Today I’d like to run a check of the most important and leading monthly GUNNER24 Up Setups, as I use to by the beginning of a month. It’s the S&P 500 that is being considered today, representative for the stock markets worldwide, as well as furthermore silver and gold.

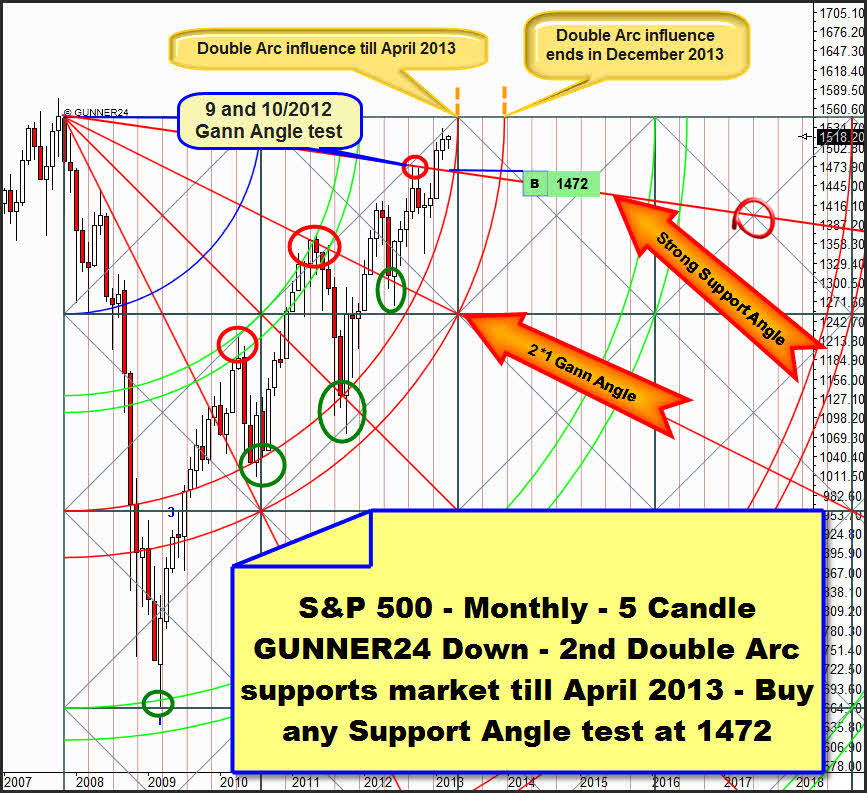

Let’s get started with the S&P 500 out of which I’m getting the greatest kick today… Since 06/03/2012 we know for certain this: The bull market in stocks that had begun at the beginning of 2009 cannot come to an end before April 2013:

That’s where the support influence of the upper line of the red support double arc ends that is thrown up by the monthly 5 Candle GUNNER24 Down Setup above. The time doesn’t permit a change in trend before. The upper line of the 2nd is cutting the time axis in May 2013. Correspondingly, April will be the last month before the temporal support of the upper line of the 2nd will finish.

From May on we’ll have to watch how the market performs trading between both lines of the 2nd. Within the lines of a double arc the forecast is always a little more difficult, concerning its course. Sometimes it’s very volatile in both directions. Mostly the market is getting severely out of breath as soon as it’s trading within both lines of an upward support double arc.

But in an extreme case the 2nd above is going to support the market until December 2013 without permitting hefty reactions downwards. So an extremely bullish year is newly facilitated for the stock markets! And that’s what is very likely to happen, I assume.

Correspondingly the market is expected to exhaust now that the price is more and more forced up by the temporal support of the 2nd, because it MUST (!) join the 2nd turning into a rather flat correction (3-5 months) from May on – about 1350 through the summer/autumn low 2013…

Beginning in 2010 the market has been bouncing between the 1st double arc (green) and the 2nd double arc (red). At the beginning of 2012 the 2*1 Support Angle was taken being re-tested in May and June 2012 (upmost green oval). This successful 2*1 Gann Angle test triggered powerful rebound energy. Since then the market has been running up, seemingly without visible corrections. As mentioned, this rally is not supposed to come to an end before April.

Correspondingly at least until the end of April 2013 longs on monthly basis keep being on the agenda! But where is the best – because riskless – entry into the current uptrend now? About that, please pay attention to the strongest support angle anchored in the middle of a square, on the very right in the setup above. For the moment this angle couldn’t be taken in 9+10/2012. Then it was tested as follows: The high 9/2012 was exactly at 1474.51, and the high 10/2012 was 1470.96. For March this strongest support Gann Angle is situated at 1469. Remember please!

Weekly time frame:

"From my point of view the market is likely to correct onto the support Gann Angle within three weeks. A daily close below 1497 will activate the next lower Support Gann Angle as the target for this correction, with target narrowly below 1480."

also:

Daily time frame:

"I suppose that the wave 4 is becoming an ABCDE correction pattern. Correspondingly, the market should be situated in wave B that shouldn’t correct above 1528. So a lower daily high should be underway now. Since the 2*1 Rally Gann Angle is broken finally now, according to W.D. Gann’s Gann Angle Trading Rules the next important Gann Angle which is the 1*1 is becoming the target of the current move. Correspondingly and taking into account the signals of the weekly 5 Candle GUNNER24 Up Setup for wave 4 I expect the 1472 to be the final target of this correction."

Now the icing on the cake:

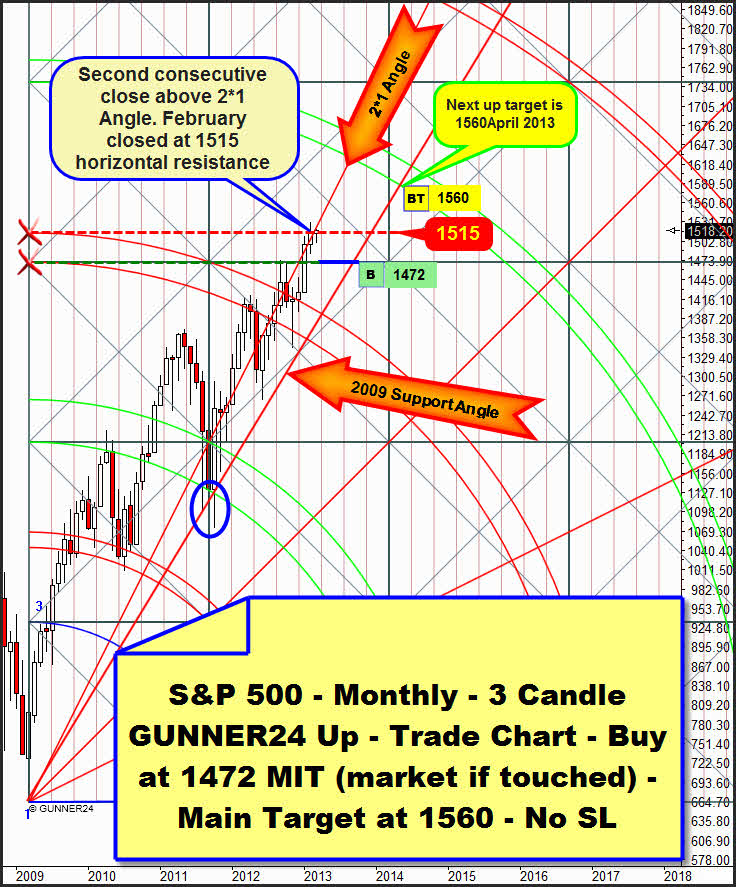

Exactly at 1472 the important monthly 3 Candle GUNNER24 Up of the S&P 500 is likewise throwing up its very strongest support and down magnet. At 1472 the horizontal support is situated that arises from the intersection point of the lower line of the 3rd with the beginning of the setup.

So altogether in four ruling GUNNER24 Setups (twice monthly, once weekly and once daily time frame) we can identify the 1480-1469 region as to be both the strongest down target and the strongest support magnet.

Rule: As soon as a Gann Magnet is identifiable in different time frames it will get the probable target of a move. – In this case as many as four different GUNNER24 Setups are throwing up the 1480-1469 as a strong support.

So, in the current correction we don’t only go long at 1472 on daily base – as announced last Sunday – but also with a monthly position MIT (market if touched)!

You see above, the monthly 3 Candle GUNNER24 Up is throwing up the strong horizontal resistance at 1515. This is what the market has to struggle with now. February 2013 closed very narrowly beyond that, exactly at 1514.68… Overcoming the 1515 is in store, March is going to close above. Thus the 1560 until April 2013 would be confirmed as the next target.

The reason for this forecast is given by both narrow closing prices above the 2*1 Angle in January and February, respectively. Indeed, this 2*1 Angle is technically representing a strong resistance. But the fact that the market newly copes to close above it is demonstrating its inner force.

In the monthly time frame the market doesn’t show any weakness. A daily close above 1531 in March should be the trigger for the 1560 that will be reached in end of April 2013.

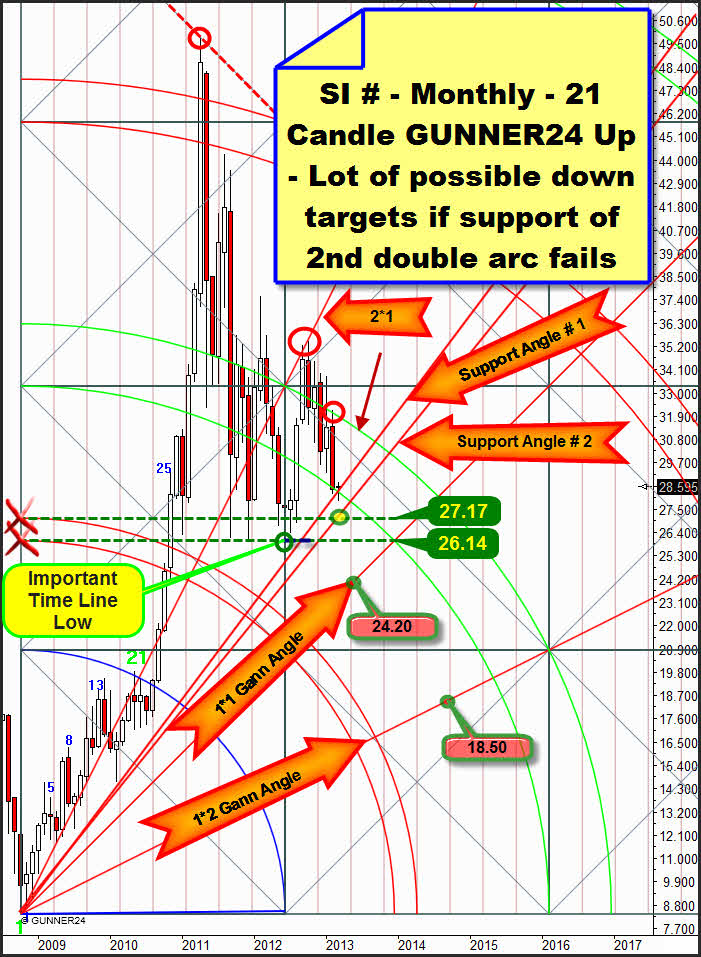

Let’s go now to the serious side of life. Silver and gold are looking like death warmed over. I don’t want to dedicate much time on them today because the outcome is really rather simple. Either both turn up significantly and permanently within the next two weeks or things will look pretty grim. If both don’t turn, persistent losses through June 2013 will be very likely. The possible correction process– I mean the individual down- and up-waves within a more extensive correction - is expected to develop infinitely complicated. From today’s point of view, temporally it is not exactly predictable:

Silver has still got some air cushions in its chambers. Silver’s actual performance around the lower line of the 2nd and my anticipation tell me that the thoroughly existing support function of the lower line of the 2nd combined with the possible – and expected – support function of the support Gann Angle # 1 should really be sufficient to force silver at least into a three to four month lasting uptrend now. First target in that case will be the upper line of the 2nd at the red arrow at about 31$. But the rebound energy of the 2*1 Angle that tested back silver in 9+10/2012 may continue being strong enough to break the support of the lower line of the 2nd downwards.

The possible lose of the lower support line of the 2nd would allow – and even make very likely – that the downtrend is intensified again. If such an important monthly support as the lower line of the 2nd finally falls, consecutively there will be the large threat that the super strong horizontal support area between 27.17 and 26.14 will likewise be cracked during the next test obliging thus the 24.20 at the 1*1 Gann Angle to be worked off till June 2013. That’s the extreme scenario that I’m able to see today. But from my point of view the way to the possible 24.20 is impossible to be sketched since at any time at the strong 27.17, 26.14 but also at the Support Angle # 2 some strong counter-trends or even new long-lasting monthly lows may be marked…

For me, the crux of the matter in silver is the lower line of the 2nd. Will it resist, will it fall? We’ll have to link this important monthly support with the very most important month support in gold, to a T. Is the 2*1 Support Angle in gold going to resist, is it going to force gold up now?

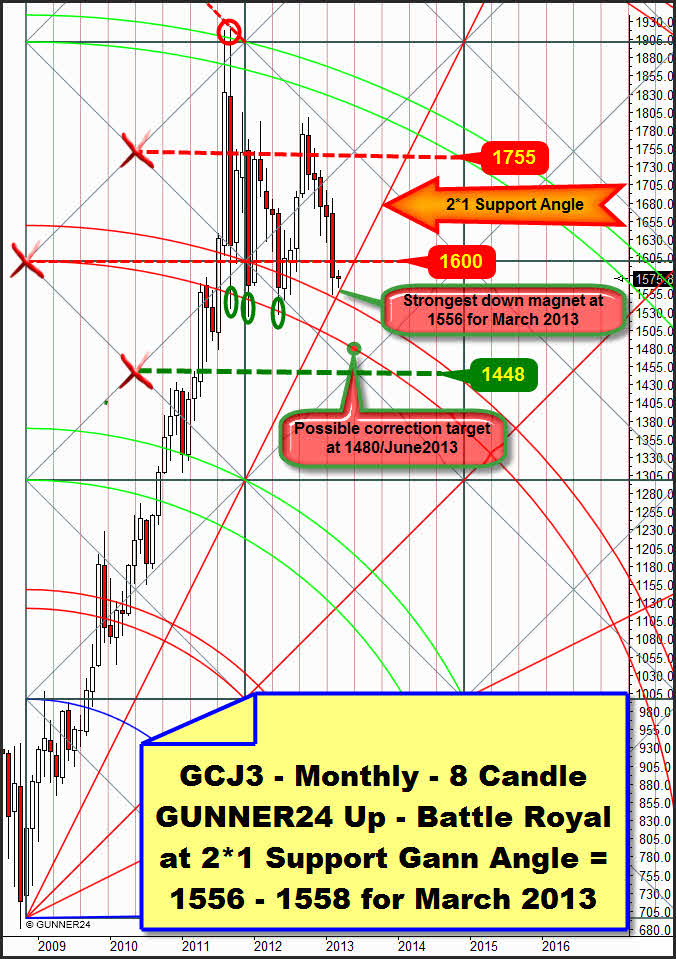

Since the last monthly December 2012 sell signal the 2*1 Gann Angle was the downtarget in the monthly 8 Candle GUNNER24 Up. It has to be reached. Only from there a change may come off. Silver and gold are at the respective important supports at the same time. And the time is mostly crucial in the GUNNER24 Forecasting Method. Will both rebound from the supports simultaneously or will they break these supports simultaneously?

To touch the 2*1 Support Angle exactly it will still take the 1558-1556 for March 2013 – maybe this week. TECHNICALLY according to the W.D. Gann Angle Trading Rules gold will have to rebound upwards significantly from this important 2*1 Support Angle. The 2*1 is just undergoing the very first test. This rebound is actually supposed to be strong enough to reach newly the 4th double arc in the monthly setup above.

Taking into consideration the lost motion, falling below the 2*1 down to the upper line of the 3rd = 1545-1540 is perhaps allowed. If the 1540 on daily base falls, the 1480 or maybe the 1448 will be likely to be headed for till June 2013. Daily closings beneath the 2*1 Support Angle in March – i.e. below 1556 – wouldn’t make just gold and silver most susceptible for further hefty declines. They might lead to brutal eruptions in many other commodities. Severe sell-offs would be to come…

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann