Last trading week confirmed the result of my analysis that the stock market lows of 03/20 touched down at some very important monthly GUNNER24 Monster Supports what made me suppose that we have to reckon with a continuation of the stock market rally:

As we know the S&P 500 closed far above the critical mark of 1279 in March even reaching nearly its multiple years high with a monthly close of 1325.83. The Dow Jones followed with a cracker on Friday: A new 3 year high!

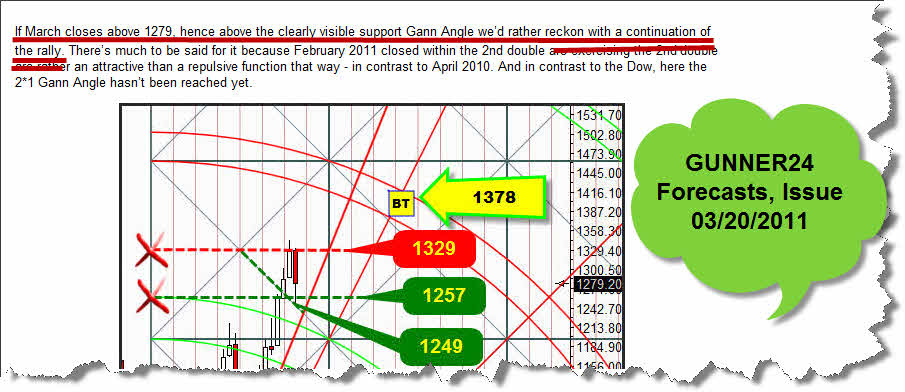

The actual monthly 3 Candle GUNNER24 of the S&P 500 is gently showing the enormous bounce of the March candle from the green dotted support diagonal brought out in the setup. Actually the market is being at its natural resistance of 1329. But that one is going to be overcome soon. Clearly on the one hand, an indication to it is the year high of the Dow Jones. Moreover, one of the most ancient pieces of stock sayings "Sell in May and go away" coming from the cyclicality, gives us an additional major security that it should go on rising for several weeks. And of course one of the most important GUNNER24 Rules – Rule # 21.3: In more than a 70% of all the cases the break of a double arc will lead to the reaching of the double arc next up (in an upwards trend) in the direction of the trend.

The actual weekly 5 Candle GUNNER24 Up Setup is showing us that the 1329 should break putting out the 1378 as to be the weekly target:

The situation: Since June 2010 the market has been following this setup, and the crossing of the 3rd double arc by candle 33 activated the 4th double arc at 1378 to become target. For several different reasons, at stock market opening after the nuclear catastrophe we covered all our positions (long and short) contrary to the rules. – You may investigate on that in the issue "When panic, panic first". Within this weekly setup as early as by the end of February we were stopped out of the current long-positions with a little profit. After the February top the market followed the 3rd double arc downwards until the horizontal support. That one stopped the decline leading to the resume of the long-term trend. As early as the week before last the 3rd double arc was broken again, but it was still in the area of the lost motion of that double arc.

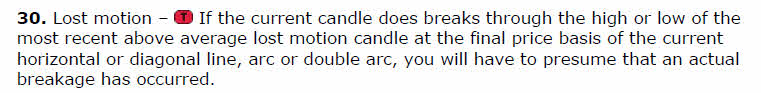

Last week, not only the support Gann Angle was re-conquered – what strictly speaking means a strong long sign per se – in addition also the lost motion of the 3rd double arc was overcome. Rule # 30 is doing the trick:

Thus the market produced a "double buy signal". From our view that’s a pretty infrequent, but a very clear long signal. That’s why by market closing we went long at 1332. Target is the 4th double arc at 1378. SL week closing price under 1281.

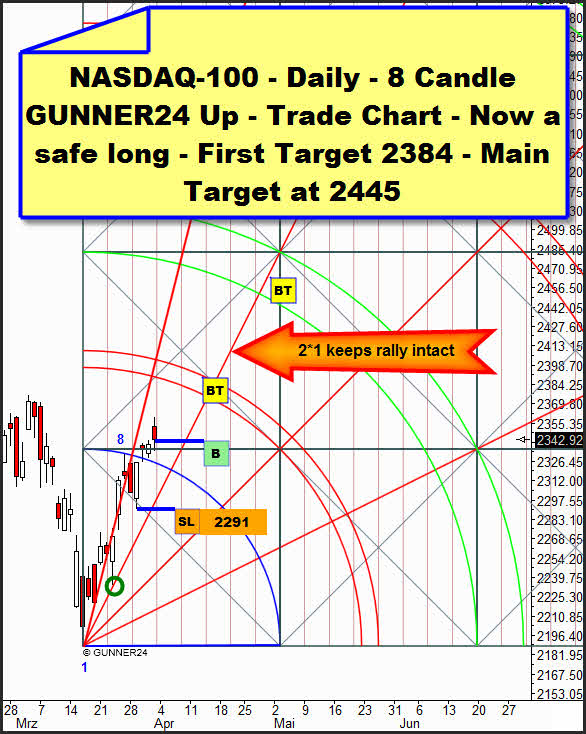

NASDAQ-100 – we’re long now here, too.

As you may know I think very highly of the NASDAQ-100 as an early indicator as far as its signals are concerned. As analyzed within the issue of 03/20/2011 "How strong are the lows" for me it was very important to see how the NASDAQ-100 would end in March. Because a closing price of less than 2284 would have meant a monthly reversal candle what again would have released the first short entry on monthly basis since more than three years in the American stock markets.

In the actual daily up setup we see that the 2284 being a very long term sell signal were actually thrown up until Wednesday. A sell out on Thursday might have thoroughly led to a monthly reversal candle. Then the Friday price course broke the first square conclusively, the reason for our long entry by the week closure. First target is 2384 and main target 2445 through the beginning of May. At the highs there we’ll have to observe whether the normal year cyclicality will lead to a several month summer consolidation or if it can still go on rising until the end of May/beginning of June.

|

The GUNNER24 Forecasting Charting Software will show you a completely new and highly successful cycle technique.

You will recognize turnarounds with bull’s eye precision in advance and, most importantly, you will also be able to see at which price levels the cycles will in fact change. After a brief period of learning, you will already have developed the skill to anticipate market movements. The special GUNNER24 Cycle Technique will open your thinking to a completely novel approach.

You will identify milestones of paradigm shifts that have absolutely nothing in common with the conventional and obsolete cycle technique. They are absolutely innovative and have not yet been discovered. Order now!

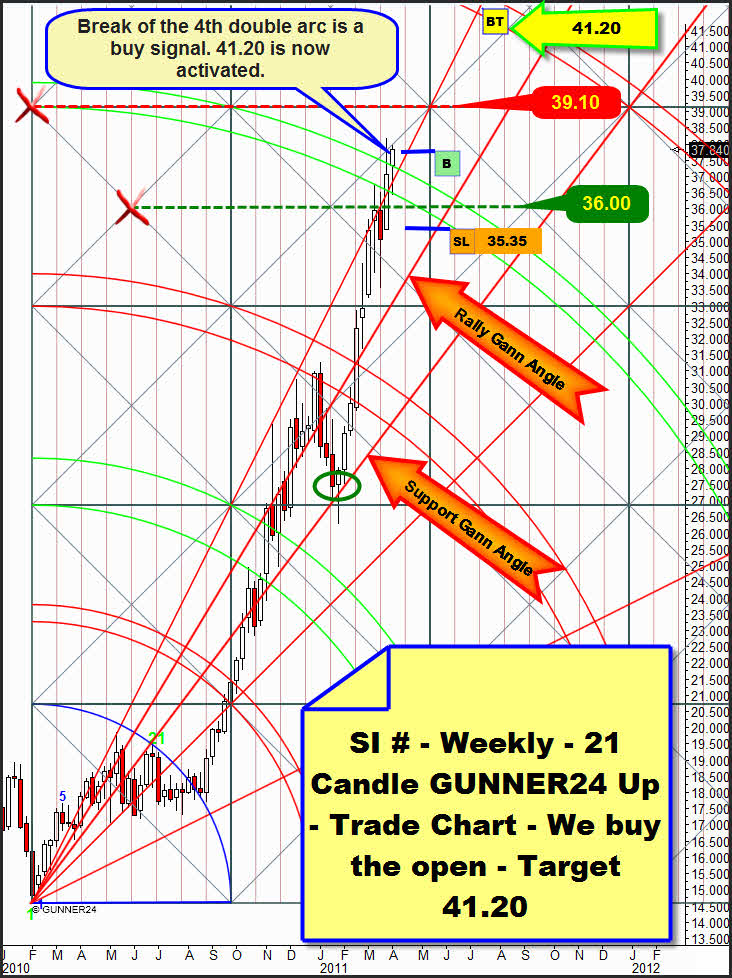

To the precious metals – at first I’d like to go into silver which has produced a long signal in the weekly 21 candle GUNNER24 Up Setup.

The week trend keeps on intensifying. As analyzed several times – at last here – also the very important 4th double arc was broken upwards. Now, the 41.20 are not only confirmed but even activated. Silver is only fighting for 3-4 weeks altogether with this 4th double arc. That doesn’t mean that the next two weeks shouldn’t test it back…Especiall y the 39 are an important resistance which inevitably has to lead to a renewed test of the 4th double arc, I think, maybe down to the 36. Please pay also attention to the analysis of the actual monthly setups about that.

The candle count, starting from the support Gann Angle, is suggesting 3 more weeks of rising prices. It’s been going straightly upwards for 10 weeks. The next Fibonacci number will be 13. For opening we’ll take a weekly long-position. Target is 41.20, SL a weekly closing price under 35.35.

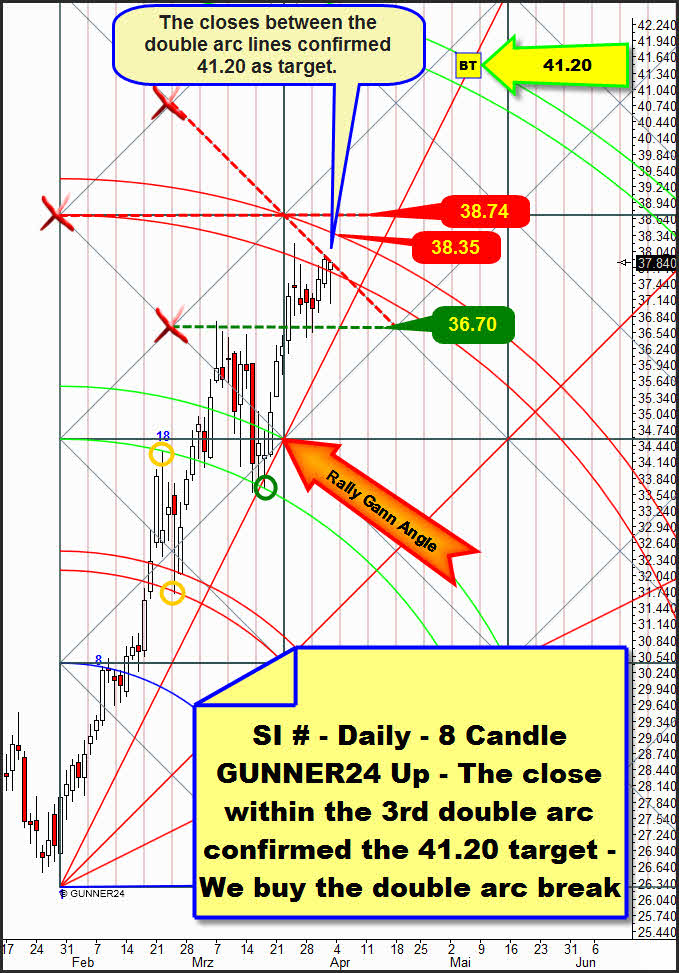

If the weekly setup provides a buy signal unavoidably very soon the 38 would have to fall as well in the daily time frame:

In the daily 8 candle up we make out that the closing prices within the 3rd double arc also in the daily time frame confirmed the 41.20, but we also see that a lot of "red material" = resistances up to 38.74 are threatening. And afterwards the weekly and monthly resistances around the 39 will come into play!

As we know silver is very unpredictable. It may still remain within its visible narrow consolidation area for three to five days being braked, perhaps it will take a touch of the support Gann Angle at the beginning of the week as a starting signal for the final breakthrough of the 3rd double arc. But I suppose that in the course of Monday, maybe even as early as by opening the resistance diagonal that’s visible in the setup will be overcome at the 31 year high being reached the 38.35-38.74 early in the week. We buy a final break of the 3rd double arc on daily basis. Main target is 41.20. The actual silver trades in the framework of GUNNER24 Forecasts and the valid stop-loss setting can be retraced here:

http://www.gunner24.com/trading-performance-forex-silver-copper/

The silver trade tactics for the week opening was sent to all the GUNNER24 Gold Trader subscribers! If you haven’t done yet – please place the opening trades now.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the acual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $29.90 US a month. For 101 members and up - $39.90 US a month.

In contrast to silver in the case of gold nothing happened last week which would have confirmed our expected weekly breakout scenario – see last issue. Singly the 3rd test of the support Gann Angle on Friday might have triggered the booster for this breakout. The rebound from the Gann Angle support was impressive, and maybe gold wants to follow the silver further up as early as Monday. By means of the consolidation week a target of just 1456 results for this upmove on daily basis that is actually pretty narrow-chested, I admit. The Gann Angle corridor actually followed by gold is pointing the pitch angle to the target 1456.

But that can change quickly if next week closes above 1450. That wouldn’t only shake off the chains of the 1442 resistance on monthly basis (read it up here, please) but also break the resistance influence of the first double arc on weekly basis, as worked out in the last issue. In that case gold should get into a significantly faster stride!

Be prepared!

Eduard Altmann