The downtrend in the Gold Sector started at the April highs and got worse in course of June and July after usual summer weakness kicked in. Some extremely bearish reversal signals in gold as well as at the Gold Miners in the weekly and monthly time frames promised shady prospects for the gold market.

Today, I’d like to illuminate the still quite complicated possibilities of the GDXJ ETF being the representative for the Gold and Silver Miners universe into the end of 2018.

GDXJ, the VanEck Vectors Junior Gold Miners ETF, seeks to replicate as closely as possible, the price and yield performance of the MVIS Global Junior Gold Miners Index and covers precious-metals-mining firms below the market-cap cutoff for GDX—the 'junior' mining firms (including those mining platinum, silver or palladium).

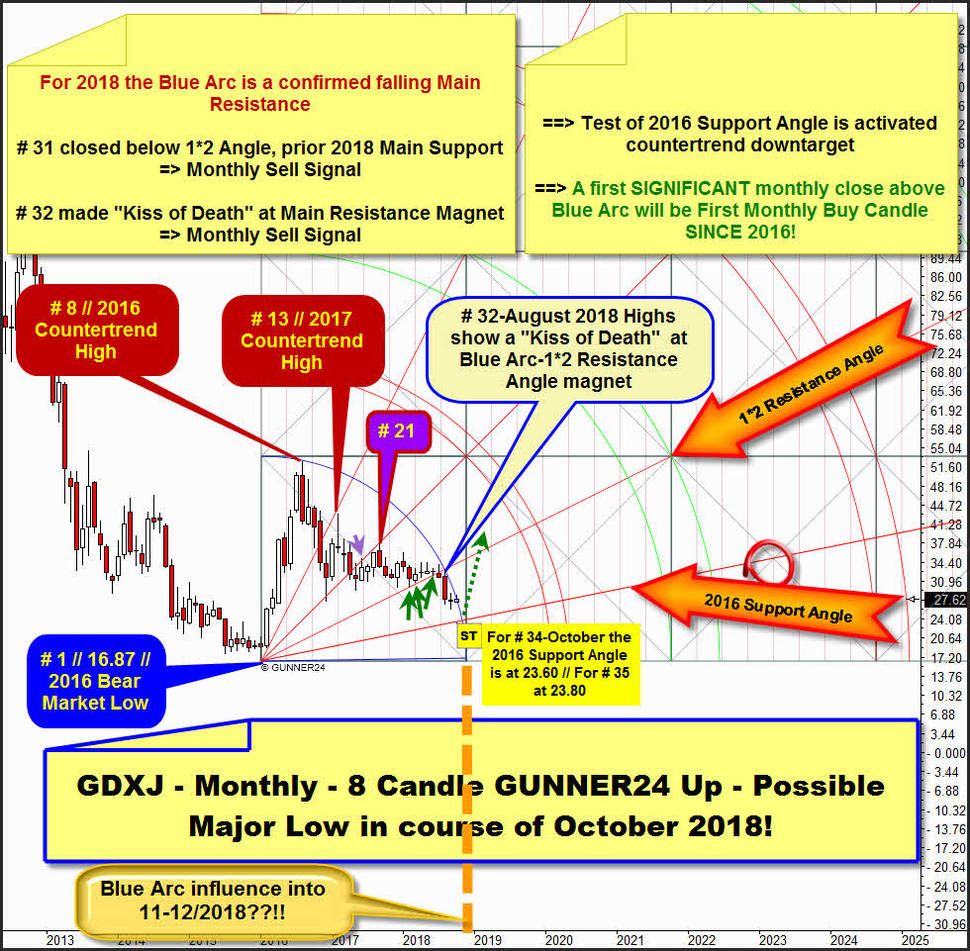

Below is the monthly GUNNER24 Up Setup which depicts the GDXJ behavior since its important year 2016 Bear Market Low.

This very, very well confirmed setup offers that the Gold and Silver Miners want to make their annual lows towards end of December, perhaps even in course of the very last trading week of this year. This is a quite possible option, the most bearish option as far as the further course in 2018 is concerned.

On the other hand, the monthly count since year 2016 Bear Market low indicates that the final year low for the Gold and Silver Miners complex could be due within coming 3 to 7 trading weeks:

The overall GDXJ countertrend started on a monthly base - as the entire GUNNER24 Up Setup - at # 1 // 2016 Bear Market Low.

Top of countertrend candle # 8 delivered the highest seen countertrend top. 8 is Fib turn number.

Candle No. 13 of countertrend marks the final high of 2017. Thus, the two Fib numbers 8 and 13 have delivered final highs or major turns. Fib number # 21-high was important countertrend high and was negative backtest of prior downwards broken 1*1 Angle. Once again a Fib number signaled a major turn in this still confirmed countertrend.

