The queries on the further course of crude oil have piled up during the last few days after being worked off the 45$ GUNNER24 Main Target – faster than predicted.

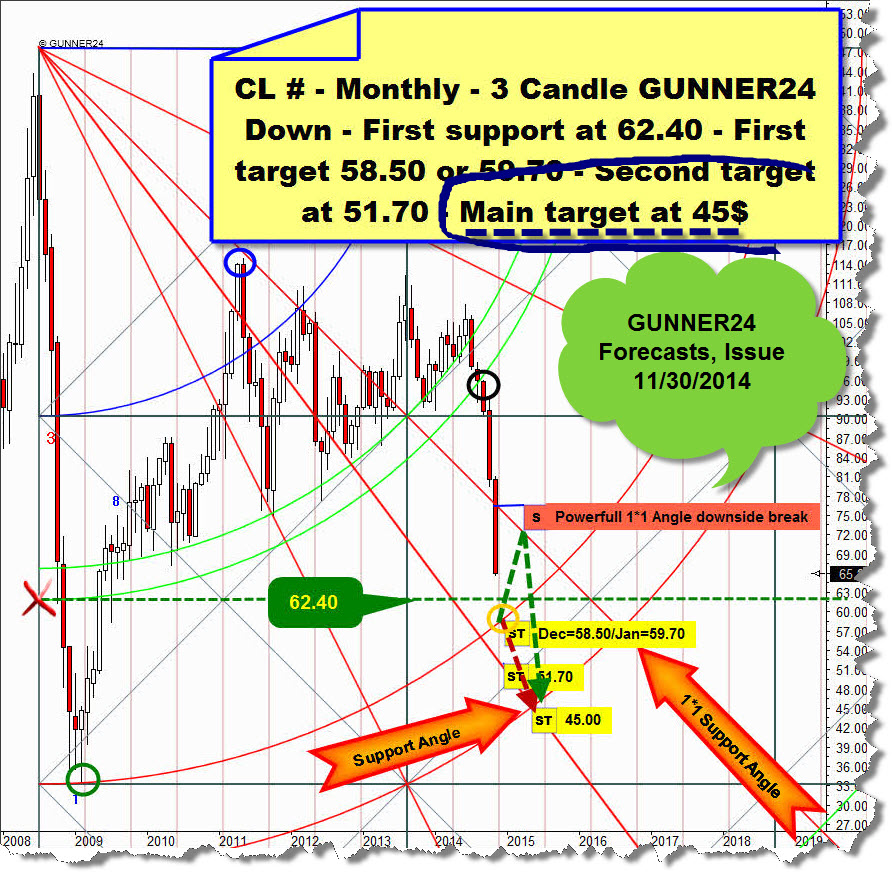

Really, in the last public US crude oil analysis (11/30/2014) I expected the 45$ main targets to be reached at the earliest in March/April 2015, at the latest by August 2015:

…yet, being in a panic cycle, this raw material went on waterfall declining faster than reckoned – more and more downwards energy is developing due to important broken supports – being now situated at the secular bull market support and having already fallen short/ripping it. The secular bull market starts at the final bear market low of the year 1998:

The low of the panic cycle is at 44.20, reached on 01/13/2015. Thereby, the current panic cycle low is already closely below the secular bull market support trendline that has been dominating/holding for more than 16 years as well as below the 75% Fibonacci retracement of the secular bull market rally that lasted from 12/1998 to 07/2007 (time) stretching from the 10.65 low to the 147.27 high (price).

So, with the present price of 45.29 crude oil is not only closely above the 75% Fibonacci retracement, but likewise closely below the secular bull market support that is lying at 46 to 45.50 in January 2015.

Beginning at 46 down to about 44, hence for January 2015 a powerful decade support is taking its course being formed A) by the 75% retracement and B) by an ascending trend line that has held 16 years.

The panic cycle is in its 7th month.

Since the very first reaction to this powerful combined decade support turns out to be extremely weak we’ll have to work on the assumption that the support zone 46-44 will fall. The explanation: Because of the importance of the tendering supports, technically at 46-44 a perceptible and visible reaction = recuperation/bounce should have begun by now.

Especially with the just now proceeding third test of a secular bull market trendline, a positive reaction to such an important support is technically the rule, i.e. the norm. Since this reaction is not visibly taking place respectively turning out pretty miserable even though the market has reached oversold regions relevant to Slow Stochastics and RSI (my records trace back to 1983 – and never since had been that oversold both), now a sustainable break of the 46-44 has to be assumed.

