Violent rebound from the monthly GUNNER24 Targets

And now? Are the EW technicians right who are seeing the stock markets having an SPX target under 700 in the primary wave C (a five major wave decline) since the January high though the markets are just in the first impulse wave within the iii? Or is it the GUNNER24 which is rather marking the end of wave 4 (ABC = corrective pattern) from Elliot Wave points of view? The decision is likely to be made next week:

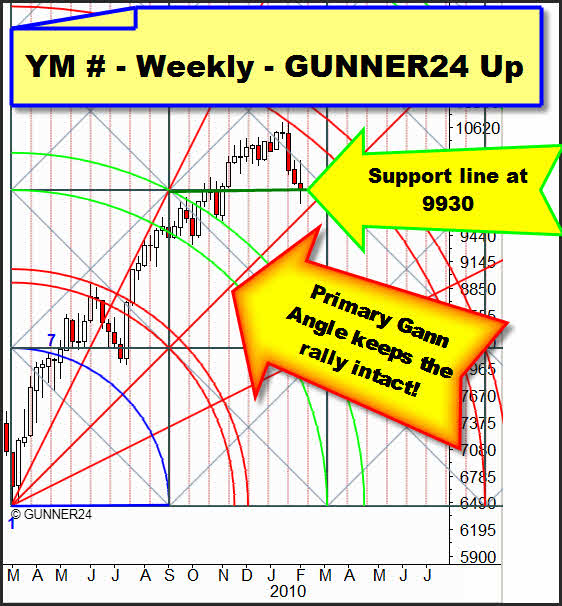

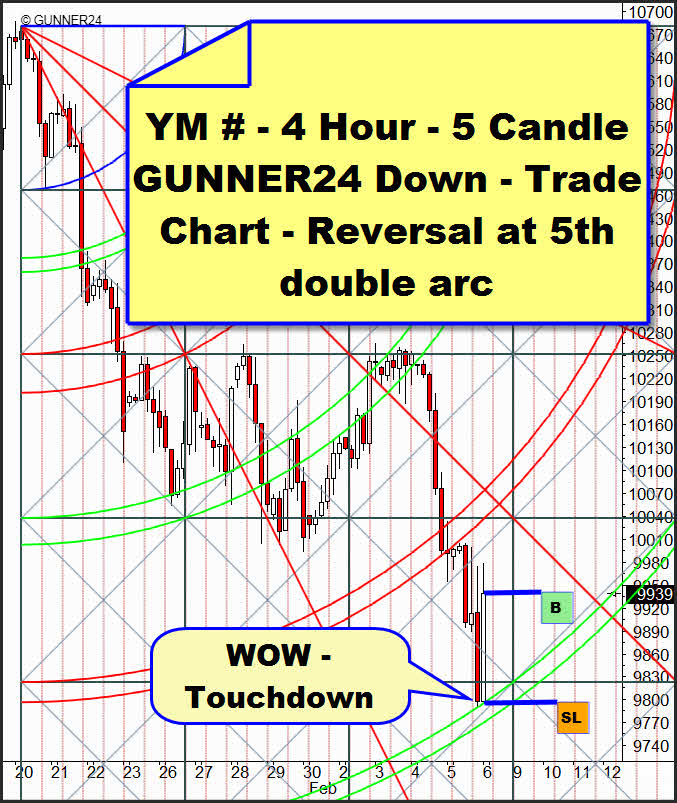

On Friday, we possibly saw the beginning of a classical V-reversal. Exactly with the important monthly and weekly supports of the GUNNER24 the markets use to turn upwards violently.

Certainly, the V-formations are within the most difficult reversal patterns to trade, because in the classical chart analysis, the price action does not provide much warning that the trend is about to reverse. There an abrupt reversal unfolds, allowing little time to react.

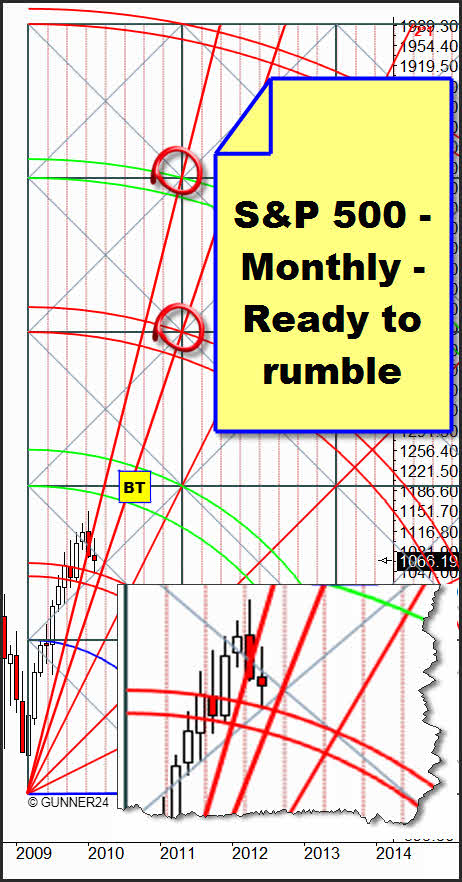

The price and time magnet in action! The test of the upper line of the first double arc at the crossing point, forecast last week, took place on Friday. The S&P 500 as well as the NASDAQ-100 are caught between the important monthly support and the resistance marks. Next week, it will make a decision on its direction.

Every single daily closing price is going to inform us on the question whether we are still in an upwards trend or in a downwards trend already: If the upwards trend is resumed the days are going to close as follows: Monday and Tuesday positive, Wednesday plus/minus, Thursday downwards, Friday day of recovery. If Monday and Tuesday close negatively the supports will be tested violently again, and they may break. I've got to say, like always in a pitched battle, there are some mixed signals within the different time frames:

Whereas the Dow Jones on weekly basis rebounded rather leisurely upwards from its lows we have received some sturdy long entries there and also at the NQ # and ES # in the 4 hour chart.

Fridays price action created a daily Dragonfly Doji, which we typically see at some sort of bottom. The $VIX additionally suggests a bounce in the markets… Well, that was the positive evidence for the continuation of the upwards trend in the stock markets. - Here's the negative:

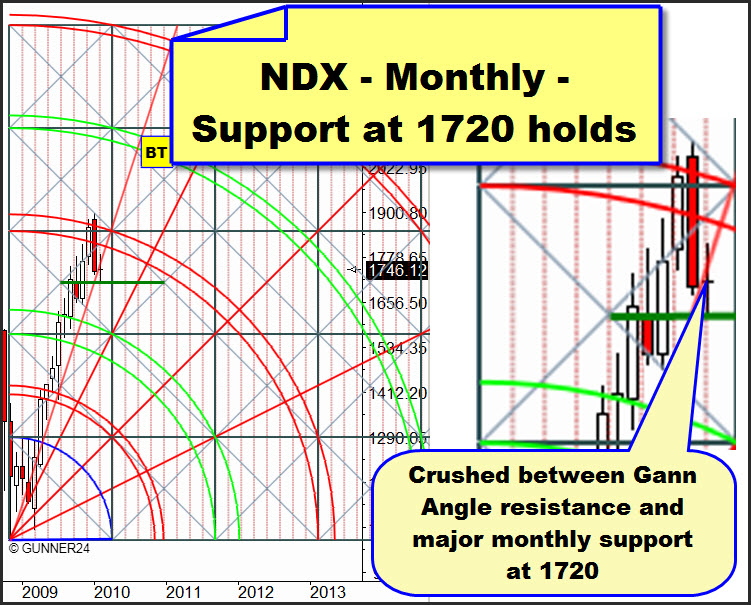

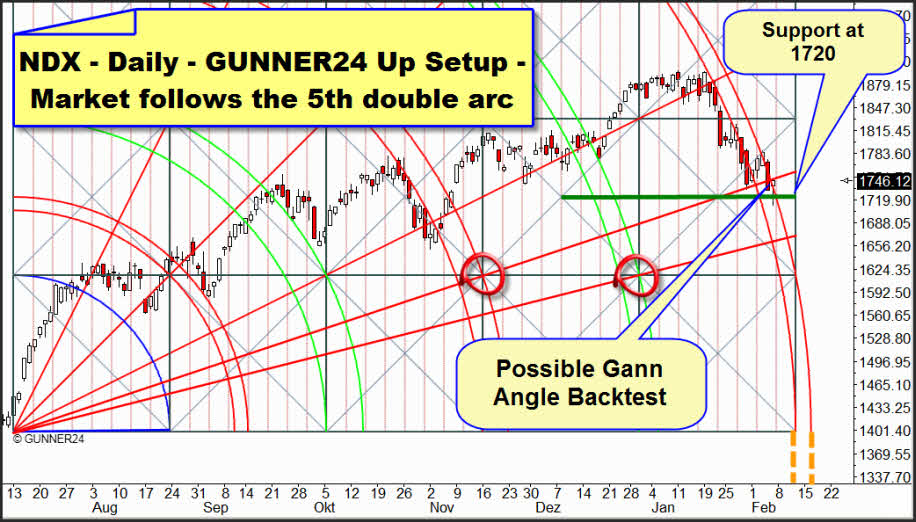

On daily basis, the GUNNER24 Down Setups have not reached their sell targets, yet. Those targets are under the monthly and weekly supports. Furthermore, this 13 Candle GUNNER24 Up Setup on the NDX, shown in the last issue as well, is demonstrating a very clearly negative impression:

This setup is in a crucial moment. With the opening of the stock market next week, the rapid Friday rebound may already find its end because possibly just the chart-anchored Gann Angle wanted to be tested back and the moment for the low of February, 15 is due to the double arc influence. Positive: Here, too, for the moment the price rebounded at 1720 (monthly support). Positive: Friday was the 13th day of the down swing! New lows next week would point to a 21 day down swing, then. This would be February 17. As well, all the stock markets are demonstrating positive divergences in the daily chart what again is evidence for having seen the low of the present down swing.

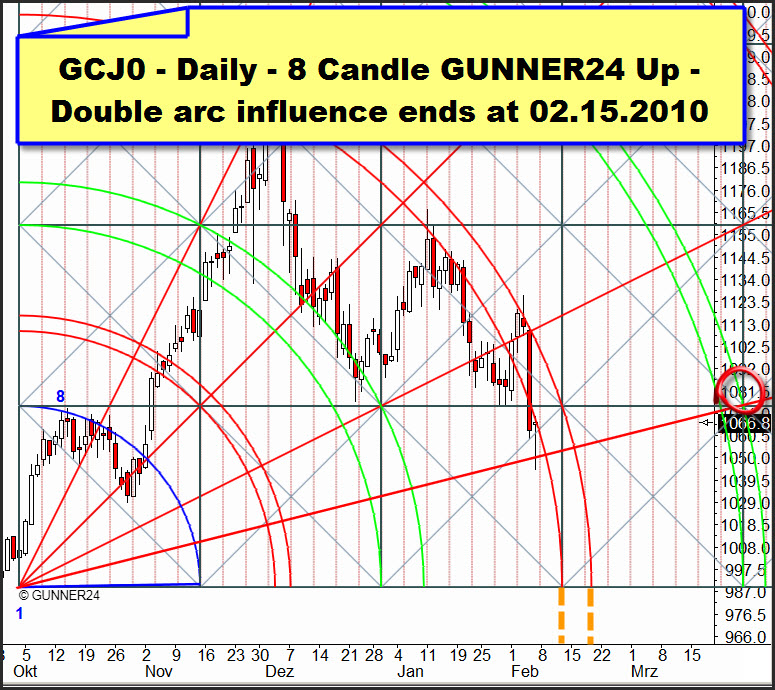

On gold, last week we stated the following: "If the Gann Angle is broken on weekly basis an extremely bearish situation will emerge because the gold price would be in the bearish part of the setup and we would level all the long positions changing to the short side quickly. Since next week we are expecting only the second test of the 1*1 Gann Angle, actually that break is not due yet."

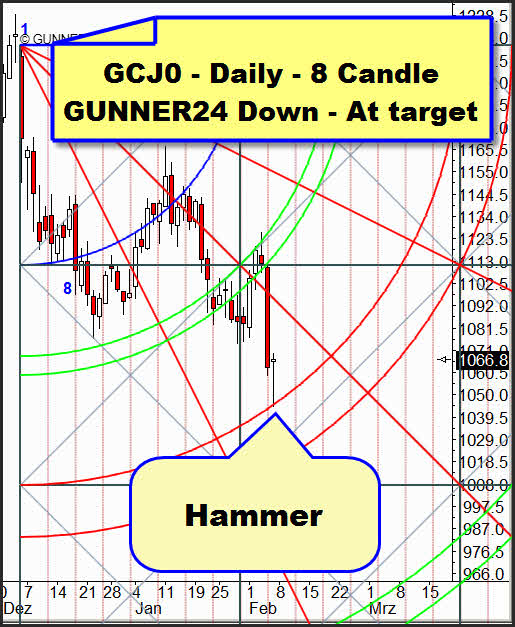

The situation: The price performance at the 1*1 Gann Angle and at the important time line is just about allowed... If we consider the lost motion the weekly candle has not broken the 1*1 Gann Angle, yet. Further, the ancient GCGO contract with its weekly candle is much closer "hardly underneath" its 1*1 Gann Angle. In addition, the actual 8 Candle Daily GUNNER24 Down has provided a pretty unequivocal signal.

A reversal candle exactly on the second sell target. "The Hammer pattern signifies a weakening in bearish sentiment. The long lower wick signifies an initial continuation of the downtrend. However, renewed buying sentiment acts as support and drives the price higher to close near its opening price." Like always, in case of the down swings we may expect a resumption of the upwards trend at the first and the second double arc. But it is still too early for executing a possible long entry. Firstly, the volume of the Hammer candle was less than on Thursday, secondly, we cannot go long before Monday brings us a reversal candle and thirdly, in the actually valid 8 Candle GUNNER24 Up, gold is following the 3rd double arc.

Gold has got a grip on itself in the chart-anchored Gann Angle. But it is still completely in the stage of correction which possibly as early as Monday, but for sure Tuesday/Wednesday will aspire to new lows, after a little counter trend reaction on Monday. If gold breaks the Friday low we will see 1000 until about February 15 or 17.

Conclusion: In the final analysis, gold is to be classified like the stock markets. There's hope because of the monthly and the weekly signs, very positive signs in the short term time frames, positive Friday – but that is only the price point of view. The time aspects rather indicate that next week we will have to see the low. That does not mean necessarily we would immediately break the supports downwards but perhaps test them intensely. The markets are closely above some important monthly and weekly supports which they reached and defended violently on Friday. Everything depends on Monday: If we are still positive while closing the day we will go long on daily basis with small positions.

When the markets open, because of the 4 hour chart reversals, we will also speculate on a resumption of the longer term upwards trend and on a 2 to 3 day up swing with small positions. But doing the long entry, in case of the Friday low you will have to work with the reverse and double technique. Thus only you can ensure to turn the previously emerged loss.

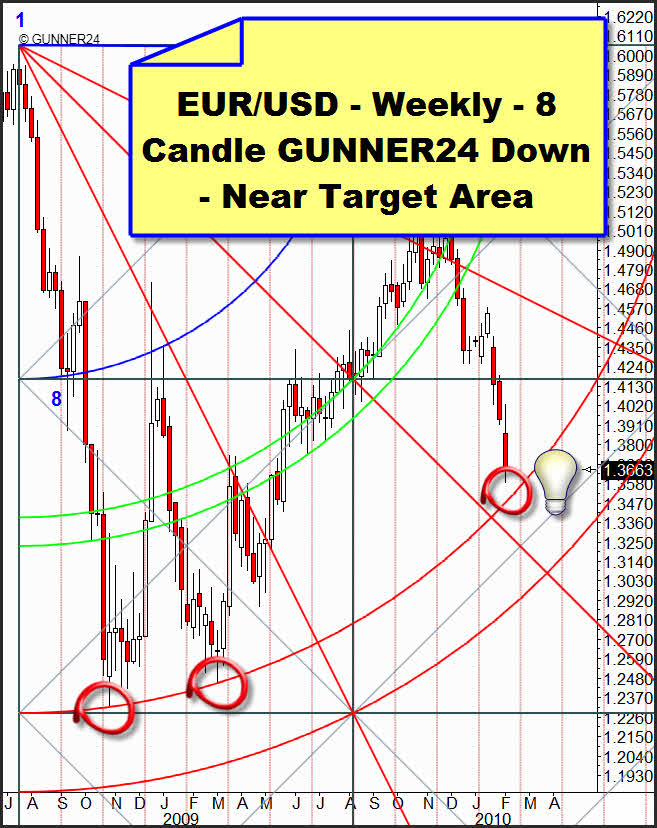

For EUR/USD the first obvious target is in reach

During the past weeks, some e-mails came in which referred on the further course of the Dollar: Which height is it still going to reach, which would be the moment to go short etc. For all the Euro-depressive people I picked out an interesting setup:

Can there be more obvious signs? For the pair, next or the week after next an interesting constellation is going to emerge which at least might back the Euro in the medium term, as well. The upper line of the red double arc is forming the target which next week will be at 1.3513 to 1.3525, the week after next at 1.3550 to 1.3565. The fact that here the low of the pair next week is going to be seen just close under the low of last week backs the theory which says gold and the stock markets should rebound at their supports upwards

Be prepared!

Eduard Altmann