Well, with the current October 2018 the GDXJ countertrend is now in it`s 34th month, so countertrend could deliver a major countertrend low or a next major turn signal at it`s October 2018 low.

Monthly setup above measures from # 1-Bear Market Low to # 8-Countertrend High, current highest countertrend price. Thus, the Blue Arc promises theoretically strongest possible future resistance or main countertrend resistance.

It somehow looks like the scored high of # 31-July 2018 was slowed down due to existing Blue Arc resistance. In any case, however, the high of #32-August 2018 has tested the Blue Arc clearly negative and 100% accurately from below, followed by next monthly sell candle which was cemented by the # 32-August 2018 close, then the lowest monthly countertrend close since # 8 // 2016 Countertrend High.

Hmm, watching all the individual candles of 2018 we first recognize that the 1*2 Angle behaved as sharp defined month low support at 3 tests which are highlighted by the 3 dark-green arrows. After # 31-July 2018 close shows first monthly close below 1*2 Angle we can state that current underway 2018 downtrend cycle began at # 31-July 2018 highs and likely was mostly influenced by Blue Arc Countertrend Main Resistance.

Think the printed # 32-August 2018 High was a full bearish backtest of 1*2 Angle and Blue Arc resistance magnet from below. We can call this a "Kiss of Death" event or pattern, triggered by a yearly resistance magnet. This in handsight bearish signal became confirmed by bearish August 2018 candle shape. After the September brought some new downtrend lows the October candle one more time shows an open below the Blue Arc. ==> Means the market still respects this important 2018 resistance arc!

=> we have strong confirmation that the Blue Arc is a very important resistance for this combined monthly and yearly countertrend cycle => the proven negative influence of the Blue Arc may last until November-December 2018. Only then the Blue Arc influence is "officially" phasing out, just then it cuts the time axis. For this near time upcoming signal = possible MAJOR TURN SIGNAL watch the highlighted fat orange-dashed vertical within monthly chart above!

==> So... it may well be that the now running Gold and Silver Miners downtrend might last until the end of the year - at a minimum...

Please watch it by your own that the confirmed negative Blue Arc energy-area for this month # 34-October candle resides close to current quotations, thus at 27.60$ to 27.70$ or so. It might be the case that the currently ongoing next test of the Blue Arc triggers a next daily and weekly downtrend leg which might test or reach next lower natural Gann Angle below 1*2 Resistance Angle in course of # 34-October 2018 or in course of downtrend month November, which would be # 35 = 34 Fib number + 1.

Or... GDXJ trades even longer to the downside until the end of this year. At least! This signals the Blue Arc timer.

"2016 Support Angle" became activated countertrend Gann Angle downtarget after final downwards break of the 1*2 Angle by # 31-July 2018 close and maybe the main support (PRICE factor) for the 2018 downtrend cycle to finish and for a next monthly upcycle to start.

Above is the GUNNER24 Main Setup on weekly base of this countertrend. Also the weekly chart made "textbook" 8 Fib number initial up impulse out of # 1 // 16.87$ // 2016 Bear Market Low.

2016 Countertrend High was textbook to the T work off of lower line of 3rd double arc natural bull uptarget. Thus, the lower line of 3rd became most strongest important future resistance for the GDXJ. And guess what did happen after first test or first - negative - backtest of lower line of falling 3rd main resistance arc...

... it started to went down the drain. Or, the 2018 downtrend cycle began at first - negative - backtest of lower line of 3rd and after "1*2 prior 2018 Support Angle" was fallen short on weekly closing base.

==> the now steeper = faster sloping 3rd double arc is confirmed falling yearly resistance arc, and still a very strong resistance as it seems. This condition may last until:

==> Please observe that the 3rd double arc resistance influence could put pressure on price until the very last trading week of 2018, only then the upper line of 3rd double arc is intersecting the time-axis. Thus, the 3rd "officially" expires at the end of this year. So - theoretically - the negative 3rd double arc energy can push the market down until the end of the year.

==> The GDXJ is caught by confirmed common negative influence of a weekly GUNNER24 Double Arc and a monthly GUNNER24 Blue Arc! This downtrend can get a lot worse! According time factor and according price factor!

For # 34-October the 2016 Support Angle downtarget is at 23.60$.

For # 35-November the 2016 Support Angle downtarget is at 23.80$.

For # 36-December the 2016 Support Angle downtarget is at 24.00$.

==> ANY FUTURE first SIGNIFICANT monthly close above Blue Arc main resistance within presented monthly 8 Candle up until this year end will be the VERY FIRST GUNNER24 Buy Signal on monthly base since 2016!!.. and usually ends 2018 downtrend and triggers a next usually 3 to 6 months lasting upleg which usually will be able to re-conquer the 1*2 Resistance Angle on monthly closing base and should test back the 40$ area!

Be prepared!

Eduard Altmann