With or Without You

More and more the world is longing for leaders who go ahead, who have everything down pat – longing for security and peace and happiness. The world is wishing for leaders who understand the nations supporting them, conveying large dreams, satisfaction and positive thinking. Passing in review now that last week with the whole politicians-false-noses-currencies-bailout-default skirmish, I’m becoming increasingly convinced of the necessity to vote out the entire caste by a referendum. 10,000 bullshitters in Brussels, Paris, Berlin, Athens washing down our hard earned money in the toilet bowl.

Then, all those bums should complete a 3 month traineeship in a nice little company in Cupertino, USA. They should have to spend the nights camping in a front yard – instead of holding major crisis meetings in chic locations – and they should have to learn in their practical training how to fulfill the innermost wishes of mankind meeting and satisfying their longings.

During these 3 months the management team of Apple Inc. wouldn’t only take over the functions of all the false-noses but also show the world how to get going again the whole global financial system in 1 week. Yeah, I think the elaboration of a useful rescue plan wouldn’t even take them a week.

It’s sort of frightening how the ideas and acts of a dozen of executives can influence complete stock markets and even trigger a world-wide "buy signal". But those are the real tasks of a true LEADER who understands his target group – clear, straightforward and simple!

Think different – is the end-of-course tattoo inscription each front yard camping participant should be given someplace – that’s really my greatest desire!

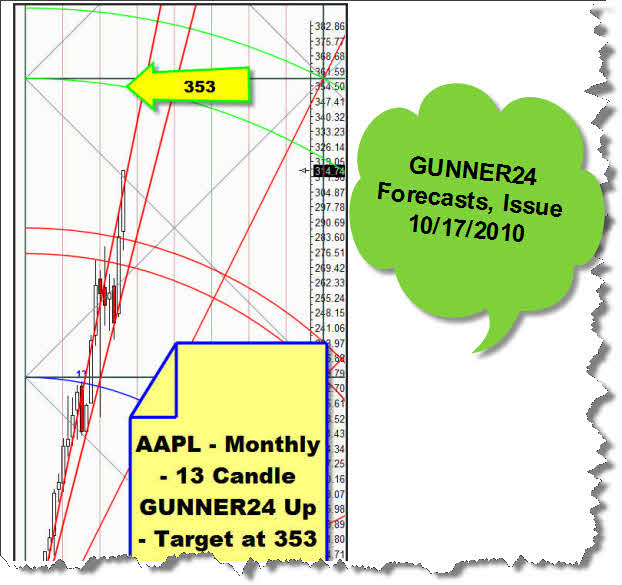

GUNNER24 Apple forecast of 10/17/2010:

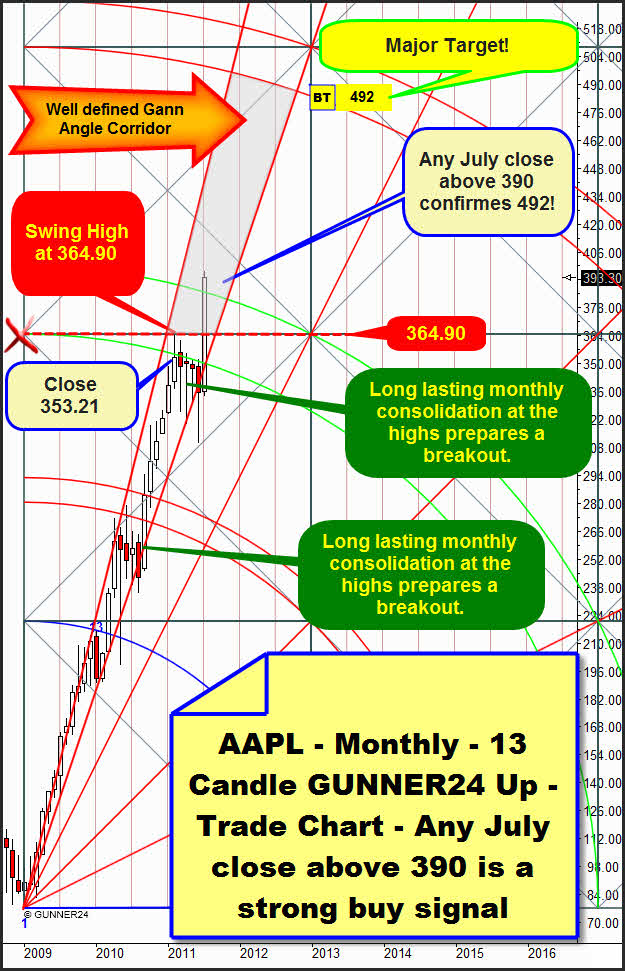

Now, the 492 seem to be inevitable. Each July closing price above 390 would activate this major target definitively. But even if AAPL closes below 390 this month the mere chart consideration and the trend dynamism speak for the achievement of the target. We make out consolidations at the highs under the respective GUNNER24 Double Arcs. The APPL remains at the highs for 5 months, with the 6th candle die breakout went off. Even though in the last trading week – maybe as early as on Monday – because of the US debt problem a sell-off takes place AAPL will be a crystal-clear buy by virtue of the chart patterns. Every setback next week, maybe to 380 or below would be a gift in the long-term sight!! In any case AAPL is going to follow the dominant Gann Angle corridor upwards for the coming months.

We should consider the AAPL as a protection against the inflation, just like gold or silver. The new money created by the inflation of all the main currencies will go on moving into the stock markets!

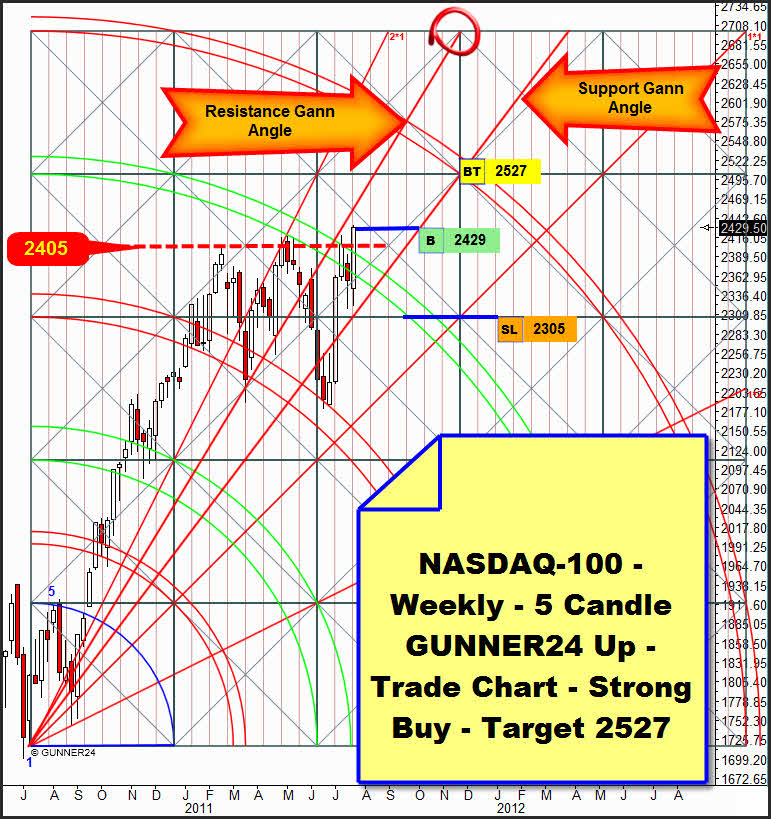

AAPL is leading the NASDAQ-100. The NASDAQ-100 is going to drag the other US markets upwards.

In the actual 5 Candle GUNNER24 we recognize the clear break of the 4th double arc. After the several month consolidation at the highs, while the index repeatedly confirmed the 3rd double arc as to be a support AAPL launched the index beyond the main resistance. It’s a buy signal with target 2527.

During the next weeks and months the index is supposed to run up to the 5th double arc in a well-ordered way between the resistance and the support Gann Angle. We’ll use a month closing price of more than 2440 for a long entry on monthly basis. In case of a definitive break of the 2440 in July target will be 2655.

