A Volatility Beast!

Overstock.com, Inc. (OSTK) was one of the most hyped stocks in 2017 as the underlying company transitions from its original e-commerce platform to one that is increasingly oriented towards the blockchain. The rally in OSTK shares over the course of the past year was accordingly powerful. But along with the cryptocurrency bubble burst, the stock price collapsed in sympathy.

Overstock.com, Inc. operates as an online retailer in the United States and was one of the first retailers to accept Bitcoin as a method of payment. The company offers home and garden products, kitchen and dining, bedding, home improvement, housewares, jewelry and watches, clothing and accessories, electronics and computers; It also provides handcrafted products; new, used, and certified pre-owned cars; and loans, credit cards, and insurance, as well as access links to automated financial advisory and discounted stock brokerage services. The company sells its products and services through its Internet Websites located at overstock.com, o.co, and o.biz, as well as through third party logistics providers to international customers.

The company operates a blockchain focused business known as Medici Ventures. Through this channel, Overstock has built significant positions in several small blockchain companies. In addition, Medici has launched a trading platform called tZero, which trades traditional stock certificates and other securities through the Overstock proprietary blockchain platform.

Because the shares formed a Double Top pattern in the MILLENNIUM resp. CENTURY and in the DECADE time frames and most recently additionally on a yearly base, it had to be the case that the share price is now so trimmed:

Above we observe the monthly live-time chart of OSTK. Final year 2004 High together with December 2017 year high and January 2018 made alltime-high (ATH) that is printed at 89.80$ form one of the strongest imaginable resistance patterns what a Double Top pattern in the MILLENNIUM or CENTURY time frame always is. Radiating mighty Double Top resistance was resolved to the downside later obviously.

I see that the slightly falling dark-green dotted "Bull Market Support" rail formed by falling final 2007 and final 2013 Highs that was broken to the upside in course of 2017 rally year is fallen short with August 2018 closing price. And definitely quite sustainable!

This month close below "Bull Market Support" which is at least a very important support existing in the CENTURY time frame is lowest month close of the year and next strong sell-signal on monthly base as far as I am concerned.

==> Accordingly, the next test or next backtest of the always at year lows supporting and sharp defined rising MILLENNIUM/CENTURY Arc Support is now officially activated!

The downtrend could pick up speed after consolidating for about 5 months just shy above the 2018 lows support area and if you ask me it can now come very quickly to the next test of the MILLENNIUM/CENTURY Arc Support. For the month of September this resides just 11$ below the current quotations and such a possible next hard sell-off the often max. volatile OSTK handles in 1, 2, 3 trading days, if desired.

We should buy OSTK at 18.30$ MILLENNIUM/CENTURY Arc Support if tested in course of September cause MILLENNIUM/CENTURY Arc Support is strongest imaginable existing future support which in 6 successful tests so far, also led 6 times to the final year's low.

==> Buy-Limit order at 18.30$, possible next textbook backtest of rising MILLENNIUM/CENTURY Arc Support = strongest existing bull market support. The Buy-Limit order should just be valid until end of September 2018 = 09/28/2018.

Because MILLENNIUM/CENTURY Arc Support usually is strongest imaginable future support at least, a "weaker" weekly bounce starting after the next obvious test of MILLENNIUM/CENTURY Arc Support should be expected. Such supposed next "countertrend" within 2018 downtrend cycle should at least test back the slightly declining downwards broken falling "Bull Market Support" rail in course of October to November 2018.

