The year 2021 will undoubtedly be a crystal-clear and very bullish uptrend year for ethereum, with final lows made near year open and final highs will be made close to year-end. This is what the chart situation tells us, this is what the bullish momentum promises and this is what the GUNNER24 Forecasting Method predicts. Buckle up ethereum bulls, the GUNNER24 Forecasting Method offers that the final ethereum highs of 2021 are still pending. My new forecast shows that it points to fly above the heavy upward magnet of the important round 5000$ until year-end!

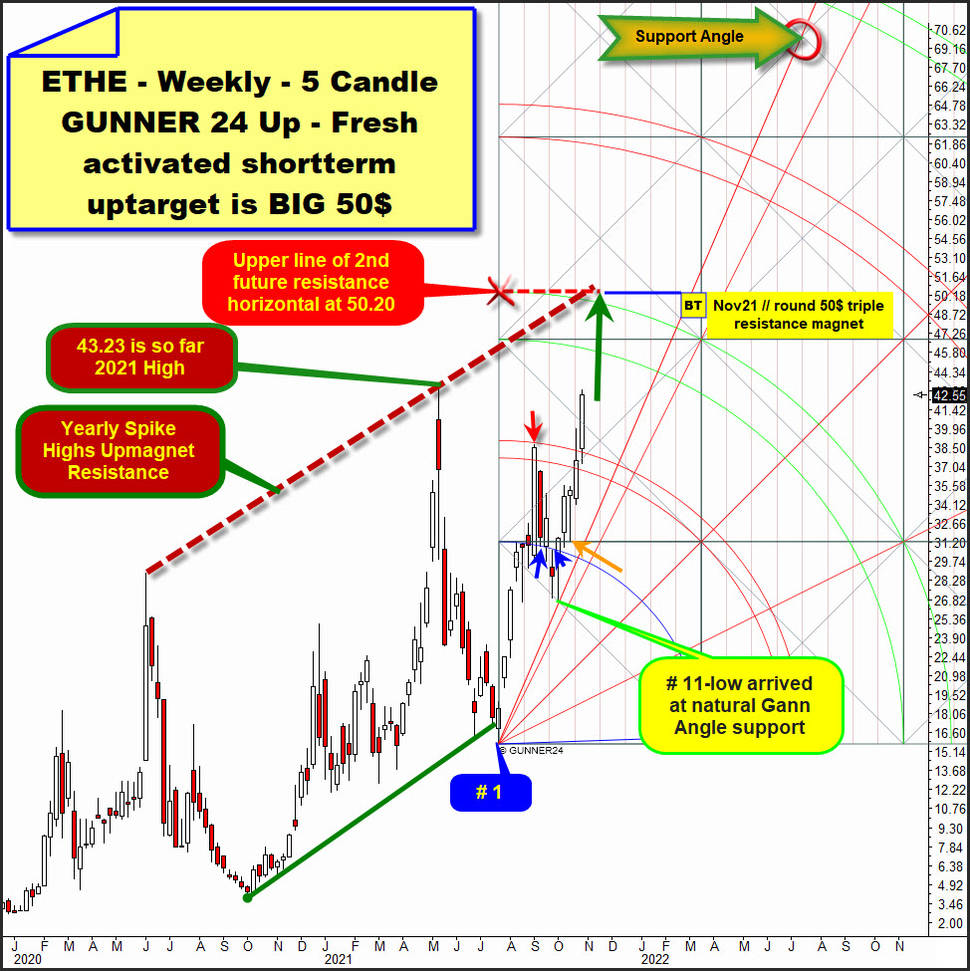

Here is the technical daily chart of the Grayscale Ethereum Trust (ETH) (ETHE). ETHE shares can be considered as a proxy for ethereum developments.

Ethereum, but also bitcoin have completed a bullish Cup with Handle bottom on their daily charts quite nicely. As a consequence bitcoin printed higher year highs some days ago. Ethereum is sporting the same pattern, although its a littly shy of its life-time high (Friday high is 42.90$), so it hasn’t quite pushed to new highs recently like bitcoin did. So ethereum may still have a bit more rally potential than big brother bitcoin.

At the 43.23$ May high started a Cup with Handle consolidation. After ther early-October lows, which mark the deepest point of the Handle, the past week Wednesday succeeded in closing above the dark-red dotted highlighted yearly Neckline Resistance of the bullish Cup with Handle. At past week Friday lows the Neckline Resistance was successfully backtested and by this confirmation morphed to a stronger future support on the daily chart.

Then, the quick and successful backtest of the former Neckline Resistance come to fruition as new rally highs and the highest daily closings and highest week close in 2021 were recorded.

==> The upward break of a for 5 long months ruling Neckline Resistance usually is alway a very serious bullish sign ==> Very promising looking Cup with Handle breakout underway!

1. It is a no brainer that ETHE shares have to print higher 2021 highs soon!

2. For crypto ethereum the end-of-year potential is above the 5000$.

3 . For ETHE shares the end-of-year potential lies above 50$. This can so obviously be derived from the weekly situation:

At # 1-low, what is the lowest price of the daily Cup and a next important higher low of the bull market ,we are allowed to anchor a classic 5-Fib number weekly up what is heavily confirmed by the activity of the recent past as there was an important weekly small red arrow high made at and influenced by former negative energy of the upper line of 1st double arc, followed by 2 exact tests of the Blue Arc rail at weekly extremes, I`ve highlighted with the small blue arrows, followed by the orange arrow week low that with an 100% accuracy tested back the first square line from above.

Last week close was the second close within lines of the 1st double arc what by this became a double-confirmed = main resistance on weekly base.

According to the GUNNER24 Trading Rules, closing prices within the lines of the double arcs prepare the respective break of these double arcs in trend direction.

And we can clearly see that this week not only managed to deliver the highest weekly closing price of the entire bull market. The closing price of 42.55$ is also extremely far above the in the recent past confirmed upper line of 1st double arc resistance, that was already successfully crossed with the opening auction of the week.

==> This just fired sustained bullish week close above the 1st double arc resistance has activated the super fast run up to the lower line of the 2nd double arc according to the GUNNER24 Rules!

But if we can calculate that an extremely prominent upward magnet is forming pretty much exactly at the round 50$ W.D. Gann number magnet, I strongly expect that this daily, weekly, monthly rally cycle should at least reach the round 50$ within a few weeks!

For the coming weeks into November, the prior unusualy sharp 1x-negative tested rising Yearly Spike Highs main resistance upmagnet should exert an ever-increasing force of attraction! This certainly very prominent future upside target unites with the round 50$ Gann number upmagnet and the upper line of 2nd uptarget or the 50.20$ GUNNER24 Uptarget Resistance horizontal in a target window at the 50$!

Thus, the now visible future triple resistance upmagnet of 50$ should become a very important target of this upward cycle!

==> Very bullish conclusion: Rarely has it been so low-risk to be long in the crypto sector over the longer term! Shortterm combined weekly and yearly uptarget for ETHE shares is the round 50.00$ upmagnet. The 50$ rail seems to be main uptarget and is expected to be worked off sometime in November 2021!

Be prepared!

Eduard Altmann