In February this year, the necessity became clear for gold to process at least the 1308 in the current move. It’s supposed to happen in the course of the coming week.

1308 is horizontal resistance, ensuing from the year high 2015. An obvious up magnet for the current gold run! As well, the 1322 is a completely normal, cause natural uptarget for this countertrend in the monthly time frame.

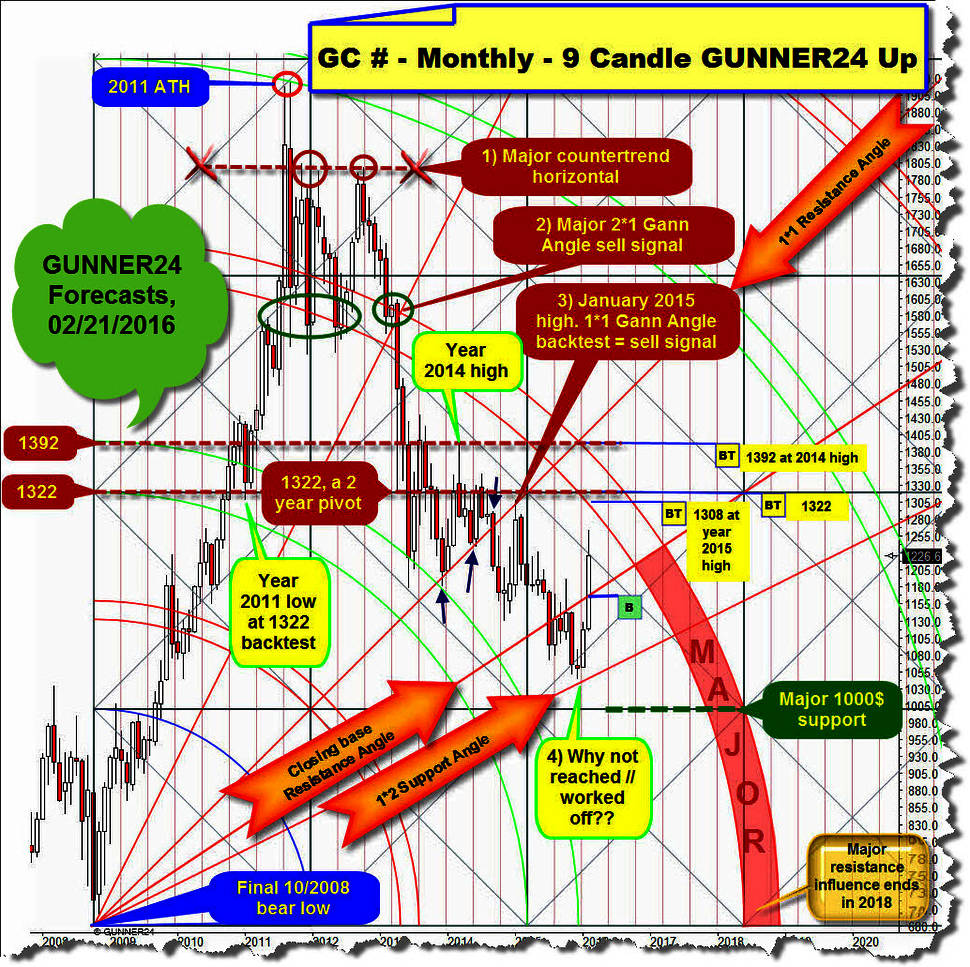

Source of the chart above and the profound analysis why 1308 is the minimum target and 1322 is important possible major-top for this monthly uptrend, here’s where you may look it up again:

http://www.gunner24.com/newsletter-archive/february-2016/21022016/

It’s certainly surprising how strong gold has been marching through since the December 2015 bear market low. Since the important first uptrend high mid-March 2016 at 1288, just once it came to a very weak downwards reaction according to price and time ending yet at 1206 on 03/28/2016 – Monday past Eastern. Upwards again, the precious metal has been going from there. On Friday, gold closed at 1295 after even having marked the new uptrend high at 1299. In other words: We’re experiencing an extremely bullish consolidation period scarcely below the uptrend high that – beginning with last Thursday – was dissolved upwards.

The month of April 2016 closed at 1294.90 being the highest monthly close in the current uptrend.

Until last Wednesday, the FOMC day it wasn’t quite for sure whether gold would have to extend its correction/consolidation phase according to time and price that had begun on March 11 at 1288 when it closed at 1250.10.

However, on Thursday a new rally leg started testing first the "famous and well-known" 1272 at the daily high on Thursday that closed yet scarcely beneath the 1272 – combined weekly/monthly/ yearly resistance - namely at 1266. Friday achieved the final clearance after that. In one go, at first the 1272 was broken upwards without much ado. Then, the 1288-March uptrend high was overcome under high buying volume.

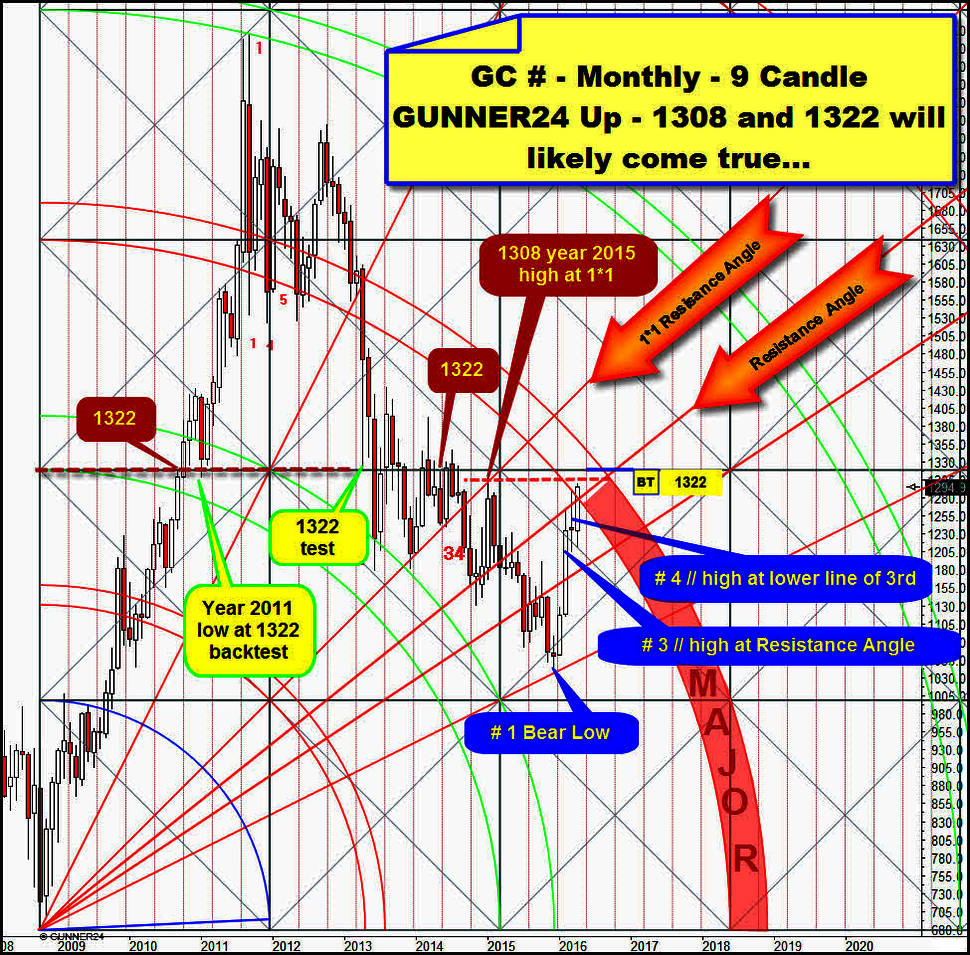

With the aid of the actualized 9 Candle monthly up above beginning at the final bear low of the year 2008 we’re getting clear about what is coming now:

A) The March high at 1288 - March is the 4th uptrend month = # 4 – tested still the important major lower line of 3rd resistance from below. Ultimately, this test led to a slightly negative March close, a thoroughly visible reaction to this major resistance. With the last trading day of April this first major resistance of the year 2016 succeeded in being finally overcome on monthly closing base however.

B) April closed above the lower line of the 3rd double arc. This is a NEW BUY SIGNAL IN THE MONTHLY TIME FRAME forcing gold to reach next the 1308 – thin red dotted horizontal in the chart above. The 1308 being the year high 2015 is now in near striking distance therefore being tested soon – in the course of next trading week!

C) April succeeded in overcoming the 1272 on monthly closing base. Thus, the 1322 is newly activated as next important uptarget for the current trend!!!

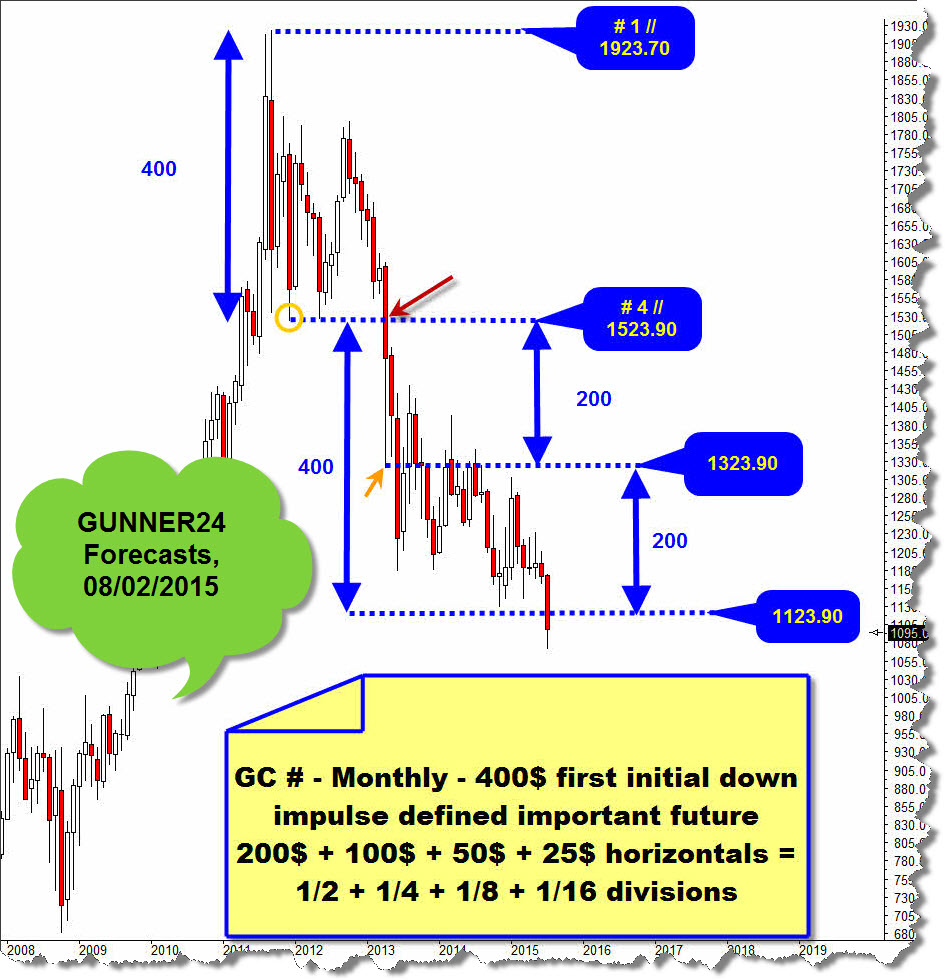

((All about the importance of the 1122, 1172, 1222, 1272, 1322 etc. and why the 1322 resistance magnet can directly be derived from the 1923.70 alltime-high and why it is still dominating yearly resistance for 2016 and the following years...:

... you’ll find again in this issue for studying:

www.gunner24.com/newsletter-archive/august-2015/02082015/ ))

D) ==> The gold uptrend will test the 1322! With a 98% of probability as early as in May 2016!

The 4 main reasons for this allegation are:

1. Because the 1322 has been important venue = magnet for gold. See each and every notes and tests above in the Monthly 9 Candle up. The 1322 are therewith much more important attraction price for the metal than the year high 2015 = 1308. 2. Because the Gold Miners (HUI) succeeded in overcoming the important resistance high of the year 2015 broadly, significantly and thus finally in the course of the last April trading day! – By the way, after overcoming the second bull-run uptarget = 225 on monthly closing base the HUI WILL HAVE TO!!! ...

... reach + work off the 260 compellingly now!!! This means that the Gold Miners target and aim for the backtest of the final year high 2014 now. The HUI closed the trading month of April 2016 at 233.46 index points!

And now again back to gold and the certainly compelling reaching of the 1322 as early as in May 2016. 3. Because the upwards momentum in the weekly time frame has got a lot of upwards space after the last seven week consolidation phase till some overbought extrema are being reached.

And 4.: With the newly generated buy signal in the monthly time frame and the 1288 and 1272 being overcome, the upwards momentum in the monthly time frame will get another mighty thrust.

==> After the 1322 being processed in May 2016, all the bulls will have exit all long posisitions awaiting what will be happening next. For the 1322 is important triple GUNNER24 Resistance Magnet in the yearly time frame, that again can be derived directly from the alltime-high = 1323.80 horizontal, see the chart before last.

In addition, the 1322 can be directly derived from the bear-market low of the year 2008 = 1322 horizontal, see both the first and second charts of today’s issue. Furthermore, the 1322-1323.80 magnet for the coming couple of months is situated in the range of the 3rd double arc resistance that is still the MAJOR RESISTANCE DOUBLE ARC for the years 2016-2018.

Overcoming a triple resistance magnet in the yearly time frame is technically not to be accomplished in the first attempt. Thus, the 1322 is offering itself as intermediate high for this uptrend just magically now!!!

If gold tops out soon, the results would be rather unequivocal. For in that case, the next additional long consolidation resp. very first correction period – duration of 7-8 weeks again – would be the minimum consequence.

Yet, working up a triple resistance in the yearly time frame may thoroughly have much farer reaching impacts, namely the final year high being brought in there. I think, that gold is indeed most likely to be able to bring in its absolute year high for 2016 at the 1322…

Some further buy signals will emerge after the 1322 being reached if:

A) one month closes above the 1330 resp.

B) two consecutive weekly closings above 1330 can be generated!

If either A) or B) happens, gold will be able to reach the 1422 quickly, harshly and brutally within a few weeks!

Be prepared!

Eduard Altmann