The Precious Metals (PM) stocks look like to be in the process of completing their next big bottom in their 2020 to 2022 consolidation cycle.

Such next important cycle lows could already be printed in course of the coming trading week.

Possibly on or around February 3rd.

Since the consolidation runs soooo long in the tooth and the possibley near cycle lows could be triggered by rising annual Gann Angle support energy, there is a fairly good possibility that the February lows mean the final lows of the entire trading year 2022.

My last analysis and shortterm forecast of the PM minings sector was less than a month ago.

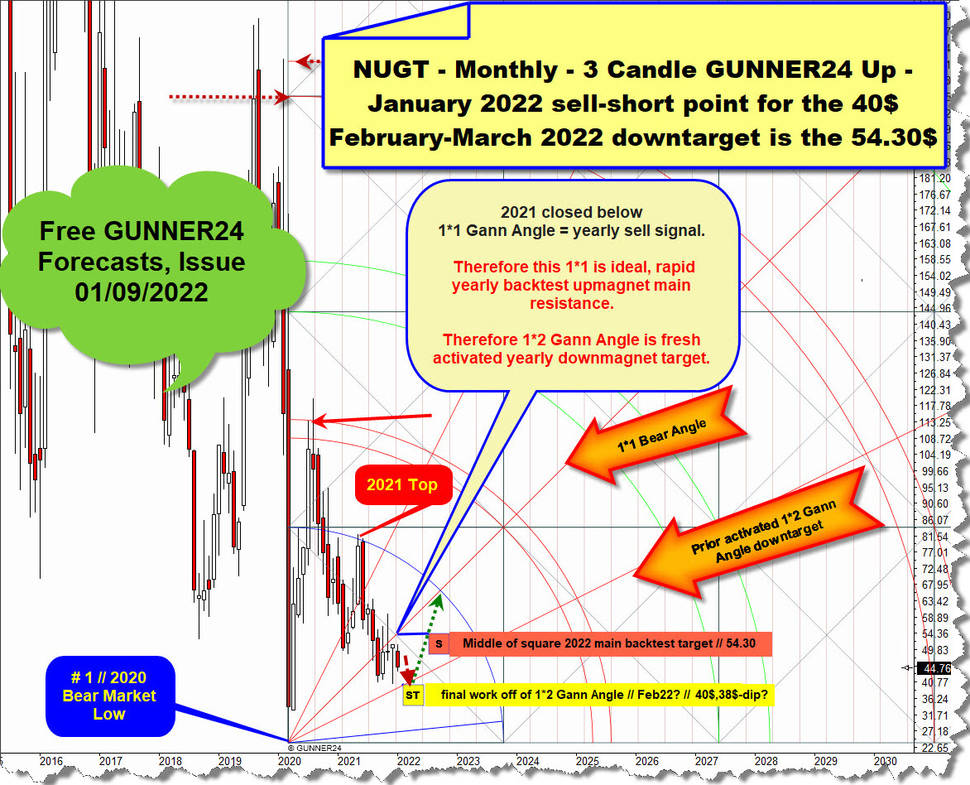

With the help of the NUGT EFT - which is currently delivering inspiringly clear indications and signals -, on Januray 9, I prepared you in advance to sell-short market with both hands at monthly 1*1 Bear Angle resp. at 54.30$ what represents ideal yearly backtest upmagnet main resistance for January 2022 candle.

This call was a perfect strike. NUGT on January 20 topped finaly at 54.36$, only to be flushed down the toilet again afterwards.

When looking at the following 3 NUGT charts keep in mind the PM stock indexes and many of the individual PM stocks actually look and behave very similar to NUGT ETF:

Within free GUNNER24 Forecasts, Issue 01/09/2022 „Gold Miners could finally bottom in February-March" - click here on blue or at chart above to re-read, GUNNER24 recognized a next major top could arrive in course of January precisely at 54.30$ as this is the mid-price of the first passed GUNNER24 Square within ruling monthly 3 Candle GUNNER24 Up Setup, starting at # 1 // year 2020 Bear Market Low.

Since NUGT shares ended the trading year 2020 below the 1*1 Gann Angle = rising Yearly Main Resistance Angle, this midpoint of the first passed square at 54.30$ means/meant three things.

1. A very, very close but 2. also a very ideal backtest magnet on combined monthly & yearly base. 3. An ideal price/time magnet on yearly base that should definitely shorted hard when getting backtested from below when reached during January 2022.

Because with the official closing of 2021 BELOW the 1*1 Gann Angle, the future work off of the 1*2 Gann Angle became activated and morphed to a necessary main downtarget for NUGT shares.

Another hard call was that the 1*2 Gann Angle work off looks to be due sometime in course of February 2022 (Feb22) at the round 40$ W.D. Gann number support surroundings. Whereby a washout down to a 38$ or so, to scare the last remaining PM stock market bulls and force them finally to cover their longs, must remain permissible.

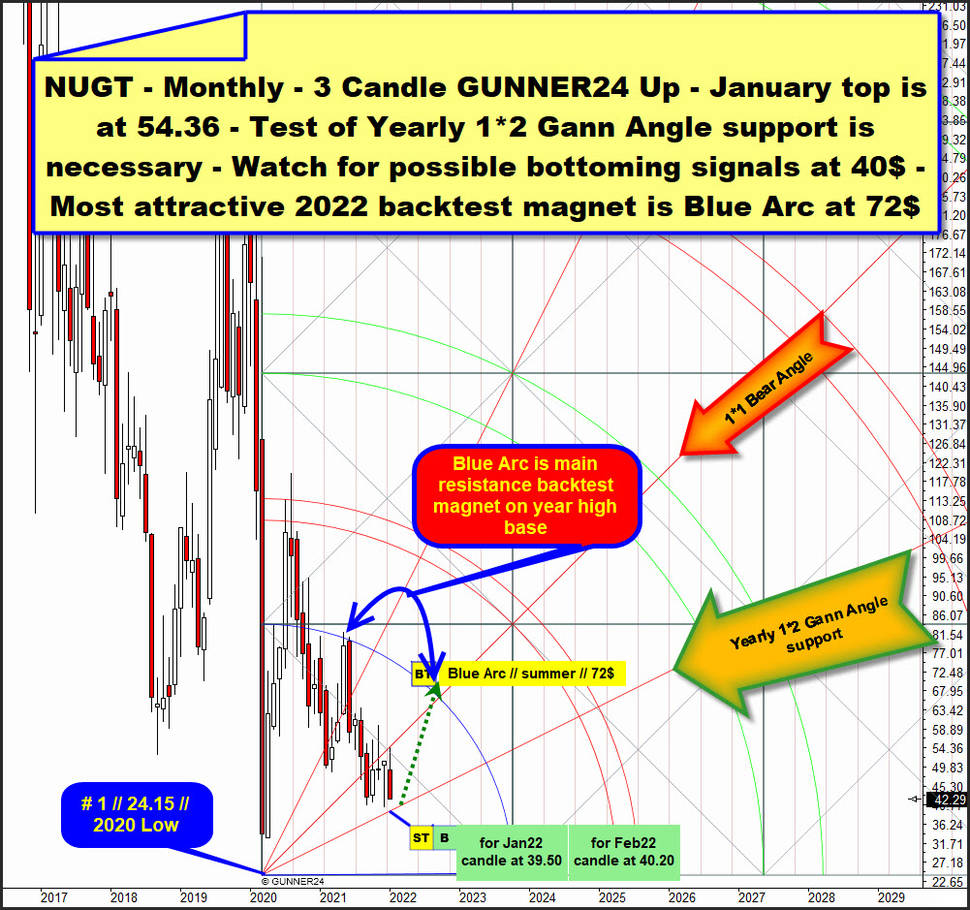

Next is the updated monthly chart. On Friday NUGT shares closed at a 42.29$. Means, the/a main downtarget magnet of 2022 is now in striking distance. Regarding the time factor and the price factor...:

The rising 1*2 Gann Angle is as much a quite normal price/time target for the year as the backtest of the 1*1 Gann Angle (morphed of course to 1*1 Bear Angle ...) was.

In the unlikely event that the very last day of January must reach the rising yearly support of the 1*2 Gann Angle, the NUGT shares should start a visible bottom after a 39.50$ reached.

But normally, means with a likelihood of well above 90%, the Yearly 1*2 Support Gann Angle will be reached/touched or finally worked off in the course of the coming February. For February, the annual support of the 1*2 Gann Angle runs precisily at 40.20$.

My advise is to go long 2x leveraged NUGT Bull ETF only after you recognize the 40$ radiates proved support on daily and/or weekly closing base and some bottoming patterns are in play.

Regarding a short-term bottom at 40$ major support, be sure to also check the usual leaders of the sector, like NEM, GOLD, RGLD etc., but also the often leading Silver Miners like CDE, HL, PAAS.

==> IF NUGT ETF bottoms now at yearly 40$ support magnet, the odd is +70% that the next weekly and monthly upcycle has to test back the yearly backtest resistance main upmagnet of the Blue Arc sometime in course of summer 2022 at 70$/72$ surroundings!

At the beginning of todays analysis, I wrote that NUGT shares deliverer inspiringly clear indications and signals what should improve the forecast at least theoretically.

7 past cycles of this stubborn correction, most of which almost perfectly matched the high Fib numbers, advise us to expect the next important cycle low around February 3rd.

==> For It could very well be that 2 cycles of tradable lows will eventually result from the 09/29/2021 low. The first cycle into next tradable low of 12/15/2021 ended after 55 Fib number days (black arrow cycle).

A printed important February 3rd low - always give +- 1,2 days - would be the PERFECT 89-Fib number Step-Sum low out of the decisive correction low of 09/29/2021, if a next tradable low cycle starting at 12/15/2021 bear extreme will be oriented to the 34 Fib number (possible light-green arrow cycle).

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best trending stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann