Once again I’d like to begin this issue with the actual state of the silver blow off. The tough and rapid trends yield the fastest money to every trader – combined with a relatively low risk. All you’ve got to do is actually to convert the results of the GUNNER24 Silver Analysis into hard cash, i.e. follow the trend and aggregate to the trade increasing considerably the amount of your account:

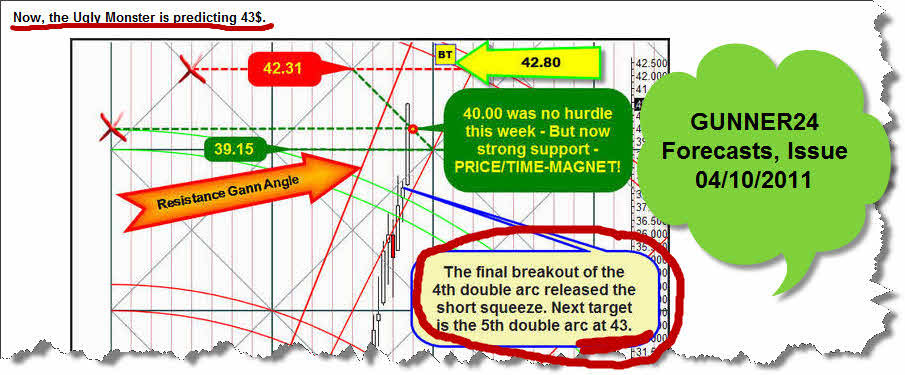

Last issue we established the following: "The weekly Ugly Monster Chart forecasts 43".

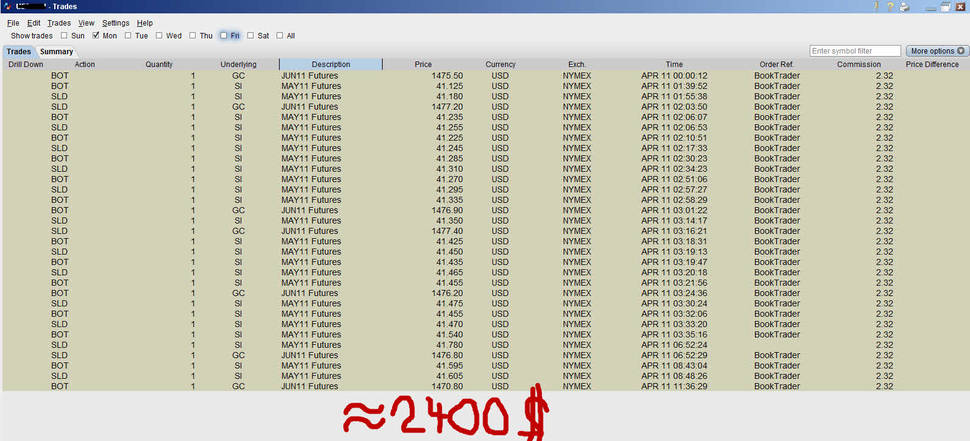

Closing price on Friday was 43.05. In that issue I further stressed that it would be nice to start the week with 1,000 or 1,500 $ of profit if you only consider the silver targets for last Monday. Here are the trades of last Monday – the large part of the money was generated in the first 7 hours of Monday:

If the analysis is relatively sure and the plan is correct all we’ll have to do is invest and collect – personally I like to trade silver with very low risk trying to be temporally invested least possible in the market, with a maximum of 2-3 contracts simultaneously. From my point of view such tactics are indispensable since because of the high volatility of the gray metal within 10 minutes the whole day profit may easily transform into twice as much of loss. I simply love to be successful slowly, but steadily, day by day, week by week and moth by month.

Why do I tell you all that? – Of course, a little pat on the back is on the agenda, as to speak we’re a little proud, because our clients have only stood to gain extremely with the GUNNER24 Silver Analysis during the last months. But at the same time I’d like to warn you, because I cannot put down the following WITHOUT warning since it sounds so incredible. Because greed is forbidden – greed is not a good adviser – it’s the ruin of the best trader one day.

I always try to interpret the GUNNER24 in a relatively „objective way" aiming to be prepared for everything, to have a plan. But after being in business for more than 15 years sometimes you get such a feeling that something might happen, you rather "grasp" the market than analyzing it objectively, you grasp the potential by virtue of the empirical knowledge how the candles within the GUNNER24 Setup stand, how the silver upswing in the GUNNER24 Resistances and Supports reacts or respectively does not do what you would actually expect.

