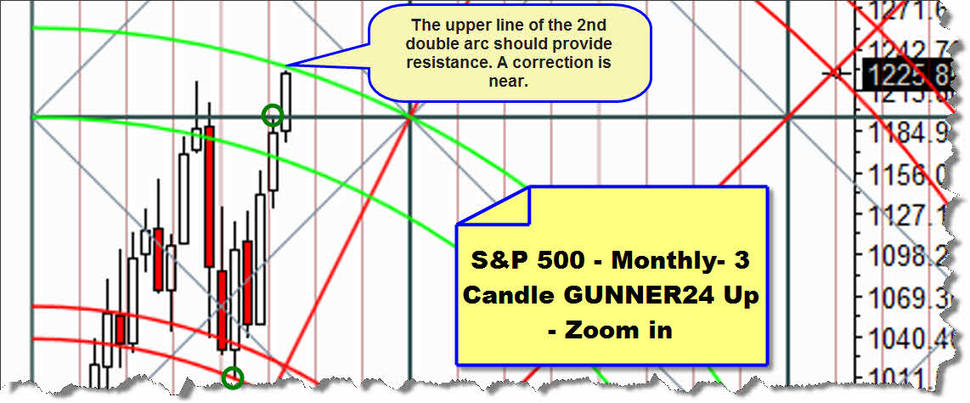

With the Friday high of 1227.08 in the S&P 500 the forecast weekly target at 1227 was reached. That might release a counter reaction.

The S&P 500 has approached the year high forecast by GUNNER24. That might release a counter reaction:

Zooming into the monthly 3 Candle GUNNER24 Up we see that only a short blip is missing to reach the upper line of the 2nd double arc:

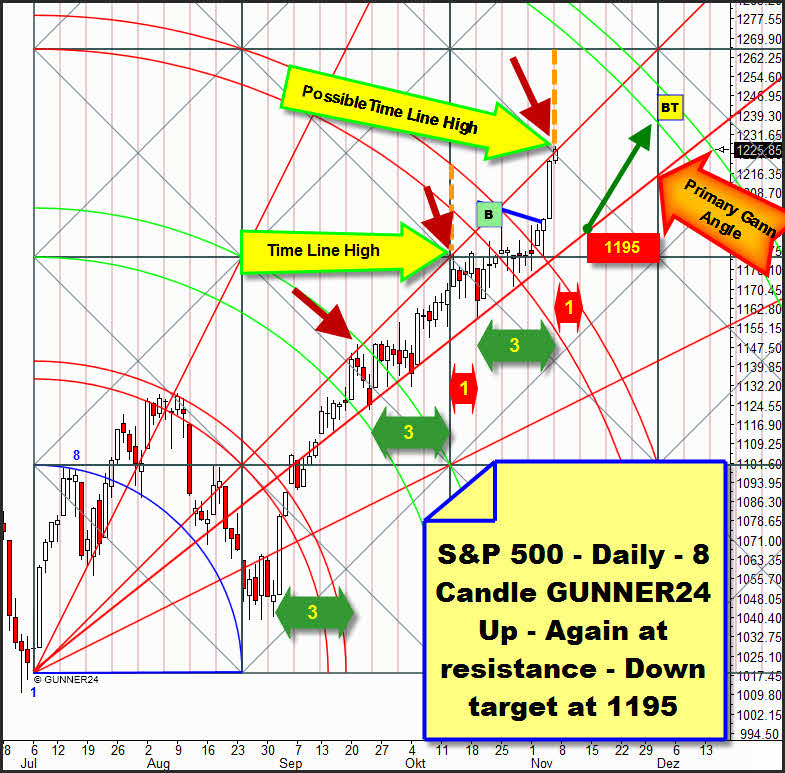

The situation: Since the middle of September the S&P 500 is moving in a Gann Angle corridor which at the 1*1 Gann Angle above offers resistance and below at the primary Gann Angle produces support. That situation should continue through the end on November/beginning of December. 24+31

On Wednesday after the FED statement and after the break of the 3rd double arc (when our supposition of a mirror image was confirmed, by the way, see here and here!) we went long again. Target 1233-1235. That’s where we’ll level those positions if we reach that target on Monday or Tuesday. We’ll level as well if the Friday low of 1220.29 is just being touched. With the Friday high the index possibly created the precondition for the mentioned mini correction that might lead the market to the primary Gann Angle again. Exactly on the important time line in the middle of the just passed square an important price and time magnet was touched. Another time line sequence (3 time lines from the low to the high) seems to have finished.

Gold:

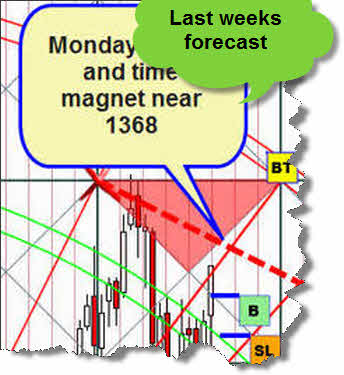

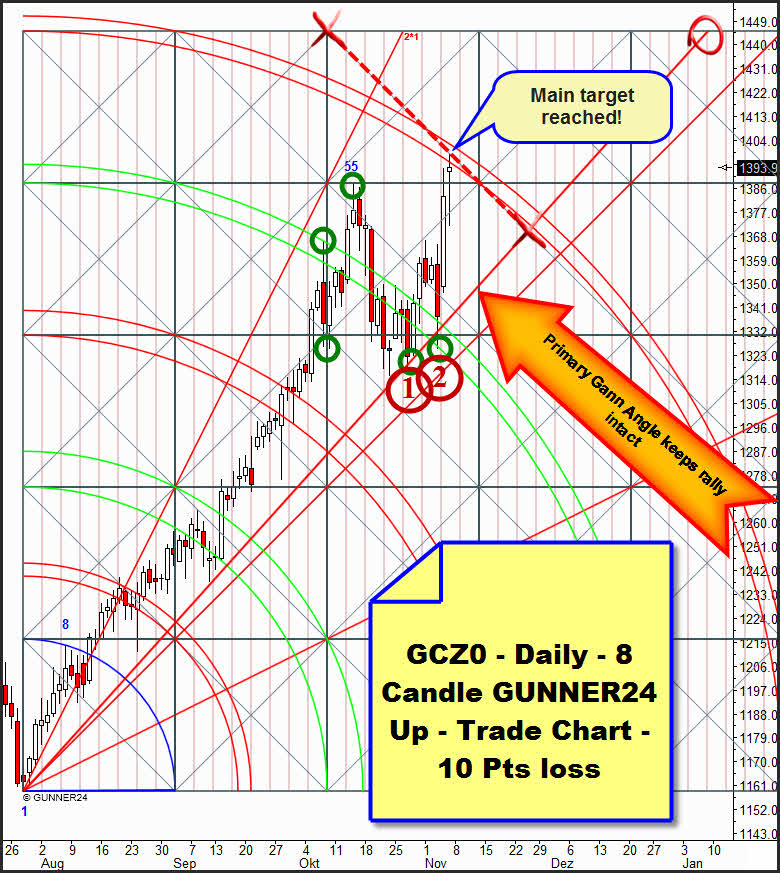

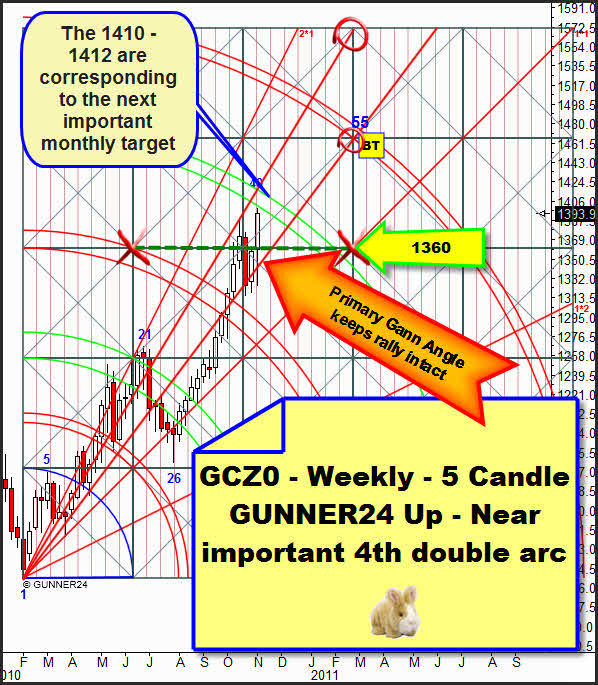

In the GUNNER24 Forecasts, Issue 10/31/2010 we pointed to the violent resistance at 1368. A severe counter reaction took place there which guided us back again to the 4th double arc and the primary Gann Angle after the FED decision. That fierce short attack resulted in a 10 point loss in the long positions contracted last week.

At red 2, gold rebounded impressively from the price and time magnet simultaneously testing the primary Gann Angle for the second time, and on Thursday and Friday it levelled off at the prognosticated 1390 target. Thus we are standing at the main target here again and subsequently in case of a mini correction we will have to reckon on a relapse at least onto the 1360. Particularly as the setup anchored resistance diagonal was hit precisely by the Friday top which confirms the correctness of this setup.

The fact that the price closed below the main target is to be considered rather negatively taking into account the importance of the main target. Furthermore, on Wednesday and on Friday there were some severe short attacks to be seen. Even though both were retraced violently we were shown that several mighty market participants are reckoning on a more extensive correction in the upwards trend.

|

„As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

Combining now the signs of the actual daily GUNNER24 Up with the approach to the 4th double arc in the actual weekly GUNNER24 Up Setup we’ll see that some hazard potentials are lurking just like in the stock markets:

The gold future in the weekly GUNNER24 Up Setup has not touched yet the 4th double arc which is very important for gold. Since gold tends to violent corrections at the 2nd and the 4th double arcs this is where something might be on the agenda. Immediately after opening next week a correction might start as the market then will open exactly at/on the lower line of the 4th double arc coming into effect then the downwards pressure of the 4th double arc strongly. You should always recall the important psychological mark: 1400! And ask yourself why gold has NOT reached that mark and why silver did not reach the mark of 27.00 last week EVEN THOUGH all the CONDITIONS were there…

As well in the stock markets as in the case of gold and silver this is true: The monthly upwards trends predominate! Targets are 29.25 in silver and 1576 in gold (last issue). Their dominance makes it easy to break any resistance on daily or weekly basis! Next due monthly target for gold is 1410-1412.

That target is corresponding with the upper line of the 4th double arc in the weekly setup!

Conclusion: Many, many GUNNER24 Setups point to a coming correction in the markets. But it should only happen on daily basis. The last issue analysis on the monthly situation is overlapping everything. Its message: Strong buy. All the weekly GUNNER24 Setups are showing green, as well. Yeah, even the analysis on daily basis offered in this issue allow the prediction that the upwards trend is rather going to increase in case of a clear break of the mentioned resistances. If the NASDAQ-100 reaches the 2210 or the S&P 500 overcomes the 1240 we’ll see that only a lukewarm breeze has made the bush tremble…

Be prepared!

Eduard Altmann