There is no question about it: nuclear power will continue to have a core position in the energy mix globally in the long term and will be used in parallel with the further development of renewable energies.

Currently there are exciting developments in the uranium sector as spot prices for uranium are on the rise for months. After beeing bearish for 13-14 years, prices are suddenly at respectable 7-year highs.

The now largest current buyer of physical uranium is not, as one might expect, a major energy company or nations through their governments. Rather, it is a new created trust established in July 2021: the Sprott Physical Uranium Trust (TSX:U.UN/US:SRUUF), which is the result of an agreement between Sprott Asset Management LP (a subsidiary of Sprott Inc., a renowned global investment management company based in Toronto, specializing in precious metals and tangible assets) and the former „Uranium Participation Corp".

This week Uranium ETF URA moved above 28.72$ to a 29.39$ higher bull market high, extending its intermediate uptrend. Responding to strenght in again rising spot uranium prices:

The Global X Uranium ETF (URA) seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Uranium Total Return Index and measures the broad-based equity market performance of global companies involved in the uranium industry. The underway daily and weekly upcycle of URA shares started at the # 1 // 17.23$ // August intermediate cycle low as a direct response to the launch of the Sprott Physical Uranium Trust. The weekly upcycle is at week candle # 9 and printed the current top of the year at 29.39$.

But at highs URA ETF ran into weekly double resistance magnet that is naturally/automatically created by Blue Arc and first square line within the above classic 5-Fib number GUNNER24 Up Setup. This week rally swing wass triggered by the light-green highlighted Rally Angle which 100% accurately supported at past week # 8 and this week # 9-small higher low.

==> This uptrend made its first important higher uptrend low at Rally Angle, which will be future main support until proven otherwise! It should therefore continue to push prices upwards until the very first weekly closing price below is triggered.

The bullish power this Rally Angle radiates is unusually strong cause A) URA reached a fresh 2021 top in course of this week! Additionally B), market fired the highest week close of this year and of the past 7 years. At the bottom of the chart, I have noted an usually very bullish fact within the volume window. Namely, that the breakout attempts of uptrend weeks # 5 and this week # 9 are heavily bought.

==> Although

the current attempt to break the 28.90$ first square line resistance

sustainably has failed for the time being, the overall situation must

be seen as EXTREMELY bullish:

This uptrend shows a perfect higher highs and higher low pattern. The

market now has found its strongest support, what is the relative steep

running natural Rally Angle. It is uber-bullish that the strongest

support has been followed very closely. Always a sign that the market

is likely to respect it in the future as well. The weekly momentum is

very bullish and the new cycle highs are probably bought with both

hands by the institutionals.

This short list above paints an insanely positive picture. Accordingly,

I think that URA will reach the lower line of 1st within this upward

cycle. If this happens then when the natural & confirmed Rally

Angle support intersects the lower line of 1st double arc to form a

future powerful attractive uptrend magnet, the lower line of 1st

uptarget could be worked off during the month of December at around the

32.50$:

==> URA-shortterm uptarget is the

weekly GUNNER24 Uptarget at the 32.50$ arc upmagnet which looks to be

worked off somtimes in course of December 2021!

Please watch above, that this week candle looks a little bit toppy

since it has a relative long upper tail and is the longest upper wick

printed since the uranium bull run has started at March 2020

coronavirus panic lows. This indicates that URA shares have turned for

a normally only short-lived pullback swing. On the daily chart below, a

textbook Cup with Handle pattern MAY be forming:

Although the possible daily Cup pattern is admittedly a bit thin => it seems to have formed in an unusually short time. Which allows or suggests that the possible orange-dotted Handle will also not need many days until its final lows are found, most likely followed by a subsequent bullish resolution => phat dark-green dotted arrow forecast!

It is excellent sign for all uranium bulls that the lows of the Cup, extremely exactly tested back the 50%-Fib retracement main support of the last upward cycle, only to trigger another higher rally high afterwards. Same uber-bullish fact is how heavily the test of the weekly Rally Angle was bought!

Well, quick coming possible Handle lows around 27$ to 25$ should definitely be used to open an URA-long position! IMO!

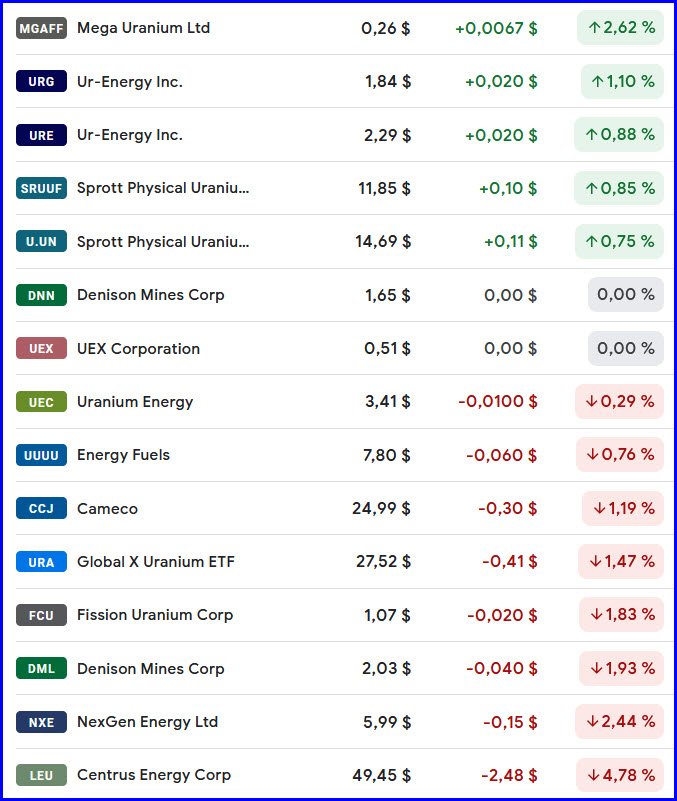

To conclude this issue, I would like to add this watchlist of some very important players in this shining sector.

Maybe you can also profit from this powerful bull market in uranium by investing directly in some of the most traded Uranium Stocks!

Be prepared!

Eduard Altmann