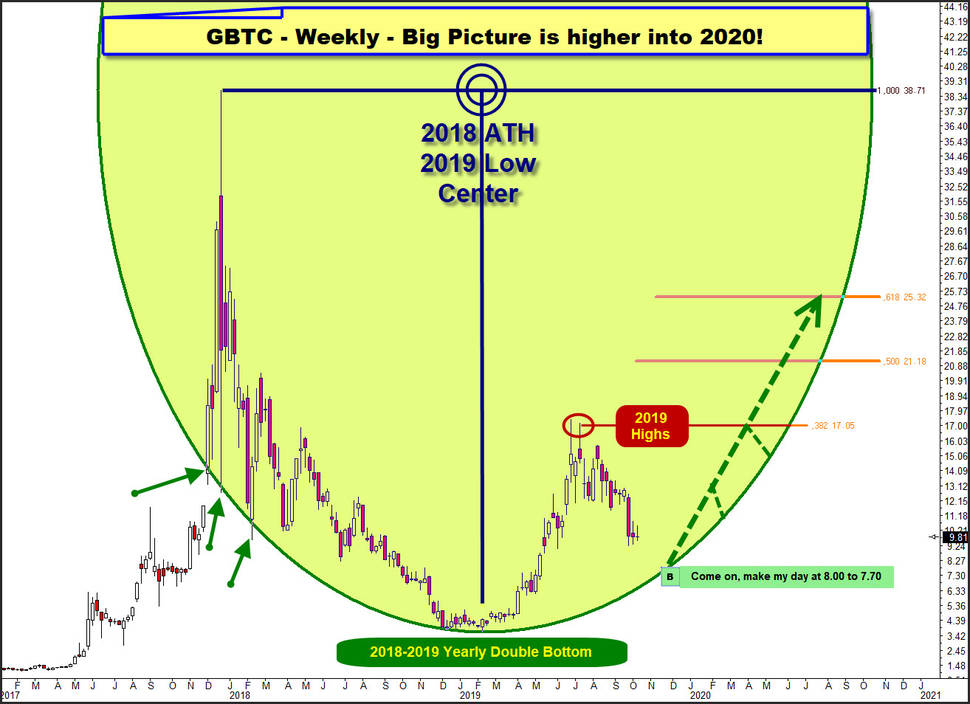

After the biggest financial bubble ever recorded - the Cryptocurrencies Bubble - GBTC/bitcoin corrected by -90% and turned finally after a to the 13 Fibonacci number oriented monthly decline, supported by the December 2018 <=> February 2019 made double bottom which is a safe Double Bottom on Yearly Base.

The Grayscale Bitcoin Trust (GBTC) can be considered as a proxy for bitcoin developments. It is a trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. Since GBTC currently has much more data points as the bitcoin future contracts, I use it today to approach the supposed bitcoin course.

2019 uptrend year started at bearish February 2019 extreme, which printed the final GBTC Low of 2019 at 3.66$. Afterwards GBTC/bitcoin one more time went nuts and topped on June 26, into final high of 2019.

2019 High is at 17.40$. This was a stunning +370% rally from 2019 Low to 2019 High. However, this monthly uptrend just tested back the 38.2% Fibonacci retracement of the Biggest Bubble ever drop. Too fast, too high and at too strong natural resistance and a serious downtrend began, which has some way to go according time and price, I suppose.

Namely, until the next test of the above in the weekly candlestick chart dark-green highlighted almost perfect circular arc whose center is defined by the all-time high (ATH) and the time and price of the 2019 low. At the moment it looks like GBTC/bitcoin would like to reach again this 5 times confirmed, now rising annual support arc mid-November/early December at about 8$-7.70$ before this rail should launch the next powerful monthly upcycle that usually will take the price to dizzy levels again into 2020.

GBTC/bitcoin is a strong buy for 2020 IF 8.00$ to 7.70$ is getting tested mid-November to early December 2019!

Weekly chart together with current most valid GUNNER24 Up Setup on weekly base:

Please use this below scaling for your trading! Starting at 2019 Low, we are allowed to measure a 13 week range to the upside:

June and July highs spiked hard and bearish into natural uptarget of 3rd double arc. There the downtrend began and that`s why 3rd double arc is a downward sloping yearly resistance environment.

The first wave of downtrend found stronger and ongoing support at 2nd double arc, back then natural weekly support area.

2 week candles ago anything was flushed down the toilet, any major supports broke and in one go market finally closed far below 2*1 Angle = major yearly support angle out of 2019 Low and 2nd double arc, former main support for the downtrend. This was a pretty strong sell signal, that ugly sell-off candle has fired.

We observe that past week candle high was classic first backtest of the finally to the downside broken 2*1 Angle, now 2*1 Resistance Angle.

And I can imagine that another test/backtest of this important 2*1 Resistance Angle is a necessity before main target of this downtrend at 8$ quadruple major support magnet needs to be tested or worked off sometimes in course of November 2019.

For now the downtrend found – perhaps yearly - 9.56$ horizontal support. That line springs from lower line of 1st double arc, so it`s a natural support out of the 2019 Low.

The 9.56$ support horizontal has morphed to 3 times weekly closing base support in which this week candle shows an accurate successful backtest of that line in the sand. Means, the 9.56$ support could lead to a Dead Cat Bounce toward 11.20$ weekly double resistance magnet which is formed by 2*1 Resistance Angle and lower line of 2nd double arc.

==> 11.20$ is ideal, because most strongest attracting nearest GUNNER24 Backtest Target!

This was the signal situation and trend state, which strongly urges us to sell-short a possibly upcoming bounce.

The simultaneous 2nd double arc and 2*1 Angle support break is a very serious = strong GUNNER24 Sell Signal on weekly base and has activated this, as well:

A) final downward break of 2nd activated future test/backtest of 1st which is next lower yearly double arc support area.

B) Breaking 2*1 to the downside has activated the test 1*1 2019 Bull Angle, which is always most natural and most important backtest target within an up setup once 2*1 downward break signaled an important trend change.

Fresh activated 1st double arc downtarget and triggered 1*1 2019 Bull Angle downtarget & first square line, which is also a natural future downtarget on yearly base, unite all together with the next coming orange-dotted ITL (important time line) for mid-November 2019 at PRIME or MAJOR 8.00$-7.70$!

==> This downtrend has shortterm and MAJOR downtarget at 8.00$-7.70$! Target work off of future most attractive 2019 support magnet could come true towards mid-November 2019!

Next analyzed daily situation reveals that it could come to a "surprising" stronger Dead Cat Bounce that maybe needs the 11.20$-weekly upmagnet resistance work off within days:

After the +370% rally at highs a 3-month, even 5-month Descending Triangle developed ("Summer Triangle") that broke finally to the downside just 14 trading days ago. Such long-developed chart patterns usually always have a fairly lasting effect when the market forces them to dissolve. GBTC fired a mid-term sell signal 3 weeks ago. That`s why a relative quick test of yearly quadruple downmagnet support at 8$ does not seem so illogical.

Before the next downwave should prevail on weekly base running counter move on daily base should continue for some more days. This view seems justified because price found 3-week downtrend lows at a natural 2019 horizontal support, followed by small higher daily lows and in harmony Slow Stokes, RSI and MACD are climbing actually, whereby the price as well as all 3 momentum oscillators have formed rounding bottoming patterns, which could force the price a little bit higher for some more days.

==> Daily price chart as daily momentum signal that a Dead Cat Bounce already has started.

==> A GBTC Dead Cat Bounce on daily base could reach 11.20$/usually very strong braking weekly GUNNER24 Backtest Resistance magnet, which IF getting tested should trigger a next strong weekly downtrend wave that usually should test yearly quadruple support magnet at "round" 8.00$ sometimes around mid of November to early-December 2019!

If this forecast comes true, we can buy bitcoin with both hands and wait for the next strong monthly uptrend cycle, which could normally chase GBTC up to the 20$ area or 50% Fibonacci retracement of the Biggest Bubble ever drop!

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best trending stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann