As it’s become a good tradition, today again, for the lapse of January through March, I’d like to make likewise publicly available a couple of our ideas and perspectives we use to develop on yearly base for our institutional customers.

So, let’s begin our little series of the envisaged prospects resp. prognosis for 2016 with crude oil since this is where the music is playing at the moment and in the foreseeable future, hence therewith – in mere theory – a pretty lot of good money is supposed to be made.

For getting started and for refreshing: free GUNNER24 Forecast for the year 2015, published a year ago, on 01/25/2015:

==> A brief summary of the crude oil forecasts a year ago:

A) Multiple-confirmed downtarget for 2015 was the 2008 low at 33.50$ to be worked off with a probability of more than a 90%.

B) Furthermore – in case the 2008 low at 33.50$ on monthly closing base bears up and can be defended – from the 33.50$ decade support area a new upleg should have to begin persisting a few years!!!!

C) Also the following make-or-break statement was made however: "A monthly closing price below 32.80 in the course of the year 2015 would keep on mobilizing defense forces. In this case the 20$ surroundings will be activated as next downtarget for the 1Q/2016 – please mind on this the upper line double arc support in the combined setup."

============

Ultimately, the 33.50 decade support could NOT be defended in 2015. Crude oil closed December 2015 and thereby the year 2015 significantly below the 33.50 decade support trail generating another significant GUNNER24 Sell Signal. The 2015 year close is at 37.04. Thus, the following targets according to price and time are activated:

Time-Outlook:

==> There’s a 90% of probability for the year low now to occur in the 1Q/2016. The year low is most likely to be seen either in February or April. The US stock market likely will – for this thesis please observe again the free GUNNER24 Forecasts, issue 01/17/2016 - bottom in 2016 April or maybe early May, rather exactly 1 year after the all-time highs of the year 2015. Technically, crude oil would have to get to its year bottom closely before that. After the 1Q/2016 lows, should have to turn in a sharp upwards trend in the monthly time frame to top out between 10/2016 and 02/2017.

Price-Outlook:

Above in the text as well as in the monthly chart, at the beginning of 2015 I assumed this bear to bottom in the 20$ surroundings.

Now, I’d like to adjust and fine-tune this relatively rough bear-market 2016 price downtarget fathoming the upwards move that follows the 1Q/2016 bottom.

For that, let’s begin with the BIG-TIME picture of this earth’s most important raw material.

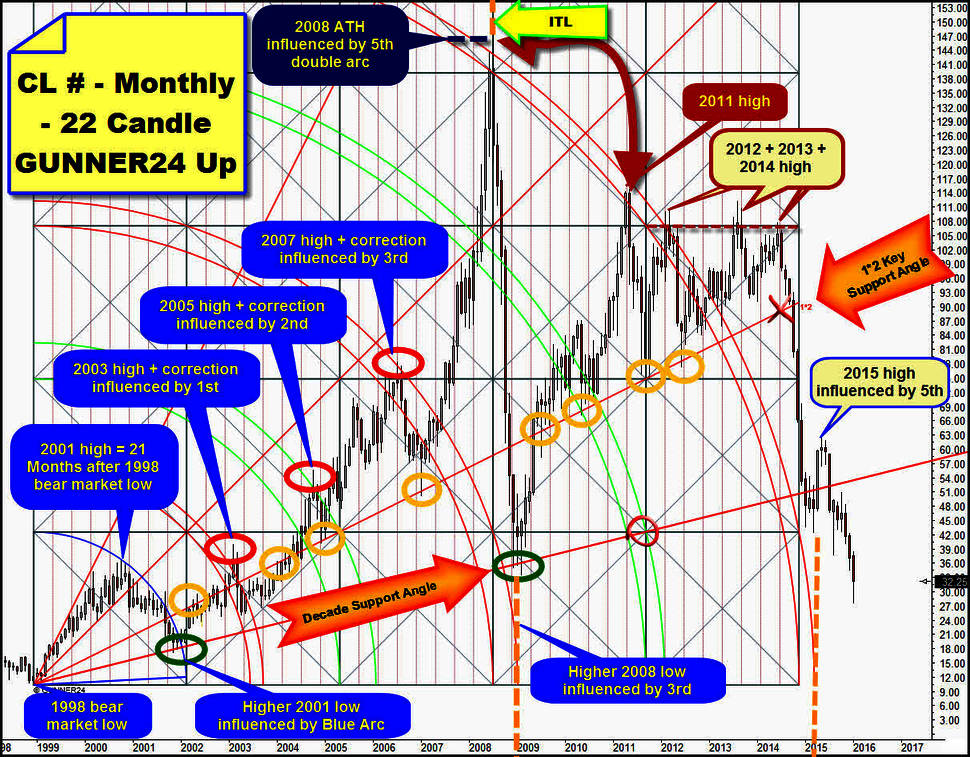

Let’s first consider the development since the final bear market low of the year 1998 up to the alltime-high (ATH) of the year 2008 as well as the structure of the downtrend beginning at the 2008 ATH till today:

Beginning at the 1998 bear market low, an initial up impulse developed lasting 22 months, hence till the 2001 high. 21 months after the 1998 bear-market low, the 2001 high was marked.

==> Thus, the monthly setup measures 22 months up, from the 1998 bear low till the 2001 high.

We realize how accurately and thereby harmonically crude oil complied with the further guidelines of the 22 candle initial up impulse because:

The 2003 high as well as the 2005 high and likewise the 2007 high with the respectively subsequent multi-month bull market corrections were influenced by the 1st, 2nd and 3rd double arc magnets.

==> Furthermore, the 2008 bear market low as well as the year 2015 high were caused by a double arc magnet: A) The 2008 bear low could not turn up and subsequently, the market could not rise before the upper line of the 3rd had ended its influence in terms of time. The intersection of the upper line of the 5th with the time axis led B) to the 2015 high = important countertrend high.

As to the textbook, this very first initial up impulse of the 1998-2008 bull market moreover forecast the ATH at the 5th double arc resistance. The 2008 ATH was ditto brought in pinpoint at the orange dotted vertical, an important time line = ITL. Both natural GUNNER24 Turning Marks of the 5th double arc and the ITL jointly signaled a possible end of the 1998-2008 bull market. So it happened.

Die 5th double arc is therewith ATH resistance double arc. The 5th was confirmed as ATH resistance double arc by the first lower bear year 2011 high. Please mind the fat red double arrow depicting the relation of the ATH with the year high 2011 at the 5th resistance.

==> The very first initial down impulse springing from the 2011 high is most likely to be crucial for the now expected/coming price low of the 1Q/2016 bear low. Mind about this the next monthly chart and the GUNNER24 Analysis afterwards!

Yet before I go in detail into the importance of the 2011 high and its consequences to the awaited 1Q/2016 bear market bottom, once more to the nearly perfect performance of crude oil at some other important magnets.

Marvelously apparent is what an impression of importance the 1*2 Gann Angle (1*2 Key Support Angle) practiced onto the orange ovals in this millennium. Being still resistance at the beginning of the millennium, from 2005 to 2008 it operated as the most important support. Being heftily broken during the 2008 bear market, it could be re-conquered quickly then supporting crude oil – from 2009 into the year 2014 – till it was given up finally at the red X in 11/2014.

Beside the 1*2 Key Support Angle, another important Support Angle was ceased finally in the course of the last months. It was matter of the Decade Support Angle, sprung from the 1998 bear market low. This angle is - we better say was - decade support because it co-caused the first higher 2001 secular bull market low as well as the next higher secular bull market low of the year 2008.

==> Thus, the Decade Support Angle is absolutely most important resistance for the year 2016 being decade resistance. Correspondingly, it is likewise the most important up magnet for 2016. It would have to be tested back before year end 2016 if crude oil bottoms for 2016 in 1Q/2016!!!!

==> Thereby, once already a meaningful, obvious cause natural bounce magnet (decade backtest magnet) according to time and price discloses itself to us for 2016!

Let’s relate now this extremely important 2016 backtest uptarget with the important high of the year 2011.

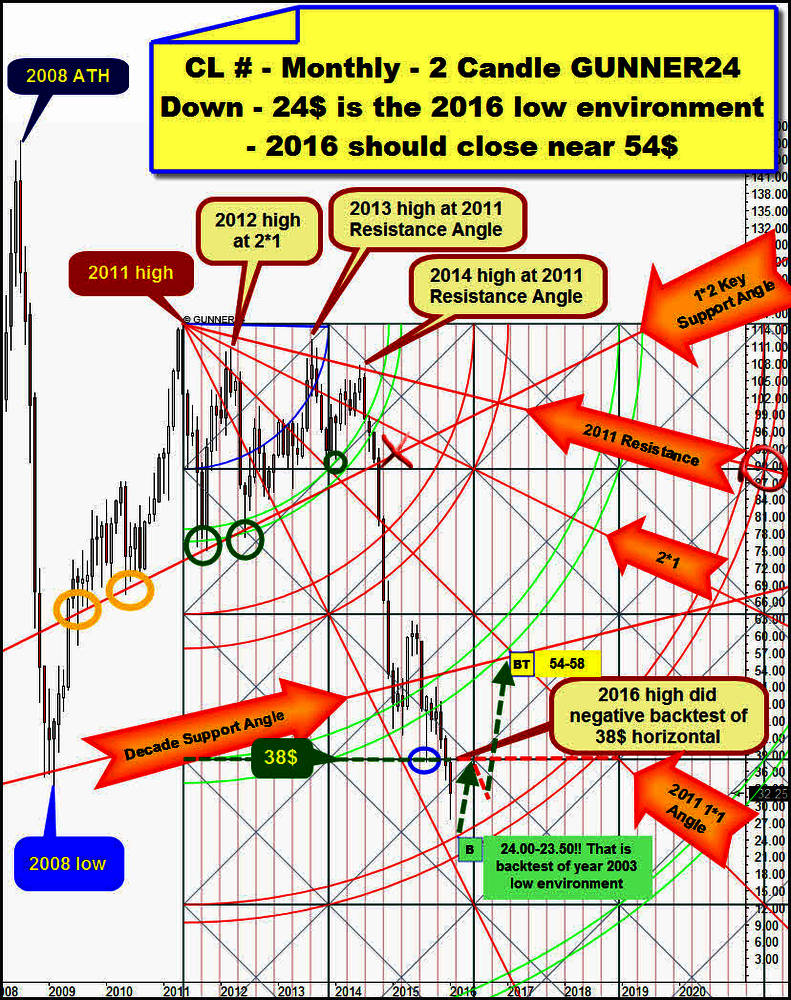

The 2011 high was achieved at the ATH resistance. It was the first important lower high in the current bear market. At the 2011 high, a first 2 Candle initial down impulse arose.

From 2011 till far into the year 2014, crude oil consolidated this first lower bear market high.

At the green ovals, the 1st double arc support upheld this consolidation period, partly combined with the 1*2 Key Support Angle.

During the 2011-2014 consolidation period, the final highs of the years 2012 till 2014 were constrained by Resistance Angles that can be derived directly from the final 2011 lower bear high:

The 2012 high rebounded from the important 2*1 Angle. The 2013 as well as the 2014 high were influenced by an angle that can be anchored in the setup, namely the 2011 Resistance Angle.

Now, on to the current signaling and a brief assessment of the trend power and af course to the expected price low in Q1/2016 (probably February or April):

The last negative test of the 2011 Resistance Angle at the 2014 high kicked off a panic wave in the monthly time frame.

As a result, at first the 1st double arc support as well as the 1*2 Key Support Angle, likewise the 1*1 Angle (= 2011 1*1 Angle), then the 2nd double arc support broke. The year 2015 lost finally the Decade Support Angle, so the 3rd double arc support as early as in the beginning.

==> Interim conclusion: The final break of the 3rd double arc is an important sell signal, THUS the 4th double arc in this bear market WILL HAVE TO be reached! And not before the 4th double arc being worked off, crude oil MAY resp. IS ALLOWED to change its trend!

All these consecutive breaks of important GUNNER24 Supports, most of them in the yearly and monthly time frame, two in the decade time frame, induced the sell-off continue accelerating, making it stronger and stronger. This supports the assumption that it will take the 4th GUNNER24 Double Arc in the 2 Candle down above to be able to balk the sell-off!!!

Yeah, even the turn of the year led again to sell-off acceleration: The 38$-GUNNER24 Horizontal is responsible for that. The first time the 38$ were tested in 08/2015 upholding for the time being was at the blue oval. Crude oil was compelled to a negative backtest of the 3rd double arc, and crude oil bounced from the 3rd resistance closing 2015 below the 38$ threshold!!

During the year opening, at the high of the current January 2016 candle, the 38$ were tested back negatively – another indication of the sell-off acceleration. Crude oil has to go into the support of the 4th double arc!!!

==> Crude oil has to test the 24.00$ to 23.50$ in 1Q/2016 thus testing back and even falling below the 2003 low. The absolute year 2003 low is at 25.03$.

==> After 4th double arc year 2016 support being worked off, with a probability of more than an 80% it will rise till the beginning of the year 2017 in a three-part ABC countertrend move, the A wave being supposed to test back the 38$, the B again to test back about the "round" 31$-30$ in summer 2016. The C wave up should have to reach about the 58$ in January 2017. Thereby, 2016 is supposed to close at about 53-55$!

The 54$-58$ is decade resistance area now and thus it’s powerful upwards magnet for the ABC bounce technically being insurmountable for the entire year 2016 as well as for the whole year 2017. There, at 54$-58$, the Decade Support Angle (now powerful decade resistance of course!!!!!) intersects the 2011 1*1 Angle at 55$ in January 2017. In addition, the lower line of the 3rd – now likewise important backtest magnet for yearend 2016/beginning of 2017 – is at 56$ to 58$!

Short-term prospects: Crude oil is bouncing in the daily time frame now, but likely to just testing back seriously the 2008 bear low environment at 33.50$. At the latest, it’s the 34$-34.50$ region where the next important sell-off thrust into the 24.00$-23.50$ = expected 1Q/2016 bear low area should have to start from!

Be prepared!

Eduard Altmann