The risk assessment of this crisis is currently overtaxing every single person on this earth. Much further in the dark and only very vaguely foreseeable are the short-term and longer-term negative economic consequences of the future in a vacuum of chaos. Because in chaos nobody can even remotely correctly weigh up when which dominoes will fall where in which sequence. Chaos gives birth to chaos, just as panic results in more and more panic.

Until at some point the state of exhaustion sets in where the bottom is found at some prior defined major supports and it turns.

We human beings, on the other hand, need

rules and safety that we can adhere to, so that we can live well or at

least in relatively orderly circumstances.

I would therefore like to first of all refer to him and his studies.

Please read this. Even if it is time consuming. It helps, because it

gives us some guidelines concerning the current situation. It provides

very sound scientific evidence and facts why where what could happen

and how it could end. This is the coranavirus playbook for what we have

to expect based on the data until 03/13.

https://medium.com/@tomaspueyo/coronavirus-act-today-or-people-will-die-f4d3d9cd99ca

Unfortunately there is a lot of math about the country-specific case numbers, the timing, but only this ingenious comprehensive work helps us to understand why there are successful models and negative models and why individual country governments are doing well to get the virus under control and others are doing super-bad because they react much too slowly and are weak in decision-making.

For this he has given us many, many revealing number sequences packed in pictures and graphs as proof and draws totally logical conclusions how all this should end if you do it mostly right like China, Taiwan or Singapore or very bad like the Italians, we Germans & most other European countries, UK & unfortunately also the USA.

In the end, it's really only a matter of hours and a few days of very few, but super important containment measures that have to be taken to keep the virus relatively under control and why the Europeans, UK and US likely will not manage to contain it because they are far too lax and clearly too concerned about the welfare of their economies.

Since the virus can stay up to 6 days at doorknobs, in buses, at work and elsewhere without dying the most important key seems to be the immediate TOTAL social quarantine = lockdown = full curfew to keep the death toll in the respective country below 1%.

Countries that trigger the lockdown „relatively" quickly will likely have a mortality rate of less than 1%. A slow, gradual, delayed, nationwide lockdown could probably lead to a mortality rate of up to 4%. Of course, the medical equipment available in the respective country also plays a key role.

All these important connections in the article above ARE of course also

known to the GOVERNMENTS and the more courageous countries are already

closing down completely because of naked numbers and their connections

do not lie. Italy lockdown on Friday. Spain lockdown on Saturday.

France started virtual lockdown on Saturday. Some other – less

system-relevant EU countries have closed their borders.

While Europe is now falling into pieces since Friday in this context please remember this rule writen in stone 2 weeks ago ==> If we see more countries shutting down like China this adds to the longerm problem for the stock markets and feeds the panic, the current drop in prices!

Additionally this is a next rule of thumb ==> the more important the lockdowned country is in terms of its economy, the greater it`s system relevance and the greater the budding panic and the drop in prices in case of lockdown!

Germany likely will consider a virtual lockdown (nor fish nor meat) in 5 days at the earliest and I really wonder if it will come with the incompetence shown so far. Before then and quite quickly, I think, the total France shutdown will be announced, because Macron is much more consistent and much smarter than Merkel.

So far, It looks like the UK-islanders are not impressed at all, according to Prime Minister Johnson, and want to be infected on purpose. This is a pragmatic view, whose impact on the economy cannot be estimated at all.

That's why the danger of a 4% death toll is given for all these most system relevant countries of Europe.

The US is - of course - the biggest, fattest domino piece imaginable. In the worst case and up to the minute, I expect the USA to virtual close down some of the more important states like possibly California, Florida, New York and the virtual lookdown of some non-system relevant states in course of the next 14 days or so, but due to the geography of the country no nationwide shutdown.

And that is probably a glimmer of hope for us traders and investors and the global economy, because a nationwide US lookdown would be the biggest potential disaster for the global economy. Then any stock index would probably trade just above 0 pts and Trump will never let either of these things happen.

So much for the more fundamental mosaic pieces of the still ongoing coronavirus stock market crash cycle for the about next 14 days. Let us now turn to the charts and other important things according price and time and psychology. Hopefully this view will going to help you understand the structure of the underway crash wave and what is really happening.

The selling will abate at some point. Even after such a rapid and steep decline which broke stock charts and bear market started nearly every where.

Cause at some point the markets found a new price balance and there will be a few reasons for the market to start an unsual strong technical countertrend cycle. One could be the sellers exhaustion/strike what usually kicks in when it becomes to risky to stay short or to continue to hammer them all cause they have dropped too steep, too fast, too low and have reached major natural supports.

Or simply the time factor takes control of everything - because the mass of market participants is often oriented exactly to this; quite unconsciously, of course. The „time is now ripe" is another good reason why selling simply ends.

The next 1% US rate cut will be announced Wednesday by Fed and this is in conjunction with the 21-day/5 week Fib number possible very important turn cluster.

This due important time-support-cluster and the knowledge and experience that important Fed rate decisions often mark or signal an intermediate extreme followed by a turn allows and offers that intermediate coronavirus crash lows could be found around next Wednesday to Thursday as we are able to count that next week Thursday will be the 21st trading day and then additionally the 5th week candle of crash cycle that started the day the S&P 500 made its alltime-high.

This monthly YM # chart above highlights the crash downtarget area that I believe represent clear and very strong price support for the Dow Jones emini. The 20700 down to a 19700 with the help of the Big Round 20.000 pts W.D. Gann MAJOR support number what is natural ideal backtest magnet.

Usually..., usually! and IF! sell-off continues into 21-day/5 week Fib number important turn cluster this crash cycle ends somewhere between 20700 down to 19700, followed by a sharp, hard and at least 4000 to 5000 pts technical countertrend.

At this point, the YM # shows a weekly close below the Blue Arc & 1*1 Angle within the monthly 35 Candles up setup that starts measuring at very important # 1 // 2015 Low.

For all the always important backround according this setup please re-visit here: „1 against all – or the now most imporant support magnet on earth! Free GUNNER24 Newsletter 03/01/2020.

Both, Blue Arc together with 1*1 Gann Angle have been major bull market supports, have been the very last bull market resort. Because the week closed far, far below the Blue Arc now both together, GUNNER24 Forecasting Method and W.D. Gann`s important gann angles trading rules activated with a +80% probability the now necessary test of 1*2 Support Angle in further course of bear market and in course of 2020.

Blue Arc as 1*1 Gann Angle have morphed to resistances at least on weekly base!

Cause this crash cycle is fastest worst ever happened in stock markets history with some more limit downs expected for Monday it might be the case that this month March 2020 already wants to test and work off the 1*2 Support Angle crash downtarget, then perhaps at around 19730, cause there the dark-green dotted 2014-2016 support line (a strong yearly support magnet) is intersecting that important Gann Angle downtarget, thus forming very, very attractive crash downmagnet!

But at a minimum and normally the YM # should again at least print a 20725 pts during this actual running crash wave and until next week Friday! So far crash wave low is at 20230! This is a MAJOR SUPPORT Fibonacci retracement support cluster out of 2 of the most important lows of this millennium!

IF a week close below 19200 pts is seen until end of April 2020 and either the March 2020 and/or April 2020 deliver a month close below 19200 we have received crash continuation signal for the # 1 // 2015 Low environment backtest - a 16000-15000, or so – likely sometimes due in course of summer 2020.

I usually do not publish my yearly chart work to the public, but it is necessary now to radiate some hope, together with some rails and rules that we are able to manage this unusual dangerous event hopefully somehow.

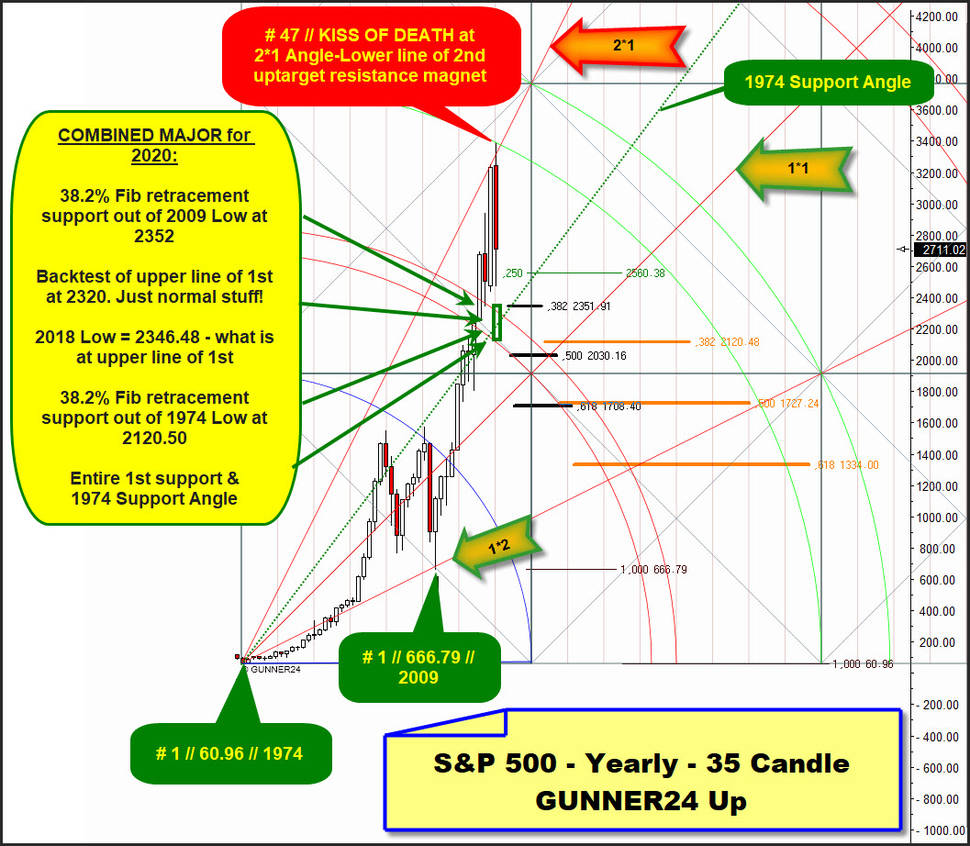

This below is a S&P 500 index chart on yearly base enriched with the most ruling GUNNER24 Up Setup. Setup starts measuring to the upside at final low of 1974.

An 35 up is 35-1= 34 Fib number measuring. The overall bull cycle starting at 1974 Low topped after 47 year candles 100% accurately at lower line of 2nd double arc GUNNER24 Uptarget. At same time price tested the 2*1 Angle the very last time from below. Negative!

And this combined is a so called "KISS OF DEATH" starting at combined resistance magnet what triggers mostly always an unusual strong countertrend cycle which often like to deliver some quick/fast backtesting of some major important support magnets below.

And this KISS OF DEATH is for sure one that will go down in the history books. At least when we look at it in terms of months and weeks and days.

KISSES of DEATH come across in any time frame. On decade, yearly, quarterly view. In the much lower time frames like 1, 5, 15 Minute and in the hourly`s we observe them a dozen times a day in any market.

And this KISS OF DEATH looks like it needs with a +95 % probability at least the very classic, just quite normal backtest of the 1st double arc environment which upper line runs at 2320 pts for the year 2020. Please watch closely that the final low of 2018, then at 2346.48 pts, was a very accurate very positive backtest of this upper line of 1st from above.

And this is why we have got confirmation that A) the upper line of 1st should be important also for the future... B) upper line of 1st should act as a strong support on yearly base.

KISSES of DEATH sometimes like to over-react and wish to violate most important supports/backtest targets running below by some amount. And this is why I have placed the tiny dark-green rectangle, where I think this coronavirus panic wave could end hopefully influenced by 21 day/5 week Fib number time cluster support and with some more help of MAJOR important supports which are carfully noted in the yellow/green left box.

So far, I believe, the overall MAJOR 1st double arc support environment and ideal backtest magnet at least on yearly base will trigger the bull energy to stop this crash cycle somewhere between 2320 and 2100 pts. Followed by massive, hard technical countertrend what could print a 2900 or so, even could head for a "classic/textbook" Big Round 3000 pts backtest!

IF weekly & monthly closings below 2070 pts bear continuation trigger will be printed until end of April 2020 nobody is safe anymore, IMHO!

In such Armageddon case the 1*1 Gann Angle together with at about 1708-1727 pts residing Fib retracement support cluster becomes official next important downtarget for the virus crisis crash cycle and with usual high odd should be worked off in further course of 2020.

==> Ideal 2020 backtest magnet for S&P 500 at 2320 to 2100 pts. This is MONSTER-CONCRETE support range. IF this CONCRETE will finally broken to the downside expect the 1700 pts support magnet and strongest existing bull market support out of 1974 Low support enormously fast.

The above analyzed YM # and S&P 500 supports combined have the potential to trigger the next Hit & Run Low and allow that stock markets could print higher bull market highs until end of 2020!

Please use these 2 setups together with analyzed crash cycle downtargets as a reminder and working tool for the coming days!

Be prepared!

Eduard