It was pretty long ago since we received some promising trading signs from the American stock markets. All in all the price courses of the past weeks were rather characterized by tediousness in the stock markets. Currently a prolonged sideways move at the tops is to be seen which really don’t facilitate any "easy money" because the quick and harsh trends are the dash of salt that a trader needs in his soup. But at least on daily basis there are some new long signals in sight we want to take along necessarily.

The sideways move is clearly recognizable in the actual weekly 8 Candle GUNNER24 Up of the S&P 500:

The S&P 500 has been forming a consolidation at the highs for as long as 3 weeks. The further ascent is going to be limited in price and time by the resistance Gann Angle during the next weeks as well. Since roughly September 2010 the market has been following the pitch angle of this Gann Angle swinging around it more or less steadily. That is going to be continued until by the end of June the 4th double arc will be reached at 1400 where we may expect a several week correction.

The last three week candles come to their low at the strong support horizontal arising on the left in the setup. There, at the intersection of the upper line of the 3rd double arc with the beginning of the setup the strong weekly support of 1329 is being defined which is supposed to resist next week, too, being able to produce enough upwards energy to reach a new year high soon:

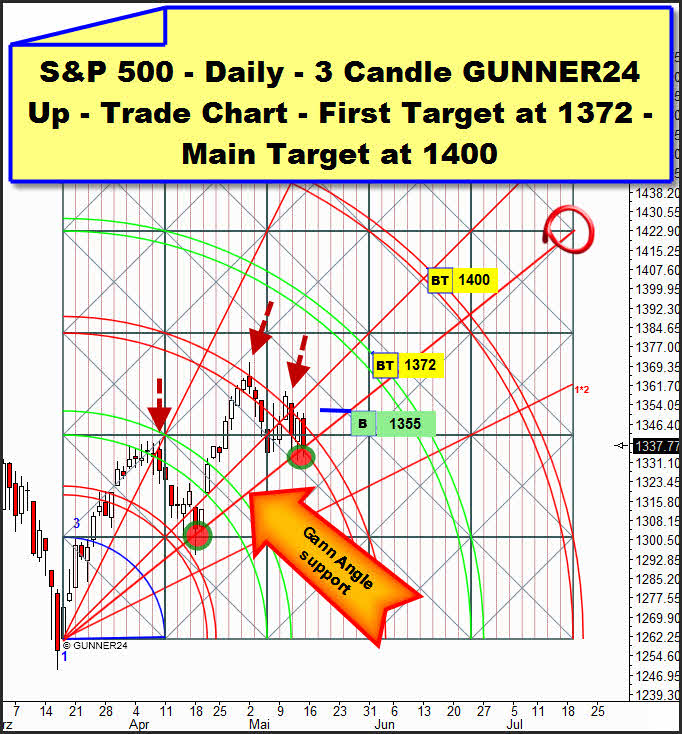

In the 3 Candle GUNNER24 Up on daily basis we can observe that the 3rd double arc has been preventing the market from keeping on rising.

We see how this double arc is impeding the market ascent slowly and steadily as prescribed in the textbook. The days are swinging around, within, above and below the 3rd double arc being pressed down slowly and certainly by its resistance effect. A clear consolidation conduct!

On Thursday and Friday the second test of the support Gann Angle took place. Since that was but the second test of the angle it should resist, and as early as on Monday the expected rebound may result in the upwards break of the 3rd double arc. Since various closing prices within or above the 3rd were marked the 4th double arc at 1372 was activated as to be the next target not so long ago. We’ll buy a daily close above 1355 if the breakthrough happens on Monday or Tuesday. If the breakthrough happens in the further course of the week we’ll buy a little lower, in any case when the 3rd is broken upwards visibly. No SL for the moment.

The Dow Jones is showing a nearly similar conduct in daily sight. Well, it hasn’t advanced as far as the S&P however:

In the Dow Jones the extension of the first initial impulse has turned out a little lesser. Certainly it allows the market reach the 3rd double arc but no closing price within this 3rd double arc has been marked yet. Further we can see the market go into a wedge that is limited above by the lower line of the 3rd and below by the horizontal support. Maybe here again the support Gann Angle will have to be reached for the second time to unleash the upwards energy that is necessary to break the 3rd double arc upwards permanently.

At the first closing price within the 3rd double arc the daring traders may go long since thereby the 4th double arc at 13000 will be confirmed as the main target. But we won’t buy before the clear break of this 3rd double arc.

By the following link you may observe which position we maintain and when and where our new trading entries follow – completely with the actual stop loss and the expected targets:

http://www.gunner24.com/trading-performance-us-stock-markets/

Gold and Silver:

About gold and silver today I’d like to deal just with the actual daily setups. You’ll find the great survey on the timing of the current correction worked out in the GUNNER24 Forecasts, Issue 05/08/2011.

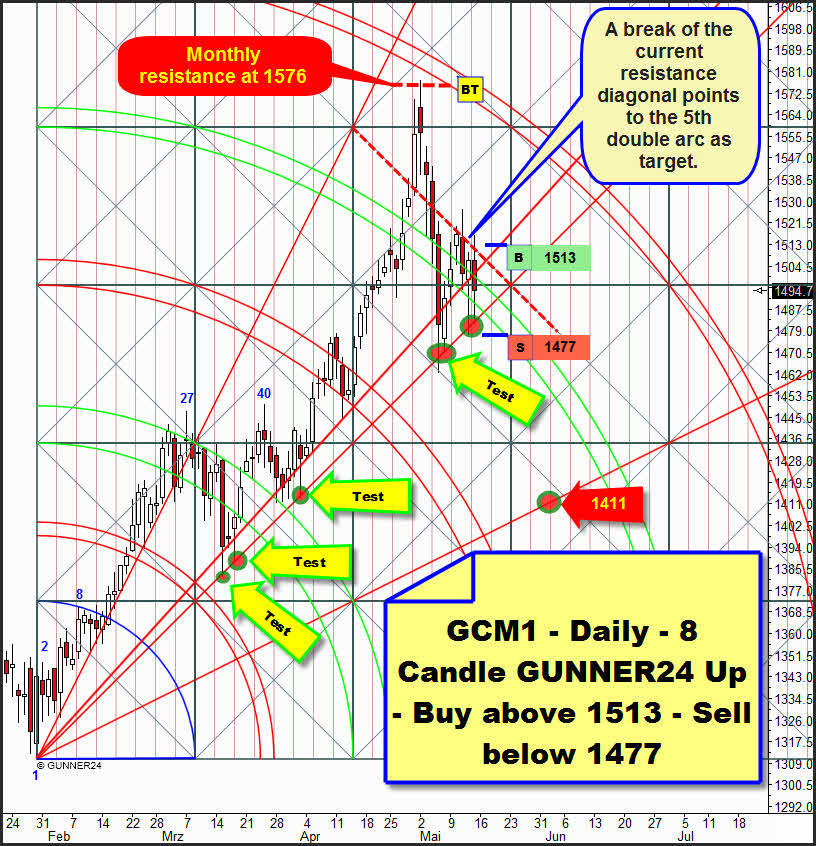

To the clearest signal at first: In the daily time frame gold maneuvered itself into a do or die situation. On Monday or at the latest on Tuesday the decision will be due whether the current correction is rather turning into a sideways move during the next weeks or at last gold will be sold off violently.

After the 4th double arc was broken back in the course of last week gold should actually head for the 5th double arc at 1540-1545. In spite of this clear re-conquest of the 4th double arc and the permanently successful test of the 1*1 Gann Angle the market doesn’t achieve to break the resistance diagonal anchored in the chart at the red X on closing price basis. The decision is nearing.

We’ll see very soon whether the correction that started at the all-time high with the break of the 1*1 Gann Angle is going to continue or the 1540 want to be headed for before the next big correction phase. While in the course of the week I rather declined to the assessment that gold would form a lower high at 1540 – the course of Friday set thinking a lot. At first, the weak Fridays use to be good atmosphere indicators on the course of the respectively following week. So red – falling prices! Furthermore the Friday closing price is pointing to an additional weakness within the 4th double arc. On the other hand the continuous tests of the 1*1 mean a strong sign that the market rather wants to go downwards. The pitcher goes often to the well, but is broken at last.

Since in this case the market can still decide its direction we’ll prepare for a resolution as well upwards as downwards:

We’ll buy a daily close above 1513 with target 1540-1545. On the other hand we’ll go short in case of a closing price under 1477 with target 1411.

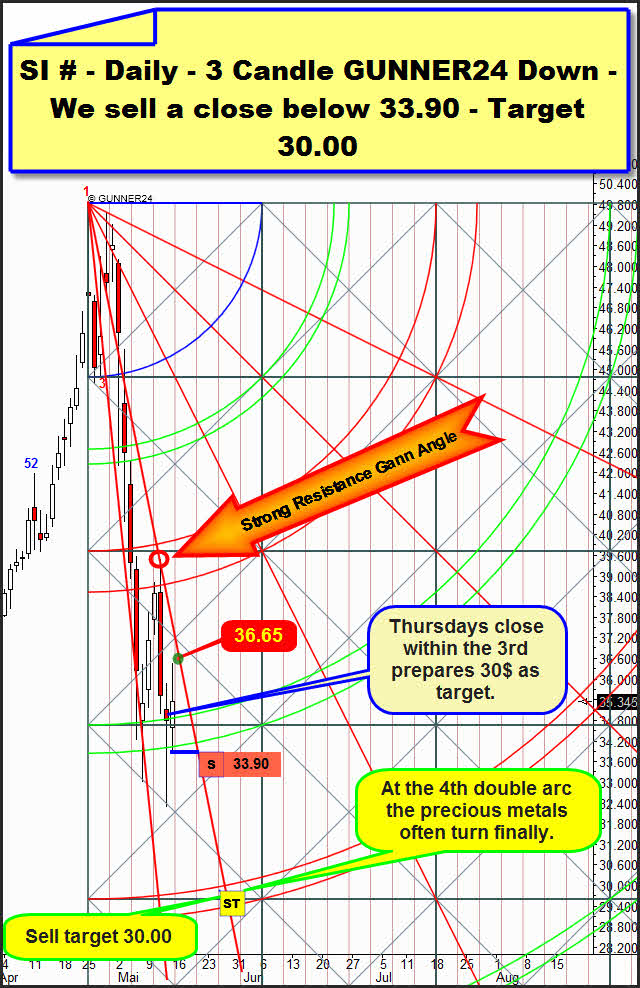

Silver closed within the 3rd double arc on Thursday. That increases the probability that the 4th double arc and the 30$ want to be reached!

The situation: In the last issue GUNNER24 called our attention to the very strong resistance at 38.50 to 40. There, at the 2nd double arc the end of the rebound was reached, as expected. The fact that no closing price within both lines of the 2nd double arc was marked shows us how strongly that arc is leading its resistance function. It’s going to be very difficult to break this 2nd double arc upwards in the course of the next weeks!! Actually impossible – At best silver may go up below this 2nd...

In addition we recognize which part the resistance Gann Angle should really play if it is newly headed for at 36.65 on Monday. That’s where by touching the resistance Gann Angle the violent 20% sell-off was released on Wednesday. The 3rd is still showing a strong visible support, but like in the case of gold it’s questionable how long this support is going to resist. In the daily count the low was marked on Thursday, the 14th day of the correction. That’s near enough to 13 for a significant low. It’s 13 already if we don’t count in the day of the top. But I rather suppose that this correction is going to last 21 days at least.

The 36.65 Gann Angle resistance is the point silver will have to overcome in order to attack the 40 again. Those 36.65 are corresponding with the 1513 in gold. If those marks are overcome together on daily basis we shall have seen the lows for a pretty long time.

By virtue of the strong resistances which are threatening and the increasing weakness of the 3rd double arc we’ll just prepare a short entry in silver: We’ll go short if silver closes below 33.90. SL 37.00. Target 30.00.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the acual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $29.90 US a month. For 101 members and up - $39.90 US a month.

Be prepared!

Eduard Altmann