During the last days and weeks, again and again I obtained inquiries by fellow traders and interested readers asking: Was that it with the gold and silver bear market resp. what do I think about the powerful gold and silver rises and the strong rally in the Mining Stocks. Or, furthermore: What is the substance of the current uptrend to be considered like? How important is it?... How far is it going to go according to price and time, as to my assessment?

Well, long enough I’ve been pondering on the last December 2015-January 2016 precious-metal complex bottom hitting/studying the charts for many, many hours. Consequently, I have to come to the result that the bear market in gold, silver and the mining stocks is not over yet. There are simply too many inconsistencies and disturbing factors speaking against the interpretation that the final bear market was reached already in December 2015-January 2016.

Certainly I think and expect now – some clear and rather strong buy signals in the monthly time frame have emerged and developed – that the precious-metal complex is mostly going to be characterized by upwards forces in 2016 rising up to some important resistance magnets. However, at the latest from January 2017 the overriding bear market is supposed to be able to gather pace again coming to an end at the earliest by the end of 2017, but rather in 2018.

Well, I don’t exactly recommend now to gamble away the roof over your head regarding the current uptrend, but anyhow we may state that the December 2015-January 2016 bottom is the sustainable trigger for a several month countertrend in the monthly time frame. Correspondingly, we are forced and being allowed now to look for long-entries prudently and carefully, always keeping in mind that everything that may happen during the coming months will certainly be but an extensive countertrend move in the overriding bear market. These countertrends use to finish abruptly, without any forewarning, sometimes or maybe often missing the calculated uptargets!

Disturbing factor # 1 I see and perceive, even feel when I analyze the December 2015-January 2016 bottom is the fact that the mining stocks (HUI-Index = NYSE Arca Gold BUGS INDEX) bottomed after silver and gold being the last of the important segments in the precious-metal complex on 01/19/2016:

Gold bottomed first on 03/12/2015, silver did secondly on 12/18/2015. With 99.19 pts., the HUI reached its last sustainable bottom on 01/19/2015. Considering the past, as far as important bottoms in the bear market are concerned resp. examining the bottoming chronology after long-lasting corrections, this sequence is actually a little unusual. Mostly, the miners are in the front row when it comes to form an important bottom.

Disturbing factor # 2 is derived from the way the current bear market bottoms take shape. Neither the gold or silver bottoms nor the Miners Stock bottom are showing the minimum indication of an exhaustion move = panic at the lows. The attained bottoms turn upwards slowly:

Silver is showing a rounding bottom in the weekly, gold does in the daily time frame. The HUI – well identifiable in the monthly chart above – tested its Decade Support Angle altogether 7!!!! times without presenting much power or deflection = energy before it decided ultimately with the January 2016 candle to turn finally upwards from the Decade Support Angle.

Disturbing factor # 3: What I think is this: Shouldn’t we expect that this long-lasting bear market end with a bombshell first demoralizing even the last bull, then pulverizing and ultimately exterminating him?

Instead – and here comes disturbing factor # 4 – in gold as well as in silver (by the way likewise in the HUI), the December range (margin from high to low) was the smallest of all the month candles of the year 2015!!! Odd + strange!

Before I deal with further disturbing factors existing in gold, briefly to the current signal situation of the HUI = Mining Stocks.

I first analyzed in detail the very important 2003 top GUNNER24 Up Setup in the monthly time frame above within free GUNNER24 Forecasts, 02/07/2016 "Gold and Silver Miners - The uptrend year". So, please read up there exactly by what the Miners are driven at the moment resp. where they are drawn to in 2016…

For the Gold and Silver miners resp. the HUI – as to my impression – reveal unequivocally what this countertrend is really, what it is trying and able to develop like according to price and time:

Firstly: By all means, the HUI seems to be willing to test back its high of the year 2015 (2015 high is at 211.23), namely at the latest in 10/2016 = Second Target 225.

Secondly: By virtue of the current signal situation the HUI is even allowed to intend to work off the high of the year 2014 (261.36) in this countertrend. Namely, at the latest till 02/2017 = Main Target 225.

Thirdly and thereby to the next buy-signal that is developing at the HUI: On Friday, the HUI closed at 158.72. Thus, with only one trading day on the agenda of the month, February is most likely to close in the important resistance area that is situated between the final bear market low 10/2008 = 150.27 and the first small higher low of the month 11/2008 = 159.28 pts. Perhaps February even closes above the 2008 bear-low resistance area that takes its course at 150.27-159.28.

==> In any case, just the fact that February should/will close near its highs and between 150.27 and 159.28 is THE NEXT IMPORTANT AND STRONG BUY SIGNAL generated by the monthly time frame! Therewith:

==> the current uptrend is supposed to work off pretty swiftly… probably as early as in March 2016, at the latest till April 2016 – its first important target, the 193 pts = First Target!!

==> So keep on long with power Gold and Silver Miners till the 193 being reached! Add some more longs on Monday! Buy more at a 140-135-pullback in course of March and April 2016!

Fourthly, and thereby to the clear hint when this countertrend of the precious-metal complex is supposed to come to an end finally:

==> I think, at all events the Gold and Silver Miners will have to begin a next strong bear market leg as soon as the 5th double arc resistance is reached and worked off. The 5th double arc is all-dominating future resistance, since it’s all-time high (ATH) resistance that is supposed to chase the HUI downwards again afterwards, into the then final bear-market low. The temporal influence of the 5th double arc = ATH resistance will end about mid-2017! ==> Therewith this countertrend is supposed to be finished either after the Second Target will have been worked off near 10/2016 or at the latest the Main Target will have been worked off till 02/2017!

==> Not before the HUI delivers a clear monthly close above the 5th double arc ATH resistance I’ll be convinced that the December 2015-January 2016 bottom was the final bear market low for the precious-metal complex. Namely till 06/2017!

==> Since the Miners are allowed to test back the high of the year 2015 still in 2016, and since they are furthermore allowed to test back also the final high of the year 2014 in this countertrend, we have to work on the assumption that gold, too, will be able to reach/have to work off the final highs of the years 2015 or 2014 in the current countertrend!!!

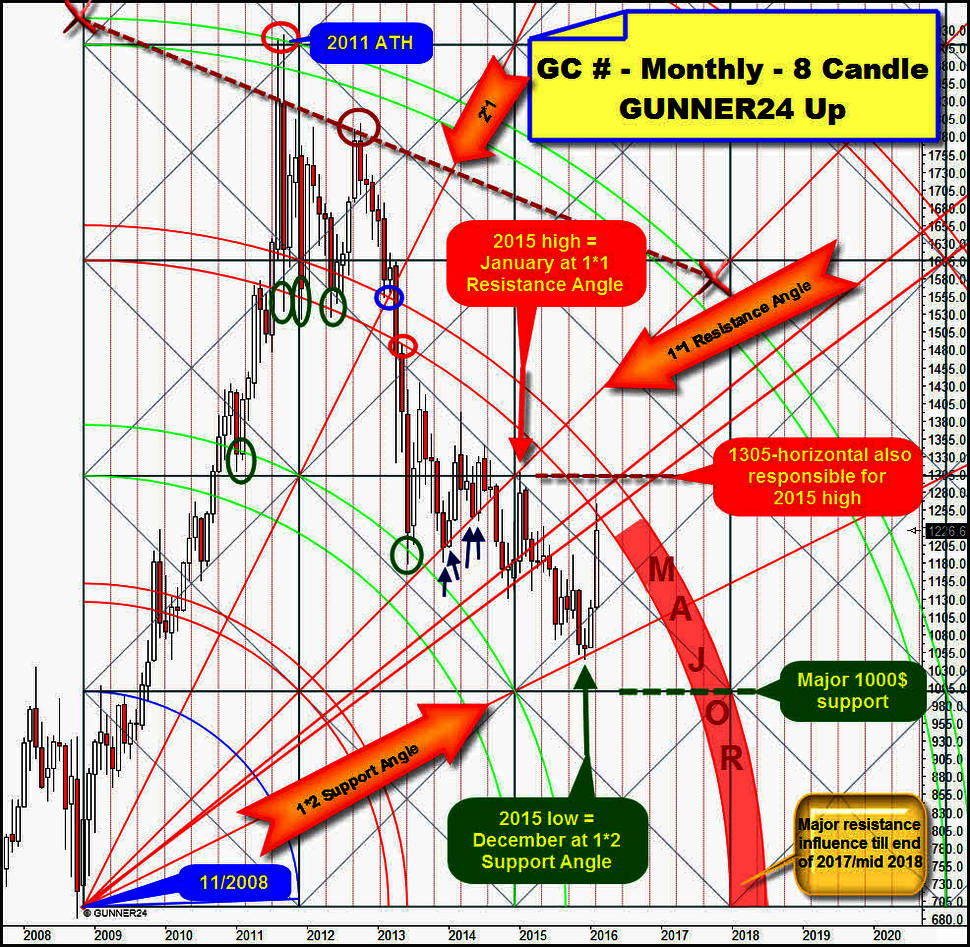

In succession, I present you two GUNNER24 Up Setups for gold in the monthly time frame. The first starts at the first small higher low of the month 11/2008, a month after the final bear low of the year 2008 was reached. The second begins at the absolutely final bear low of the year 2008. Both setups are parallel valid since both lows strongly influence the gold price to date, being expected to influence it the next years as well:

11/2008 is starting point. Then, the setup measures classically from the 11/2008 low 8 candles initial up impulse upwards. The setup catches the ATH at the resistance of the upper line of the 4th double arc. The last important countertrend low of the year 2012 is brought in at the dark red oval at an anchorable GUNNER24 Diagonal Resistance. Then, southwards it goes…

At the blue oval, at the upper line of the 3rd double arc support and 2*1 Angle, the next powerful sell signal arises. This final break of the 2*1 Angle activates as next target the 1*1 Angle to be reached/worked off (after W. D. Gann’s important Gann Angle trading rules!!)

The 1*1 Angle – then most important bull support – is tested 4 times at the blue arrows first bearing up, then being finally broken in 2014 and tested back negatively at the big red arrow. This 1*1 backtest delivered the final high of the year 2015.

The final year 2015 high was reached in January 2015 being exactly at 1307.80. Simultaneously, the 1305-GUNNER24 Horizontal Resistance was tested back negatively at the year high 2015.

This extremely strong 1305 monthly + yearly resistance magnet led to gold laying down a flawless downtrend year being brought in the year high at the beginning and the year low at the end of the year and the year closing very narrow to the absolute low.

The final break of the 1*1 Angle activated as next target the 1*2 Angle to be reached/worked off (after W. D. Gann’s important Gann Angle trading rules!!) At the final low (December) of the year 2015, this powerful support being derived from the low 11/2008 was worked off. As a result, the current monthly uptrend = countertrend started in January 2016 because the 1*2 Support Angle released relatively strong rebound energy after the first test!

We see that the current February candle has reached the next higher, strong – even a MAJOR RESISTANCE – at the highs. Of course, it’s matter of the 3rd double arc resistance. The lower line of the 3rd was tested three times successfully in 2012 at the green ovals after the 2011 ATH was achieved. Also the upper line of the 3rd at the blue oval gave shortterm support again. Since the 3rd was clearly and finally fallen below during the bear market, gold will have to overcome first this MAJOR RESISTANCE of the 3rd on monthly closing base to confirm a new bull market!

==> Yet it’s simpler for gold not to succeed in overcoming the MAJOR RESISTANCE of the 3rd double arc being forced to follow its downwards course in order to fall into the then ultimate bear market low till the end of 2017, or even till mid-2018!!!! (800$ till 2018 is now the expected bear market low!!!).

==> I think that gold wants to test back the high of the year 2015 at the 1308 resp. 1305 horizontal resistance = yearly resistance during the current countertrend BY ALL MEANS. Namely in the first half year 2016. But above that, I mean a monthly close above the 1305-1308, wow, that would be strong!

A scenario I can imagine is that the HUI will reach its 193-First Target till April and gold will bring in the 1305-1308 then. Then we’ll observe anxiously how the current countertrend will develop after this important year 2016 resistance will be worked off…

Disturbing Factor # 5:

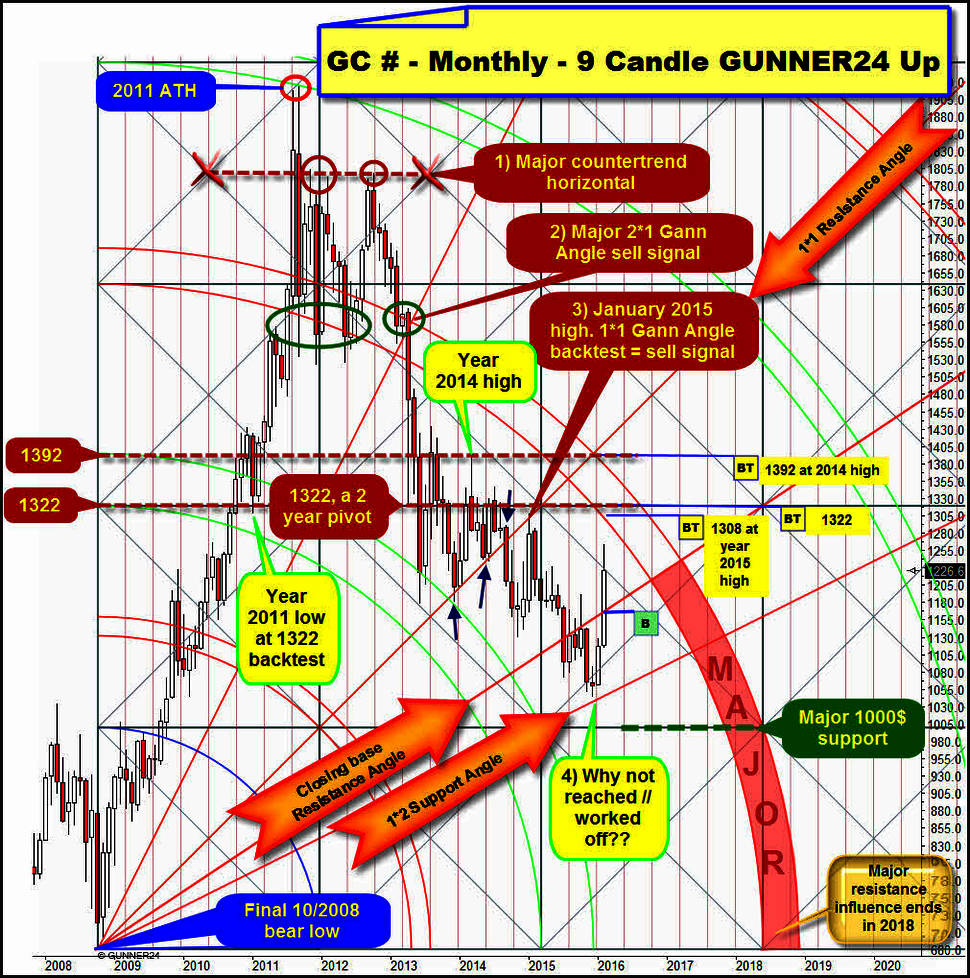

Above now the up setup that begins at the final bear low of the year 2008. It is a 9 candle up. To a T, it nails the reached ATH at the lower line of the 4th double arc resistance!! Also this setup is absolutely confirmed. At red 1), the important countertrend highs are running in after the ATH at the anchored horizontal.

At red 2), the 2*1 Angle breaks finally with the 3rd double arc support activating the 1*1 Angle to be worked off.

After the 1*1 Angle at the blue arrows bears for the time being, it was broken downwards and was tested back negatively at red 3). Another powerful bear market sell-signal that activated the 1*2 Angle to be worked off after W. D. Gann’s important Gann Angle trading rules.

However, why the hell was the 1*2 Support Angle avoided to be worked off at the December 2015 = year low 2015? Why? This 1*2 Support Angle that springs from the much more important low of the year 2008 after all, i.e. THE final bear low of the year 2008, was not worked off! For me that means that this 1*2 Angle is still imminent to be worked off.

Ergo, at least the 1100 region will have to be headed for once more, some day during the next months because the 1*2 Support Angle takes its course there for the rest of the year 2016 – if the 3rd double arc performs in future the way it would technically have to as per energy state. After all, it’s the future MAJOR RESISTANCE for gold… After being reached/worked off its possible countertrend uptargets, gold should have to fall once more into another strong bear market leg according to price and time. The 3rd double arc in the setup above won’t lose officially its resistance influence before the end of 2018!!!!

Disturbing factor # 6: Why hasn’t yet been worked off the "round" 1000$ Gann number? My answer can only be: "This is still to come! Someday in 2016, 2017 or at the latest till 2018".

Now to the buy signal produced by the current February candle: February closes above an important Resistance Angle that restrained gold on monthly closing base in 2015. Thus, after the GUNNER24 Method, a test of the year high 2015 is activated as uptarget for that countertrend at 1305-1308.

Going again into the setup above, we also identify the important 1322 pivot. An important magnet on monthly and yearly base, simultaneously a next higher important horizontal resistance on yearly base. The 1322 is just narrowly above the 1305-1308 first target, thereby being an obvious target for this countertrend!

Next higher allowed uptarget for this countertrend is the 1392-GUNNER24 Horizontal where the final high of the year 2014 was attained exactly.

==> As a maximally possible uptarget for this gold countertrend I see a backtest of the 2014 high at 1392! Then at the latest, in case the 1392 are reached, the MAJOR RESISTANCE of the 3rd double arc should have to be activated again force gold in succession – till the year 2017 resp. 2018 – at first to the first serious test of the 1*2 Support Angle, then into the 1000$ and ultimately into the 800$ main bear target!

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann