…that’s how a fundamental motto of the metalheads reads. I’m afraid both precious metals we consider – gold and silver – haven’t either dropped or risen properly for weeks.

The volatility eases, the tradable swings occure only intraday, all in all it’s an enervating struggling along between the narrow daily supports and resistances with many false signals. For as many as 5 weeks gold and silver have been in a narrow trading range that on daily basis is clearly to be identified as a downtrend.

Since end of February gold and silver have been producing lower daily highs and lower daily lows… All in all the bears are in a superior position for there are more important tops being sold-off strongly than important lows being bought.

As analyzed in detail last week already regarding gold the reason for this comportment is that in the weekly time frame both metals are positioned within some important double arcs that on the one hand allow only narrow trading ranges and on the other hand prevent both metals from rising tending to press them down because their bows are passing downwards.

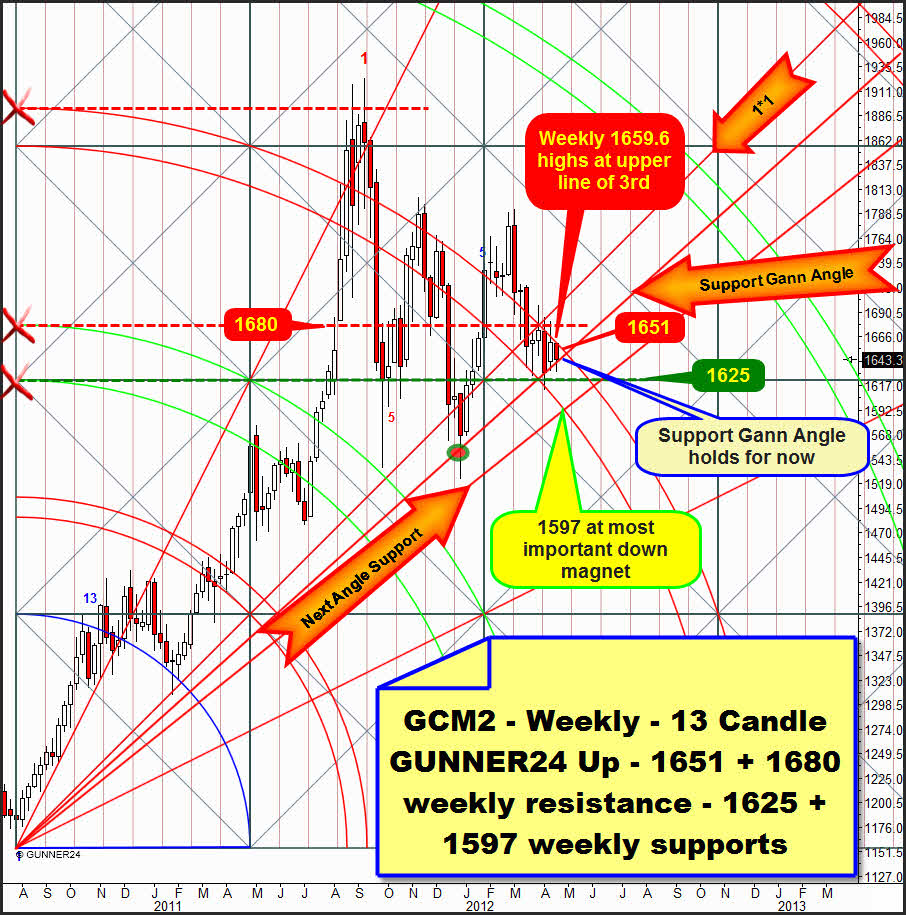

Gold: The weekly 13 Candle GUNNER24 Up Setup is showing a 13 week initial impulse that began in July 2010 ending in October 2010. This initial impulse defines all the important future supports and resistances and targets until the setup temporally expires (end of 2015). All the Gann Angles, time lines, horizontals and diagonals, and all the double arcs are included. If the price meets one of those magnets - when the occasion arises – the trend may change or increase. W. D. Gann: "When price meets time, a change is imminent"!

All the components of a GUNNER24 Setup are magnets that may attract the price and accelerate or retrace it. Their function is either support or resistance, and if the price is trapped within both lines of a double arc as in the actual case it will bounce to and fro in a narrow range. During the last 5 weeks the upper line of the 3rd double arc was unambiguously showing its resistance function because the opening or respective close of the corresponding candles is clearly identifiable at the upper line, the lower line of the 3rd support function the weekly lows were made there as many as three times.

The actual support Gann Angle has been aiding for three weeks. In their respecting closings the weeks escaped above so far.

From above the upper line of the 3rd is pressing onto the market. The highs of last week are lying exactly on the upper line, at 1659.6. Next week a decision is supposed to be due whether the metal finally succeeds in breaking upwards. Monday might give clear indications. A Monday close clearly above 1651 where the upper line is going to pass next week would signal a good chance that the actual downtrend will terminate.

Every daily close below 1640 certainly increases the probability that for the moment the horizontal support at 1625 will newly be reached, in an extreme case forcing the most important weekly magnet – intersection point between the next lower support Gann Angle and the lower line of the 3rd – to be headed for at 1597 before from there may arise enough rebound energy to end this enervating downtrend. There, below 1600 the daily inverse SHS would come to its very most perfect completion (watch last issue!).

In the issue of 03/11/2012 we elaborated the silver long-term by which the 4th double arc is backed in an extrapolated 18 Candle Elliptical GUNNER24 Up Setup. Please do absolutely read up again in the 03/11/2012 issue which way we derive the following important silver setup, it’s for understanding!

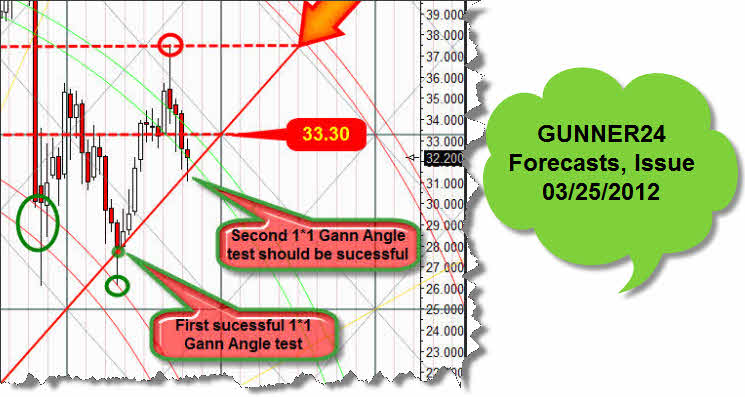

The last time I considered this advanced GUNNER24 Setup was on 03/25:

And I supposed then that the second test of the 1*1 Gann Angle would take a successful course, the rebound from the 1*1 would produce enough energy to overcome the down pressure of the 4th double arc definitely leading thus up to 37$. Otherwise the 21$ mark until the end of June would threaten. No such luck! – False analysis:

Like gold for as many as 5 weeks silver has been joining the down course of the 4th double arc. Four out of the last six week closings were lying exactly on the lower line of the 4th = support. The upper line of the 4th clearly provides resistance. For next week this resistance is at 32.01. Now, for silver it may take another touch with the probably more important support Gann Angle that led to an important turn in December 2011 already. The year low 2011 was made there and the rebound from this support Gann Angle led to the mighty rally up to the 37.50 resistance that is lying in the center of a square, you know.

The important support angle for next week is lying at 30.98 precisely at the current lows of this correction, but some even lower lows wouldn’t surprise me, a bear trap so to speak before silver maybe turns up finally from the 30.90 or so heading for 33.50-34 by the beginning of June where the best short-entry for the summer months is positioned.

But if silver acts as gold breaking the 32.01 on Monday and closing above that as well on Monday as on Tuesday we’ll be able to work on the assumption that the resistance of this upper line of the 4th will have been overcome definitely and a new upleg will have begun that will have to lead up to +33.50.

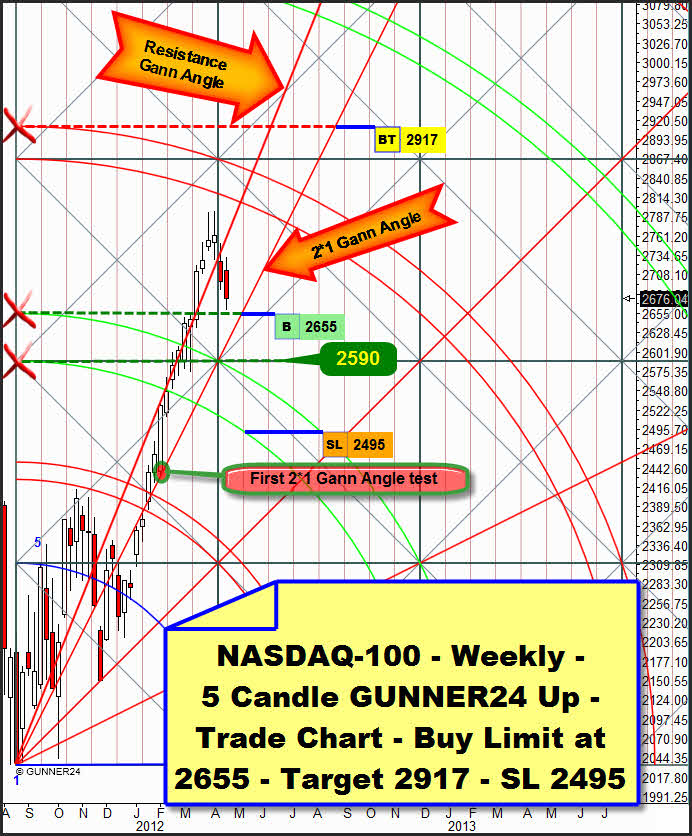

Let’s have a brief look at the US stock markets and our possible long-entry trigger at the Dow Jones and the NASDAQ-100.

In detail, I treated both trigger marks in the last issue of the GUNNER24 Forecasts already. With the last week lows the NASDAQ-100 almost reached our 2655 entry, but just at 2660 it bounced upwards:

So the absolute low of this correction is still waited for - as to my assessment. No important magnet in this setup has been reached hence – according to Cocker – no important rebound from a magnet can have happened. After the break of the resistance Gann Angle two weeks ago the market is expected to go on correcting. The strongest magnet of this correction is supposed to aim at continues being the combined weekly and monthly support at 2655. There we’ll go long in case of a daily close below 2655.

Possible further depressions of this corrections might be produced by a touch with the next lower horizontal support at 2590 or the second touch with the long lasting 2*1 support Gann angle. But since we are – still – in an extremely strong upwards trend it won’t be rather advisable to speculate on the most extreme possible lows…

Moreover the Dow Jones is standing closely in front of a daily buy signal:

We keep on buying each significant break of the 3rd double arc in the daily 9 Candle GUNNER24 Up. Target in this case is the 4th double arc at 14000. If for example Monday closes above 13130 we’ll go long with target 14000. In that case the 3rd is expected to be broken upwards unequivocally. About that please pay attention to our US Stock markets performance statistics. That’s where you may observe very promptly our exact entries and exits…

At any rate the comportment of the market at the currently dominant double arc is interesting again. Here’s again the 3rd double arc. The first contact with the lower line of the 3rd led to the first strong retracement in 2012. A contact with the 1*1 Gann Angle followed that made the index rebound upwards again leading to the year-high within the two lines of the 3rd. There – between the lines of the third – the actual correction began that became a solid one after the 1*1 was broken on daily basis.

After the market had come to its correction low up to now at the green-dotted GUNNER24 Support Line rebounding from that magnet it newly found resistance at the upper line of the 3rd. The last four trading days were subject to the resistance function of the upper line.

Technically the index should follow now the down-turned bow of the upper line downwards in order to conclude a three week ABC correction with the C wave. The ideal target of this correction keeps being the extremely strong GUNNER24 Magnet at 12620.

An April close below 12620 would deny the 14000 targets, the tops for the first half year 2012 would be done, a more extended correction than the ABC-correction would follow. The signal for the 14000 will only be given by the significant break of the 3rd double arc in the trend direction in the daily 9 candle up setup above.

Be prepared!

Eduard Altmann