Since the panic cycle is in its 7th month in January 2015 and movements tending to turn with Fibonacci numbers – the next higher after the 5 is 8 – we have to proceed on the assumption that crude oil can/may shape an important panic cycle low at the earliest in February 2015.

Since the seasonality has always a very important impact on crude oil implying now that the February low should be lower than the January low, and since as a rule February uses to ring in the yearly up-move and February 2015 will furthermore be the 8th month of the move, crude oil is supposed to turn upwards in February 2015 – period middle to end of the month. From A) either the 39.50-40 (78.6% retracement of the 1998-2007 rally) respectively from 37.50 (mothly GUNNER24 Support).

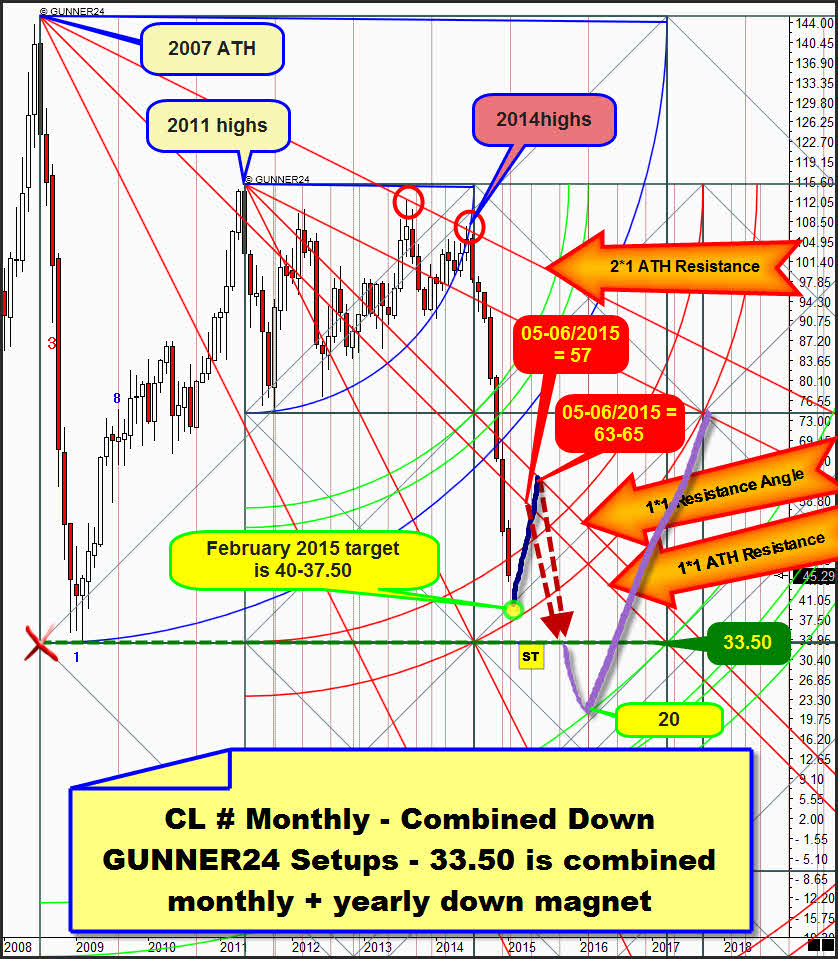

From February 2015 to at least May 2015 – perhaps June 2015 – a countertrend move is likely to lead the market to as many as 57 till at most up to 63-65. After being finished this countertrend move, crude oil is supposed to fall at least down to the 2009 low environment = 33.55$:

The 33.50 are now the new main target for crude oil. The applied setup starts at the 2007 all-time high (ATH). As the currently dominating trend is down now for as many as 7 years, this setup is also the currently dominating GUNNER24 Setup for the market. Thus, the signals put out by this setup are the presently most important and most dominating ones as well.

The monthly setup measures the first initial down impulse from the 2007 high that lasted exactly 8 months ending at the 2009 low (33.55). Thereby, the first square line support has cemented at 33.50. The very first down impulse – duration 8 months – was corrected up to the absolute high of the correction move = high of the year 2011. The years 2013 and 2014 formed lower highs each, following the downwards directed 2*1 Resistance Angle.

Finally, the lower high of the year 2014 rang in the end of the entire correction move. The second test of the 2*1 Resistance Angle, turning out negative, produced plenty of downwards energy, so subsequently all the dams burst. On month after the 2014 highs, the panic cycle began.

In November 2014, within the panic cycle the Blue Arc support broke. A new downthrust in December was the consequence. December 2014 tested back the Blue Arc at the high. Then, the December 2014 candle ultimately broke the 1*1 Gann Angle as well, normally a strong support, now strong resistance angle for the whole year 2015!

This new monthly sell signal, generated in December of all months, is thereby likewise a sell signal on yearly base… i.e. the whole year 2014 generates a powerful GUNNER24 Sell Signal. This circumstance leads to the first square line support becoming new main target, most likely having to be reached in 2015 respectively being reached…

The first square line is now the very most important down magnet for the raw material. It has got the strongest impact to the year 2015. The first square line is now inevitably going to be headed for. The signaling does not allow a different conclusion!

The several month countertrend possibly beginning in February 2015 is anyway supposed to be able to test back the 1*1 Resistance Angle. So, the 57 are the minimum target of the expected countertrend. Just mind however the former performance of the market at the 1*1 surroundings, emphasized by the orange zigzag line:

==> It’s striking there, that the market is not exactly orienting itself by the 1*1 Angle. The 1*1 functioned then rather as a guide crude oil oscillated around. That’s why we will have to expect the anticipated countertrend also in future to attach value to the 1*1 Angle and thereby to the future resistance of the 1*1 Angle on daily respectively weekly base just temporally, from the monthly point of view the countertrend being allowed to go higher – just up to the 63-65, torn above already.

The 63-65 countertrend target as well as the allowed February 2015 at 37.50 can be derived from this monthly down setup. It starts at the final countertrend high of the year 2011 measuring 6 month down impulses:

Perfectly did the Blue Arc guide and support crude oil up to the 2014 highs. At the 2014 high the waterfall begins that subsequently broke through the 2*1 Angle, the 1st double arc and the 1*1 Angle. Here again the 1*1 Gann Angle = Resistance Angle is the currently most important future resistance for the market.

Please pay attention here, too, to the action at the December 2014 high. Just like in the all dominating monthly 8 candle down above, the December 2014 high tested back an important magnet: Here it is the 1*1 Resistance Angle. We note down: In both important down setups, the December 2014 high tested back a magnet in an extremely weak way.

The bounce from the 1*1 Resistance Angle is going that deep so the crude is currently quoting within the lines of the 2nd double arc. That means: the upper line of the 2nd is not giving any support for January 2015 as it seems! Thus, crude will technically have to go even lower, maybe down to the lower line of the 2nd double arc ==> that is at 37.50 for February 2015, hence suggesting itself as the next important GUNNER24 Support on monthly base… perhaps – if not at the round 40$ already – the low of this panic move SHOULD/WILL form at the 37.50 surroundings in February 2015.

If this happens – crude turning upwards either at 40 or at 37.50 next month – the next test of the 1*1 Resistance Angle will be supposed to occur till May 2015, perhaps June 2015. Depending on the moment when crude will meet it, the 1*1 Angle takes its course at 63-65. This is technically the maximum for any countertrend that may begin in February 2015. The future resistance power of the 1*1 Angle to be expected should lead to further downleg in any case!

Also this down setup is putting out a horizontal support at the 2009 low surroundings = 33.75!

If we just put both so far analyzed setups on top of each other:

… so the signaling of the combined setups according to time and price will resume the expected course for the year 2015 as follows:

A counter move in the bear market is likely to start from the low of the 8th month of the panic cycle = at the February 2015 low that is supposed to be between 40 and 37.50.

The anticipated counter move is likely to go at least 3 full months = March + April + May 2015, with a possible countertrend high either in May of at the latest in June 2015.

The anticipated countertrend is supposed to go at least to 57, the 1*1 ATH Resistance Angle. The 63-65 resistance region at the 1*1 Resistance Angle is more likely to be reached however.

From there, crude oil is expected to decline again steadily and intensely until the main target, the 33.50 is reached. The 33.50 is a monthly down magnet, so it is also the absolutely most important down magnet for the whole year 2015 being worked off with a +90% of probability.

If in 2015 the 33.50 is defended on monthly base, from there a new up leg will be supposed to start, lasting several years.

A monthly closing price below 32.80 in the course of the year 2015 would keep on mobilizing defense forces. In this case the 20$ surroundings will be activated as next downtarget for the 1Q/2016 – please mind on this the upper line double arc support in the combined setup.

Caution! If February 2015 closes below the 37$ mark, the 33.50 will be worked off swiftly until May 2015!

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to protect your wealth!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann