As happened so often over the last months, gold and silver newly caved in by the weekend. All those positive chart signals that had built up over the week were swept within a couple of hours on Friday turning into the contrary. Bearish reversal candles that come in on a Friday use to imply far-reaching weakness for the beginning of the following trading week and pretty often for the whole week.

Weak Fridays or Fridays with sell-off tendencies or real sell-off Fridays are typical for downtrends as well as strong Fridays and positive-reversal Fridays are very, very typical for uptrends. On Fridays the smart money enters the floor increasingly. In existing uptrends it uses to buy the markets upwards as well as working on the assumption of a trend continuation for the following week in downtrends. It sells the markets!

Last Friday it newly became very obvious how the smart money judges/assesses the recuperation tries of the past weeks in gold and silver… to wit pretty irrelevant and unsuccessful. The smart money shorted both metals with a high volume, presumably hoping for new swing lows or at least for a new test of the April lows during a few of the following days… The way the important GUNNER24 Setups are presenting themselves, technically implies a coming successful test of the April lows. On weekly base something has improved and brightened up regarding some important Gann Magnets, you see:

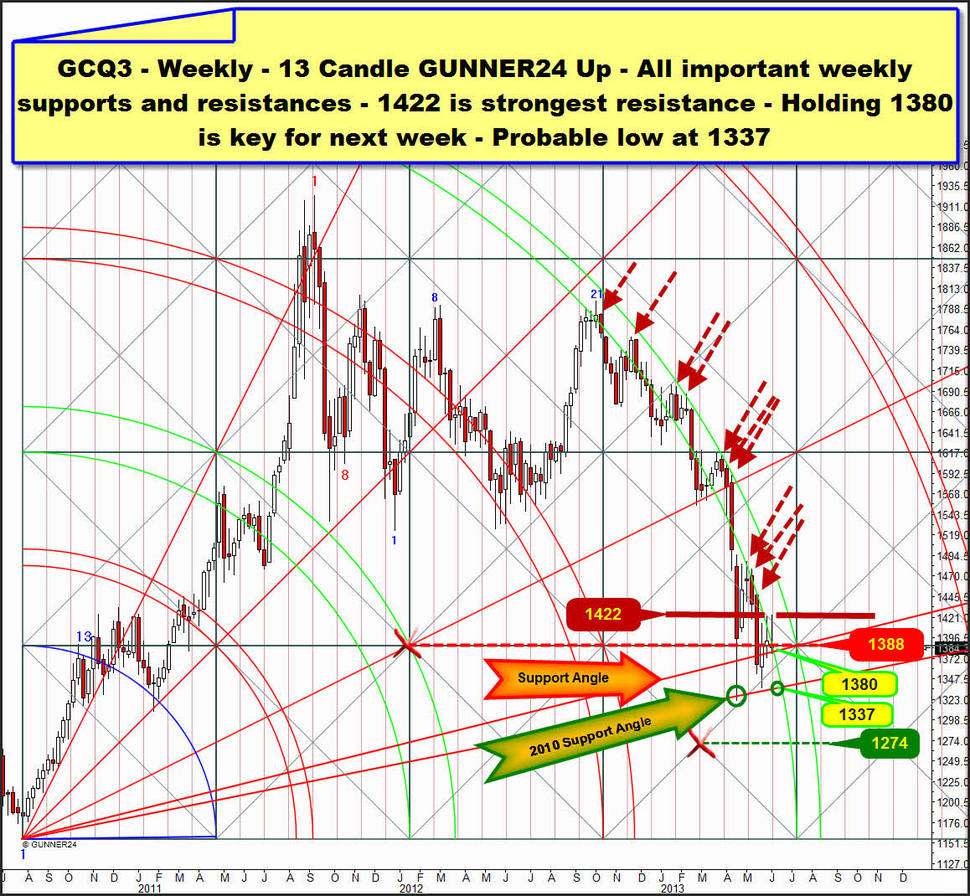

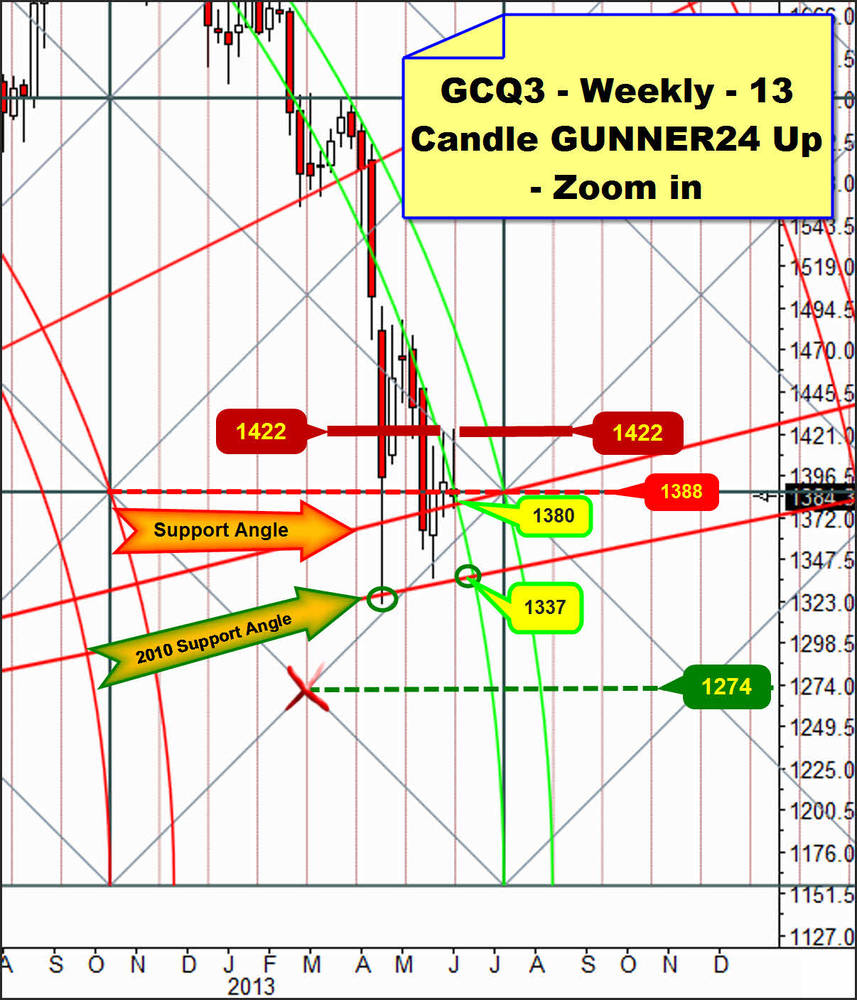

But it did not in this one, the most important gold setup at all. You know it. It’s the 13 Candle GUNNER24 Up in the weekly time frame. I’ve been picking on it for months, pointing to the importance of the 4th double arc – to the importance of the upper line of the 4th as well as the resistance of the lower line of the 4th double arc.

The 4th keeps on pressing gold down. Again there’s no weekly close within the lines of the 4th. Last week closed with 1384.30$ keeping thus beneath the important 1388 horizontal resistance again. Conclusion: The downtrend was newly confirmed!

Thus all in all goes on being valid the assessment that I expressed here last week already: "The 4th is a beast and it keeps on being one. Any price within the lines of the 4th may anytime release a mighty decline bringing new lows".

As it did the trading week before last gold did not succeed in overcoming the extremely important and extremely strong monthly GUNNER24 Horizontal Resistance at 1422. (See the derivation of the 1422 as well as the importance of the 1322 and the 1522 here!)

The GCQ3 contract topped last Thursday at 1423.30 arguably finishing its daily upswing at the 13th day. From the low of May 20 (1338) to the high of June 6 we count 13 days. We have to work on the assumption that gold is now situated in a new downswing on daily base. This may last but 2 or 3 days (countertrend in the current daily uptrend), but it’s more likely that it is going to persist at least 5 or 8 or even 13 days (continuation of the weekly downtrend).

Friday was the 2nd day of the downswing. Tomorrow, Monday will be the 3rd day of the new downswing.

In case the actually determining Support Gann Angle – thus the 1380 – is broken downwards next week (daily close below 1377) gold will be supposed to head for the 2010 Support Gann Angle again at any rate: 1337. That the 1337 might be reached next week probably even wanting to be reached is told us by this important setup and the daily swing count. Of course, if the 1337 goes for a burton a new lows will come. In that case the 1280 zone at the next lower horizontal support will be the first point of contact. It doesn’t look good…