My feelings tell me now that this exhaustion move is being in the last quarter when the last dams ought to burst in silver, when in an extremely short time the fastest and thereby the safest money should be made:

My feelings may be absolutely wrong, but I think that silver may be going up to 47 within the next two weeks:

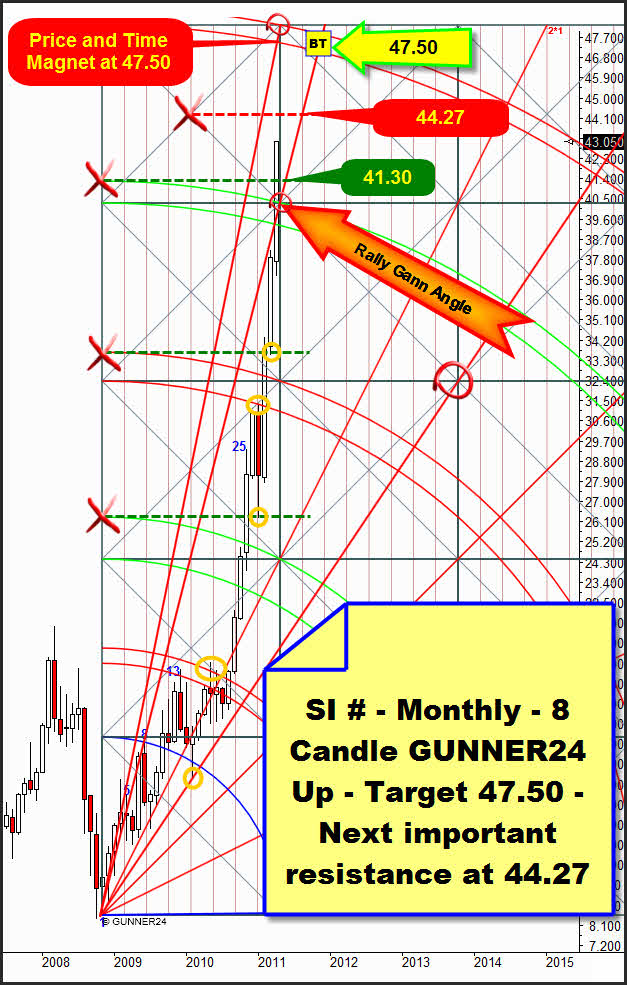

In the actual monthly 8 Candle GUNNER24 first of all we regard the setup in itself, and we make out that silver is following the setup, is considering it in the orange circles. For my taste there are not quite enough points of contact, not enough price and time magnets meeting the silver. Particularly in the two last passed squares there are almost no magnets left which are being considered. With the three first passed squares we recognize undoubtedly that the months are at least rudimentarily still oriented to the really important supports and resistances, but I’d describe the actual April candle as to be a "hammer candle"… it’s popping through the 4th double arc as if its natural resistance weren’t there.

That candle is re-conquering a resistance Gann Angle (now its condition has transformed into a support – no, more detailed, into a rally Gann Angle!) meaning since the beginning of the upwards trend it has been a really unbreakable resistance. At candle 5 to 8 you can see that it should actually provide very strong resistance.

On top of that, April popped through the actually important resistance at 41.30. Because of being visible it’s important that the horizontal resistances coming from the upper lines of the double arc (anchored with the red X) were significant in the past… Conclusion: The April candle is accelerating interminably, the 44.27 might be nothing but a red dotted line sketched by Mr. Altmann because it’s really always important, according to empirical knowledge.

And now things are becoming subjective. Since everything is being overcome that easily the target of 47.50 for April can’t be ruled out. After all April is still going on for a fortnight!

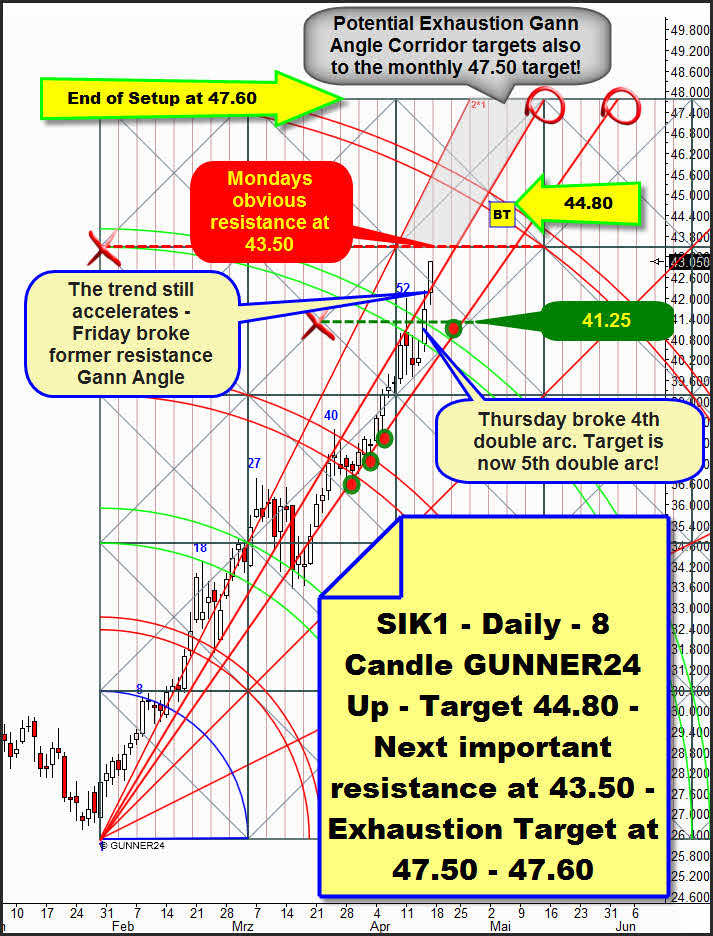

Also in the daily 8 Candle GUNNER24 the target of 47 is being confirmed as to be the exhaustion target!

In this setup as well we can make out some mighty signs of acceleration. Let’s first consider the comportment of the market at the 3rd double arc – it lasted about 7 trading days until that 3rd one was broken or overcome, respectively. Let’s consider now silver at the 4th double arc: Here it really lasted only 5 days until the 4th one was clearly broken – even though in the case of the commodities the 4th ones really use to provide a much stronger resistance than the 3rd double arcs.

Furthermore on Friday a former resistance Gann Angle was re-conquered. Now it’s providing support. It’s another sign that the trend is boosting. IF silver now follows the possibly newly defined Gann Angle corridor, i.e. also the next two weeks it rises by the new steeper angle and if we can work on the assumption that also the 5th resistance double arc might be nothing but hot air, the 47.50 in the daily setup as well arise as the main target. In the daily setup the 44.80 can be made out as to be the next target at the 5th double arc. That is corresponding to the next recognizable horizontal resistance in the monthly setup!

Thus we’ve got two corresponding targets in two different time frames. That means a lot of safety for us and a good plan above all. We’ll have to adjust ourselves to the 44.80 being able to reckon possibly with another price rise of 10% altogether up to the 47.50 before we figure on a serious correction.

For next Monday the same will be valid as it was last Monday. Again 1,000 to 1,500 $ are possible until the first visible resistance will be seen in the daily time frame at 43.50! So we’ll have to get up early again shoving down a beautiful beginning of the week!

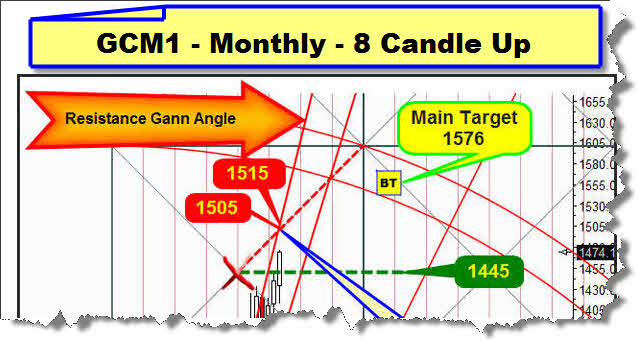

Gold keeps on backing the continuous silver exhaustion. Here’s again the monthly situation, as analyzed in the last issue:

Gold has clearly broken the 1445 at least heading for the significant price and time magnet at 1505 in April with a possible exhaustion to 1515.

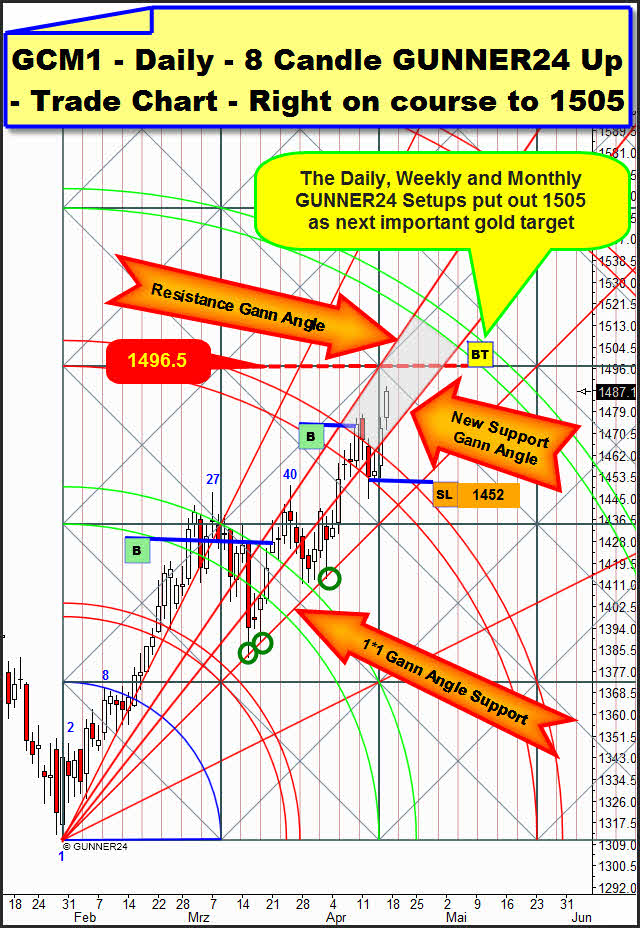

The daily GUNNER24 Up Setup continues putting out at least 1505$ for April 2011 as target:

As in the case of the daily silver setup gold re-conquered a resistance Gann Angle. On Thursday the 3rd double arc including its resistance was broken together with the resistance Gann Angle. That one is changing its condition to becoming a support Gann Angle now. Gold seems to be following the gray hatched Gann Angle corridor again. The 1505 are obvious. So is the next visible resistance, the upper limit of the just passed square at 1496.5. Here, too, we’ll have to expect the 1496.5 perhaps as early as on Monday, not later than on Tuesday. This week the support Gann Angle shouldn’t really be broken, we’d have to buy a decline to the support Gann Angle.

Conclusion: All in all the PMs should go on rising for 2 more weeks, each and every little correction will have to be used for increasing the long position, therefore.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the acual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $29.90 US a month. For 101 members and up - $39.90 US a month.

Let’s still have a little look at the stock market – it’s actually been boring for weeks (compared with the PMs…):

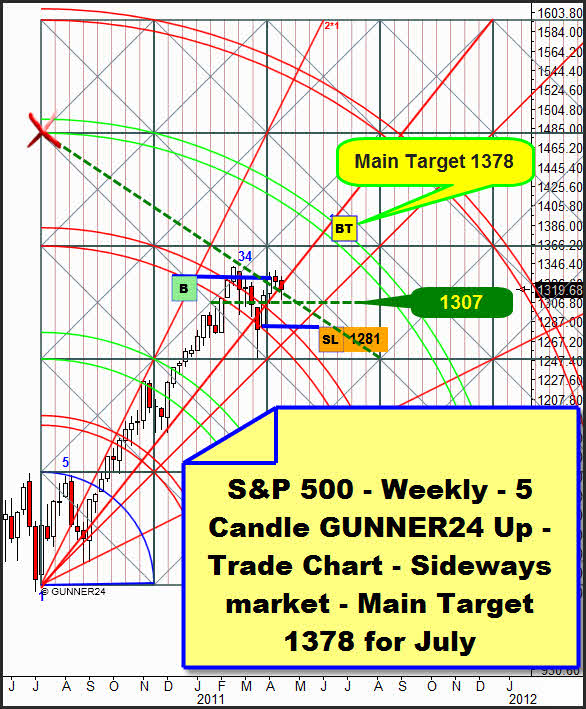

The weekly 5 Candle GUNNER24 Setup of the S&P 500 keeps on putting out the 1378 as being the main target. The last two weeks seem to test back the final break out of the 3rd double arc. At week closing the support Gann Angle seems to be broken. But the price losses of the last two weeks are just a correction in the upwards trend. That’s what I’m told by the fact that the market is testing back the support diagonal above left, anchored at the 4th double arc.

Probably the S&P 500 will first have to touch down at the horizontal support at 1307 before the new highs of the year can be tackled. In terms of seasonality the week before Eastern uses to be very strong. And especially strong it is in the Presidential Year 3. Correspondingly we should close next week with a green candle.

Be prepared!

Eduard Altmann