Dow Jones, S&P 500 and US Tech indexes have formed a classic Bear Flag over the past 8-9 days which experience has shown resolve to the downside with a rate of around 70%.

One of the weakest US sectors are the Tech Stocks: in terms of momentum, but also from a GUNNER24 Perspective. The Tech indexes have been the only one of the main markets to send out the next GUNNER24 Sell Signal in the daily chart.

For the NASDAQ-100 emini continuous contract (NQ #) after the # 1 // 12465.25 pts alltime-high (ATH) a first classic 5 Fib number days long initial down impulse is seen. Afterwards a daily Bear Flag develops, showing that the absolute high of the Bear Flag resistance was the accurate backtest of the former yearly support, now major backtest resistance upmagnet.

Bear Flag is a 9 days long tight consolidation shy above cycle lows and these tend to dissolve lower.

And usually this has to happen soon finally when observing the Slow Stokes which again point lower and try to establish a bearish embedding and the MACD lines also pointing lower with some bearish potential ahead. Friday weak closing auction is the lowest since alltime-high and also the Friday printed lowest low of the correction. This ugly Friday candle fired a double GUNNER24 Sell Signal on daily base as Friday close is far enough below the initial down impulse low and this is why the measured move downtarget of the Bear Flag is now offically activated.

==> Price and time downtarget for the NASDAQ-100 emini is 9400 pts for early-October.

The second indicator that the next week is likely to be mostly bearish is the seasonality, as the week following the September quadruple witching is one of the most consistently negative weeks of the year with the S&P 500 closing lower nearly 80% of the time over the past 30 years and a average loss of -0.95%. The NASDAQ shows a average loss of -0.71% over the past 40 years. Source: https://jeffhirsch.tumblr.com; the Almanac Trader.

Third, Apple shares fired a double sell signal on weekly base:

The bear has grabbed the Apple after shares now lost more than -22.5% since the 137.98$ alltime-high. Thus the Apple stock is now officially in bear market market territory. Well, that doesn't mean very much for the known high volatile Tech Shares. But there is always this main rule: „As goes Apple, so goes the Stock Market!".

For the first time in 2020, APPL shares had a trendline failure. It isn`t looking good for Apple and the general stock market:

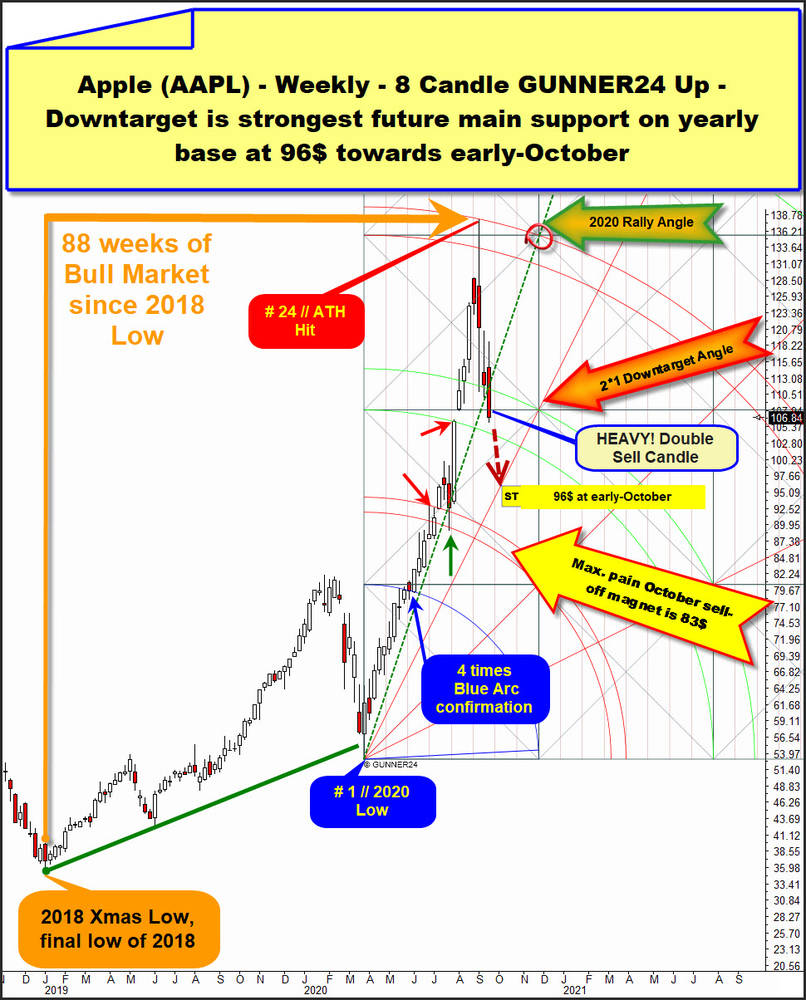

The new bear market had to start on the one hand because the time factor wanted it that way, as the upward trend from the final low of the year 2018 to the latest alltime-high lasted 88 week candles in total and was therefore oriented towards the very high 89 Fib number and on the other hand within the weekly 8 Candle up the upper line of 3rd double arc uptarget was met and finally worked off then.

This upper line of the 3rd double arc, as all the other arcs of this setup, are, resp. have been important natural uptrend targets of the 2020 rally cycle which began at the # 1 // 2020 Low and ended obviously at the # 24 // ATH (at 137.98$).

==> Thus we must state that during the week of the alltime-high the time factor met the price, and this event triggered the trend change from bull to bear.

This past week fired a serious AAPL bear market continuation signal, which therefore also means an indirect sell signal for all the Western Stock Markets.

As in 1 go = AT THE SAME TIME, and on weekly closing base a AAPL double support magnet is flushed into the toilet:

A) Shares show a yearly trendline break as they have closed far enough below the natural price/time support of the „2020 Rally Angle". This dark-green dotted highlighted 2020 Rally Angle is/was the most important support for shares and because it springs from the most important bear extreme of the year it is a yearly support, now usually very strong future backtest resistance upmagnet.

B) The upper line of 2nd double arc, whose support was defended the last two weeks, gave way at the same time!

This double GUNNER24 Sell Signal on weekly base activates the very first and straight test of the 2*1 Gann Angle in (bear) trend direction!

Activated downtarget is the 2*1 Gann Angle. The 2*1 Angle is nearest MAJOR important support for the shares. It is for sure big,big support downmagnet on yearly base but also could radiate MAJOR SUPPORT on a DECADE base. Means, it is the most natural downtarget for this bear market what finally could end at the very first test of the fresh activated 2*1 Downtarget Angle.

By analyzing other markets, we know that the end of September <> early October should be a fairly reliable time window to end this daily & weekly correction cycle of the US stock market indexes, to start from there a quite serious countertrend swing that will run for at least 3 to 5 week candles.

And somehow AAPL shares also smell like they wish to deliver a very important intermediate cycle low = decisive bear market low towards end-September/early-October:

Hmm, I told you that the very first test of the 2*1 Downtarget Angle, the nearest most important yearly support below, now is an urgent necessity.

This major downtarget runs at 96$ surroundings for the trading week September 28 ==> October 2 and I think this is no coincidence, since the very last price quoted before the 4 for 1 stock split announcement is exactly 96.19$.

==> Think AAPL shares have to deliver a very classic backtest of 96.19$, what is another price magnet on yearly base, therefore perhaps this pivot is the future most important yearly support magnet below current quotations.

==> Until then please remind: As goes Apple, so goes the Stock Market!!!!! There are many indications that Apple has to reach its next major yearly support magnet at 96$ before there is even the chance of an important bear market low to be made.

Be prepared!

Eduard Altmann