But I’ve got two more weekly down setups that thoroughly give hope for continuation of the uptrend on daily base and that the actual downswing is just a countertrend reaction in the actual uptrend on daily base:

Here’s at first the weekly 5 candle down that has never been published in the free area. It starts at the important October 2012 high excellently unraveling for us the individual stations of the current weekly downtrend.

In this setup three things are important. Please pay attention first to the 1421/1422. We know that the 1422 is the most important resistance for June 2013. At 1421 the setup puts out a horizontal resistance that starts from the intersection point of the upper line of the 3rd with the beginning of the setup. Thus the 1421/1422 is a combined Gann Magnet, a resistance that exists in the monthly as well as in the weekly time frame. It’s hard to take or to re-conquer respectively! If gold achieves to hold out above the 1422 with two or three consecutive closings we’d have an extremely strong long-signal!!

The next thing we see is the support-function of the upper line of the 4th. The performance of the market at the upper line of the 4th is demonstrating that also in case of the next go to this support we’ll have to work on the assumption of a strong rebound. The upper line of the 4th is lying at 1342 for next week, very close to the 1337 support put out by the weekly 13 candle up uppermost. Conclusion: 1342-1337 is a super strong weekly support!

The key function to see whether the 1342 are going to be headed for has the 2*1 Gann Angle in the setup. The candle body of the last week is situated back above the 2*1 Angle. That’s clearly positive. The 2*1 might be an extremely important support now. With the low of 1377.10 the week moreover tested back the 2*1 Angle exactly. For next week this 2*1 Angle is at 1364.50. So, after a possible break of the 1380 the market may fall down to 1364.50 without losing the support function of this angle! Conclusion: A daily close below 1360 will activate the 1342-1337-region, but a possible weekly low may also be marked at 1364.50. From there it may go up then very rapidly!

And here’s the cherry on the cake. Last I analyzed this setup here working out then the importance of a weekly closing above the 1*1 Gann Angle.

Gold did make it. Now it’s trading unambiguously above the 1*1 in the bullish half of the setup. We see that now two candle bodies are lying above the 1*1. According to the Gann Angle Trading Rules thereby the next higher important Gann Angle, the 2*1 Angle, is activated as the next uptarget! Uptarget is now in this setup the 2*1 Angle at 1570$. Also in this setup the 1*1 was tested exactly by the 1377.10 low of Friday. It may have been the matter of a successful back-test. Perhaps the uptrend on daily base may go on as early as on Tuesday. For next week this setup is only putting out a very exact support. The most important Gann Support Magnet is lying at 1371! That’s the intersection point of the upper line of the 2nd with the 1*1 Gann Angle.

But gold is also allowed to dip newly into the space between both lines of the 2nd – as happened with the April and May low…

A weekly close within the lines of the 2nd in the weekly 4 Candle GUNNER24 Down Setup is the first warning signal indicating that the 1140-1040-region wants to be reached as the (then) final target of the downtrend on weekly base.

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann