|

Dear GUNNER24 Traders,

May I speak on my own behalf at first? On account of many inquiries I’d like to offer you an e-mail trader service on gold. We’re talking about pure, quick short term gold trading. It’s GUNNER24 Trading Signals, based on the actual Gold Future – short term trading at sight of just a few trading days and frequently just a couple of trading hours. Preferred duration of keeping is between a few days and several weeks. To adjust oneself to the volatility of the market the trading style may be very active from phase to phase. Investment instruments are the actual Gold Future, ETFs and CFDs.

My idea is to send from 2 to 3 e-mails a week to the interested gold traders and even some more, of course, in case of urgent call for action. Each e-mail contains between one and three charts of GUNNER24 Setups – plus: some brief comments, prospects and instructions for action – by me.

Since I use to trade gold daily and I already have a little distribution list of e-mails on gold for some special friends of ours I’d like to extend that group of e-mail friends. In the beginning I’d say it will be $29.90 US a month. In case you accept my offer you’d only have to cancel within your PayPal account if you want to leave the distribution list. Later on, to subsidize the increased e-mail traffic with further enquiry and explanations the monthly charge would raise to $39.90 US with 101 members and up participating.

At first I’d like to see whether there’s really an increased need for action beyond the normal member area by our readers. If we manage to fill 100 places I’d feel that my offer is accepted. If you want to join the e-mail group just subscribe by PayPal here and now. In case we can’t fill 100 places of course I would transfer the money back. Thank you very much!

Ok, here are the major turning points of the precious metals

By the Friday low silver reached its expected correction target, it rebounded there impressively and it slammed down a monstrous reversal day producing a buy signal on daily basis. Both silver and gold rebounded from their respective major turning points within their weekly GUNNER24 Up Setups. As matters stand today, also the extremely important month supports of both metals seem to resist. BUT: we’ll still have one trading day in January and that one will be decisive for the continuance of the long term rally.

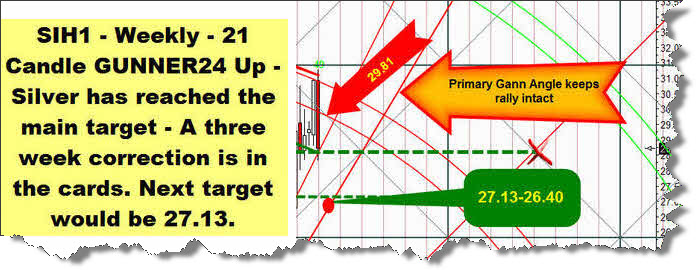

In the issue of 01/09/2011 GUNNER24 prognosticated a three week correction with target 27.13 – 26.40 and certainly that target has been exhausted completely…

Since the beginning of the year the market has been correcting in well-ordered tracks. After reaching the main target being the 3rd double arc last week the primary Gann Angle was caught, at first being tested successfully. The rebound from it was pretty impressive. By the closing price of 27.96 furthermore both setup-anchored green dotted supports were overcome.

Some resistance will be produced by the 28.60 next week. If the rebound continues on Monday/Tuesday theoretically the change is going to be expected there at 28.60. In addition the primary Gann Angle is producing some support of course. That one should be tested back in technical respect. If next week turns to be volatile – it’s supposed to considering the generally known shortness of silver and the globally escalating political disturbances – the rebound might even induce a test of the main target at 29.60.

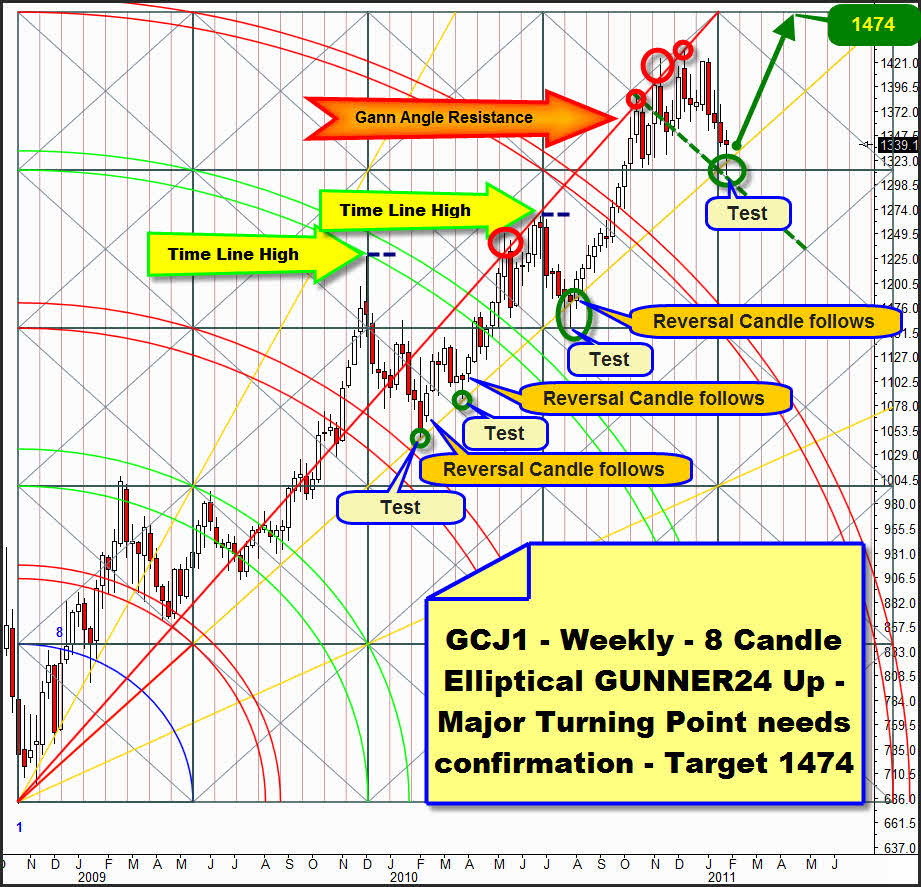

Likewise in case of the gold the primary Gann Angle that has been supporting the market for as long as a year was reached:

On 02/05/2010 the year low of 2010 was marked by the first test of the primary Gann Angle. After each of the three tests in the respectively subsequent week the test of a reversal candle followed. If such a constellation arises this time again we’ll go long on weekly basis with target 1474.

But let’s deal with the problem of the precious metals now – the last trading day in January:

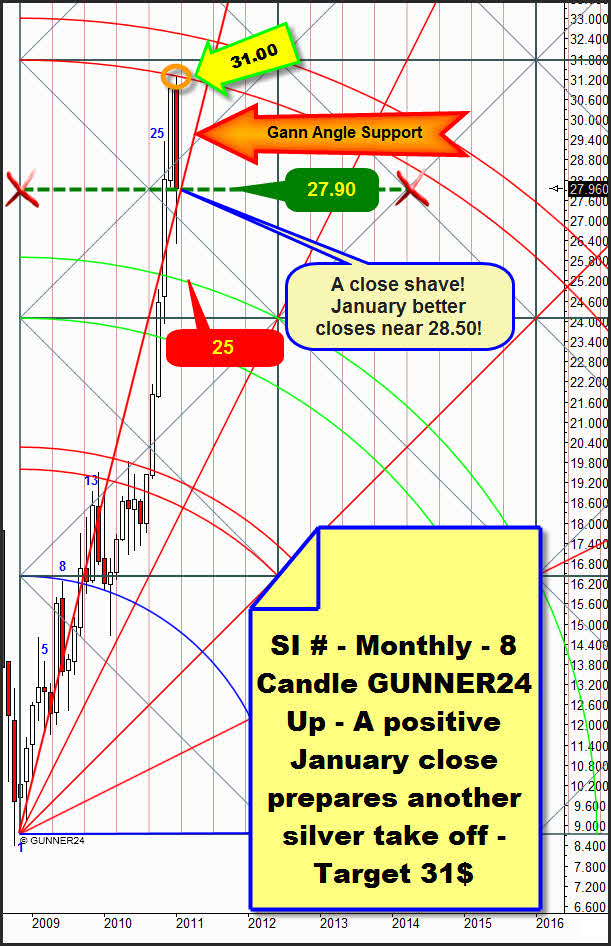

It can be described best in the monthly silver 8 Candle GUNNER24 Up. We see that the market is being supported by the Gann Angle. A month closing price on the Gann Angle, for instance at 27.50 makes the February likely to open near the 27.50. Thus A) the actually existing horizontal support (27.90) wouldn’t have been overcome rather becoming a horizontal resistance. And B) The market would open respectively on or narrowly underneath the Gann Angle. That is to be interpreted as bearish. The mini-correction should turn into being a "big" correction testing back the 2nd double arc at 25. A January closing price from 28.40 would ease the situation giving the market a moment to spare in order to test the Gann Angle again in February, newly taking off then for the main target which in February will be at 31.

It’s similar in gold. Here and here we analyzed how important it will be that the 1340 resists in January.

Let’s go now to the daily gold and silver GUNNER24 Setups:

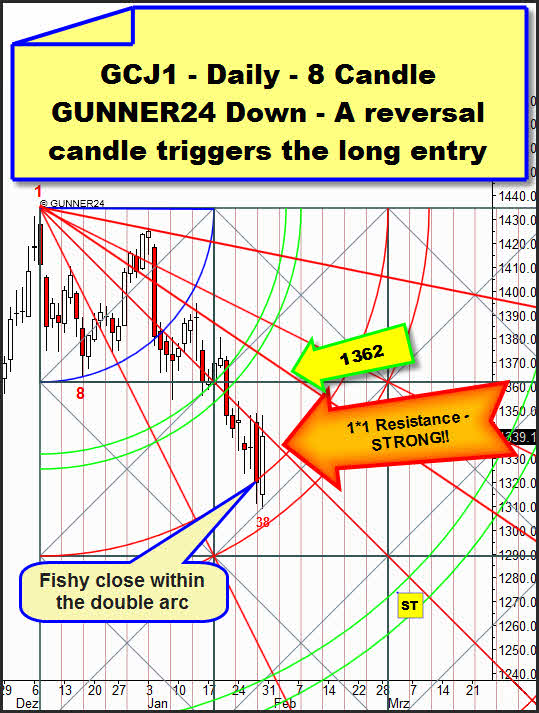

All that glitters is not gold. One swallow doesn’t make a summer, and one day doesn’t make a turn. That’s what we can recognize here. On the one hand it’s unfavorable that the 1*1 hasn’t been re-conquered even though there were opportunities. Anyhow gold rebounded impressively from the 2nd double arc, and anyhow the day high was at 1348. A closing price at the day high would have produced a reversal candle which would have been a clear long sign. In the average-strong upwards-trends we may expect at a 41% that the corrections end at the 2nd double arc. Moreover Thursday closed within the 2nd double arc preparing the 1270…

We see that Monday will be decisive and very, very important. A closing price above the 1*1 would ultimately confirm not only "The Low" but furthermore the monthly monster support of 1340 probably preparing the reversal candle on weekly basis. A Monday closing price of more than 1340 would be used by us for a long entry. SL are the 1309.1 – reverse and double.

Silver is showing unequivocal signs that the upwards-trend is going to be resumed. There were rebounds not only in the weekly and monthly setups but also in the daily one. We’re seeing three identical signals in three different time frames. That’s very seldom, very important! Friday properly produced the reversal candle as well.

Nevertheless there are warning signs, too: If there were not additionally the monthly and the weekly signs I’d say that the Friday candle a clear fake with the closing price exactly at the price and time magnet and the high of 28.03 lying precisely on the resistance-providing Gann Angle. The first double arc truly offers too much resistance to be simply broken upwards on Monday. But: With the opening bell we’ll move to the right by one candle. If the opening price is the same as the closing price at least the Gann Angle will be skipped over! And it should unblock the way to the 28.60. That’s where we’ll cover. On Monday I wouldn’t like to see a big gap up at opening, maybe with an early high at 28.60. Cause such might induce a general sell-off. Silver uses to close its gaps within two days, frequently the same day. SL is reverse and double!

Here’s still a little observation on the US stock markets: The S&P 500 closed underneath its dominating Gann Angle corridor. On Friday we went short at 1276. Target 1252. SL 1303 (MIT). Here you may read up the complete analysis on that entry and the target.

Be prepared!

Eduard Altmann