The EUR/USD Forex market has been in a bear trend for over 2 years. The +2 year bear cycle is part of a 14 yearlong secular bear market. Therefore market is in a bear market which spans entire DECADE of 2009 to 2019. And it is valid that the pair still is trapped in bear mode in the newly started DECADE of 2020-2029.

The point regarding price & time could soon be reached where the EURO fires a buy signal against the US$ in the major important DECADE time frame. Perhaps the imminent June close will trigger this DECADE buy signal...

A long time has passed since we last looked at the EUR/USD. But now it should be interesting again, in a market that has been quite strong and relentless in trend over the last 2 years, but that has hardly tended to move quickly, which normally means fast money:

Towards the end of September last year, the above elliptical 8 Candle up anchored # 1 // 2017 Bear Market Low predicted that the EUR/USD would have to reach the 1.07 in further course of 2019. Alternatively/additionally, there was an activated weekly Falling Wedge downtarget at 1.04.

It was also analysed that the bear market could last until December 2019 to January 2020 and then a new bull market could start afterwards.

For the full analysis and former outlook please click here or on the chart above.

In retrospect I must say that the analysis was 50:50, as the annual major down target of 1.07 was well met (price factor), but unfortunately not until 2020, namely in course of March at the end of the coronavirus sell-off cycle (time factor).

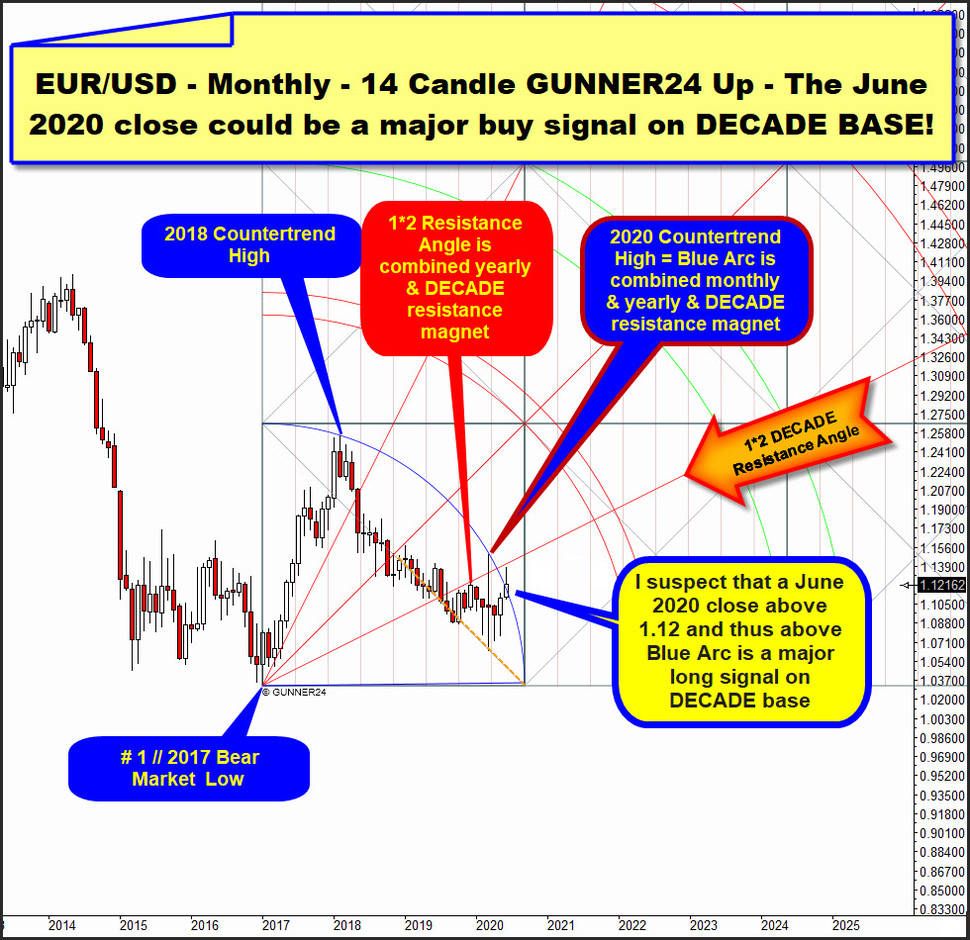

Due to this time shift of an annual low it is now possible to remeasure the the +2 year bear market what started at so far secular bear market low with this monthly circular GUNNER24 Up Setup:

Setup measures the yearly upleg starting at # 1 // 2017 Bear Market Low finally topped out at final high of 2018. This is a classic 14 - 1 = 13 Fib number GUNNER24 Up Measurement and this is why this above circular Blue Arc is major important resistance rail on yearly base and on year high base. Top of 2020, another important countertrend high, also tested the Blue Arc from below to the T, therefore triggering coronavirus sell-off cycle at March 2020 highs.

So obviously the Blue Arc above has braked 1 time at perhaps most important countertrend high of the last DECADE. Also it stopped market advances at so far highest price of the new 2020-2029 DECADE. ==> This is why the Blue Arc radiates additionally DECADE resistance actually and until proven otherwise.

When observing the still in the making June 2020 candle we recognize some very bullish activity as candle so far trades above the combined yearly & DECADE Blue Arc resistance.

+2 year combined yearly & DECADE Blue Bear Arc is weakening!

There are still 2 trading days remaining in June. So far, the month has a small bull body. A final June 2020 close here at these levels might be an unusual strong buy signal, as major +2 yearlong circular arc bear market resistance would be overcome on monthly closing base. And this allows that the 1.06359 coronavirus panic low of the March 2020 triggered another mighty and perhaps yearlong countertrend in the secular bear market, because it is a far higher low compared to the # 1 // 2017 Bear Market Low.

==> I suspect that a June 2020 close above 1.12 fires a sustainable monthly buy signal as such close would mean the first monthly buy signal of the 2020-2029 DECADE and this is a buy signal on DECADE base!

Another bullish thing is that the 1*2 DECADE Resistance Angle looks like it will soon be tested again from below for another backtest of this major important upmagnet resistance what is unusual strong resistance as the 1*2 Gann Angle out of # 1 // 2017 Bear Market Low actually acts as a combined monthly & yearly & DECADE resistance as not only the entire 2010-2019 DECADE and the past year 2019, but also the last 11 month candles closed below this massive bear rail.

Seen June 2020 highs have traded very close to the 1*2 DECADE Resistance Angle what runs at 1.1410 for the June 2020 and at around 1.1430 for the coming July 2020. The 99.99% final June top at 1.1383 nearly has worked off and tested 1.1410 1*2 DECADE Resistance Angle which should therefore now exert an actually irresistible attraction on the price and perhaps has to be tested in course of the July. But such high quotations for July would imply that the market has finally overcome the resistance of the Blue Arc!

The summary of the monthly situation through GUNNER24 Lens is as follows:

==> There are significant signs that the price action is changing. The bulls are getting stronger and the bears are getting weaker as they smell a higher low on yearly base has formed now. EUR/USD is on the brink of a major buying spree IF June 2020 closes above 1.12!!!

This following weekly 2 Candle EUR/USD up setup shows us the starting point of the likely due buying panic – which if released, indirectly confirms a DECADE buy signal = normally UNUSUAL sustainable new bull market was fired shortly before:

The new determining weekly GUNNER24 Upward Setup is the classic 2 Fib number, that starts measuring at # 1 // 1.06359 // 2020 Low, the coronavirus panic low and the 90% likely first higher low on yearly base since the multiyear countertrend began at 2017 Low.

We see 2 uplegs from the March low. The first leg was the big bull candle that began on March 23 and turned the weekly trend from down to up. Then EUR/USD went sideways for weeks during that time confirming that the within setup naturally anchorable 2020 Support Angle is MAIN support of the still underway weekly uptrend cycle. The second leg up started at the last successful test of the 2020 Support Angle and ended at natural 1st double arc GUNNER24 Uptarget at highs of uptrend weeks # 11 to # 14.

==> Since 4 week candles the pair is testing this 1st double arc resistance environment the natural 1.1350 GUNNER24 Horizontal, the current year highs made in March and the +2 year bear market resistance from below. These 4 items together form combined weekly and yearly resistance magnet or a very strong quadruple combined resistance magnet.

Given the appearance of the past 4 weeks we recognize a pullback according time and price is getting started. But the pullback looks healthy and is a weaker one as price for 4 weeks trades near cycle highs and any of the 4 pullback weeks has tested the quad resistance area.

==> Minor reversal down regarding price and time from a quadruple resistance magnet is very bullish development and a successful June 2020 close above 1.12 could be the reason why EUR/USD then plans to overcome the quadruple resistance magnet finally within weeks, at latest until end of July and this would mean a next/another major buy signal!

In that case the lower line of 2nd double arc environment would be activated as next important weekly GUNNER24 Uptarget and then usually the lower line of 2nd should getting tested and worked off towards the natural 21st Fib number uptrend week = next due important time magnet of the since 3 months running weekly and monthly EUR/USD uptrend cycle...

==> I recommend to buy the first weekly EUR/USD close above 1.1350 year 2020 quadruple resistance magnet until end of July 2020 for the then finally activated uptrend week # 21 // 1.16 to 1.17 summer uptarget.

If the bulls can get a monthly close above the March high by July to August and/or the very first weekly close above 1.1350 until end of July, they will expect the rally to continue up to the major important January 2018 countertrend high until year end. That was the start of the +2 year bear and and would therefore be the first really important processing area of a buy signal in the DECADE time frame. The then triggered GUNNER24 Year End uptarget is the 1.20 area where runs the weekly lower line of 3rd double arc projection for the end of 2020.

Be prepared!

Eduard Altmann