Who would have thought that the leading US stock markets Dow Jones, NASDAQ, NASDAQ-100 and S&P 500 are able to overcome their dominating and actually super heavy 2015 annual resistances within the last two trading days in such a spectacular way?

Well, the middle-term effects of the last two trading days are quite easy to spot: A new bull market leg is now underway which will lead to all-time highs for at least NASDAQ, S&P 500 and NASDAQ-100 most likely until the end of 2015.

Last Sunday the likelihood for the leading US stock market indices to have finished their corrections and for a new sustainable bull market upleg underway was at 80%. Today it is a 99%!

The new bull market is now 4 weeks old, so from a temporal perspective they have just started. This is why there is nothing but to advise to invest again strongly in the stock markets.

Invest directly with a first load and hope that shortly after there will be a correction. During this correction, you have to invest the second load.

Please consider always to accumulate the amount into three or four loads.

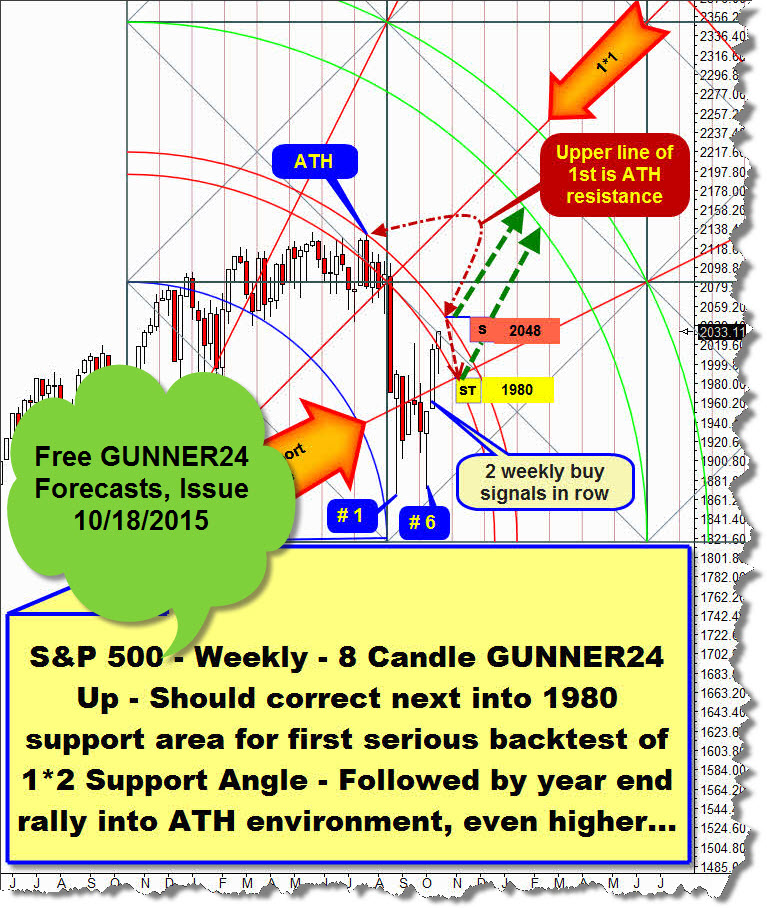

The important 8 Candle GUNNER24 Up Setup – chart abvoe – of the S&P 500 visualizes excellent how unambiguous the determining (upper line of 1st double arc) resistance for the rest of the year of 2015 was almost pulverized.

==> With the clear weekly close above the 1st double arc resistance the 2nd double arc has been activated as the next higher weekly uptarget. The probability that the lower line of the 2nd double arc will be reached in trend direction is more than 75%.

A serious test of the all-time high area now is assured and higher all-time highs for the rest of the year and the first months of 2016 are likely.

The Big Picture of the S&P 500:

The dominating resistances of 2015 of the mentioned US indices were shattered under heavy volume (both in the future markets and in the index ETFs) on Thursday and Friday. There is the possibility that with the Friday opening run away gaps have been arisen with the above-mentioned US indices.

It can be run away gaps because the dominating resistances of 2015 have been taken under heavy Friday volume with the opening.

==> Therefore, there is a possibility that the arisen gaps of Friday have not been closed shortly after and as a result, there is no fast correction movement to be expected. Regarding NASDAQ and also NASDAQ-100 it really looks like as if the opening gaps of Friday can just be closed in the far future after having reached new all-time highs.

Now a deep look into the S&P 500 Big Picture Setup.

It starts at the final low of 2014 and measures the Blue Arc until the high of the first important lower high of the 2015 correction. At this high the correction of 2015 started to have a real boost. Officially the correction started at the 2134.71 all-time high (ATH) but the correction movement could be first officially stated with the first important lower high of 2015, because in answer to the first lower high of 2015 a heavy reaction followed.

Therefore the Blue Arc practically shows us the dominating resistance of the last correction and the most important resistance for the rest of the year of 2015 (= annual resistance of 2015).

The next lower high of the correction, the second lower correction high, was also reached at the now officially approved important resistance (= strong resistance of the Blue Arc).

As a consequence, the market kept falling until a GUNNER24 Monthly Support and provided a higher correction low exactly 86 weeks after the year-low of 2014. The 87 is extremely close to the high Fibonacci number 89 and therefore equivalent to a finished cycle.

This low to low cycle seems to act in accordance with the important Fibonacci numbers which starts at the absolute 2014-low = # 1, it has an important higher 2014-low, the final end of the year correction of 2014 exhibits close to the Fibonacci number 34 (= # 37) and now the 86 weeks after the 2014-low a next higher low at # 87 is provided.

Since the # 87-low we just see "green" candles with in part really large bodies. Impulsive upwards wave!!!!!

Now a look at the last two week candles: Somehow the penultimate week already made it to close above the Blue Arc. I passed it, respectively it did not seem really important to me because of no significance…

The last candle tested back at the low, but pretty accurately at the one week earlier upwards broken Blue Arc resistance. The low of last week, including the Blue Arc backtest was made on Wednesday. And precisely at the Wednesday low and the successful backtest of the former Blue Arc resistance – now weekly Blue Arc support – the surprise party began.

The party is at day 4 for Monday. So actually from my point of view there will be at the earliest an important interim high on the 5th day (= next Tuesday). The rally might last up to 8, 13, even 21 days even without large corrections/consolidations.

With the final break of the Blue Arc resistance the index has activated a GUNNER24 Signal which requires the reach of the lower line of the 1st double arc in trend direction (= UP!!!) until the middle of 2016. The probability for this scenario is also above 75%.

The final consequences that trigger the final break of the Blue Arc Resistance are not easy to be estimated safely at the moment because we do not know a lot about the current energy status of this new initial impulse yet...

... but we can always imagine it like an archer shooting his arrow. He buckles the arrow on the bowstring, in this case the Blue Arc is the bowstring. After that he draws the bowstring and the arrow with a tensile force towards him (= low off week # 87). Then he unhands the arrow and the bowstring blasts in the reverse direction due to the tense and bends to the outside until the arrow has to relinquish the bowstring.

Transferred to the weekly chart situation above it means that the S&P 500 just only left the Blue Arc (= bowstring) within last week and now it has to trade upwards (until the uptarget is reached) during the next weeks depending on how strong the force at the bowstring (= Blue Arc) was and on how high the setting angle of the archer`s arm was.

... this is why I entered three possible uptargets = buy targets (BT) of the bull leg at the lower line of the 1st double arc in the chart above. These uptargets are geared to approved Resistance Angles, respectively the strongest upwards magnet.

