By the end of last year 2020 the EURUSD Forex market for the first time on the monthly chart closed above the Mother of all Bull Flags which started at the alltime-high what was printed in 2008.

Breaking a MILLENNIUM Bull Flag resistance with the very last monthly close of the very first trading year of a new DECADE is a major buy signal on DECADE base, what projects an unusual sustainable EURUSD buy signal is triggered.

A fresh DECADE buy signal fired at the beginning of a new DECADE usually means that at least the first 2, 3 and maybe even 4 trading years of the new DECADE should be bullishly supported...

Therefore, a for 13 years lasting bear market of the Euro compared to the US dollar can now officially declared to be over.

Or, likely the EURUSD pair has started a some-yearslong bull market at # 1 // March 2020 Low. The first monthly upwave out of this 2020 Low run for 11-month candles into so far 2021 High what arrived early in the year. It was made in course of January 2021 at a 1.23495.

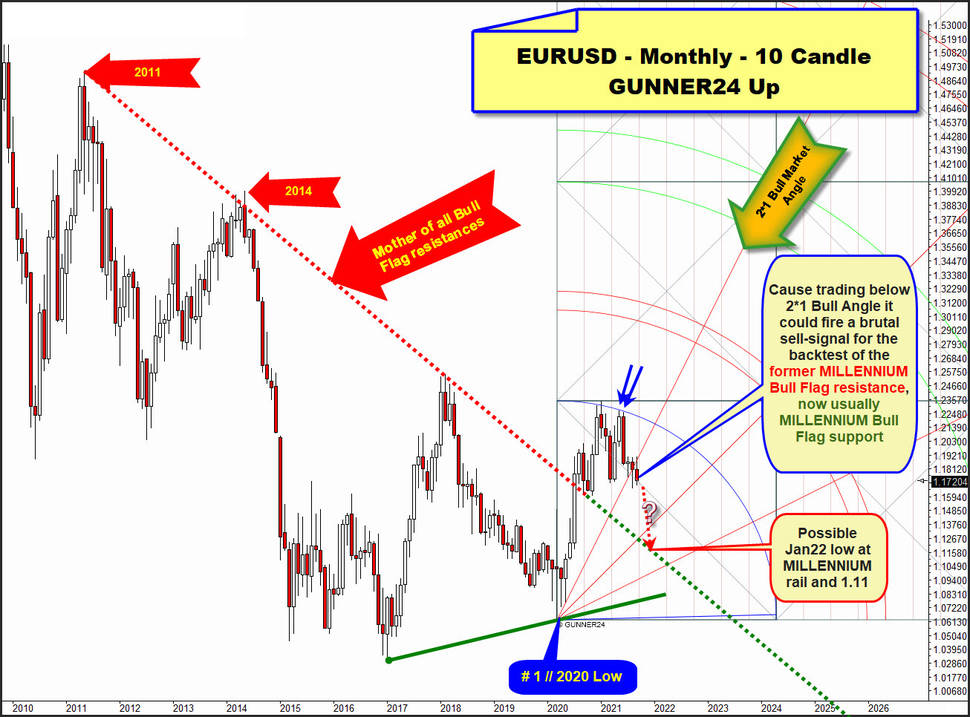

What leads to this valid and at same time above-average confirmed monthly 10 Candle GUNNER24 Up Setup:

Above you recognize the most ruling monthly up setup for the pair what is a bit unsual looking monthly 10 Candles GUNNER24 Up Setup. You see, the Blue Arc is measuring from the # 1 // final low of 2020 into the final high of 2020 that arrived at month of December 2020 bull extreme.

The Blue Arc is now very-well confirmed future main resistance cause there have been 2 pretty exact backtests of the Blue Arc from below, which I`ve highlighted with the 2 blue resistance arrows.

By this we know for sure the Blue Arc is main resistance on falling month high base. It radiates also a yearly resistance energy cause it braked for entire 2021 time window until today. At same time it now acts as a MAJOR backtest upmagnet resistance on a monthly and maybe even on a yearly base ...

Watch it carefully ..., the current September 2021 (Sep21) candle is trading below 2*1 Bull Market Angle, after the former month of August was strong enough to defend this main bull market support on closing base to the T.

With this little bit strange action – as the 2*1 Bull Angles within up setups usually hold quite nicely at first tests – pair is in peril producing a sell-off cycle what could lead to a very classic backtest and above all very rapid backtest of the former MILLENNIUM Bull Flag resistance rail – falling red-dotted –, now usually active future MILLENNIUM Bull Flag support = falling green-dotted ...

I have shown this possibility with the red-dotted arrow placement, which is kind of questionable as the pair usually is now in A) a sustainable multi-yearslong bull market, B) 2*1 Bull Market Angle normally provides stronger bull market support, and C) because of the seasonal peculiarity that over the last 50 years the US Dollar Index on average reaches its last important high of a year during the month of September, only to suffer from pronounced weakness throughout the entire fourth quarter.

On the other hand when either the September or October 2021 will close below the 1.17 or so, EURUSD should .... usually ..., should sell-off rapidly into the December 2021-January 2022 time window for the very classic test of the green-dotted MILLENNIUM support rail and a 1.11 big downtarget magnet or so.

With the help of the following textbook 3-Fib number Candle monthly down setup, what begins measuring the perhaps running deeper correction cycle or a longerlasting sideways phase which developed after the # 1 // 2021 Top, it maybe becomes a little bit clearer why pair here trading at the 1.17-horizontal is at very critical juncture!

This 3 Candle down gives the 1.17 horizontal is natural and very important monthly rail, as it is now the nearest natural montly horizontal support out of the 2021 Top.

Precisely at 1.17 for ever runs the first square line support, and well, going further below that horizontal or maybe even closing below that big 2021 support rail on a monthly closing base officially activates some lower monthly – then a confirmed correction – target(s).

Among other stuff we recognize that the possible big natural downtarget of the upper line of 2nd double arc fits nearly perfect to the falling dark-green dotted MILLENNIUM support rail for end of 2021 to early-2022 at the already mentioned 1.11.

So its most important for the bulls now that the 1.17 will be defended the coming days and at official Sep21-close. Then pair could AND USUALLY should rally back towards end of year/early-2022 time window for a 1.2160 and the very, very, very classic next backtest of the in the meantime twice negative tested 1*2 Resistance Angle, originating from the absolule # 1-high of 2021.

==> We can prepare for this long-bet accordingly, placing a EURUSD Buy-Stop order shy above the September 2021 opening auction what forms a future buy trigger on mpnthly base at the 1.1809.

And I think, it will be relative safe to place a Buy-Stop order shy above this nearest monthly resistance:

==> I recommend to long EURUSD market if trading at a 1.1812 and higher!

Within above again shown monthly 10 Candle up I`ve added 1 super-interesting upward magnet and backtest resistance magnet stuff.

Namely the 1*2 Resistance Angle out of the 2021 High what intersects the Blue Arc and the 2*1 Bull Market Angle at same time and at same price just for forming a PERFECT TRIPLE future backtest resistance upmagnet existing at the 1.2160 for the month of January 2022!

==> And since this future triple upmagnet resistance could be a very dominant influencer for this market because it might radiate irresistable upward energy on a yearly basis, it may well turn out that it has to be reached in time for the turn-of-the-year time magnet.

==> Possible 2021-year-end uptarget at 1.2160!

Be prepared!

Eduard Altmann