And this mainly because of some important time factor abnormalities!

On Wednesday the S&P 500 market made another alltime-high (ATH) before giving up all gains in the last hour after the Fed announcement, printing a solid looking bearish reversal candle.

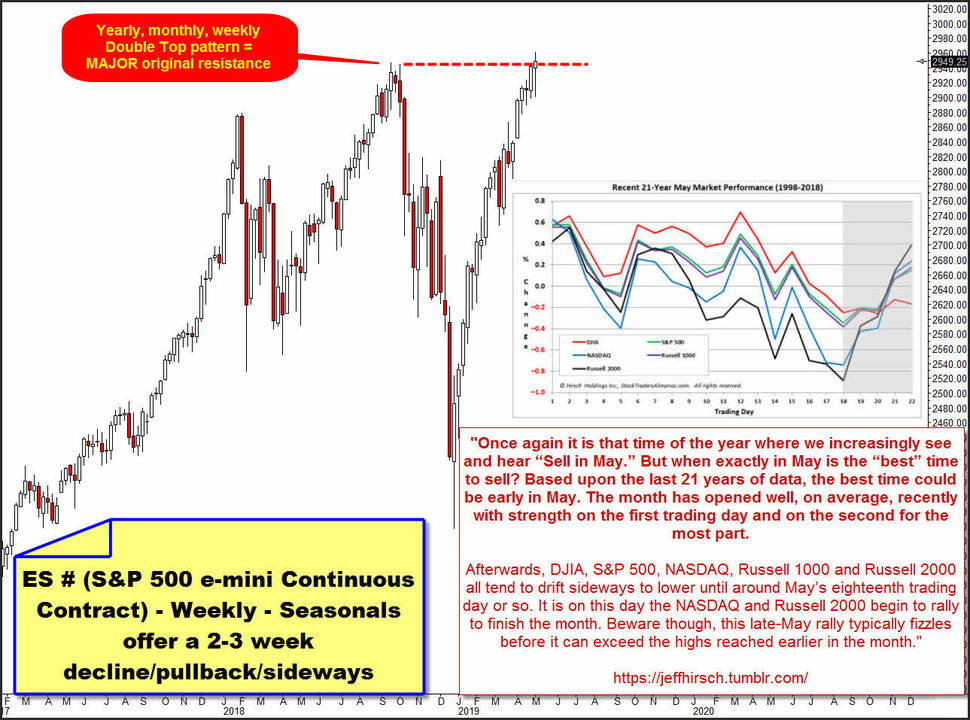

Of course the uptrend technically remains in place but unless Wednesday`s bearish closing pattern is not completely reversed, we could see a change in trend in the next few days. The market has rallied without much of a break since March and now that we are in May - "Sell in May, and go away!" - and with new ATH, but still within Double Top pattern resistance influence radiating on the yearly, & on the monthly & on the weekly charts a first try shorting the US stock indexes now looks very promissing, for some reasons!

For this lets first observe the S&P 500 e-mini futures contract chart (ES #) on weekly base. Market is at alltime-high horizontal resistance although by Friday`s close it printed highest week close ever. Market still trades at it`s main resistance. This is an important price factor observation.

And there is the rule of thumb, that we always should sell short a Double Top, especially when Double Top resistance is set on yearly base and on alltime-high base. This is a trading automatism that has developed over the centuries, that the market usually respects, simply because there is a +70% success rate to make some money selling a Double Top condition, because this is always a stronger natural resistance magnet:

What weighs most of all now is the time factor.

Important time considerations regarding what happened after Wednesday made fresh 2961.25 pts ATH:

Wednesday was the first trading day of the new month May 2019. Then, in addition to the reaction to the Fed meeting, there was the first reaction to the most recent AAPL figures.

All in all the reaction to these events was a negative one, which is remarkable cause the very first trading days of a new month generally are bullish days ==> The experience shows us that 80% to 90% of all first trading days of the new month are bull days. This rate is actually higher in the strong bull market that we have. The reason for this is that on this first trading day of the month, fresh shoveled money is immediately pumped into the stock markets.

I especially mention the AAPL earning figures, because we often have observed that the earnings release and outlook of this stock triggered an important general market top, important US market lows or more or less sustainable or important turns.

Looking back on the last two decades, I can remember dozens of overall market turns that were somehow triggered by fresh released AAPL numbers.

==> Well, AAPL and FOMC meeting have been potential catalysts for something to happen and in the end they delivered and printed on a usually very bullish day an unusually hard drop or outside down day..., which started at yearly/ATH resistance.

AND THAT`s WHY it might well be that this May 2019 wants to follow the "average 21-year" seasonal pattern of the US stock indexes, I placed in the lower right corner within weekly chart above, which offers:

==> Starting from the first trading day of May, a 2 to 3 weeks lasting pullback/sideways/downtrend starts. What ever...!, first we have to observe the outcome of the next few days before we should agree on what might have begun at the recent ATH...

==> But in any case we have now:

At the alltime-high of the last Wednesday maybe the time factor has met or hit the price (= ATH resistance) ==> Accordingly we could see a change in trend in the next few days!

What convinced me additionally that now a first ES # sell short attempt is justified is that the price has now also reached important uptarget resistance within this very confirmed looking GUNNER24 Up Setup on daily base.

And somehow promising for bears this natural arc led to the strong bearish reversal after the Wednesday alltime-high:

Classic and textbook 21 Fib number Candle up starting at 2018 Xmas low, that represents the final low of 2018.

Shown 21 Fib number upwards measuring nais some of the most important 2019 rally turns/lows/tops. Among other stuff, there is backtest of former upwards broken first square line and upper line of 1st double arc, highlighted by the dark-green ovals.

Then the lower line of 1st natural uptarget resistance triggered the longest and "deepest" pullback cycle of entire 2019 rally after first test/this natural uptarget work off.

At red-dotted GUNNER24 Resistance Horizontal which springs from upper line of 1st double arc and starting point of the up setup or a year low the market made some near-term rally highs on rally days # 58 & # 59, thus this turn very likely was influenced by the often important 55 Fibonacci turn number!

Please keep in mind that the total already 87th day of this rally, the Wednesday ATH bearish reversal candle, finally rebounded hard from natural resistance of lower line of 2nd double arc uptarget, therefore confirming this lower line of 2nd daily resistance arc as important future daily resistance.

Means, the lower line of 2nd resistance on Wednesday became confirmed resistance on daily base and that daily resistance rail kicked in at ATH resistance area which per se is a combined resistance on weekly & monthly & yearly & on ATH base. Thus any important time frame - AT THE SAME TIME - started to radiate some negative forces at Wednesday 2961.25 pts ATH!

And as a consequence the actual ATH environment, at current given time and likely also for the next few days, appears to be a very hard to overcome concrete, which in turn might have triggered the for this season "quite" normal 2 to 3 weeks lasting pullback/sideways/downtrend cycle!

Hmm, please observe that the rally count whose counting starts at # 1 // 2018 Low on Friday was at the next higher Fibonacci number after the 55 Fib number, thus noted at the 89.

Then time (89 Fib number) could again have met price = lower line of 2nd double arc (-resistance). Cause market history often rhymes and this market made some important cycle highs close to the 55 Fib number triggered by a GUNNER24 Resistance the # 89-Friday or tomorrow`s trading day # 90 (=89+1)-Monday perhaps represents the first important lower high after the # 87-Wednesday ATH.

Who knows always for sure, but shorting market here at next, the second, test lower line of 2nd offers at least a nice risk-reward ratio!

==> That`s why in the course of # 89-Friday our GUNNER24 Trade of the Day members started to short S&P 500 e-mini futures contract at 2943.00 pts! Stop-Loss (SL) for a short position starting at 2943.00 should be placed at at 2962.00 pts. This is tight 0.75 pts above just made ATH.

Another perhaps very important price-time event in another highly influencing stock index was finally seen on Friday. On the very late Friday ...

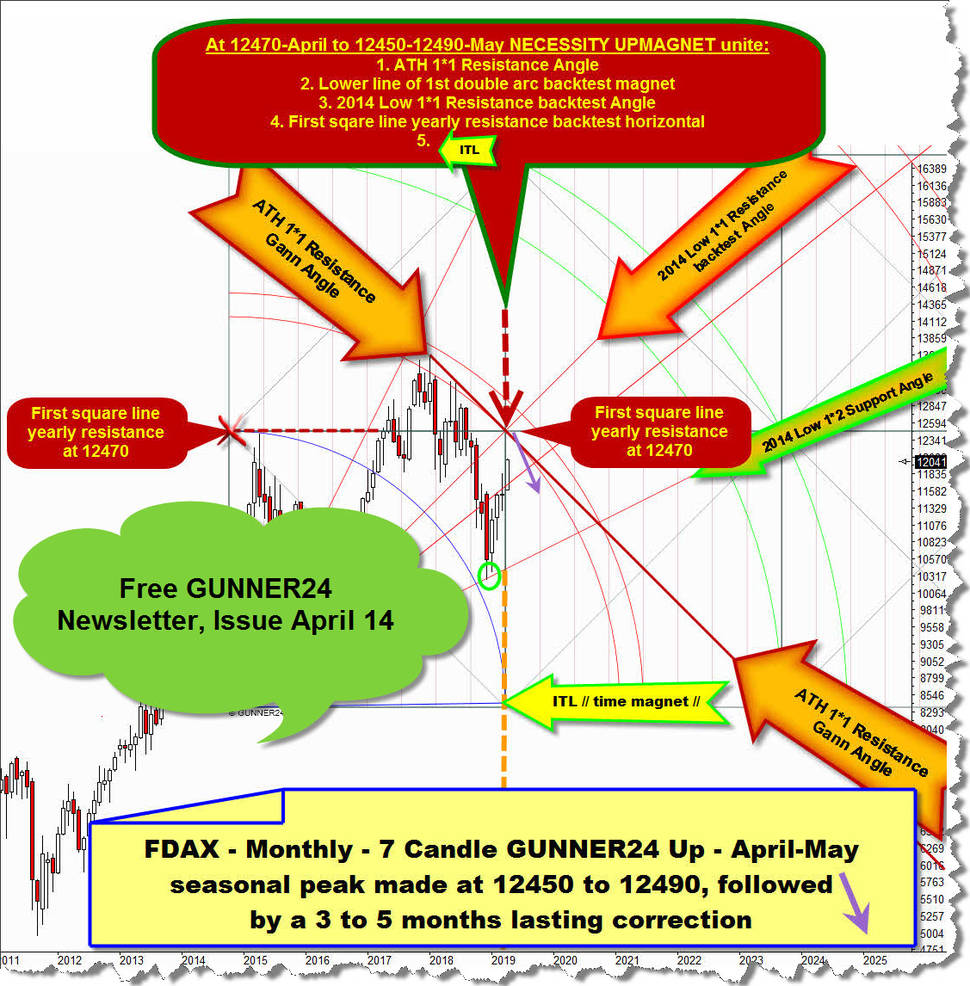

This MANDARTORY processing of an extremely important identified upward magnet occured in the FDAX, which represents the Germany DAX futures contract.

3 weeks ago, within "For the FDAX now 12450 pts are mandatory"-Newsletter - click here to re-read this very important issue -, I stressed the FDAX compellingly should test 12470 at April highs OR if this 5x resistance upmagnet will not be reached in further course of April price NECESSARILY has to work off major 12450 to 12490 upmagnet resistance area sometimes in course of month of May, before the anticipated spring-top process is allowed to begin.

On Friday FDAX closed at 12463 pts, after this day for the first time in 2019 reached 12450 to 12490 mega resistance area and the day high precisely arrived at 12470 pts fivefold GUNNER24 Resistance Upmagnet.

Taking the Germany Seasonals into account FDAX is now finally prepared to start it`s quite normal 3 to 5 month candles lasting sideways or digesting cycle after successful hit of 12450-12490 MAJOR resistance upmagnet test/backtest!

But of course also the FDAX uptrend technically remains 100% in place unless first signs of some technical weakness has occured. But we could see a change in trend in the next few days cause price has met time on Friday...

Possibly most attractive ES # downtarget in a possibly 2 to 3 weeks lasting pullback/correction is the open 2837.75 pts gap on monthly closing base!, that fits 100% accurately to the GUNNER24 Horizontal out of lower line of 1st double arc within the daily 21 Candle GUNNER24 Down Setup.

Cause price was able to deliver a single month close far above 2837.75 pts, this magnet has morphed to usually very strong support horizontal on yearly base!

==> 2837.75 is future support magnet on daily and on monthly base!, thus this horizontal rail now represents also major support for entire 2019!

Accordingly, a 2-3 week pullback could fill very attractive 2837.75 pts yearly gap support down magnet!

Risk-reward calculation:

Risk = 19.00. Potential reward = 105.00. Risk-reward ratio 19.00/105.00 or 1:5.63

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best trending stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann