The uptrend that had begun in December 2015 at gold’s current bear market low suffered some pretty tough punches in the guts these past days. A correction move of some degree started thereby at the May high. From today’s analysis you may infer inter alia the expected correction targets according to price and time.

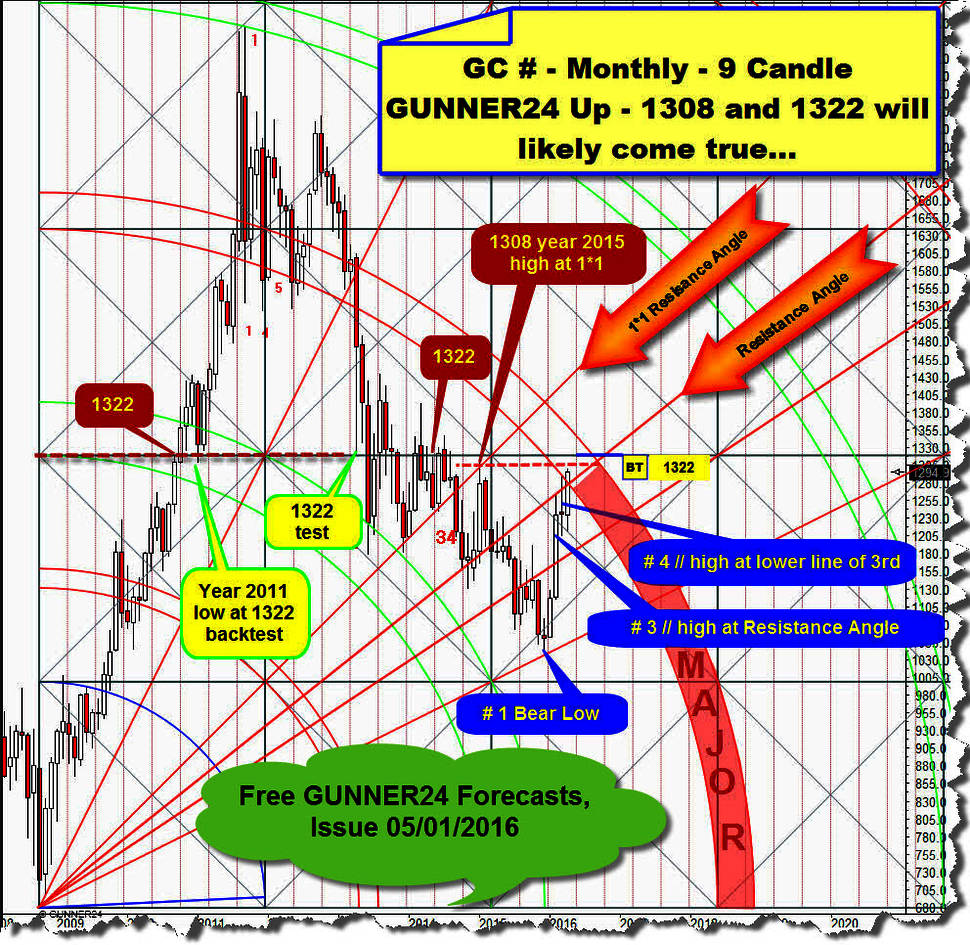

In February this year (GUNNER24 Forecasts, issue 02/21/2016), the necessity became clear for gold to process at least the 1308 for the monthly uptrend that indeed had started at the Dec15 bear market low.

The reasons for the 1308 to be reached: 1308 is the natural horizontal resistance ensuing from the year high 2015. It’s an obvious up magnet for the uptrend move finished at the May high. 1308 was minimum uptarget for the monthly uptrend!

In February, the 1322 was identified as possible major top for the uptrend. The last uptrend was allowed to process the 1322, but it didn’t succeed in doing.

On Sunday 05/01/2016, the necessity for gold was determined to process the 1308 being the first objective of the uptrend within 5 trading days. For this, please mind at first the monthly gold continuous-future-contract chart at the April close extracted from the 05/01 forecast:

==> Ultimately, the 1308 objective uptarget was processed as early as the very first trading day (05/02) of the new month with the final 1306 May high.

From the attained 1306 high (June 16 contract), gold declined steadily and swiftly over the whole month marking its present month low on Friday at 1206.40 (June16 contract) resp. 1209 (August16 contract).

Thus, a tough and groundbreaking monthly sell signal is generated opening some further downwards potential. ==> By tendency, gold is going to keep on plummeting in order to cement then its half-year low someday between the end of June and the beginning of August… technically the usual comportment. Keyword "summer doldrums".

After the consolidated summer low, gold will be supposed to go about the 1300 again. I ventured and I keep on venturing to doubt vigorously whether in succession the 1308-1322 resistance area succeeds to be exceeded in the further course of 2016…

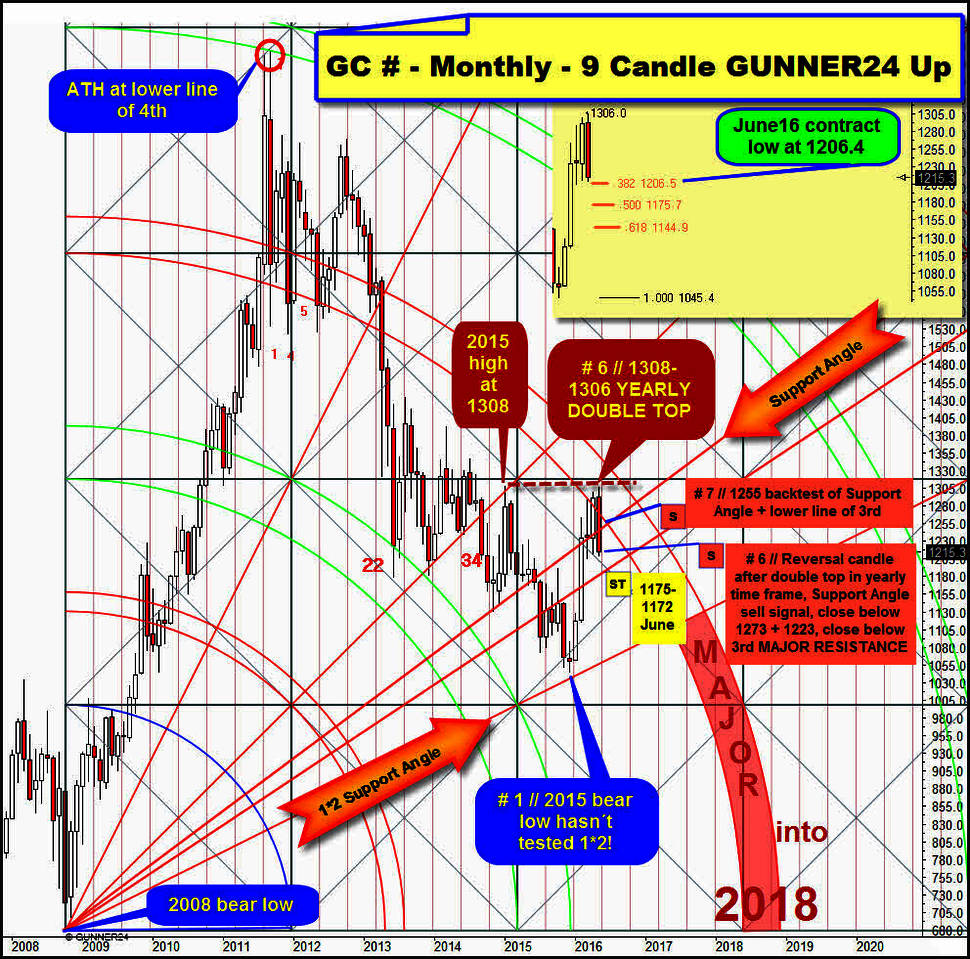

Let’s go now in medias res - with the aid of the actualized 9 Candle monthly up above beginning at the final bear low of the year 2008. Just the crude hard facts, Sir:

It’s a fact that the final high of the month of May 2016 (# 6 of the uptrend) clearly hammered into the chart a confirmed double high at 1308-1306 in the yearly time frame, since May reacted that heftily to this yearly double high = sell off.

It’s another fact – just the way it was really to be expected – that by the crystal clear downtrend month # 6 the 3rd double arc was confirmed as THE future MAJOR RESISTANCE for gold

==> before anyone may proclaim a sustainable new bull market for gold, the metal will HAVE TO deliver an UNAMBIGUOUS month close above the 3rd double arc MAJOR RESISTANCE.

Only in that case the 3rd double arc is taken upwards unequivocally + finally, only in that case gold will be in a confirmed bull market!

Before this happens, the 3rd double arc MAJOR RESISTANCE will have a powerful cause natural future downwards influence to the gold price since it’s directed downwards, and it won’t begin to expire before mid-2018 (factor time). This means that – merely in theory – gold will have to go ahead with its bear market through mid-2018, perhaps till the beginning of 2019.

The yearly double high was followed by a reversal May Candle ==> bearish in the short- and perhaps mid-term!!

# 6 lost the Support Angle that was re-conquered in the course of the upmove. This incident and the clear closing price of # 6 below the lower line of the 3rd double arc resistance are just bearish.

The important monthly – in part yearly – horizontal GUNNER24 Supports 1273 + 1223 were dropped again in month # 6. Bearish developments. It’s heavily bearish to lose two of such monthly resp. yearly horizontal supports in the course of just 1 month!

# 6 is supposed to close below 1223 = bearish since thereby the 1173-1172 to be reached on monthly base would newly be activated as minimum downtarget for the monthly time frame.

For the proven importance of the 1323-50=1273-50=1223-50=1173-50=1123-50=1073 have a look at: "The importance of 1072.30 for Gold! ==> www.gunner24.com/newsletter-archive/august-2015/02082015/

Let’s go on with the absolutely bearish May facts that seem to have rung in the summer doldrums.

At the May high above, there were simply no buyers any more. The upmove had exhausted at the yearly double high. That’s ok, quite normal. As first reaction, gold drifted a little bit down to 1260 from the 1306. This first May downswing didn’t have an impulsive but just a corrective character. This suggests that after the summer doldrum low is found and cemented, at least the 1300 will likely be attacked hard again in the further course of the year 2016.

We’re put in an apprehensive mood however by this fact: The same bulls couldn’t defend either the 1273 or the 1223, nor had they a strong defense behavior at 1273 and 1223. The just didn’t go to the barricades…

This circumstance and the fact that the commercials = Big Boys = Big Banks succeeded once more in pressing the gold market day by day deeper into the June16-August16 contract roll over due date (last Friday) – obviously planned and controlled – don’t promise anything good for the near future.

A big lot of chart-technical damage was done in May. Since the Big Boys have clearly taken the reins again now, a very deep price correction might be pending for the summer doldrums!!

Just reflect: Solely May lost 100$ from the high down to the Friday low. So, what else may happen downwards according to the price till the summer low if the Big Boys wanna launch really bad short-attacks soon?

In view of the May development I can only recommend to side with the Big Boys till July/August or so, since they have assumed the reins of government again. They want to see gold lower, and in May they proved that they’re able to press gold down severely without much strain.

How is gold going to develop now the coming couple of days?

Answer: On Friday, the Big Boys succeeded in processing the 38.2% Fib retracement of the upmove. The 38.2% Fib retracement is at 1206.50, the June16 contract reached 1206.40 with the Friday low. Next week, the August16 contract might reach once more the 1206.50 perhaps even test the "round" 1200 at the latest at that moment gold is supposed to bounce for about 2 weeks testing back the 1255.

The August16 contract won’t have to test the 1206.50 resp. 1200, even without the deviation by the 1206.50/1200-test gold may rise to process the 1255 in 10 to 13 trading days!

There, at the technically mighty strong 1255-GUNNER24 Resistance Magnet on monthly base any June recuperation move is supposed to have exhausted, then it’s going down till July reaches and processes the 1175-1172. 1173-1172 is well-know and well-tested yearly + monthly GUNNER24 Support Magnet + simultaneously the 50% retracement of the first Dec15-May16 upmove.

==> Thereby, 1175-1172 – because of currently being the strongest down magnet – is also the obvious downtarget for the summer doldrums and the then expected half-year low.

The summer doldrums may be brought in much lower than 1175-1172, a lot lower...

...because:

Let’s just presume that the Dec15-May16 upmove was the A of an ABC correction in the overall bear market, thus gold currently being in B wave down that should bottom someday in July/August.

==> In my view, the 1175-1172 support magnet area looks rather normal + natural for a B-wave low. 50% retracement for a B-wave is/would be absolutely normal... then up into the C-Wave top with maybe 1322 at most, then go on jolly in the bear market till the 800$ or so marks the final low of the deflationary bear market some day in 2018.

Or secondly: If indeed the Dec15 low represents the beginning of a new bull market, the May16 high will turn out to have been actually the 1 of a primary wave I that is being corrected now = 2. Such 2 waves in a primary I can and may correct extremely low and for a very long time, wave-technically. Factor price: Low! Factor time: long!

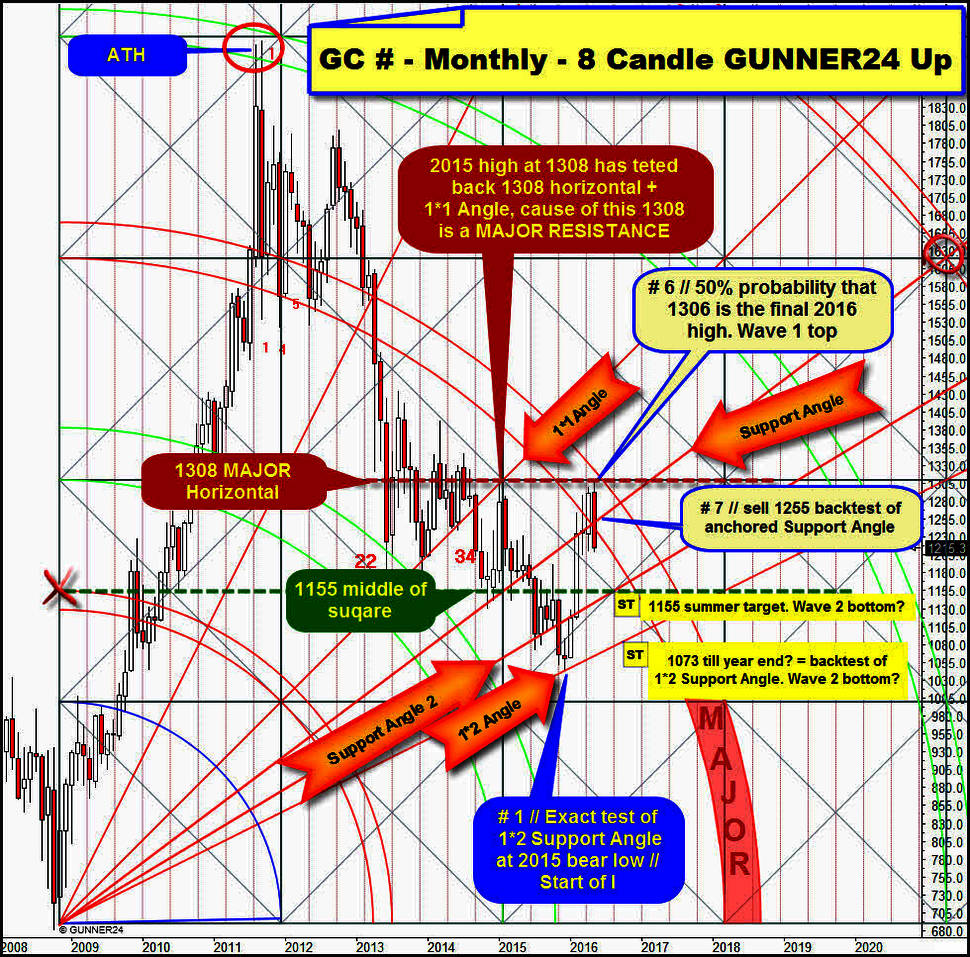

In order to be able to assess a potential wave-2 correction within a possible primary I the right way, let’s have a very last look at the 9 Candle up above:

==> Starting point of the setup is the final 2008 bear low after all. The alltime-high (ATH) nails the setup exactly at the lower line of the 4th double arc resistance. This perfect hit at the lower line of 4th major resistance started the bear market. Then, down it went to the current Dec15 bear low that queerly!!! did NOT reach the 1*2 Support Angle even though this one was the activated target after the 1*1 Angle had broken downwards finally.

Thereby, we have home to the following 8 Candle up in the monthly time frame. It starts at the low of the candle after the final 2008 bear-low month. This setup nailed the ATH within the lines of the 4th double arc resistance at the two spike highs, watch red oval. This setup nailed also the final 2015 high exactly at the 1*1 Angle and the 1308-MAJOR RESISTANCE horizontal. And the Dec15 bear low OCCURED ACCURATELY at the very first test of the 1*2 Support Angle!

==> Since after the final break of the 1*1 Angle in the year 2014 and after the negative backtest of the 1*1 Angle at the final 2015 high the 1*2 Angle was activated downtarget of the bear, and since the 1*2 was processed and since after the first successful test of the 1*2 Angle at the Dec15 bear low some visible and strong up-forces kicked into the market, we are certainly allowed to work on the assumption that at the Dec15 low test of the 1*2 Support Angle a completely new bull market started that compellingly will have to lead to new ATHs sometimes, after all.

So, at the Dec15 low the primary I would start having found the wave 1 high of the primary I at the 1308-1306 yearly double top at 1306 in May. Thus, gold would now be in the correction wave 2 of the primary I.

In merely signal-technical terms, there is absolutely nothing positive to say about the May candle. Confirmed rebound from a yearly double top at 1308-1306 with close below the 3rd MAJOR DOUBLE ARC RESISTANCE. The best cause most riskless June-Sell-Short entry (# 7) is still at 1255 because the now newly downwards broken anchored Support Angle will be the possible target of a June bounce. And of course… sell the next dip into the 3rd MAJOR DOUBLE ARC RESISTANCE!

This 8 Candle up gives a little lower first objective support for the expected summer doldrums half-year low. At 1155, the Support Angle 2 intersects the important center of square horizontal in August 2016. ==> Thereby, the monthly-1155 support magnet offers itself as narrowly lower B-wave resp. possible 2 wave correction low!!!

Next major GUNNER24 Sell Signal in the monthly time frame: If gold conjures on the floor a monthly close below 1140, with a 99% of probability and certainty it would have to come to the – then – second test of the 1*2 Support Angle.

==> Yet gold – and here we see the madness/lunacy of wave 2 corrections – may have reached its final high for the year 2016 already at the 1306-May yearly double high now eroding into the 1*2 Support Angle and the 1100-1073-1*2 Angle support area till year-end 2016! Slowly and steadily low and long-time. This is allowed, and it wouldn’t be any unusual for wave 2 corrections.

A next test of the 1*2 Support Angle for the possible 2 wave low is really imposing because a backtest of the 1*2 Support Angle would simply be nothing unusual to confirm this one as the most important future monthly and yearly support of a new bull market.

Gold is now a tricky subject. For any bullish-attuned gold investor it cannot become interesting again before:

A) a monthly or a weekly close above 1272 ensues. Then, for sure the next serious attack to the 1300-1308 with promising prospects to 1322 and perhaps higher = 1400 follows till year-end (if gold is really in a new bull market).

B) if the 1175-1172 area is reached till July/beginning of August, and that’s where the first hesitant long-attempts with a relatively narrow stop-loss should be dared.

==> The Commercials and the Big Banks are at the helm again now. And the GUNNER24 Method and the current GUNNER24 Signal Situation permit a backtest of the 1100-1073 till year-end. Just the fact that this prospect exists at all after the fulminant ascent of the last couple of months should prompt every Gold Bug to brooding reflection and above all force to careful action.

Be prepared!

Eduard Altmann