It’s the best performing metal of the last 6 months +16.62%, of the last 12 months +14.78% and of the last 3 years +33.35%. In the 5 year ranking of the best performing commodities it come second with an overall performance of +59.22%. Only gold has performed a little better over the last 5 years. By a performance of +63.20% it’s still positioned before palladium.

In comparison with the most important stock-market indexes, considering the past 5 years the NASDAQ Composite Index is ahead with a plus of a 40.53%. Far behind, the Dow Jones is following with 18.61%. The reason for the inner strength of palladium is to be defined very easily.

The demand is higher than the supply. The inventories are shrinking. There is shortage in delivery. Finding and producing palladium is becoming more and more expensive. Full stop.

Gold and silver have shown weak over the last two years because the buyers are being thinned out more and more. The production/recycling quantities are slightly increasing annually. So the supply is stable and assured for years. Thus, if for instance there is more gold available in the market than the quantity being absorbed the prices will fall. It’s a fact. Don’t let pull the wool over your eyes in this context, some analysts/websites/newsletter constantly reckoning up for you how many gold coins are here, what is the investment demand like and which gold-standard phantasies are there.

The main purchasers of gold in the world are the central banks. Whenever they take away/buy less gold or even appear as net sellers the gold price will fall. When the EU countries in total decide to throw gold to the market in order to save their EURO gold may ever be situated 200$-300$ lower than the year before, because of this fact - even though China and Asia pick up the quantities of gold they want to…

In the case of palladium the fat lady sings because the demand was and keeps being higher than the supply. Nationwide miners’ strikes and dismissals of mine workers are going to restrict the palladium production for time yet. Being the main manufacturer of palladium, Russia is reporting supply bottlenecks, and the actual stocks aren’t really looking rosy.

Combining those uncertainties on the supply side with the slightly booming or pretty stable world economy = slightly booming demand we’ll have worked out the fundamental reasons for a fine uptrend:

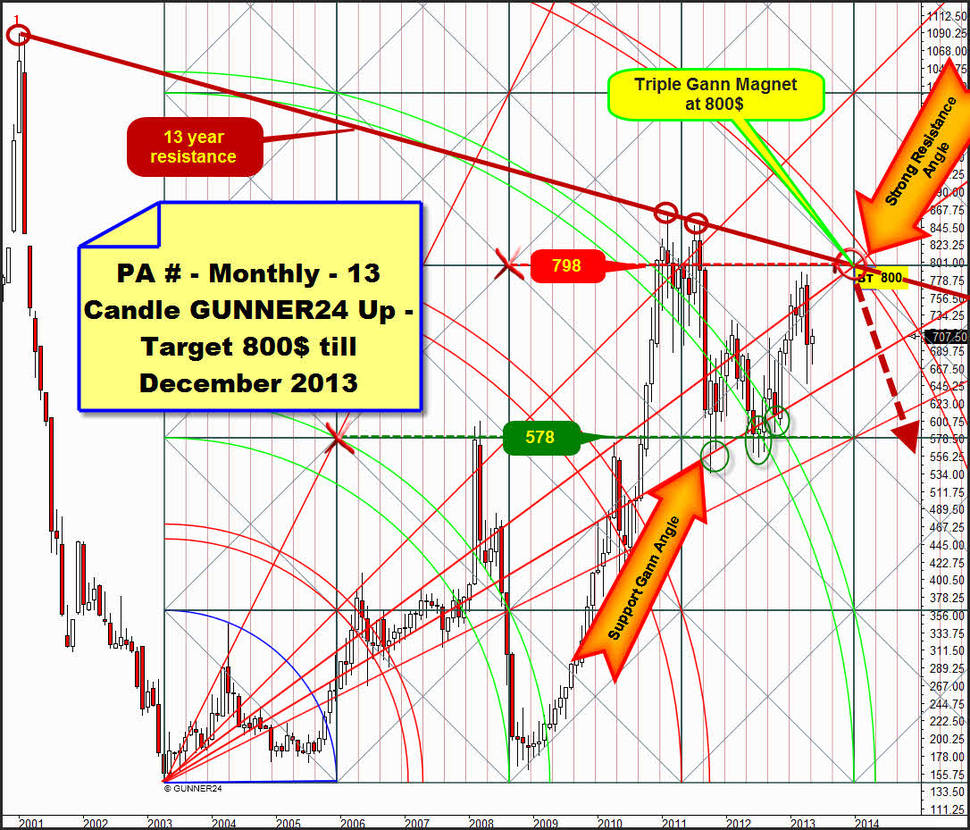

Since 2008 palladium has been following a clearly defined upwards trendline. It was newly tested successfully in April (green arrow) seeming to be obvious that at least another +15% is possible till the thoroughly dominating resistance line, determining since 13 years should be reached at 800$.

It will be the matter of the third test of this monster resistance. According to W.D. Gann the third and the fourth tests of a resistance/support are the most important ones. The result of the third test determines the further price course. Correspondingly you may expect a powerful price move that is supposed to lead at least to a double top – in case the third test overcomes the long-standing resistance. It’s about the 1000-1090 from the year 2000. Or it will lead to a new hefty rebound from the decade resistance. If consequently follows a monthly close below the green dotted uptrend line we’d have the confirmation for A) an ongoing decline and B) that overcoming the decade resistance won’t be possible before the following fourth test.

Anyway, this upline that has been dominating since 2008 is an absolutely perfect signal setter. We can use it as a very secure stop-loss or as a short-trigger. Since 2008 palladium has not been able to close beneath it on monthly base. A clear monthly close below this uptrend line is on the one hand not only the perfect stop-loss for any long-engagement. I think it’s also the perfect short-trigger for the decline to 580 that is going to be expected then:

But as analyzed PA # should head for 800 at first. In the monthly time frame a pretty stable and rule-compliant GUNNER24 Up Setup is present.

It’s a textbook-like initial impulse. We can measure off exactly 13 monthly initial impulses from the 2003 low, a Fibonacci number! Subsequently the PA endless contract breaks any double arc resistance upwards at first, so each time generating a longterm buy signal before it joins – more or less distinctive – the first as well as the 2nd and the 3rd double arc downwards for a couple of months. Subsequently palladium will rise in the trend direction again marking some important tops above the respective double arc resistances. Since the 4th double arc was overcome in trend direction the lower line of the 5th double arc has become the actual buy target.

The probability that the 5th will be reached in the trend direction marking there a next important top is above 75%!

If PA # wants to perform as is it did with the previous double arcs – at least we’ll have to reckon with it – it should come to monthly closings above the 5th double arc! I.e. it also might come to monthly closings above the existing 13 year resistance trendline. That would be another buy signal on monthly base. Thus there’d be the possibility that PA # will have to target the price end of the monthly 13 candle up setup = new all-time high at about 1140$!

So at 800$ there is the actually strongest and most important Gann Magnet, a Triple Gann Magnet, the combination between the lower line of the 5th and the upper line of the just passed square and the ruling Resistance Gann Angle. After the 4th double arc was taken in the trend direction the lower line of the 5th is the actual buy target. So, at the moment the 800$ mark has an enormous attraction force. In addition the longterm resistance is intersecting exactly this Triple Gann Magnet for December 2013. Is it Coincidence??

So, it should be at least 800$ till December 2013. But also about 830-850$ are possible/allowed for the current monthly upswing. At any rate reckon with the beginning of a hefty counter reaction at 800$. A triple magnet may cause a severe rebound. At the 5th double arcs we always have to reckon with a change in trend. It’s technically a good short-chance but an extremely risky one because:

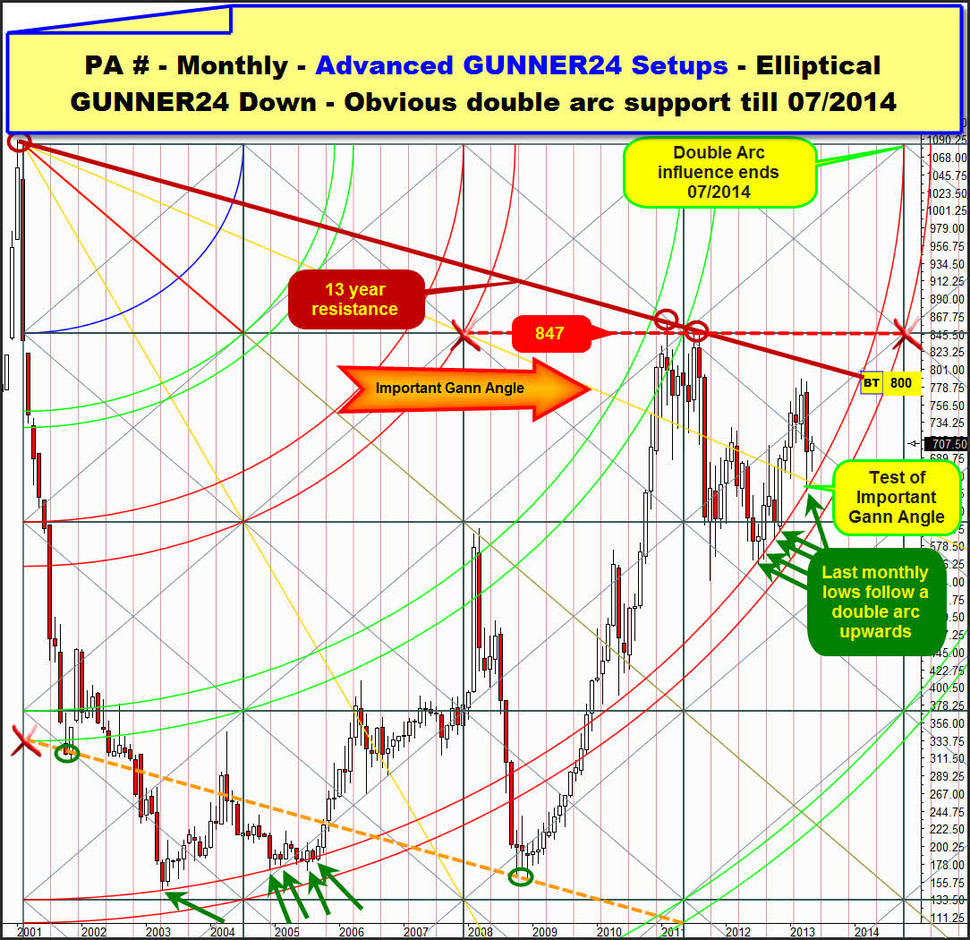

I suppose that palladium in terms of time might finally top-out by the middle of next year at the earliest. I come to this assessment because it seems to me very plausible that palladium might become visible with the advanced GUNNER24 Technique being driven upwards at least till June by a support double arc.