==> In an extreme case the new bull market up leg that has been started 4 weeks ago can target the strongest upwards magnet to the end of 2015 = 2350, at the point where the first square line resistance crosses lower line of the 1st double arc and the 1*1 Gann Angle for the beginnings of 2016. 2350 is a triple weekly GUNNER24 Up Magnet!!

==> If the new bull market up leg acts nearly as hesitant according to price and time as the last upwards boost of the bull market we can just budget 2220 until the middle of the year of 2016.

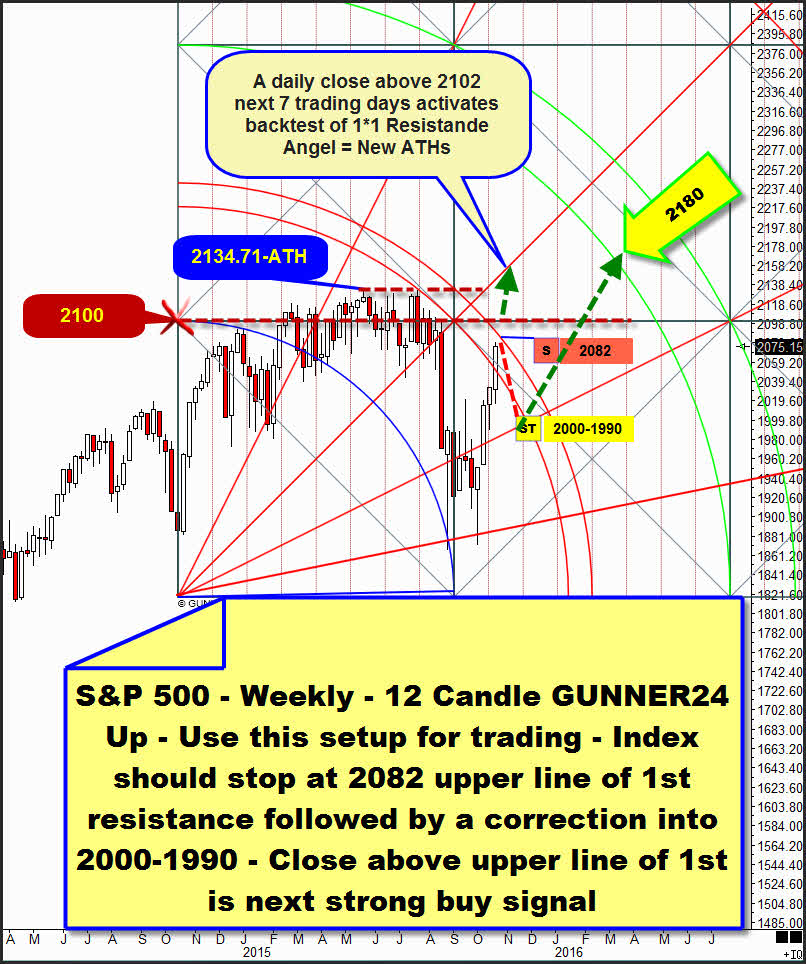

Please use the following GUNNER24 Up Setup in weekly time frame now for short-termed signaling.

It also starts at the important low of October 2014 and measures 12 (close to Fibonacci number 13) weeks first initial up impulse. This setup drops the both lines of the 1st double arc as important resistances for 2015.

The first lower high of the correction hit exactly the lower line of the 1st. From there the correction accelerated down to the correction lows.

It was now possible for the last week to close above the determining 2015 resistance of the lower line of the 1st. This is why the index HAS TO!!! reach the upper line of 1st resistance. The upper line of the 1st is most likely to be reached/touched in the course of next week!

The upper line of the 1st is at 2082 for the coming week. Since next week will be the rally’s 5th, the first correction may start there!! …not being unlikely to lead to the correction target that is the 1*2 Support Angle, down to 2000-1990 by mid-November!

Indeed I put an S = Sell short signal at the 2082 resistance, but really just the intraday and day traders should trade that – with a narrow stop-loss management. All the position and swing-traders and investors should buy each correction that leads down to the 1*2 Support Angle at 2000-1990!

If the S&P 500 conjures a daily close clearly above the 2082 resistance next week – more than 2086 or so – in one go the 2100 first square line horizontal resistance will be supposed to be reached!

A daily close above 2102 within the next 7 trading days will finally activate the FIRST BACKTEST of the 1*1 Gann Angle in the course of this rally move. The 1*1 Angle was finally smashed downwards after the last negative test of the 2100 first square line resistance.

Such important resistances as the 1*1 Angle are relished for being tested back! However, in this case it means that the 1*1 Resistance Angle is taking its course high enough to make new ATHs likely to be reached! So, be careful with short-engagements at present!

If next week – the 5th of the current rally – closes above the upper line of the 1st double arc, by all means a quick test of the 1*1 Resistance Angle will be activated, I think! This first back test of the 1*1 Angle will be expected to ensue then at the high of the 7th resp. 8th or 9th rally week.

Will the S&P 500 bounce from the 2082 downwards next week or won’t it in order to tackle the "round" 2000 test till mid-November 2015? I really don’t know. The 2082 might likewise be heftily broken upwards as all the resistances were that last week still had appeared important.

The S&P 500 Big Picture setup and the final break of the Blue Arc resistance sketched there as well as the possible run away gaps emerging on Friday permit now the rapid pulverization of important resistances above and the continuation of the rally for approximately 10-15 days.

The most important European stock market index is now in the same signal situation and has got the same signal power as the S&P 500. The DAX/FDAX is on fire now. When and where it will start to correct the current rally leg – is still in the stars for me. I only have some suppositions on the item.

The last DAX/FDAX analysis you’ll find in the 08/30/2015 forecasts. There was a good chance then for the correction of coming to an end with a small lower low at 9200-9250 to begin a new bull market upleg up into the monthly 12850-13000 uptarget from there:

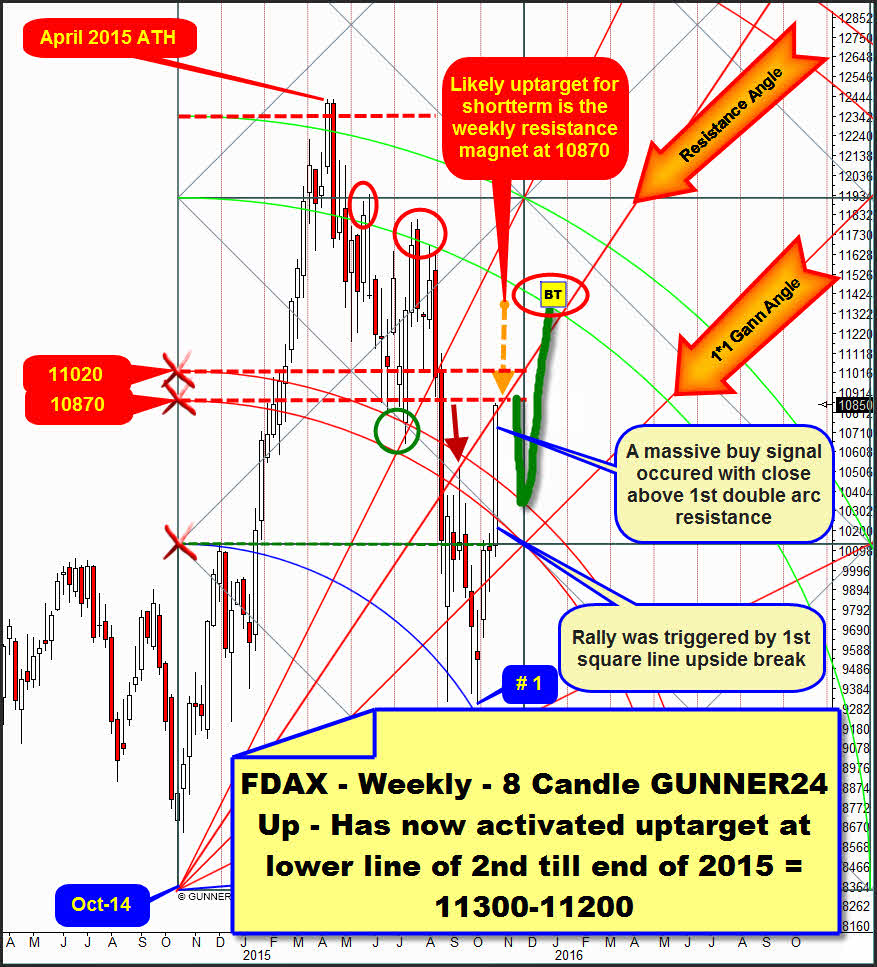

Indeed the FDAX made a small lower correction low at 9301 on 09/28 – watch blue # 1 – to start a strong rally move afterwards.

Also the FDAX succeeded in cracking impressively its most important resistance of the year 2015 in the course of the last two trading days.

The signaling is simple and logical now:

==> Since the important resistance on the 1st double arc in the weekly time frame is overcome now on closing base, the lower line of the 2nd double arc resistance lwill have to be headed for now again. This was the decisive resistance at both lower weekly highs of the last correction move, marked with the red ovals.

At first, the 1st double arc gave strong bounce support within the correction (watch green circle for this), but it was smashed finally in the course of the August sell-off, thereby becoming powerful resistance environment for the correction since the April 2015 ATH.

The last week candle was a so-called double GUNNER24 Buy Candle because in one go just this entire 1st double arc resistance as well as the first square line resistance (now again horizontal support) were overcome impressively.

Interesting is the fact that the first square line was tested at the week low and the week opening. This successful test resp. the first square line being finally overcome gave the energy thrust/starting signal for the strong rally week that in addition succeeded in overcoming another important resistance, at least formally. It is matter of the dominating Resistance Angle that was tested back impressively negative once within the correction, at the red arrow.

The fact that this Resistance Angle was harmed now – a little bit at least – is A) another evidence for the current rally power, and B) this violation of the Resistance Angle in the last trading hours of a mighty rally week indicates that within a few days the rally may/can reach the lower line of the 2nd double arc resistance in a quick, tough and strong way!!

==> There is the possibility that the DAX may reach/work off the lower line of the 2nd at 11400 as early as next week or just the week after next. Whether or not it will happen like this – I don’t know.

This outcome is allowed by the signaling and the existing power of the consisting upwards momentum that succeeded in really smashing the most important resistances of the year 2015 within 2 days, since any overcoming of an important resistance releases more and further upwards energy-thrusts, after all!

Customarily, the shortterm development is supposed to ensue as follows however:

==> Next week, the rally since the correction low will be in its 5th week. Since last week - the 4th – closed at the weekly high, in any case the 5th rally week will likely be able to deliver another higher rally high. Since 5 is a Fib number allowing/indicating an exhaustion, followed by a turn, next week is supposed to mark an interim rally top in the range of 10870-10900.

Last week’s high is at 10860! The 10870 is powerful GUNNER24 Cross Resistance = GUNNER24 Resistance Magnet in the weekly time frame. This is where the next higher resistance zone begins comprising the area 10870-11020. Mind on this also the positioning of the dotted orange arrow at 10870.

So, if the index really turns in the course of next week (# 5) in the realm of 10870-10900, technically it should have to correct toughly and quickly into the support of the 1st double arc to test this one back. This pullback in the new bull market up leg is supposed to last 2-3 weeks (rally week # 8), with price target 10300-10200! According to price and time, ideally that would be the realm for collecting conveniently, unless the market spoils us the party running away unchecked up to the lower line of the 2nd double arc!

Be prepared!

Eduard Altmann