The TIME FACTOR forced the e-mini NASDAQ-100 continuous futures contract (NQ #) to the final highs of a 21-month candles bull market last November.

The bull market that began at # 1 // March 2020 coronavirus panic low with the candle of the alltime-high (ATH) was in its 88th week candle of life. So, the final top in the course of the bull market week # 88 was obviously influenced by the very high and thus often MAJOR important Fib number No. 89.

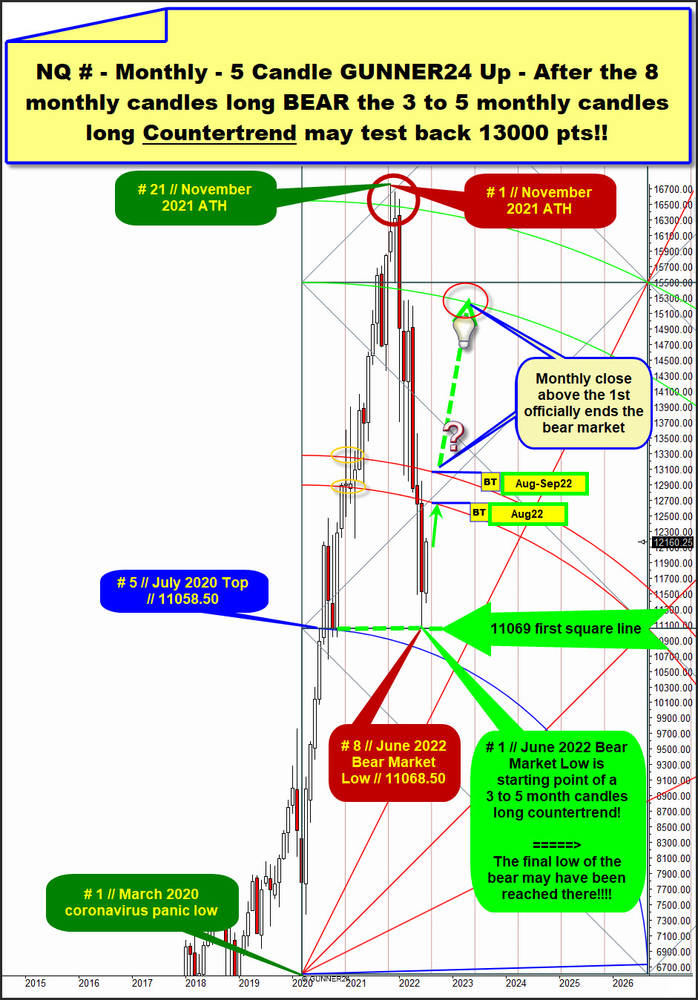

On the monthly NQ # candlestick chart below the November 2021 candle was the 21st-Fib number month candle of the former bull market what ignited at the # 1 // March 2020 coronavirus panic low:

==> The NASDAQ-100 printed a nearly perfect # 89-weeks/# 21-months Fib number combo bull market high and therefore the seeds were sown for the beginning of the subsequent bear market that has now accompanied us all year long.

The determining price factor at the dark-green highlighted # 21 // November 2021 ATH that brought the market to its knees was the upper line of 2nd double arc, which automatically develops from the rally range of the first 5-Fib number month candles of the previous bull market cycle.

And again as if drawn with a ruler, the subsequent bear market behaves ideally in terms of time and price, as researched by W.D. Gann.

A) In the time frame of exactly 8 monthly candles - again an important Fibonacci number and thus also important mathematical turning point - at the reached dark-red 11068.50 pts // # 8 // June 2022 low = current annual low/ bear market low, the natural annual support horizontal of the first square line was backtested successfully to the T.

B) The light-green # 1 // June 2022 Bear Market Low is the starting point of a 3 to 5 month candles long countertrend which has to test back the 1st double arc backtest magnet.

Where the current July candle is already the 2nd-Fib number candle of this countertrend and the lower line of 1st double arc will be the minimum target of this countertrend. According to the rules, the lower line of 1st upmagnet resistance will be reached with a probability of over 90% in the course of August. Accordingly, the then 3rd-Fib number monthly candle of the COUNTERTREND!

C) Ergo, it is allowed that this monthly countertrend will end already on Monday of August 1 very exactly at or very close to the future lower line of 1st main resistance.

D) With the same probability as analysis point C), the monthly countertrend has to turn only after the final processing of the uper line of 1st double arc.

Next dear US equity bears, listen carefully and memorize this bullish scenario and consider it carefully in your upcoming trading decisions:

=> In very clear words: ==> THE final low of the ENTIRE bear market may have been reached at the light-green 11068.50 pts # 1 // June 2022 Bear Market Low, as a major important combined YEARLY price/time magnet was ideally hit and backtested there, which led to a visible and possibly also strong & looong upward trend.

The VERY FIRST monthly close above the 1st GUNNER24 Double Arc main resistance officially ends the bear market. The probability that the price will close above the 1st double arc on a monthly base by the end of 2022 is "only" 30% SO FAR! But that`s something to think about, after all, isn`t it??

The outcome that the future 1st double arc main resistance environment will be defended at the due backtest and afterwards the so far bear market lows will be seriously backtested and/or even undercut is of course much higher.

Be prepared!

Eduard