Topping and bottoming out are processes that use to degenerate in enervating and severely persisting grave battles – the bulls fight hard against the bears. Both sides need to employ heavy material to hold and re-conquer their respecting positions. Minimal gains of ground i.e. defending supports and taking or re-conquering resistance lines use to claim a lot of money and energy on both sides.

Some time may pass until the respective forces in the bull and the bear camps wane inclining the scale to the winner, i.e. to the new trend. Still there is no unambiguous winner to be seen in the battle for the possible or likely next intermediate gold high, but the pendulum is bending to the contrary now.

Gold could have topped on Thursday and could start to roll over now:

Can we say: that was it? I think we can. The bulls seem to have shot their bolts – for the moment…

Let’s consider the most important and strongest bear bastion in the monthly gold chart above – the blue elliptical arc resistance which represents combined monthly and yearly resistance. We relate the strongest monthly upswing according price and time beginning at # 1 // December 2015 Bear Market Low with the major highs produced since then recognizing that the resistance of the elliptical Blue Arc above EXACTLY nails the:

Final high of entire 2016. At dark-red 1, or end of initial up impulse out of 2015 Bear Market low precisely after a 8 Fib number months lasting impulse.

The immediately afterwards produced small lower monthly high at dark-red 2 that triggered a 5 months Fib number correction.

Final high of 2017. See dark-red 3. 2017 Top has arrived at candle No. 22 of impulse out of # 1 // Dec 2015 Bear Market Low. 22 - 1 is important 21 Fib number.

One of the most important month highs of 2018. Marked by the dark-red 4 (& dark-red arrow). For entire 2018 we count 4 negative tests of elliptical Blue Arc resistance at the most important month highs of that year.

Conclusion: This bent Blue Arc above equals to the most strongest existing resistance for gold. It is confirmed resistance on:

A) Monthly closing base, B) resistance on year high base, C) resistance on month high base. And last but not least the D) current most strongest resistance of the running DECADE. It is nicely confirmed and sharp defined E) +2.5-years lasting MAJOR resistance for gold.

Through these 4 touching points, the stretch of the Blue Arc can be automatically updated for the future. Pretty sensible, I mean, because it`s inter alia defined by 2 final tops on yearly base, and above all mathematically correct in terms of time and price.

And you will have already recognized it, if you are attentive:

Highlighted by the dark-red 5 current 2019 High once again tested MAJOR resistance at 1331.10$.

Also - young - February candle seems to respond to the elliptical Blue Arc rail, showing a small lower month high compared to January 2019 High exactly at slightly declining MAJOR resistance from below at dark-red 6.

Gold is at it`s MAJOR resistance magnet that can be expressed by elliptical Blue Arc above, additionally at the well-know and well-recognized 1322$-1320$ yearly GUNNER24 Resistance Horizontal. Furthermore, it is quite overbought.

==> Thats why we have to prepare for a gold correction cycle over the next 6 to 12 weeks that in extreme cases needs another test of above named "Important Angle Bull Support" which runs at around 1222$ for March to April candle, there and then forming heavy support magnet together with well-known and well-recognized yearly GUNNER24 Support Horizontal.

The probability that the gold in the expected 6 to 12 week correction cycle will again test back the 1222$ before the next big upside leg starts which then - USUALLY...! - should push through MAJOR elliptical Blue Arc resistance in course of summer 2018 we have to set to about 20%-25%!

Also interesting is this now arisen probability:

We recognize an about 30% probability that gold just now, either at January, or February 2019 highs, and usually very close to the above measured elliptical Blue Arc resistance prints it`s FINAL HIGH for the entire 2019.

However, should succeed with the February to the March closing a liberation. And should gold be able to deliver just 1 monthly close above the elliptical Blue Arc resistance AND 1333$ the at 2018 Low started monthly uptrend becomes a breakout move which then should test the 1st double arc near 1422$-1455$ within just 6 month candles.

But as I written above, we should rather prepare for the scenario with the highest probability now and that is a correction lasting at least 6 weeks.

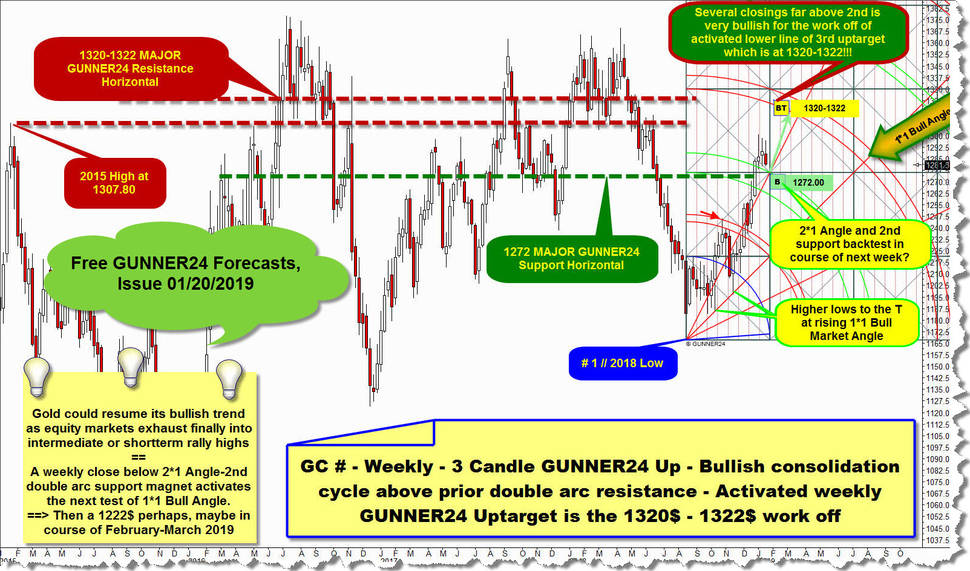

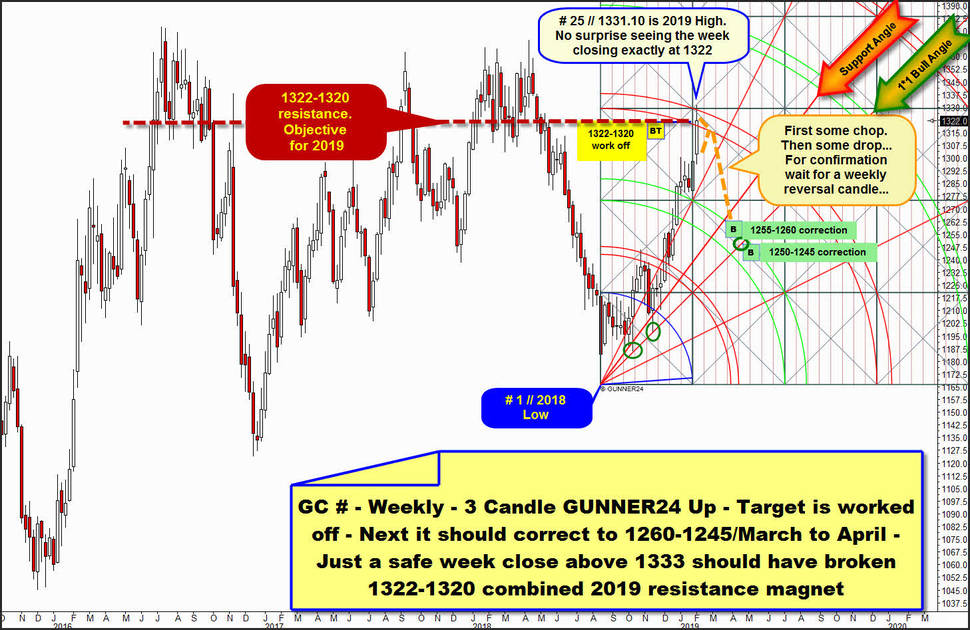

1322$-1320$ Big Resistance upmagnet is finally worked off, as prior activated weekly 3rd double arc target environment. And what can I say even more about the importance of the 1322$ and its magnetic power in the gold futures market as the week closed down to the cent right at this magnet.

That is the typical behavior of a global market. Leaving the most people in the dark. Does this week close exactly at magnet now means it soon will be broken to the upside or will it continue to deliver future resistance? Has he exactly reached the balance between buyers and sellers at Friday's close? Baffling, but for sure it is always fascinating how important magnets do work from time to time.

Well, I think the 3rd double arc together with 1322$-1320$ yearly GUNNER24 Horizontal Resistance magnet wants to continue very important = stronger and sustainable resistance and we should prepare for a lower price rotation.

Somehow I can imagine very well the above placed orange-dotted lines scenarios. Namely that the gold would like to intensively test the overall 3rd double arc resistance and 1331$ to 1315$ area for even 2 more weeks or about 10 trading days before the awaited 6 to 12 weeks correction is allowed to gain speed. Maybe starting caused by a SHS pattern or lower high pattern in the daily chart.

Actually, GUNNER24 calculates for the March-April correction "just" an intense but in the end successful backtest of broader future 2nd double arc support environment. At the heights of either the Support Angle or the 1*1 Bull Market Angle that is 2 times to the T tested higher week low support - for this pattern and also future expected support importance of the 1*1 watch the dark-green ovals.

Usually a correction should successfully test back the 1*1 Bull Market Angle on week low and/or week closing base. This mean just a 50% correction according Gann methods should be on the agenda ==> highest GUNNER24 Bet is that gold should test 1250$-1245$ at March to April lows.

If bulls remain strong during a coming correction gold should just test 1260$ to 1255$ at March to April lows, before gold is expected to rally into yearly 1422$-1455$ uptarget range!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

Let's take an updated look at the weekly chart and the weekly 3 Candle up:

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann