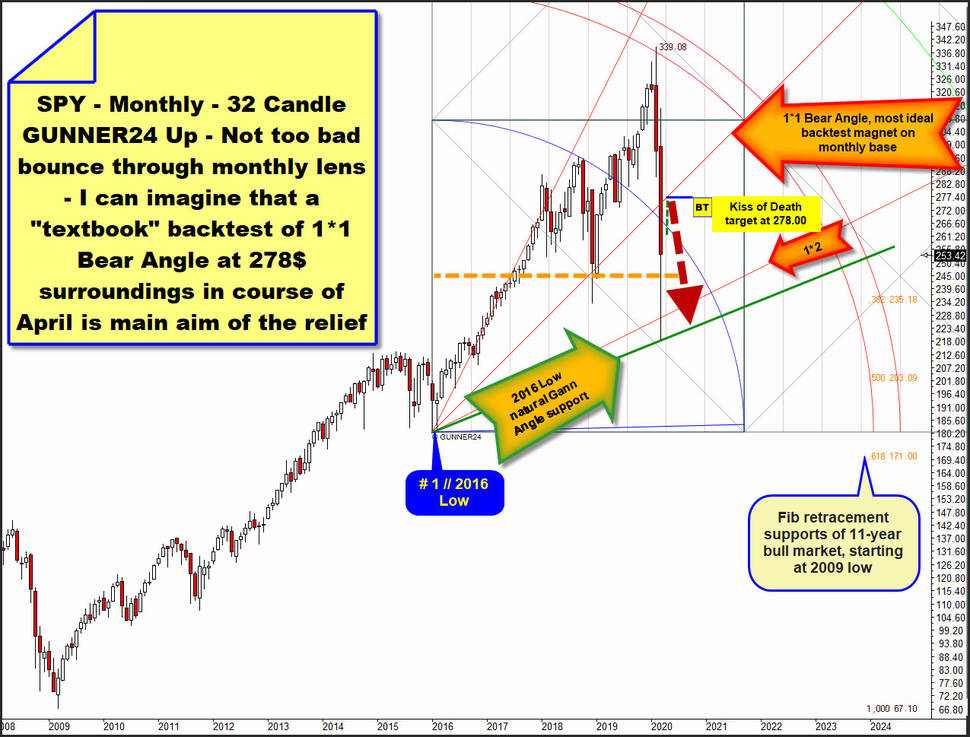

First lets check whats likely going on now in the bigger picture, using SPY ETF and it`s unfolded monthly 32 Candle GUNNER24 Up Setup as example:

The SPY ETF corresponds generally to the price and yield performance of the S&P 500 Index and it seems that the SPY on monthly base is oriented to this 32 Candle up that starts measuring to the upside at # 1 // final low of 2016. After the price for the very first time reached the natural GUNNER24 Uptarget of the lower line of 1st double arc the coronavirus crash-cycle was triggered and in further course any most important nearest support broke finally to the downside, so that market is in bear market condition.

The so far reached crash low (218.26$) exactly arrived at a natural Gann Angle support that springs from important final low of the year 2016.

SPY additionally tested some more existing supports on monthly resp. yearly base at the crash lows and this usually means some stronger support magnet energy has kicked what usually leads to a stronger relief = Dead Cat Bounce cycle= Countertrend cycle = Short Covering cycle. According to the price BUT ALSO ACCORDING to the TIME-FACTOR!

==> At crash lows market reached a nest of strong supports at the same time. Ergo and usually, the market should bounce at least for 2 to 3 week candles.

Since lows of the crash the SPY was able to gain a 43$ on daily closing base or so and about a 35$ on weekly closing base, therefore the March 2020 candle so far shows unusual and very rare long lower wick.

It will be exciting to see how this long fuse will change in the near future into soon due end of month auction. However, since daily trend now likely is up, it is possible that the lower wick gets even longer.

Regarding March close we have to watch and control if price is able to close above Blue Arc resistance what runs 268$ for the candle.

A closing auction above a 267$-268$ for March, therefore somehow defending Blue Arc as important monthly rail, would be relative safe sign for that the backtest of the 1*1 Bear Market Angle is necessary within likely underway relief cycle.

And somehow I feel and estimate that the bounce has the main aim to test this most important resistance magnet back sometimes in course of April...

A) Hmm, I often recognized when such important 1*1 Angles – which always represent the separator between a bull market and a bear market -, are broken or seem to be broken finally with such violence they can also be tested back in a quite short time window.

B) For the coming April 2020 candle the 1*1 Bear Market Angle takes it`s course at around 278$ and I suppose this will be the main target of the started Dead Cat Bounce cycle and perhaps the highest level (give +3$/-3$ in this special SPY case) this relief will be able to achieve before the next plunge:

==> Most natural W.D. Gann backtest magnet is a 278$ with +3$/-3$ divergence or so sometimes in course of April, afterwards comes the cycle which should test back crash lows in a very serious manner. At least...

C) Please remember this, so to say as a rule of thumb until proven otherwise: US markets havn`t shown and received bearish panic or washout volume at so far printed crash lows, therefore a high probability bet is that at least US stock markets have to test back their crash low environments very seriously in further course of 2020. At a minimum...

D) Cause such 1*1 Bear Angles because of their natural importance are sometimes just only tested back to the T from below we maybe can expect a so called "Kiss of Death" turn right at the 1*1 Bear Market Angle separator and IF afterwards main trend resumes then we would have some more proof for the test of crash lows.

E) Time factor/crashwaves-count: We recognize that the first main wave of the coronavirus crash was based on the Fibonacci number 21 before this natural clock forced countless markets in the equity environment into first more sustainable bottoms and counter waves began.

Therefore, it may very well be that current recovery waves will have to orientate themselves once again quite precisely to a higher Fib number.

So either, again, to the number 21 in maximum. Or at the number 13. And that's my tip, due to the present situation!

==> 1*1 Bear Market Angle at 278$ for April 2020 towards the end of a 13 trading days lasting Dead Cat Bounce!

Exactly at 278$ additionally the 50% Fib retracement horizontal rail = future MAIN RESISTANCE of the crash wave has formed:

That's why the 278$ is a very, very important, & at same time unusual strong future resistance magnet for the coming April. Definitely it is a resistance rail on a monthly basis. But more likely it will radiate strength on yearly base.

278$ upmagnet resistance is a logical consequence of the W.D. Gann techniques on the one hand and the Fibonacci technique on the other. Therefore the 278$/April 2020 is a MAJOR Dead Cat Bounce target!

==> For the entire April 2020 the 278$ is MAJOR YEARLY Resistance magnet ==> Most ideal price point where the/a third crash wave could begin.

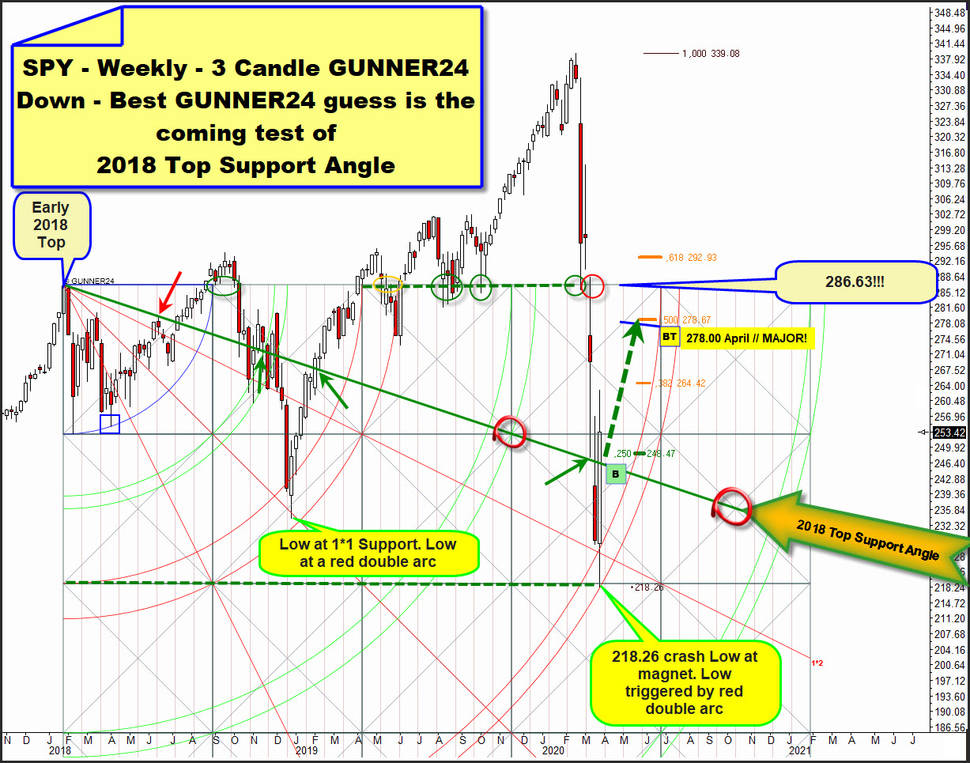

Next please focus to the obvious, well-confirmed & sharp-defined ruling daily resistance I named "8 times Crash Resistance" what represents so far holding resistance on day high base.

The highs of Thursday and Friday tops again have hit so far "8 times Crash Resistance" from below, so the first day the "8 times Crash Resistance" could be finally overcome will be Monday followed by the dark-green arrow forecast into 278.00$/April main Dead Cat Bounce Target!

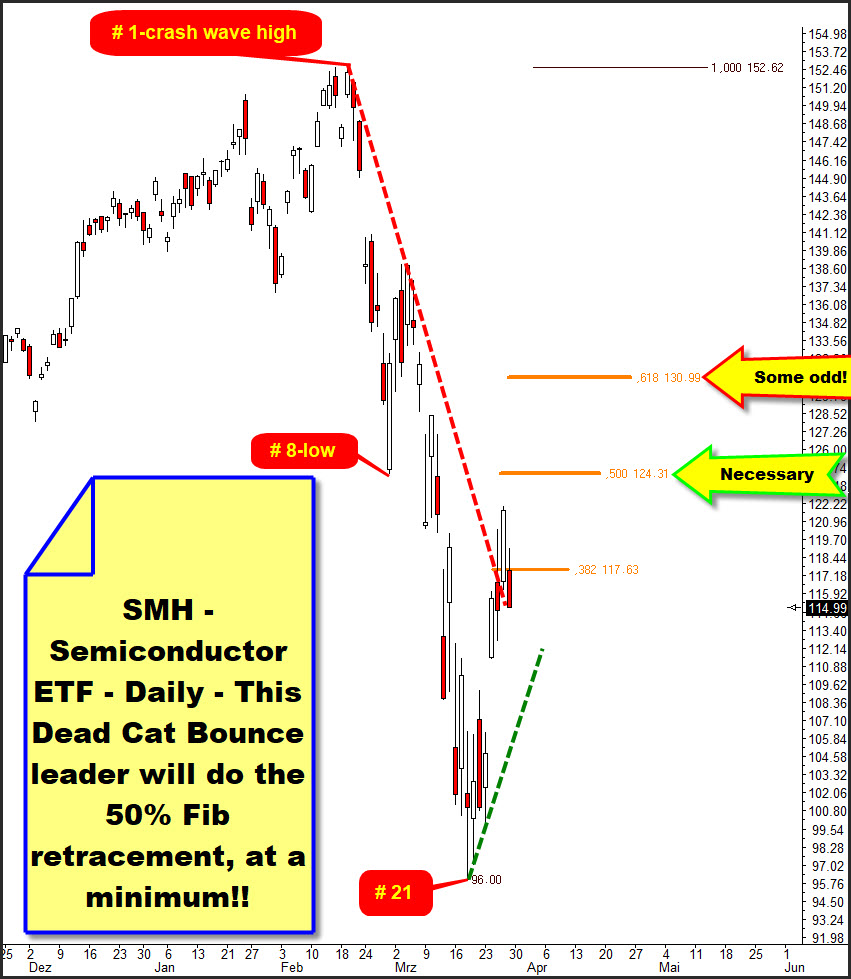

A 50% Fib crash retracement as main target for SPY ETF is not too unlikely outcome when observing a Dead Cat Bounce leader which are – yet again – Semiconductors:

SMH Semiconductor EFT on Thursday closed above crash wave 38.2% Fib retracement rail and at same time above its red-dotted former crash resistance rail whose backtest is probably running right now.

This combined daily long signal activated the run into their 50% Fib retracement at 124.31$! SHM could even test back the 131$ what represents prominent 61.8% retracement resistance!

By the way. Look at the length of that first SMH crash wave. It lasted exactly 21 days here. It's perfect!

After the fastest, deepest crash ever, the monthly main trend and maybe even the yearly trend is now down with some safety and until it is proven otherwise. And since the surprises in a weekly/perhaps also monthly/perhaps also yearly bear market trend usually always happen to the downside, a shortterm oriented bull should not fall in love of buying too high supports. To be on the safe side you should only buy the deeper dips which might turn at somehow stronger supports below current quotations.

Problem: After a just some days of countertrend no really serious SPY supports on daily and weekly base have been finally established. This is why perhaps strongest existing future weekly support should/could be this dark-green lined one below:

The dark-green downward oriented line springs from important early made high of the year 2018 (286.63$) and originally is a Gann Angle that can be naturally anchored in the above overlayed weekly 3 Candle GUNNER24 Down, starting at this "Early 2018 Top".

This setup find should be valid cause we recognize former important bull market low triggered by 1*1 Support Angle and red 2nd double arc combo support.

And again a natural given red double arc became important for the SPY as 218.26$ crash low EXACTLY tested lower line of 4th – = SUPPORT – from above, followed by the massive relief candle that closed at 253.42$ ...

This early-2018 Top price seems to me unusual important for the past crash wave and for some important turns since 2018. For this watch upper end of setup line according price. There are so many visible tests, backtests, achieved weekly extremes!

Think a last test of this 2018 Top Support Angle occured at most right placed dark-green arrow what marks a weekly spike low within seen crash wave.

==> so this angle was important magnet within recent crash wave and perhaps will be important future support for the awaited dip within overall Dead Cat Bounce cycle which might test back the 2018 Top Support Angle at 245.50$ surroundings in course of the next 5 trading days!

Be prepared!

Eduard Altmann