Tomorrow Monday 29 will be the last trading day (TD) of the month of February. There are strong and clear indications on this day to become extremely important in regard to its signaling, so that tomorrow may happen something fundamental for gold.

Price meets time. When these two important trading factors come together, mostly important moves, frequently strong trend moves imminent. Extremely important decisions in terms of signaling can be made respecting the short as well as the medium term.

==> So, beginning tomorrow, the current sideways trend in gold is very likely to dissolve either upwards or downwards. Thereby, some very good trading opportunities in gold will emerge:

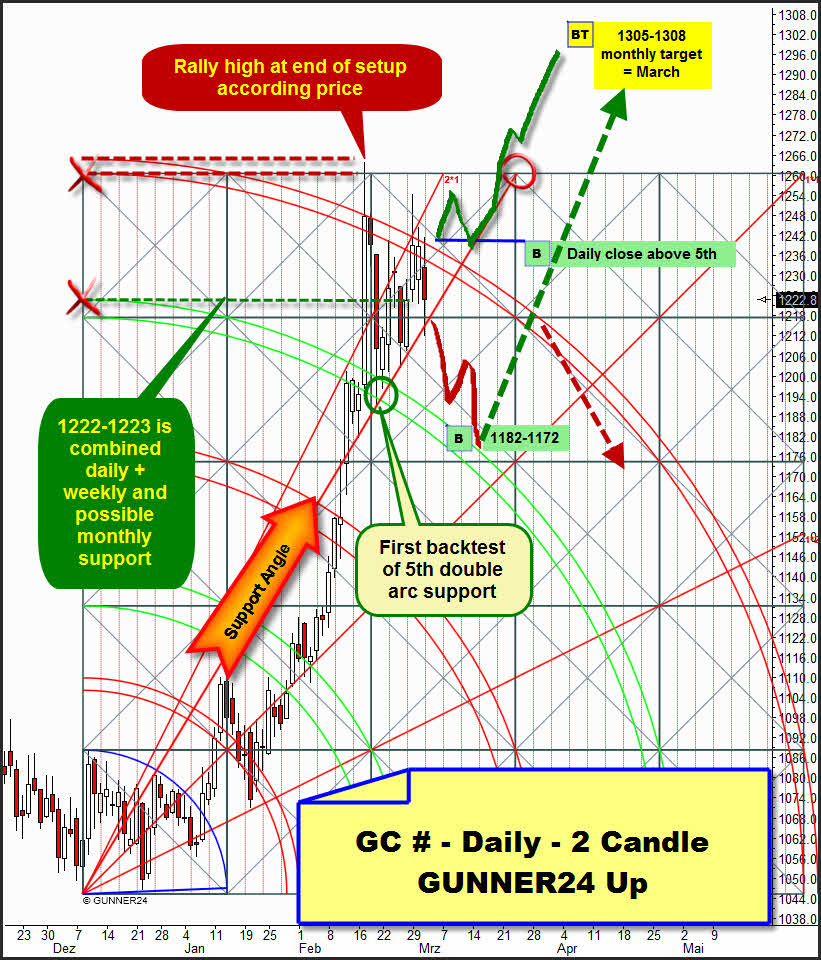

The down setup in the daily time frame above visualizes for us the currently most important factor of influence in terms of time. The three higher lows after being reached the December 2015 bear low were influenced by the Blue Arc = strong uptrend support in the daily time frame.

The third touch = 3rd test at the Blue Arc released a really enormous upwards energy thrust being ultimately the trigger for gold to ascend truly in panic up to the final February 2016 high (1263.90).

Tomorrow, on Monday, the price will meet again its currently most important and most dominating time support. In the chart above, I optically visualized this condition with the dotted orange vertical. The Blue Arc intersects the time axis tomorrow, thus it comes to the fourth test of the market with its currently most important time support in the daily time frame.

We know that the rule of 3 and the rule of 4 were elementary investment and trading instruments for W.D. Gann. After the third and the fourth tests of a support resp. resistance magnet, generally the strongest trend moves develop --> like the gold rally above after the third successful test of the Blue Arc. Yet at the same time this rule means that precisely these magnets have the tendency to fail finally at the third resp. fourth test. In such a case the trend changes.

==> Thereby tomorrow a preliminary decision is supposed resp. most likely to be made on the way gold will be willing to perform in the near future. Either it will be keeps on rising again or the present congestion zone will rapidly dissolve downwards.

Extremely precarious is the coming together of two trend-setting time factors the same day. Tomorrow is also February close, thus an important signal in the monthly time frame will/may be generated/released.

Gold has developed insofar as the die 1222-1223-GUNNER24 Horizontal has now become the currently most important price magnet again. This magnet is soon going to decide the way gold will develop further on:

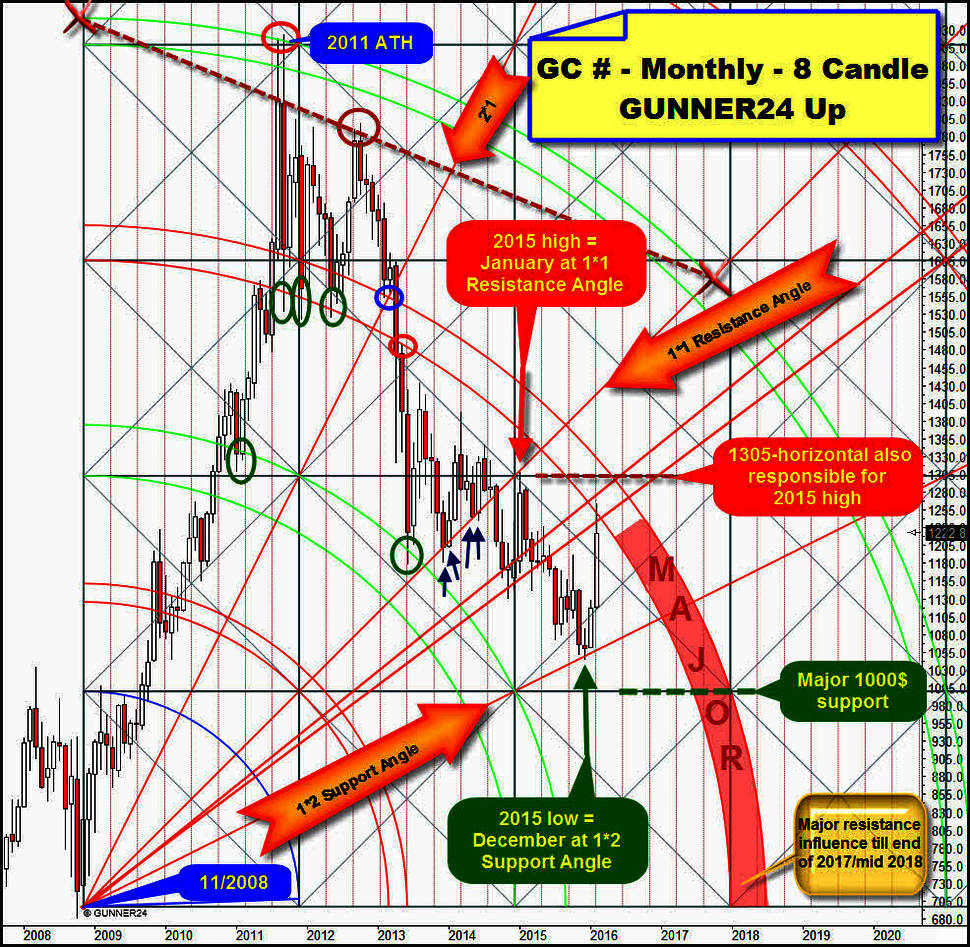

Above, a fundamental chart for gold in regard to its most important horizontal magnet. It was worked out and presented on 08/02/2015. Since it’s matter of horizontal magnets that can all derived from the all-time high, they have an enormous signal effect and enormous support resp. resistance function in the decade + yearly + monthly + weekly + daily time frames:

Obviously, the 1222-1223 magnet has been examined very intensely the last days. In the chart before the last, compiled on 08/02/2015 you can verify once more the elementary importance of the 1222-1223 horizontal for gold in the years 2014 and 2015…

By being finally overcome on weekly closing base during the last rally, the 1222-1223 has newly become an extremely important weekly horizontal support for the year 2016 for the time being.

Last week closed at 1222.80, thus testing back this weekly support successfully for now = I mean at least successfully on weekly closing base.

In addition, during the last days this magnet has gained importance again in the daily time frame as well. Last Wednesday and Thursday tested together the 1222-1223 magnet at the lows. Like perchance, Friday closed exactly at 1222.80 at the combined daily and weekly support horizontal magnet.

Now we summarize: 1222-1223 is now combined support magnet in daily and weekly time frame again!!!

Since tomorrow, 29th, the next signal in the monthly time frame will be generated, technically it can turn out only this or that way:

A) February 2016 succeeds in closing above 1222-1223. In this case gold has got to go even higher in the short term. For a February 2016 close above the 1222-1223 would be a rather important GUNNER24 Buy Signal in the monthly time frame! This would activate the 1305-1308 to be reached AS EARLY AS IN MARCH 2016!

B) If February does not succeed in closing above the 1222-1223, hence gold will fall below on Monday already – quite possible because at the fourth test the important Blue Arc time support in the daily time frame wants to fail!!!! Tcha, then consequently it will go swiftly downwards to the next lower and important 1182-1172-daily support area.

Which way gold will choose ultimately – rapidly upwards again or heftily and harshly downwards!? – I cannot tell you at the moment. But I can show you the way you’ll have to trade the imminent important developments of next week – with the help of this GUNNER24 Up Setup:

The 2 day up setup applied at the bear low telegraphed a change in trend at the rally high because that is where the end of the setup according to the price was reached. At the end of the setup in terms of price, the dominating trend changed from up to sideways gold thereby consolidating by and large very bullish the last days between the 5th and the 4th double arc.

With the first backtest, the first downswing after the rally high tested the 4th double arc as well as the currently determining Support Angle very successfully.

==> Because being confirmed, the 4th double arc is thus future strong support in the daily time frame.

Since the 4th double arc emitted astonishingly strong support energy, during the current sideways trend gold had to go up again in order to pay a few visits.

Gold tested back the 5th double arc in an intense and rather promising way. So far, the metal has not achieved any daily close yet above the 5th double arc however.

==> Thereby, the 5th double arc is multiply confirmed daily closing base resistance. Consequently, as soon as the 5th double arc is finally taken on daily closing base in the course of the coming days, we will have to BUY gold with a 1305-1308 uptarget = next higher uptarget in the monthly time frame!

==> For to see the monthly situation and where the 1305-1308 resistance magnet is located please observe this chart:

The last 7 trading days, gold bounced between the 5th double arc = daily main resistance and the Support Angle to and fro. Together with the 1222-1223 magnet, the Support Angle is the currently determining support. Therewith gold is restricted by the 5th double arc now. The Support Angle is an intraday support (for this, please watch the latest successful backtest of the Support Angle at the received 1212 - Friday low) as well as the daily closing-base support.

Here’s still a pretty intense remark on the consolidation pattern that took shape after the rally highs. For it gives a first serious clue on how gold is supposed to be developing and which signal in the short resp. even medium term is expected to be generated tomorrow, 29th...

It is clearly matter of a tight pennant. Pennants use to dissolve in the dominating trend direction with a 61% of probability. The current sideways trend is definitely not a symmetrical triangle, so far!!

Because:

A) The consolidation after the rally high was clearly preceded by an unusual steep flagpole. And B) as long as the consolidation period amounts to less than 15 trading days, after chart-technical definition it is always matter of a pennant that does not mutate to a symmetrical triangle before the 16th day of the consolidation.

Read up in Bulkowski’s (http://thepatternsite.com/pennants.html)!!!

==> So, with a 61% of probability, the existing tight pennant consolidation pattern makes gold be supposed to break upwards finally in the course of next week.

==> And now, hold on tight. If the bullish pennant happens to be dissolved upwards, after the measure rule a next 100$rally may be triggered = 1222$ + 100$ = 1322$.

If however the month of February is not able to re-conquer the 1222-1223 on closing base and if just one of the next 5 trading days closes below the determining daily supports being the Support Angle, technically gold would have to dissolve the pennant downwards gold consequently falling back to the 4th support double arc environment in the daily time frame within 10 trading days and working off the 1182-1172 in March! In order to test back afterwards at least the daily major 5th resistance double arc in succession.

==> So, you buy the first daily close above the 5th double arc within the next 5 trading days for the then activated 1305-1308 monthly uptarget that is supposed to be reached very fast in that case, probably as early as in March 2016.

==> Or/and you buy the 1182-1172 support area within the next 10 days for another test of the 5th resistance double arc (1222-1230 region) in the course of March. 1172 is now most important future support in the monthly time frame and for the rest of 2016!

Be prepared!

Eduard Altmann