US boys kicked out of the Soccer World Cup at first - and now: Are the US stock markets going to be flabbergasted?

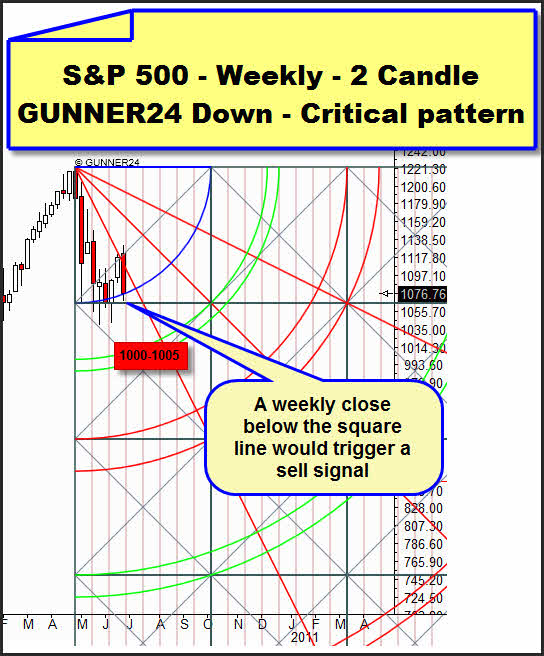

After a glorious fight the US boys had to say good bye in South Africa, and now in the extra time, the stock markets are threatened to be kicked out as well. The weekly GUNNER24 Down Setup shows the S&P 500 being at a very critical point that might drive to new lows at 1000-1010 we prognosticated at first here (GUNNER24 Forecast, Issue 05/30/2010) and then there (GUNNER24 Forecasts, Issue 06/06/2010).

The situation: Last week rebounded very harshly from the 2*1 Gann Angle downwards. The reversal candle is pretty impressive and harm-hatching. At the week closing, the price is parking exactly on the blue arc that gives support. The next and relatively powerful support is the lower horizontal of the first square at 1065. If next week closes underneath we would have a significant sell signal that would lead to the first sell target at 1000 to 1005. Due to the GUNNER24 Forecasting Method, that is where a strong rebound should happen with which the market will resume its long term upwards trend.

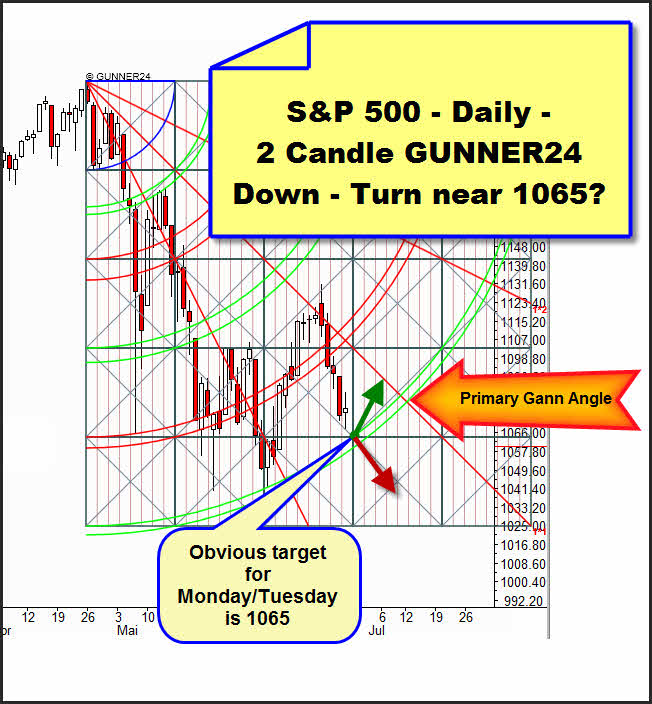

Both following daily GUNNER24 Down Setups show that the weekly break may certainly be hindered yet:

On daily basis, it's obvious that on Monday or Tuesday the market will test again the 1065 at the 5th double arc. Then, the decision will be due whether or not that 5th double arc will resist, you might say whether or not the USA succeeds in equalizing during the 120th minute. Next week, several scenarios will be conceivable:

1. On Monday or Tuesday we rebound impressively from the 5th double arc testing again the 1*1 Gann Angle. It would be the 4th test that makes a break through become likely. In case of a significant break of that angle we would go long.

2. The 5th double arc may be tested extensively during the whole week because the 1065 are forming a very strong support as well in the daily as in the weekly time frames. Or

3. break immediately at the beginning of the week, respectively. In that case, we would switch onto short in day trading, i.e. we would sell intraday rallies.

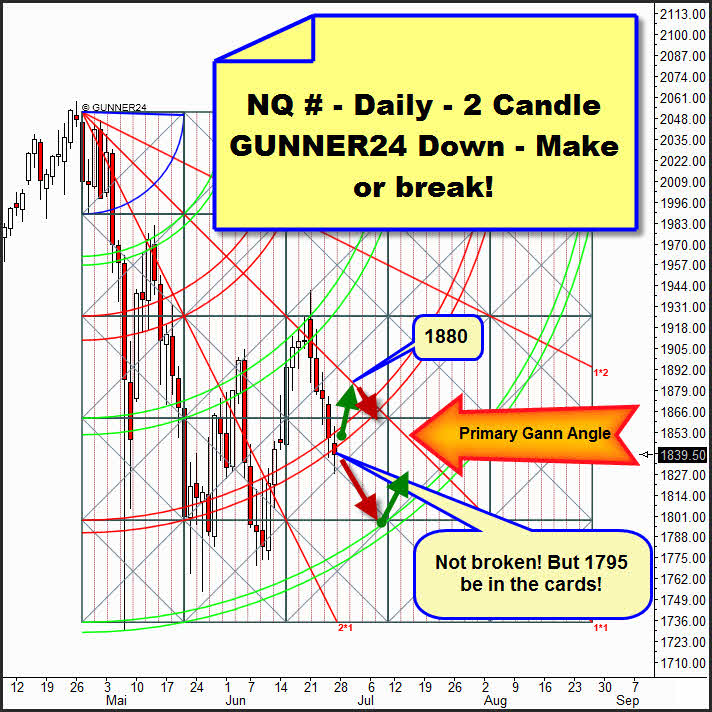

The NQ continuous contract is showing a mixed picture as well, the 4th double arc seems to be broken, but it is not, considering the lost motion. However, the Friday clothing underneath the 4th double arc makes the 5th double arc probably to be reached. There, again a rebound should happen. I'm not convinced yet of the long term shorts (daily and weekly basis). In the final analysis, the market is swinging to and fro between the double arcs testing them from above and from below, respectively. Unambiguously, that's sideways movement performance. On Monday, at the second test of the 1*1 Gann Angle the price rebounded impressively downwards. A quite normal behaviour, that Gann Angle simply cannot be taken at the first or second attempt. On Tuesday, it was tested for the third time. The conversely conclusion is: the 4th test will allow its definite break!

Furthermore, the NQ # has simply got some "permitted" space downwards yet, until the 5th double arc at about 1800. The sideways move is not going do be quited downwards before the definite break of that 5th double arc.

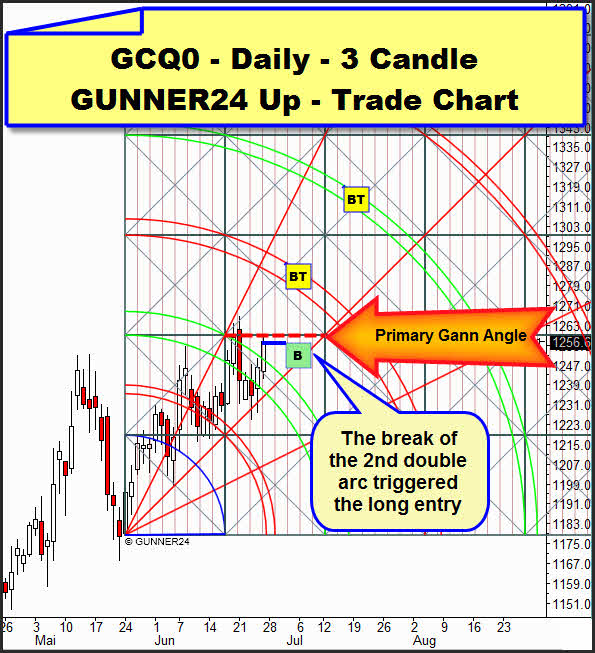

Our periodical look at the gold:

We left a wild week behind us. At first, on Monday the new all time high with the following intraday reversal. On Wednesday, all of a sudden, by the break of the primary Gann Angle we defined in the last issue the rally has almost come to its end, and we are being stopped out with our long positions. Then, on Thursday – as prognosticated – the blow off move begins that we had expected. And then, on Friday the futures contract breaks the 2nd double arc giving another long signal with the daily close at 1256.60.

The situation: We recognize that the gold future has still remained in the bullish half of the daily 3 Candle GUNNER24 Up Setup. On Wednesday and on Thursday, the 1*1 Gann Angle stopped the price decline impressively leading to a powerful turnaround. A closing price below that 1*1 Gann Angle ended the blow off move. With the Friday close the 2nd double arc was broken significantly, and a new long signal was generated. The Friday high which was marked exactly on the upper horizontal line of the just passed square is a resistance to be overcome next week by the price. In case of its break the way to the 3rd double arc would be cleared.

Caution: Always drag the SL sensibly. In the daily time frame it is the Primary Gann Angle marked above. That is extremely important in a blow off and especially in the gold market because at the end of the blow off there are considerable dominating volatilities, and particularly in the commodities they watch out for ransacking any trader. That means at the end of the blow off the last ones still have to jump up having to cover then their longs quickly because after reaching the price targets the direction turns downwards rapidly.

Let's have a look at the important and dominant Elliptical GUNNER24 Down Setup that is determining the exhaustion move in gold by its ruling 2nd double arc. For all the new readers: Here you may read up where we derive this GUNNER24 Setup from:

As we expressed our hope in the last issue at the most important Elliptical weekly GUNNER24 Down Setup, last week some new findings arose which we can slip in now. I suppose that the low of the week before last can be made tally with the upper line of the 2nd double arc (topmost little green square). If we combine that low with the four other lows marked by a green square a new time target for the exhaustion move will arise: The week of 07/05 until 07/09/2010.

The price target for that blow off remains at 1298 to 1320. Please read here how we determine the price targets.

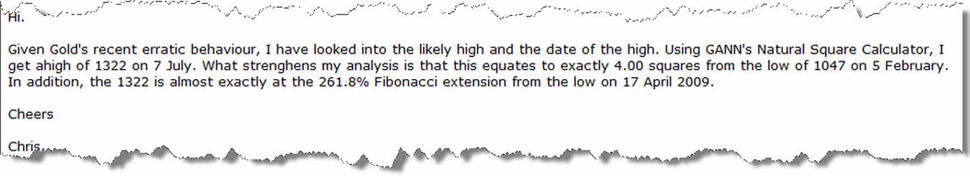

An interesting calculation that is corresponding with the GUNNER24 Price and Time Target, by one of our newsletter readers. Many thanks for it!

Definitely, the gold bugs should not become nervous because of some short term down swings. At least for the coming two weeks, everything is still pointing to rising prices. The gold market is well-known for its wild swings. Trade only the instruments and position sizes which do not endanger your account in case of deep retracements. Do not overtrade because of the expected profits and pay attention to the primary 1*1 Gann Angle in the upper daily 3 Candle GUNNER24 Up Setup that will give us the first hint for the moment when the blow off will have come to its end.

Be prepared!

Eduard Altmann