One thing leads to another one – In the long term, the weekly NASDAQ-100 buy signal will lead the S&P500 and the Dow Jones to new highs, as well:

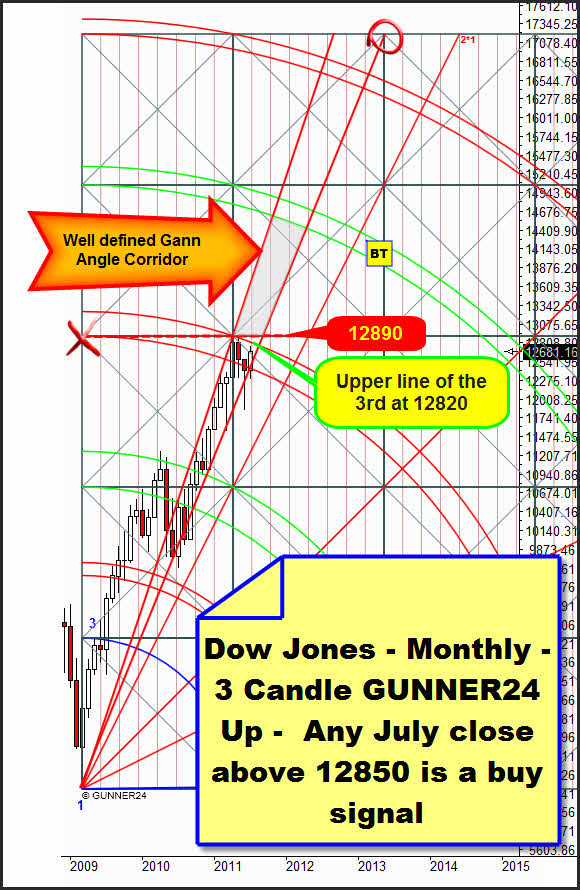

The Dow Jones should actually break the main resistance of the 2nd double arc upwards as early as this month or at the latest next month. In that case a rally would be inevitable following the (here again) trend setting Gann Angle corridor upwards through the next spring. If July closes above 12,850 we’ll buy the Dow Jones on a long-term basis. Major target will be 14,140 in that case.

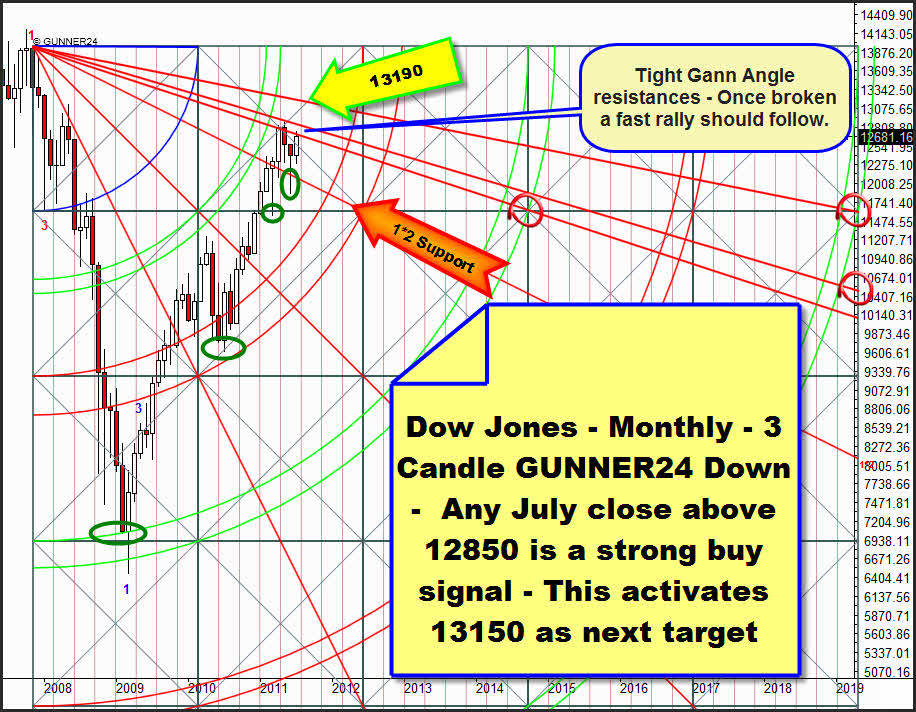

Here you get a different angle of view to the Dow Jones:.

In the monthly 3 Candle GUNNER24 Down Setup we recognise the market being retained by both Gann Angles lying narrowly together, starting from the all-time high. Each swing that leads to a new year high this week or one of the next weeks should go up to the next higher important Gann Angle at 13,190. That’s where a pretty long consolidation phase will have to be reckoned with.

Be prepared!

Eduard Altmann