Gold, silver, platinum and the related Miners should take off like a rocket if UUP (Invesco DB US Dollar Bullish ETF) closes below 24.23$ on a monthly base or if the 24.23$ is undercut by two consecutive weekly closing auctions by the end of June. In the case of this heavy $US sell-short alarm the rapid sell-off into the next lower UUP DECADE support rail at around 23.20$ will be mandatory. This is what the GUNNER24 predicts with great conviction. And well, there are some clear warnings that the final break of 24.23$ may be necessary very soon.

So dear Precious Metal Bulls, you better prepare to go all in soon ...

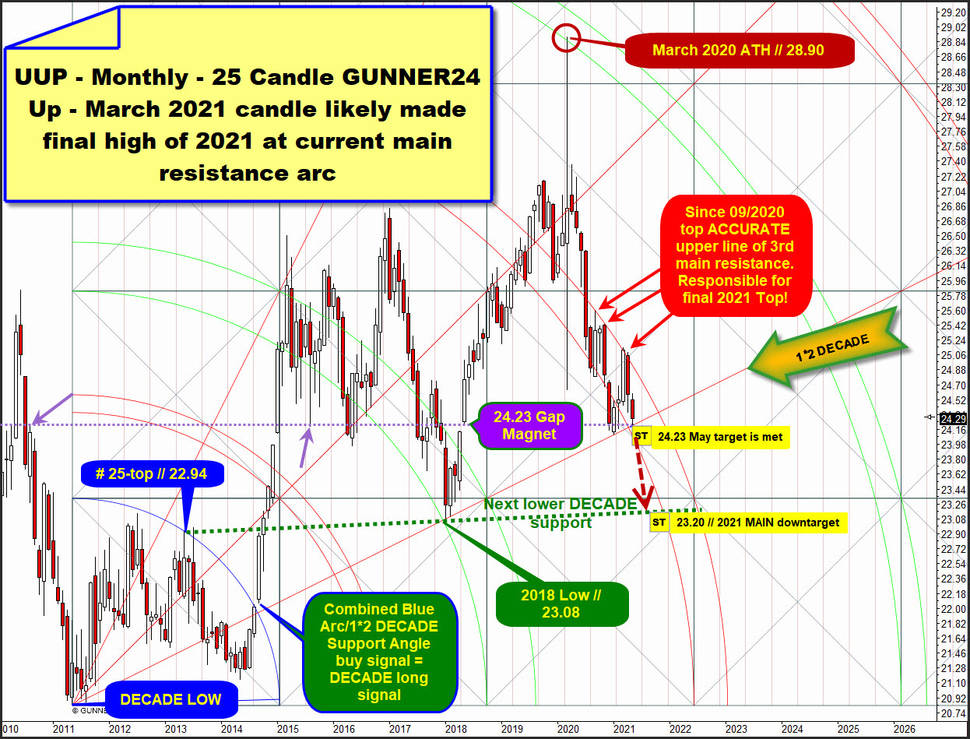

Above you recognize an UUP ETF up setup on monthly base what starts its upward measuremen at absolute lowest price of the passed DECADE. The Blue Arc ruler measures to the final high of the year 2013, what is the in blue noted # 25-top, made at a 22.94$. This price/time magnet defines the starting event of the „Next lower DECADE support" for UUP shares.

This Dark-green dotted „Next lower DECADE support" line provided sustained main support at the final low of 2018, which was the last major support of the secular bull market before UUP finally topped precisely at lower line of 4th double arc into its coronavirus spike high panic top of March 2020 (at 28.90$). There and triggered by the resistance energy offered by the lower line of 4th GUNNER24 Uptarget Magnet, the current +1-year bear market cycle began.

This bear has been visibly tied to the downward oriented upper line of 3rd double arc main resistance = falling month high resistance arc since September 2020 with a series of lower monthly highs. Final highs of September 2020 & November 2020 & March 2021 & April 2021 have arrived at lower line of 3rd main resistance from below.

Because the printed March 2021 top is the highest UUP price of the entire 2021 this upper line of 3rd is very good-confirmed lower year high resistance arc.

Because the price since the beginning of the year is mostly trapped within the two downward oriented lines of the 3rd double arc, the March 2021 top likely marks the final high price of 2021 cause the heavy-bearish energy state of this main 3rd double arc is expected to radiate or could radiate stronger bear power until the end of the year 2022! Then, when the upper line of 3rd double arc officially runs out in terms of time as it hits the time-axis.

Just a very first decisive month close above the upper line of 3rd double arc likely will signal that important bear market lows have printed before.

Please carefully watch the long bearish April 2021 candle, what arrived after a lower year high (2021 compared to 2020 ATH).

This April 2021 course with final highs made first and final lows made last and a close near lows was a next monthly sell-signal/candle released by the upper line of 3rd main resistance and by this activating the next test of the 1*2 DECADE Support Angle what is responsible support for printing the so far 2021 Low what occured at January 2021 low (24.09$).

Or, the heavy April 2021 sell-candle activated the next necessary 1*2 DECADE Support Angle backtest which was exactly worked off with the final low of this past week at 24.22$.

And well I think, this actual next test of the 1*2 DECADE Support Angle will not succeed in the end.

==> This MOST important nearest and well-confirmed DECADE support should break down finally soon and then the market should normally reach its „Next lower DECADE support" line quite quickly within 2, 3 month candles at probably a 23.20$ or so.

==> 2021 Main downtarget at a 23.20$!

For this Big Bear Call we below first count this +1-year bear market cycle on a weekly base. Remember this likely outcome => the March 2021 Top should mean the final high of the entire year 2021...:

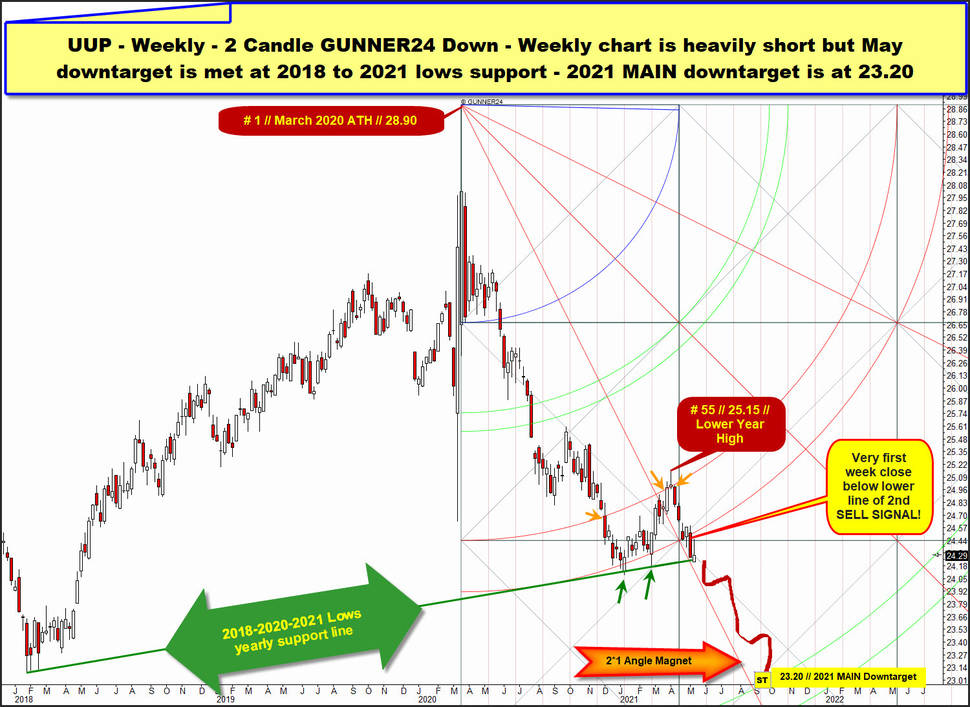

The weekly bear count starting at # 1 // March 2020 ATH made so far 2021 Top after precisely 55 Fib number candles. => 2021 Year High additionally arrived at the natural time magnet of the 55 Fib number. And because this # 55-top is an ugly negative backtest of a monthly main resistance arc there at # 55 // 25.15$ // Lower Year High we recognize a price/time event what usually has triggered the next monthly downcycle.

With the UUP usually with a renewed monthly downcycle and the weekly MACD oscillator just shy before a next major bear cross the 2018-2020-2021 Lows yearly support line should be finally broken to the downside soon and maybe even before this May 2021 ends offically!

The weekly chart additionally ignites a GUNNER24 Sell Candle. Big double arc support, what was defended throughout the entire year, gave way a week ago:

Within above at # 1 // March 2020 ATH // 28.90$ anchorable weekly 2 Candle GUNNER24 Down Setup we see that 1 week ago there was the very first decisive close below the lower line of 2nd double arc. This lower line of 2nd double arc has held at first test, highlighted by the left dark-green arrow, which occured in the course of the very first trading week of the new 2021. At then printed so far 2021 Low also the positive energy of the 2018-2020-2021 Lows yearly support line kicked in. The 2018-2020-2021 Lows yearly support line for May 2021 runs at a 24.23$!

It was the same with at the February 2021 lows where at the right dark-green arrow again the lower line of 2nd and the 2018-2020-2021 Lows yearly support line together radiated stronger support energy. Thus the lower line of 2nd meant slightly rising yearly week low support. Which had to be officially abandoned with the final close of the week before last.

This first decisive close below the so far holding yearly lower line of 2nd double arc support activated the lower line of 3rd double arc downtarget in (bear market) trend direction and it might be the outcome that the likely underway monthly and weekly downtrend will follow the 2*1 Magnet Angle in terms of its angle of descent, until the upper line of 3rd downtarget at 23.20$ combined DECADE and weekly downtarget magnet is hit maybe in course of summer 2021!

Be prepared!

Eduard Altmann