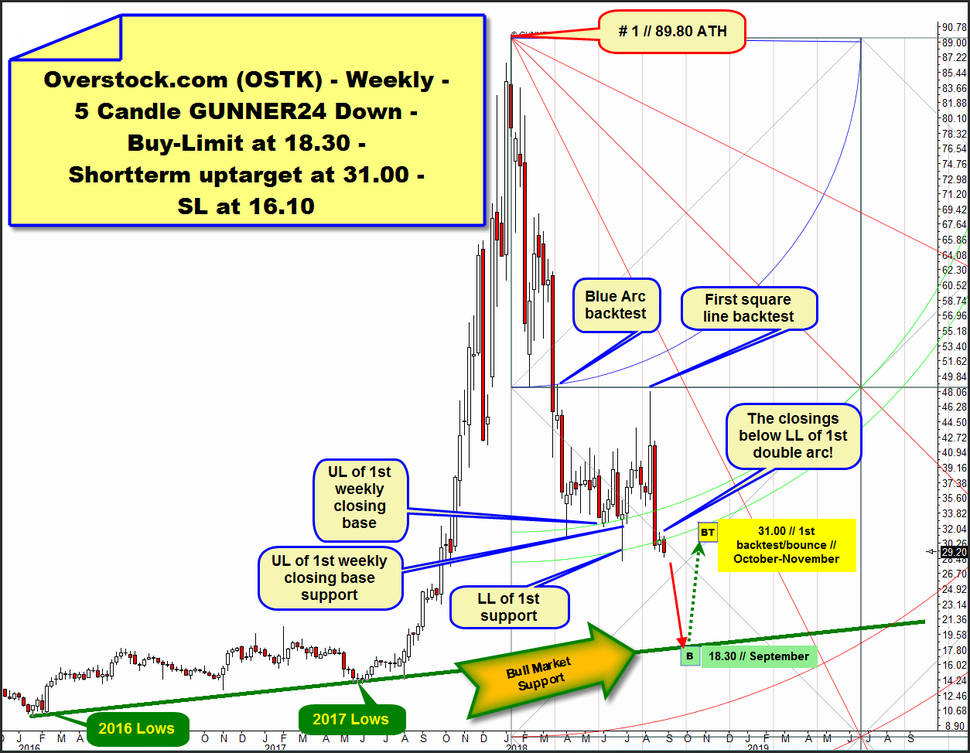

For this supposed dark-green dotted arrow snap back scenario additionally watch the weekly chart and valid GUNNER24 Down Setup in the weekly which follow here:

Classic 5 Fib number down setup starting at ATH. Important lower downtrend spike highs have tested back Blue Arc and first square line in a very negative way from below. After final, decisive downside break of Blue Arc support, the downtrend accelerated into overall, natural 1st double arc downtrend support = important downtrend target. For some months upper line (UL) of 1st double arc radiated sharp defined support on weekly closing base and lower line (LL) of 1st offered support a year 2018 low.

Now we recognize 3! consecutive weekly closing prices below the lower line of 1st and this week candle close is lowest of entire 2018. ==> this is very bearish stuff, a GUNNER24 Sell Signal on weekly base, activating much lower downtrend targets! A drop into 18.30$/September 2018 heavy support magnet appears possible!

Fat dark-green highlighted rising 2016 Lows to 2017 Lows support line runs at 18.30$ to 18.50$ for September 2018. Thus, this rising yearly support line usually adds a lot of strength to MILLENNIUM/CENTURY Arc Support existing at 18.30$/September 2018. Thus, the major attracting 18.30$ price down magnet is combined MILLENNIUM & CENTURY & yearly support for the trading weeks of September!

And a combined MILLENNIUM & CENTURY & yearly support magnet usually will be able to force the price into a weaker "countertrend" cycle. Whereby a "weaker" countertrend means for the OSTK shares that the price easily should be able to retrace by a 30%, 40%, 50% or so in a very short time.

Therefore, it is probably to be assumed that if the main support is reached in the course of September, a bounce should begin, which likely will be able to test back the downwards broken 1st double arc resistance above. And thus about the 31$ main threshold would have to be reached or tested back sometimes October to November 2018.

==> Shortterm uptarget of the today presented OSTK-long setup is 31.00$/October to November 2018!

==> Please place the SL for a OSTK long position at 16.10$!

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best trending stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann