The Fib count and the GUNNER24 Magnets reached in the current countertrend are indicating most strongly that the precious metal silver in unison with the silver- and gold-mines have ended their bounce since the downtrend respectively bear lows. Technically, on Friday these markets definitely topped finally according to price and time. Gold may go a skosh higher the next 3 days working off/reaching the 1172-1178. Platinum, too, seems to have finished its countertrend from the bear-low.

In reverse, the stock markets are thereby supposed to start bouncing up keenly at the beginning of the week. It’s even allowed to think that next week’s lows will mean the early end of the stock correction, beginning a new bull market leg. The question is of course which support levels the stock will start to rise from.

By means of the HUI and gold I’m going to show you today why silver, platinum, the mining stocks and gold are prepared now being supposed to strike off next week to test the current bear lows. Most of these markets are expected to fall below the current bear lows till October 2015.

I’ll save me today the direct charter evidence why silver and platinum have topped out now, because their performance and expected course can be derived right from and will be oriented closely by the HUI and/or gold.

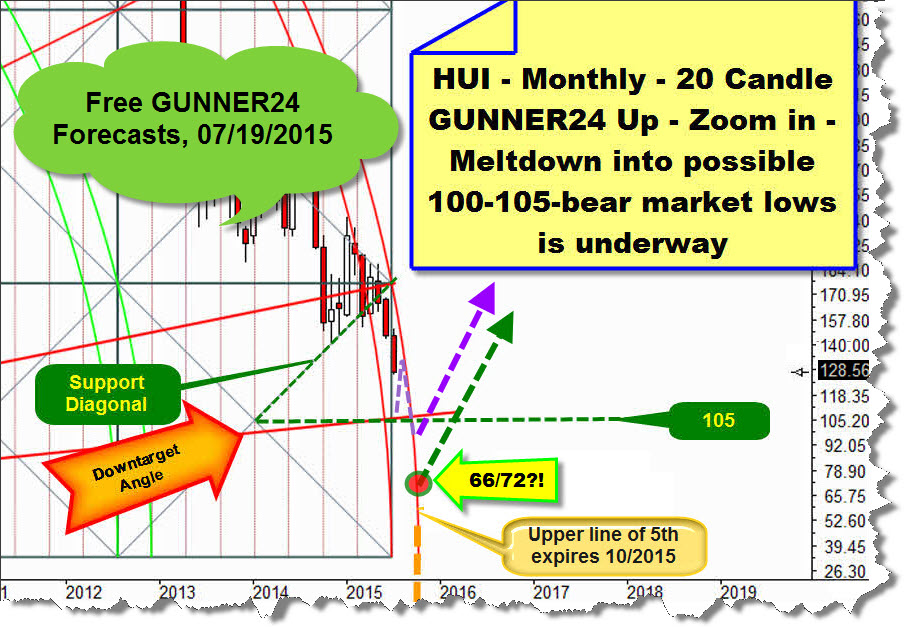

The miners topped finally in the countertrend! The HUI, the NYSE Arca Gold BUGS Index that comprises the stocks of international gold manufacturers had a downtarget for the bear low at 105.

The 105 downtarget was worked out in March 2015 = free GUNNER24 Forecasts, issue 03/29/2015. The bear low was timed between July and October 2015.

Since the notified bear low came in foreseeably too early – much too early – namely at 104.66 by the beginning of August (5th), from out the bear low the HUI is supposed to start a countertrend that would newly lead it to the upper line resistance of the 5th double arc in the dominating monthly 20 Candle up (that starts at the important bear low of the year 2000):

Mind about this the first ascending dotted purple line. All about the expected important 105 bear low including countertrend into the upper line of the 5th double arc resistance you can read again in the free GUNNER24 Forecasts of 07/19/2015.

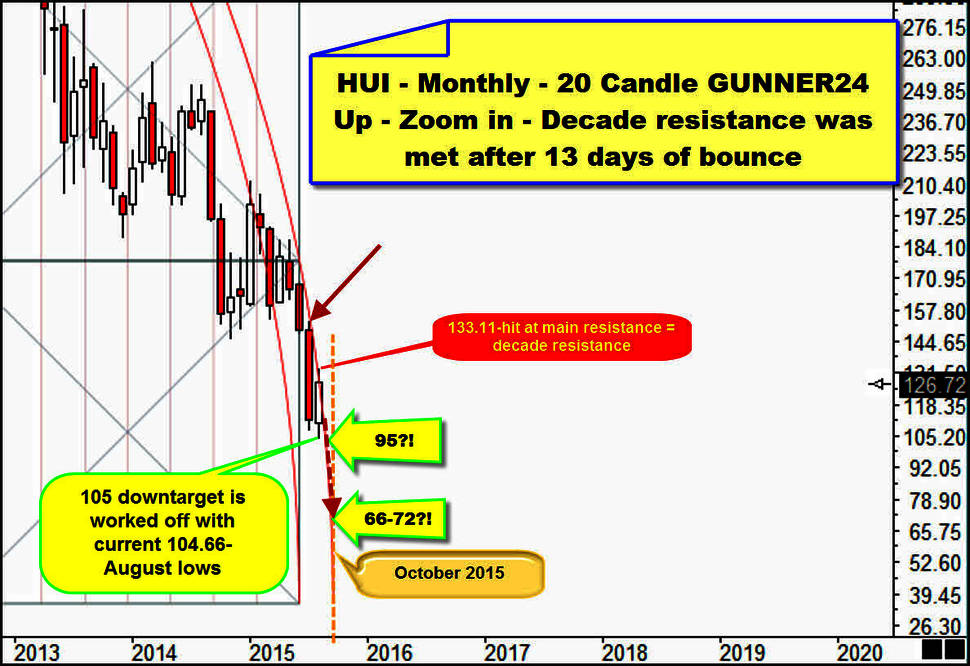

==> After working off the 5th double arc resistance may be expected that the HUI will set off now for testing the 105 bear low and falling below it. With 133.11, the upper line of the 5th was reached on Friday. I think, now it can only go downwards, since the upper line of the 5th is matter of a so-called decade resistance. The setup begins at the absolute bear low of the year 2000 after all, thus the resistance of the 5th double arc was pre-defined as early as in 2000 = decade resistance:

Since the 105 low came in very early in the panic cycle – beginning of August – there is a very worst scenario for the index situated at 66-72 index points. Yet, technically the 105 low is supposed to be fallen below narrowly at least once more = about 95-97 is minimum downtarget at the moment… a weekly close below 95 would activate the 66-72 main downtarget!

I save me the proof by means of the daily chart… but the bounce/countertrend in the decade resistance lasted exactly 13 days. As you know, Fib numbers are predestined for turns and significant tops and lows, after all:

The decade resistance was reached on Friday to a T not expiring before 2015. Thus, the possible final low of this bear is timed there. The weekly candle is looking weak after the HUI lost as many as 6 pts from the countertrend high to the Friday close. The 13 day bounce from the 104.66 low into the 133.11 countertrend high was not even able to correct the last panic wave by 38.2 % (only the GDX accomplished that). The miners just can’t get their act together.

Likewise silver! Extremely indecisive weekly candle with a long upper wick. This points to exhaustion = an important weekly top (I save me the proof here as well)… and simply unable to overcome the 15.50$-15.60$ resistance permanently.

The silver Fib count is showing us the following: last important higher downtrend low on 07/24 at 14.33. Present countertrend high on 08/21 = last Friday at 15.715. Thereby we count altogether 5 weeks upwards from the higher downtrend low to the current countertrend high. From the downtrend low to the high of last Friday, we can count exactly 21 (Fib number) trading days.

Since silver delivered such a weak countertrend according to the price, also the gold/silver ratio rises automatically generating a buy signal last week (= means usually a more rising gold/silver ratio in the short term). Such a condition is always negative for a lasting and above all substantial turnaround of the precious-metal complex meaning that silver compared with gold may/will have to underperform also next week as well as possibly many more weeks.

==> Therefore, the current gold rise can also only be classified as not lasting and thus as extremely vulnerable!

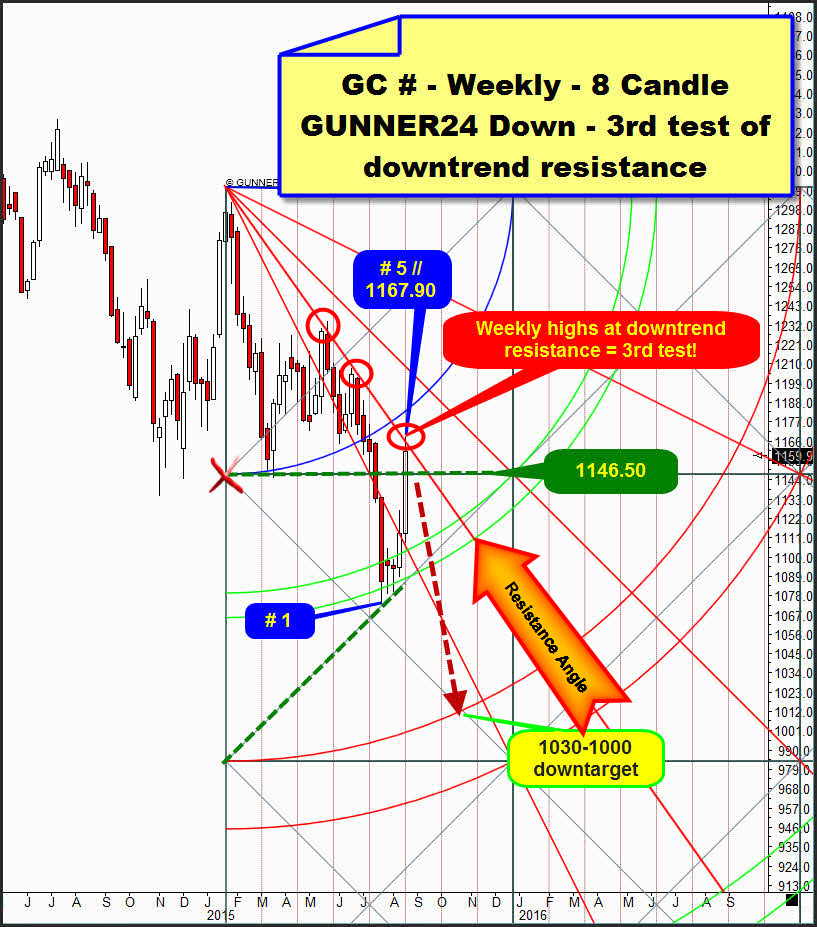

All the same, till Friday gold succeeded in reaching its absolutely strongest downtrend resistance:

It’s matter of the Resistance Angle in the currently dominating weekly 8 Candle up. Gold is testing this resistance for the third time now. Technically, it is expected to turn now heftily downwards from there.

==> Out of the bear low of 07/24, it rose from 1072.30 to 1167.90 on Friday. Like in silver, we thereby count 5 weeks of countertrend with exactly 21 days up from the low to the high.

==> Since the miners worked off their decade resistance after 13 days, the Fib count implying now also for silver and gold countertrends highs combined in the weekly as well as the daily count and gold having worked off its ruling downtrend resistance nearly pinpoint at the Friday high, the whole precious-metal complex is supposed now to sally forth to test the present bear/downtrend lows.

Gold: hmm, we are all familiar with the importance of the 1172-GUNNER24 Magnet. It derives directly from the all-time high, just like the current 1072 bear low (watch free GUNNER24 Forecasts, issue 08/02/2015). Therefore, the 1172 may be reached yet for this countertrend. If gold still wants to see the 1172, this magnet should be reached till Tuesday. Silver, platinum and the miners are not expected to join in this possible last gold countertrend upswing actually not exceeding their respective countertrend highs of last week.

==> If the markets analyzed above succeed however in overcoming sustainably the mentioned important resistances on weekly closing base in the course of next week, I and we will have to work on the assumption that these markets have started lasting countertrends that will naturally go much, much higher yet in price. They may last 5-6 months then, starting from the July/August lows.

==> Can the current countertrend extend that long? – Yes it’s allowed. At last, the minimum requirements for an important respectively "THE FINAL" gold miners bear low (calculated 105 pts/in deed attained 104.66 pts) was reached most exactly according to the price. Hence, as gold quasi simultaneously worked off – likewise to a T – the 1072-GUNNER24 Support Magnet that is derivable directly from the all-time high, with the current bear low some obvious price/time targets were reached, good for strong countertrends at least!

==> New 5-6 month countertrends mean however that the current bear market in the precious metals and the miners will extend till the end of 2016/beginning of 2017 – AT LEAST!!!! Gold 800$ and silver under 10$ and HUI at 40-60 pts would be the consequence and minimum targets for this bear. Being an old gold- and silver fan I pray for the complex to submerge again now inclusive panic exhaustion into October 2015 for new lower bear lows. That would have been it with the bear market, you see…

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann