Crude Oil made new highs, so the processing of the "round" 70$ threshold by the end of April is almost mandatory.

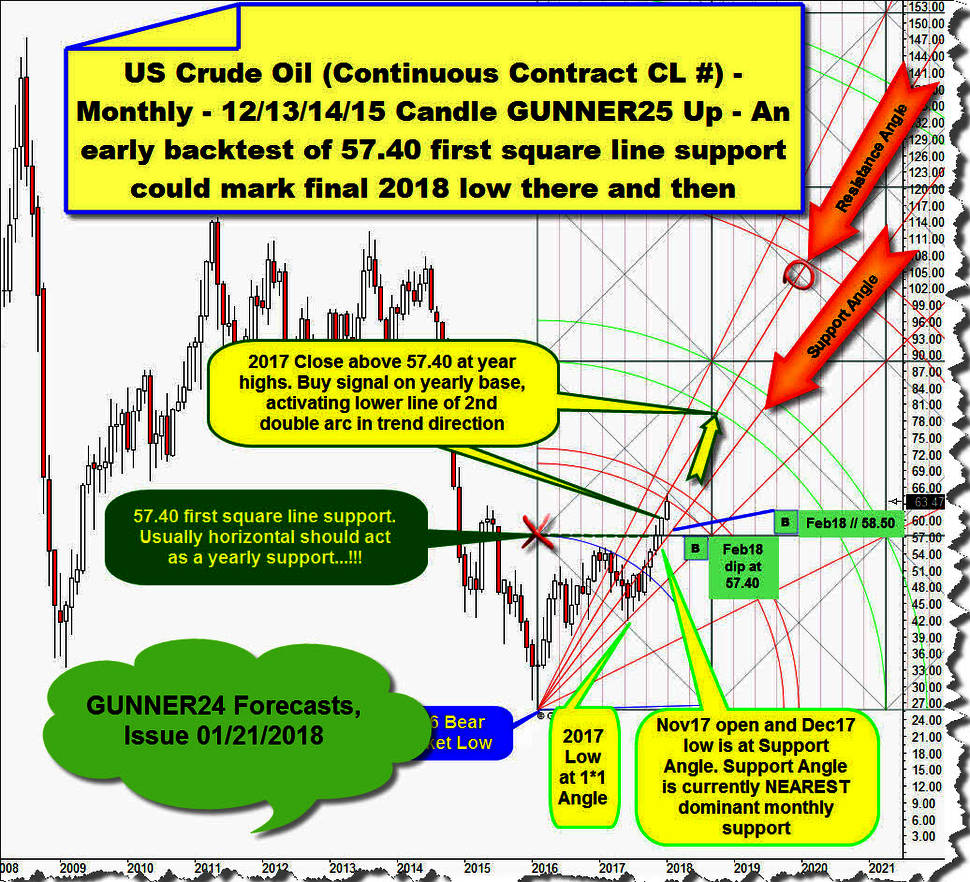

Most recently (GUNNER24 Forecasts, Issue 01/21/2018), the signaling for Crude Oil was that after the very bullish 2017 close which fired important DOUBLE buy signal on yearly base a pullback in the monthly and weekly time frame could test the 57.40$ support horizontal before the bull market in the yearly should resume.

57.40$ is mighty GUNNER24 First Square line support and is expected to be strongest 2018 support...

But instead retracing into 57.40$ annual support threshold and granting a Gentleman`s long-entry it surprised, as strong bull markets usually do...

... according to the GUNNER24 Trading Rules, the 2017 close far above 57.40$ first square line resistance within 12/13/14/15 Candle GUNNER24 Up Setup means exactly two important things:

First, namely, that the year 2018 should again be an upward trend year. As it was the fact with the 2016 and 2017! And thus, the final low of 2018 should be printed near open and the final high of 2018 should arrive near the close of 2018.

==> The lowest price of 2018 so far arrived in course of February at 58.07$, and after the higher year highs of the previous week, it seems very likely that this February extreme was the final low of the entire year.

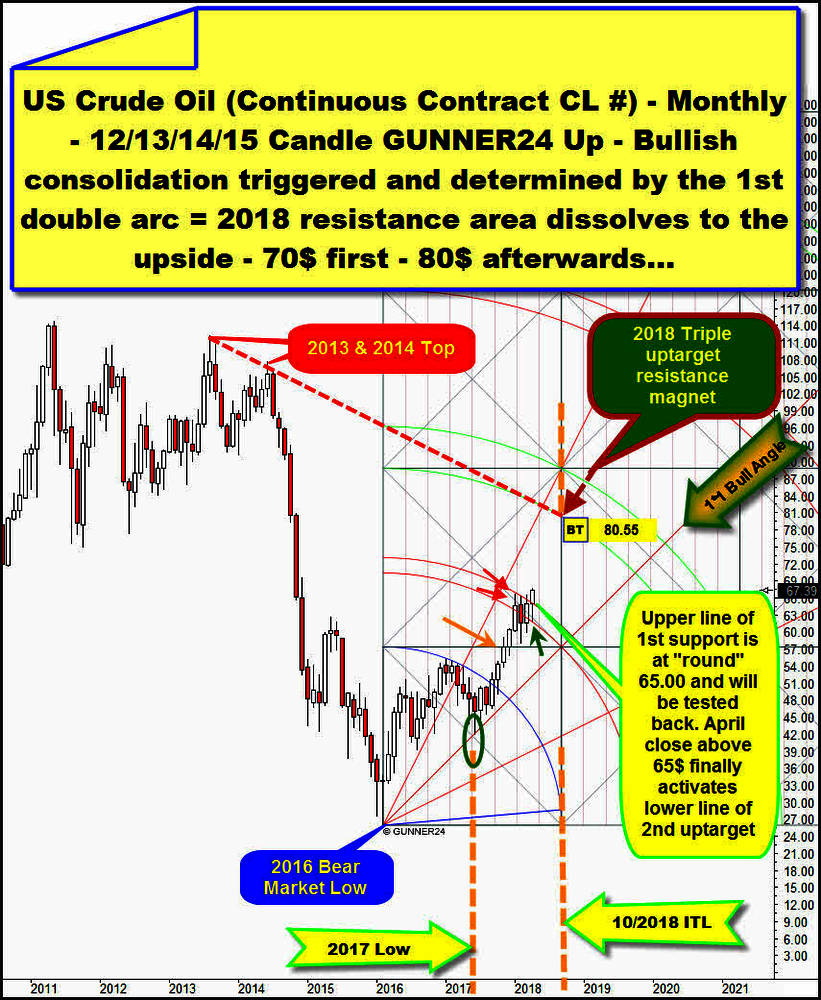

And oh yes, second: because the oil so far behaves exactly as the classic uptrend year pattern pretends, it is now more and more likely that the market will deliver a very strong uptrend year 2018 according the price - very similar to 2016, even reaching the 80$ monthly GUNNER24 Uptarget at some point!

Let us now look at how the market has evolved since January:

After the early 2018 highs which have arrived precisely at upper line of 1st double arc bull market uptarget = bull market resistance = red arrows the Crude Oil began a consolidation cycle which developed just shy below the highs of 2018.

This in itself is quite bullish development in terms of short- and medium-term expectations because this means that a continuation of the main trend is much more favorable in further course of 2018 than the end of the bull market starting at 1st double arc main resistance which is most important resistance area.

The 2018 consolidation is mainly determined by the lines of the 1st double arc that was initial bull market uptarget. The observation that the 2018 consolidation formed as a pennant exactly at a GUNNER24 Double Arc magnet which obviously determined the consolidation cycle points to the outcome that the 3-months pennant is - or maybe was!! - just a bull trend continuation pattern!

After the current April candle opened (64.91$) pretty exact but below! the upper line of 1st double arc 2018 main resistance, the afterwards printed April low nailed the lower line of 1st to the T from above.

Means: Upper line of 1st double arc at 65$ in the first step radiated a strong April resistance for the market. Lower line of 1st double arc fired strong support energy at 61.81$ April low = green arrow which came in just 6 trading days ago.

Starting at April low, precisely made at lower line of 1st double arc support and cause of the emerging Syria issues, the oil succeeded in overcoming the mighty upper line of 1st double arc main resistance on Wednesday printing new 2018 highs and finally closing the week visibly far above the upper line of 1st double arc 2018 main resistance.

Crude in the monthly looks now extremely bullish into "round" 80$ cause the upper line of 1st double arc 2018 main resistance was overcome on weekly closing base!

And with a new upcycle that started just 6 days ago at monthly support arc, this new upmove has a lot of upside in terms of price and time!

==> The 80$ is getting closer and closer! And will be finally confirmed and finally activated GUNNER24 Uptarget if April and/or May candle deliver a close above the "round" 65$ Gann Number.

==> A monthly close above 65$ (= upper line of 1st double arc) is a next serious monthly buy signal and triggers a 80.55$ which than usually should be worked off September to October 2018. There we are able to identify strongest future price/time magnet which forms by falling 2013 & 2014-Top resistance in the yearly time frame which in turn hits the lower line of the 2nd double arc monthly uptarget exactly for the month of 10/2018 that is on an important time line (ITL) of the setup.

==> 10/2018 ITL could become very important oil magnet regarding an important turn or bull market high cause the last ITL in advance signaled the potential turn at final 2017 low!

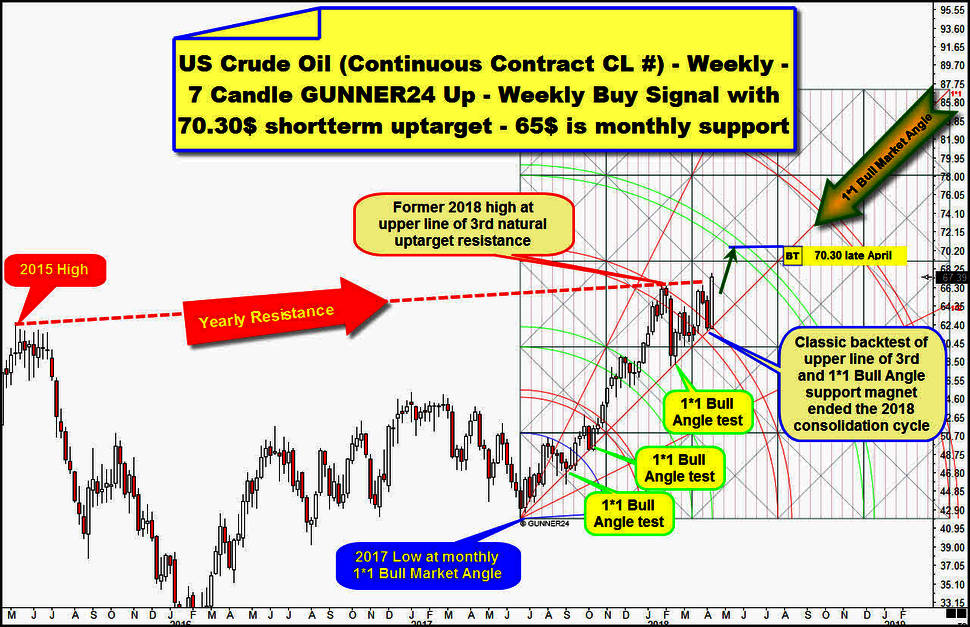

But before the "round" 80$, is well known the "round" 70$, and the imminent 70$ test is activated with the new year highs as next important upside or bull market target.

==> GUNNER24 fires a weekly buy signal with 70.30$-work off until end of April 2018:

7 Candle up out of 2017 Low, that was next important higher bull market low made at yearly 1*1 Bull Market Angle, signaled in advance possible resistance starting at 3rd double arc natural uptarget in the weekly and so it happened.

==> Upper line of 3rd together with monthly upper line of 1st triggered the monthly pennant and recent consolidation cycle.

Falling 3rd resistance environment had full consolidation-control as it was responsible for the lower highs of the consolidation.

According price factor the consolidation ended at next test, the third test of 1*1 Bull Market Angle at February 2018 low = potential final low of entire 2018. Starting at 1*1 Bull Market Angle which is always the strongest natural support within an up setup the oil fought back up to the 3rd double arc resistance area and overcame it on a closing base in course of March. Nevertheless, the 3rd double arc magnet still had a negative impact and forced the market into next accurate test = fourth test of 1*1 Bull Market Angle at this and past week candle lows.

There Crude Oil very classic tested back at the same time the prior finally upwards broken upper line of 3rd & well-confirmed rising 1*1 Bull Market Angle support magnet and there and then the 3-month consolidation was finally over according the time factor!... since obviously the rebound from this very important and strong support magnet triggered new year's highs. And as mentioned within a very short time...

A new daily and a new weekly and perhaps also a new monthly uptrend is triggered at April low!

This week close is a strong buy signal in the weekly time frame cause 3rd double arc magnet - former resistance area now future support area - is finally cleared to the upside and a Yearly Resistance is additionally overcome on weekly closing base.

==> Crude activated the test of the lower line of 4th double arc in trend direction until end of April 2018! 70$ until end of April 2018!

Enjoy and be prepared!

Eduard Altmann