It’s the matter of a support double arc that can’t be made visible but with an elliptical down setup. In this down setup it doesn’t depend on the rule-compliant measurement of the first initial impulse but only on the question whether we can identify somewhere/somehow a double arc where some important monthly lows are marked.

The 4th double arc identified in the variant has supported the PA # countless times since 2003. Especially the last 5 successful tests at the upper line of the 4th with the respective higher monthly lows show us that an "ascending dynamic" monthly support is dominating. The precious metal might follow now faster and faster the supposed course of the 4th upwards being forced up more and more noticeable. Also the successful test of the important Gann Angle of last month speaks for further rising prices.

Since the time mostly rules above price being able the 4th double arc in the elliptical down setup above to enforce so to speak rising prices the elliptical down setup allows a lasting overcome of the 800 or of the decade resistance. As analyzed above a monthly close within the next 8 months (December 2013) at 830-850 would activate far higher prices! I think that PA # in this case wants to see the 1100$ mark till middle of next year!

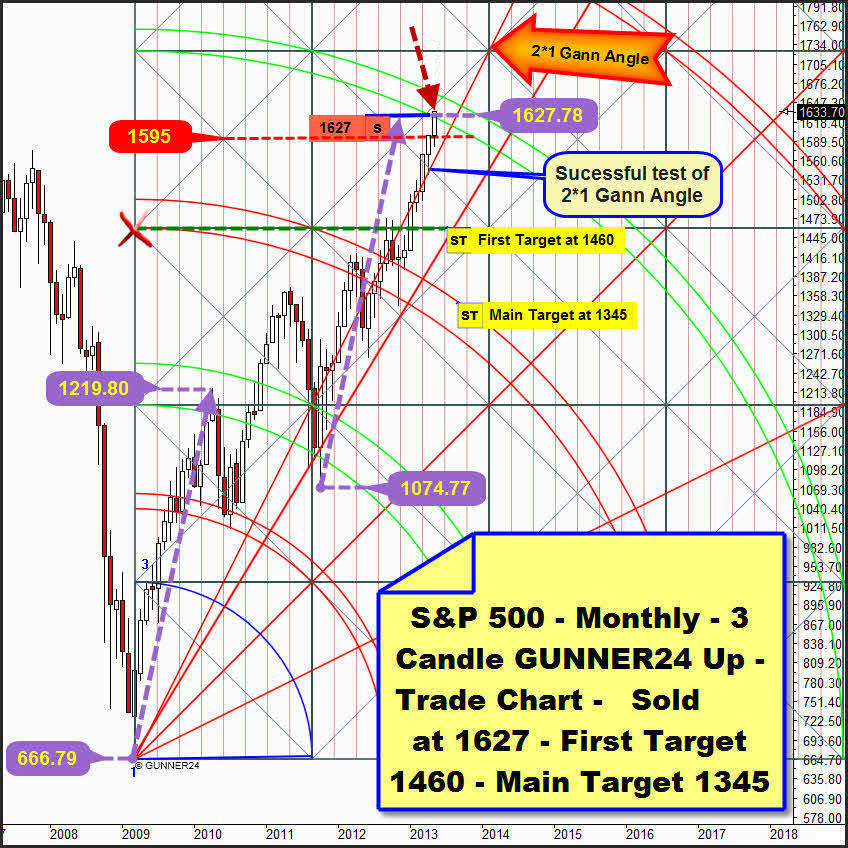

With the first monthly position in the S&P 500 at 1627 Index points we went short. The super strong monthly resistance of the 4th double arc was reached in the monthly 3 candle up setup. A more severe rebound from it is to be expected even though the market is trading within the lines of the 4th now. The thing may fall like a stone any time since it is trading at a natural resistance.

In addition the US markets are overbought, and in terms of the seasonality they are due for a correction. The sell signal won’t be negated before the S&P 500 overcomes clearly the 4th double arc on monthly closing base (about 1660). I sent you the last extensive analysis on the US markets 2 weeks before. There’s nothing to be added, besides every trade is allowed to develop, and lack of patience is always out of place in trading. Especially the trades in the weekly or even the monthly time frames use to have a wide horizon of expectation.

Just a brief announcement: Next week, over Pentecost, I’ll take a couple of days off, so I won’t make the issue of Sunday 05/19.Thus, the next issue of the GUNNER24 Forecasts will come out again on 05/26/2013.

Be prepared!

Eduard Altmann