Since the beginning of this year, Palantir Technologies shares have only gained an average of +5.3% in value. Compared to some other tier 2 tech stocks, this is a fairly moderate performance that is not really convincing. An investment in other tech companies would have been much better and more profitable.

But now all at once the data specialist Palantir (Palantir builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations) has been convincing for many weeks with a straight stock market performance. Shares of the company had gained +18.5% in the past month. In that same time, the Business Services sector gained +1.31%, while the S&P 500 gained ... small losses ...

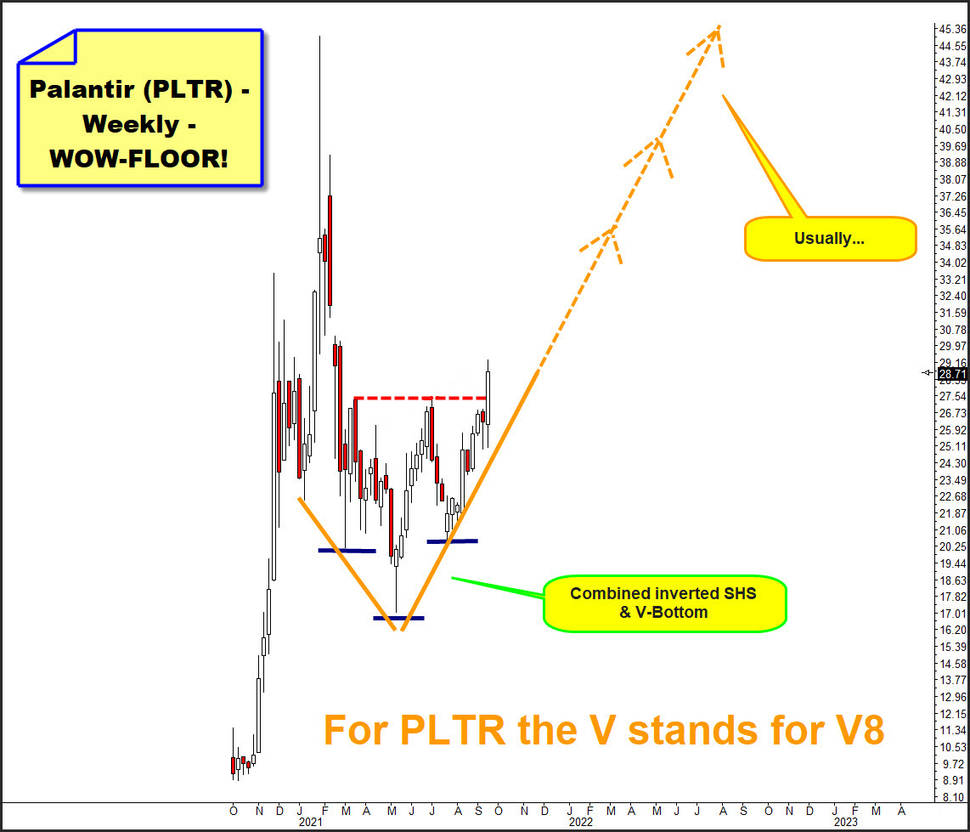

And now, PLTR shares are breaking above their 2021 main resistance ..., and this is of course a very good reason to have a look into the near and further future of the stock.

==> The most important first: Higher alltime-highs should come true for around early-2022!

Second, I would like to give you a closer look at the bottoming formations that have formed over the year 2021, and well, I have rarely seen such a large number of individual bullish bottoming formations in my career.

All these individual bottoming patterns taken together indicate that what is visible so far in 2021 is with unusually high probability a rare substantial bull market bottom which will form over this year 2021. This is why the printed 17.06$-year low usually marks the VERY FIRST important higher bull market low of a for some more years lasting bull market.

Palantir shares started a lifelong bull market cycle immediately after first notice on September-30-2020. Lifetime-low (ATL) is at 8.90$. Alltime-high (ATH) stands at 45$ and arrived very early in the year on January-27-2021.

From 45$-Jan21-ATH it corrected until May 2021 and a 17.06$.

That year 2021 bear extreme at 17.06$ is:

A) the FINAL Low of 2021.

B) A SPIKE LOW on the weekly chart, signaling final bearish exhaustion.

C) The FIRST important HIGHER low of an awaited multi-yearslong running bull market.

D) It is the Head (H) of a weekly inverted Head-and-Shoulders (SHS) bottom.

E) It looks to be the Head (H) of a possible complex inverted Head-and-Shoulders (SSHSS) bottom, recognizable on the daily chart below.

F) The bear extreme of 2!!!! different Rounded Bottom formations on the daily chart which are forming over entire 2021.

G) The starting price of the now underway weekly uptrend cycle which with the next week candle will be at No. 20.

H) It is the low point of a textbook V-shaped reversal pattern on the weekly chart.

==> OR TRANSLATED: PLTR shares likely have formed one of the most solid bottoms and possibly explosive springboards ever recognized during 2021.

On the daily chart, I`ve highlighted the inverted Head-and-Shoulders respective the possibly existing complex inverted Shoulder/Shoulder-Head-Shoulder/Shoulder (SSHSS) bottom in blue.

In green I`ve indicated the two individual Rounded Bottom patterns which differ among other little things by their starting point. The dark-green-lined Rounded Bottom EXACTLY starts to radiate energy at the VERY FIRST TRADING DAY of 2021!

Last but not least there is the by the Institutionals well-recognized and mostly respected 200-day Moving Average (MA) what was finally overcome some days ago and whose last successful to the T test from above triggered the now underway bullisch breakout wave.

Thursday candle close was able to overcome the red horizontal resistance field what represents the Neckline of the 2 Rounded and the inverted SHS, resp. SSHSS formations.

In PLTR case the V likely stands for V8-performance:

There now is a phantastic V-shaped bottom on the weekly life-time chart. At same time we recognize the inverted SHS pattern formed nearly perfect on the weekly chart because the left and right shoulder are almost at the same level.

Combined bottoms, visible in different time frames usually form an extreme solid base. So the rule ...

==> PLTR shares over the course 2021 likely have formed one of the most solid bottoms ever recognized.

This is why PLTR shares likely have to overcome their 45$ bull market high by far in the course of the next few months and into 2022. The test of the important 50$ upside magnet now seems somehow inevitable, IMHO & soooon!

Gentle reader, the next two trading weeks have a hair-rising history of sizable stock market losses and although Palantir should act as a kind of breakwater for the bulls in bumpy times and negative sentiment, it is very likey that even this long-term runner on fire has to pullback somewhat over the coming days. Especially when we recognize Friday`s Doji candle which was again accompanied by high volume.

Be prepared!

Eduard Altmann